Is KTON (KTON) a good investment?: A Comprehensive Analysis of Price Potential, Market Trends, and Risk Factors for 2024

Introduction: KTON's Investment Position and Market Outlook

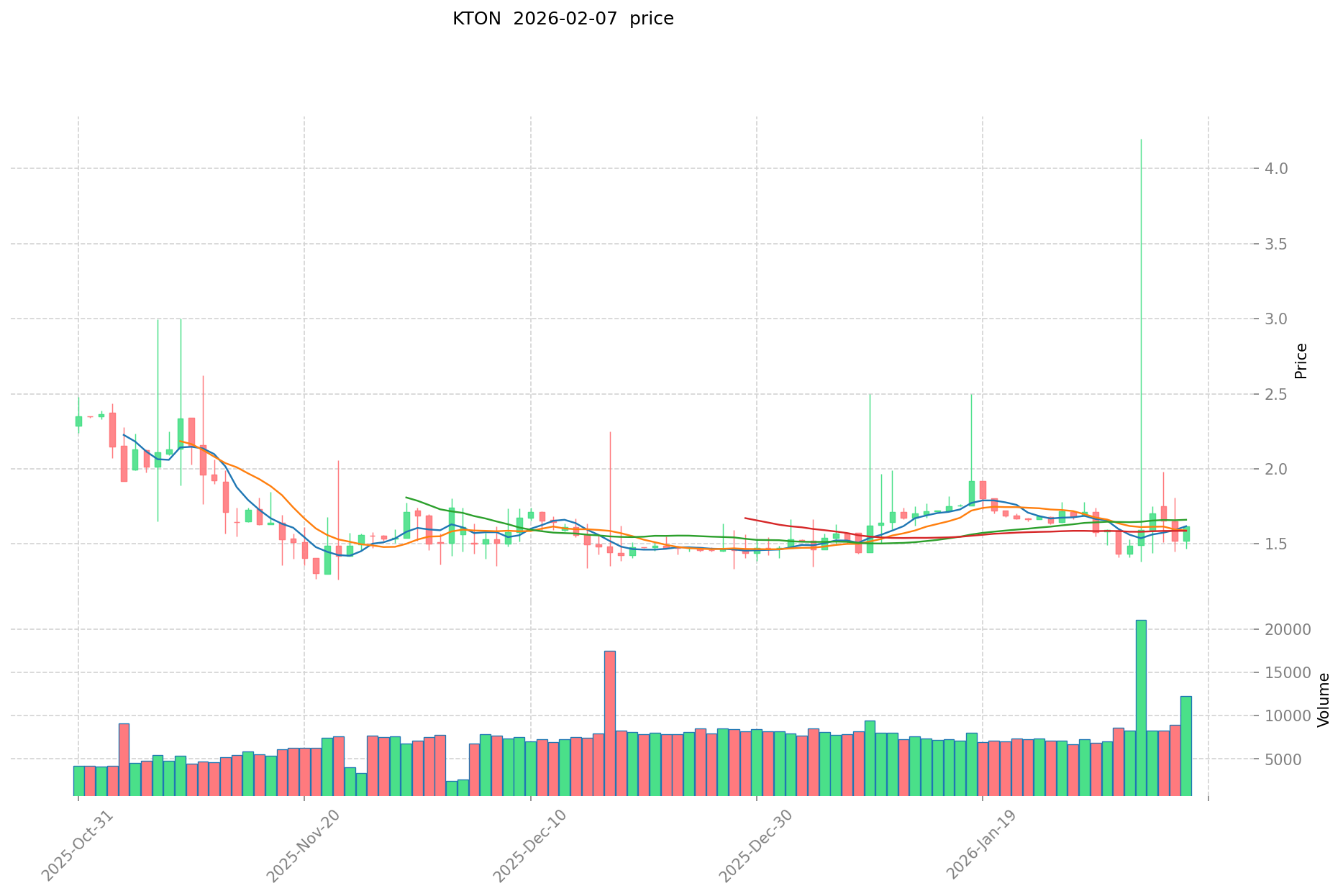

KTON is a derivative token within the cryptocurrency sector, serving as the commitment token of Darwinia Network's native token RING. As of February 8, 2026, KTON maintains a market capitalization of approximately $244,959, with a circulating supply of 149,914 tokens and a current price around $1.634. The token ranks 3,714 in the global cryptocurrency market, holding a market share of 0.0000098%. Designed to incentivize long-term commitment locking within the Darwinia Network ecosystem, KTON operates as a compensation mechanism for users who lock RING tokens during staking processes. The Darwinia Network, built on Substrate, functions as a cross-chain bridge network connecting Polkadot parachain ecosystems with external heterogeneous chains, featuring full EVM compatibility and focusing on areas including NFT auction markets, stablecoin cross-chain transactions, and asset exchange infrastructure. With 2,304 holders and trading activity on one exchange platform, KTON presents a case study in niche utility tokens within the cross-chain infrastructure sector. This article examines KTON's investment characteristics, historical price movements, future price considerations, and associated risks to provide reference information for those evaluating "Is KTON a good investment?"

I. KTON Price History Review and Current Investment Value

KTON (KTON) Investment Performance

- 2020: Reached a significant price milestone, delivering notable returns for investors

- 2025: Market dynamics shifted as KTON experienced considerable volatility throughout the year

- Recent period: Price movement from higher levels toward $1.634, reflecting broader market adjustments

Current KTON Investment Market Status (February 2026)

- KTON current price: $1.634

- 24-hour trading volume: $20,767.34

- Market capitalization: $244,959.48

- Circulating supply: 149,914 KTON

- Price performance: +1.11% (24H), +8.07% (7D), +11.99% (30D)

Check real-time KTON market price

II. Core Factors Influencing Whether KTON is a Good Investment (Is KTON(KTON) a Good Investment)

Supply Mechanism and Scarcity (KTON investment scarcity)

-

Unique Commitment-Based Supply Model → Influences Price and Investment Value

- KTON operates as a derivative commitment token within the Darwinia Network ecosystem, obtained by users who lock RING tokens for periods ranging from 3 to 36 months

- The total supply stands at 149,914 KTON with unlimited maximum supply, while the circulating supply maintains 100% of the total, indicating full distribution

- Users receive KTON as compensation for locking RING tokens, creating a mechanism that ties supply to long-term network commitment rather than traditional mining or staking

-

Historical Context: Price Volatility and Supply Dynamics

- KTON has experienced significant price fluctuations, with historical data showing a price of $1.52 as of January 25, 2026, though current price movements remain limited

- The token's unlimited maximum supply structure contrasts with scarcity-driven models, potentially affecting long-term value proposition

-

Investment Implications: Scarcity Considerations

- The commitment-based distribution model creates indirect scarcity through RING token locking requirements

- With 2,304 holders and relatively low market capitalization of approximately $244,959, KTON represents a niche asset within the broader cryptocurrency landscape

- The unlimited supply ceiling may present different investment dynamics compared to fixed-supply digital assets

Institutional Investment and Mainstream Adoption (Institutional investment in KTON)

-

Current Market Position and Accessibility

- KTON ranks at position 3,714 in market capitalization, indicating limited mainstream recognition

- The token is available for trading on one exchange, with a 24-hour trading volume of approximately $20,767

- Market share stands at 0.0000098%, reflecting minimal institutional presence in the current market structure

-

Ecosystem Integration and Adoption Trends

- KTON functions within the Darwinia Network, which focuses on cross-chain bridge infrastructure connecting Polkadot parachain ecosystems with external heterogeneous chains

- The network's emphasis on NFT auction markets, stablecoin cross-chain transactions, and asset exchange positions it within emerging blockchain infrastructure segments

- Limited public information regarding institutional holdings or enterprise adoption patterns

Macroeconomic Environment's Impact on KTON Investment

-

Market Positioning in Broader Economic Context

- KTON's governance and staking utility within the Darwinia Network provides specific use cases beyond speculative trading

- The token's performance appears relatively insulated from broader macroeconomic trends due to its specialized ecosystem role

- As a derivative governance token, KTON's value proposition centers on network participation rather than serving as a macroeconomic hedge

-

Volatility and Market Dynamics

- Recent performance shows 1-hour change of 0.25%, 24-hour change of 1.11%, 7-day change of 8.07%, and 30-day change of 11.99%

- The 1-year performance indicates a decline of 54.49%, suggesting sensitivity to market conditions and ecosystem development

Technology and Ecosystem Development (Technology & Ecosystem for KTON investment)

-

Substrate-Based Infrastructure

- Darwinia Network is developed on Substrate, providing compatibility with Polkadot ecosystem standards

- The network maintains full EVM virtual machine compatibility, enabling cross-chain application development

-

Cross-Chain Bridge Functionality

- Darwinia focuses on connecting Polkadot parallel chain ecosystems with external heterogeneous chains

- The infrastructure supports cross-chain asset transfers, NFT marketplaces, stablecoin interoperability, and asset exchange mechanisms

-

Governance and Staking Utility

- KTON holders can participate in on-chain staking to gain network influence and governance rights

- The token serves dual functions: compensating RING lock-up participants and enabling network governance participation

- The commitment token model incentivizes long-term network alignment through the locking mechanism

-

Ecosystem Application Scope

- The network emphasizes infrastructure for cross-chain and multi-chain applications

- Focus areas include non-standard asset NFT auction markets, stablecoin cross-chain operations, and asset trading exchanges

- Deployment on Ethereum (contract address: 0x9f284e1337a815fe77d2ff4ae46544645b20c5ff) provides access to established DeFi ecosystems

III. KTON Future Investment Forecast and Price Outlook (Is KTON(KTON) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term KTON investment outlook)

- Conservative forecast: $1.40 - $1.63

- Neutral forecast: $1.63 - $1.78

- Optimistic forecast: $1.78 - $1.94

Mid-term Investment Outlook (2027-2029, mid-term KTON(KTON) investment forecast)

-

Market stage expectation: Based on historical performance, KTON may experience moderate volatility as the Darwinia Network ecosystem continues to develop its cross-chain bridging capabilities and NFT marketplace infrastructure.

-

Investment return forecast:

- 2027: $1.23 - $2.55

- 2028: $1.30 - $2.32

- 2029: $1.95 - $3.19

-

Key catalysts: Cross-chain technology adoption, Substrate framework developments, EVM compatibility enhancements, and expansion of non-standard asset trading activities within the Darwinia ecosystem.

Long-term Investment Outlook (Is KTON a good long-term investment?)

- Base scenario: $2.15 - $3.29 (assuming steady ecosystem growth and sustained cross-chain infrastructure development)

- Optimistic scenario: $3.29 - $3.86 (assuming accelerated adoption of Darwinia's bridging solutions and increased NFT marketplace activity)

- Risk scenario: Below $1.40 (in case of prolonged market downturn or significant competitive pressure in cross-chain solutions)

For detailed KTON long-term investment and price predictions, visit: Price Prediction

2026-02-08 to 2031 Long-term Outlook

- Base scenario: $2.15 - $2.72 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $2.72 - $3.86 (corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $3.86 (in case of breakthrough ecosystem developments and mainstream adoption)

- 2031-12-31 predicted high: $3.86 (based on optimistic development assumptions)

Disclaimer: These forecasts are speculative and based on historical data and market analysis. Digital asset markets are highly volatile, and prices may deviate significantly from predictions. This information does not constitute financial advice. Investors should conduct their own research and assess their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 1.94446 | 1.634 | 1.40524 | 0 |

| 2027 | 2.5585989 | 1.78923 | 1.2345687 | 9 |

| 2028 | 2.3260884615 | 2.17391445 | 1.30434867 | 33 |

| 2029 | 3.195002067165 | 2.25000145575 | 1.9575012665025 | 37 |

| 2030 | 3.86595250126965 | 2.7225017614575 | 2.150776391551425 | 66 |

| 2031 | 3.590707573186296 | 3.294227131363575 | 2.63538170509086 | 101 |

IV. KTON Investment Strategy and Risk Management (How to invest in KTON)

Investment Strategy (KTON investment strategy)

-

Long-term holding (HODL KTON): Suitable for conservative investors. KTON serves as a commitment token within the Darwinia Network ecosystem, designed to reward users who lock RING tokens for extended periods. This mechanism may align with strategies focused on long-term ecosystem participation and governance influence.

-

Active trading: Relies on technical analysis and swing trading approaches. Given KTON's price fluctuations (1-hour change: 0.25%, 24-hour change: 1.11%, 7-day change: 8.07%), traders may identify short-term opportunities based on market momentum and technical indicators.

Risk Management (Risk management for KTON investment)

-

Asset allocation ratio:

- Conservative investors: Consider limiting KTON exposure to a small percentage of the portfolio due to its lower market capitalization (approximately $244,959 as of February 8, 2026) and ranking (#3714).

- Aggressive investors: May allocate a larger proportion while maintaining awareness of liquidity constraints given the 24-hour trading volume of approximately $20,767.

- Professional investors: Should assess position sizing based on risk tolerance and portfolio diversification requirements.

-

Risk hedging strategies: Diversification across multiple assets and potential hedging instruments may help mitigate exposure to single-token volatility.

-

Secure storage:

- Cold and hot wallet solutions: Segregate funds between operational (hot) wallets for active use and cold storage for long-term holdings.

- Hardware wallet recommendations: Physical devices offer enhanced security for private key management.

V. KTON Investment Risks and Challenges (Risks of investing in KTON)

-

Market risks:

- High volatility: KTON experienced significant price movements, with a 1-year change of -54.49% and a 30-day change of 11.99%, indicating substantial price swings.

- Price manipulation potential: Lower market capitalization and trading volume may increase susceptibility to large order impacts.

-

Regulatory risks: Policy uncertainty across different jurisdictions may affect the accessibility and legal status of KTON and related network activities.

-

Technical risks:

- Network security vulnerabilities: As a derivative token within the Darwinia Network infrastructure, KTON's security depends on the underlying Substrate-based architecture and cross-chain bridging mechanisms.

- Upgrade failures: Technical updates to the Darwinia Network or related components could potentially impact KTON functionality or value proposition.

-

Liquidity concerns: With only one exchange listing and relatively low trading volume, investors may face challenges entering or exiting positions at desired price levels.

VI. Conclusion: Is KTON a Good Investment?

-

Investment value summary: KTON represents a specialized utility token within the Darwinia Network ecosystem, designed to incentivize long-term commitment and governance participation. Its investment characteristics differ from mainstream cryptocurrencies due to its specific use case and relatively limited market presence.

-

Investor recommendations:

✅ Beginners: Exercise caution due to KTON's specialized nature and limited liquidity. If considering participation, secure wallet storage and thorough research into the Darwinia Network ecosystem are essential.

✅ Experienced investors: May evaluate swing trading opportunities based on technical analysis while maintaining strict position sizing discipline given volatility patterns and liquidity constraints.

✅ Institutional investors: Should conduct comprehensive due diligence on the Darwinia Network's cross-chain infrastructure development and governance mechanisms before considering strategic allocation.

⚠️ Notice: Cryptocurrency investments carry substantial risks. This content is for informational purposes only and does not constitute investment advice. Investors should conduct independent research and consider their financial situation before making investment decisions.

VII. FAQ

Q1: What makes KTON different from other cryptocurrency investments?

KTON is a commitment token rather than a traditional cryptocurrency. It serves as compensation for users who lock RING tokens within the Darwinia Network for periods ranging from 3 to 36 months. Unlike speculative cryptocurrencies, KTON's value proposition centers on governance participation and network commitment incentivization. The token operates within a specialized cross-chain bridge infrastructure built on Substrate, with full EVM compatibility, focusing on NFT auction markets and stablecoin cross-chain transactions. With a market cap of approximately $244,959 and ranking #3,714 globally, KTON represents a niche utility token rather than a mainstream investment asset.

Q2: Is KTON suitable for short-term trading strategies?

Limited suitability with significant constraints. KTON demonstrates moderate short-term volatility (24-hour change: 1.11%, 7-day change: 8.07%), which may present trading opportunities. However, critical limitations include: only one exchange listing, 24-hour trading volume of approximately $20,767, and low liquidity due to the small holder base of 2,304 participants. These factors increase slippage risk and may prevent efficient execution of entry and exit positions. Active traders should employ strict position sizing and acknowledge that market depth constraints may significantly impact execution quality.

Q3: What are the primary risks associated with KTON investment?

Three major risk categories dominate KTON's investment profile. First, market risks include high volatility (-54.49% over 1 year) and potential price manipulation due to low market capitalization. Second, liquidity risks stem from limited exchange listings and trading volume, making position entry and exit challenging at desired price levels. Third, ecosystem dependency risks arise from KTON's tight integration with Darwinia Network's development trajectory—any technical failures, security vulnerabilities in cross-chain bridging mechanisms, or competitive displacement could significantly impact value. Additionally, regulatory uncertainty across jurisdictions presents ongoing policy risk for cross-chain infrastructure projects.

Q4: How does KTON's supply mechanism affect its investment value?

KTON employs an unlimited maximum supply model with 100% circulating supply (149,914 KTON). Unlike fixed-supply scarcity models such as Bitcoin, KTON's supply expands when users lock RING tokens for extended periods. This commitment-based distribution creates indirect scarcity through locking requirements rather than traditional supply caps. The unlimited ceiling structure presents different investment dynamics—value derives from utility and ecosystem adoption rather than predetermined scarcity. As RING locking activity fluctuates with network adoption, KTON issuance adjusts accordingly, linking supply expansion directly to ecosystem engagement levels.

Q5: What is the realistic long-term price outlook for KTON through 2031?

Price forecasts suggest modest appreciation under base scenarios. By 2031, conservative projections estimate $2.64 (low scenario) to $3.59 (high scenario) with an average predicted price of $3.29. These forecasts assume steady Darwinia Network ecosystem development, gradual adoption of cross-chain bridging solutions, and sustained NFT marketplace activity. However, significant uncertainty remains due to: (1) competitive pressure from alternative cross-chain solutions, (2) dependence on Polkadot ecosystem growth, (3) limited current mainstream adoption, and (4) historical volatility patterns (-54.49% over 1 year). Transformative scenarios exceeding $3.86 require breakthrough adoption and favorable market conditions. Investors should recognize that these projections are highly speculative and actual outcomes may deviate substantially.

Q6: Should beginners consider KTON as their first cryptocurrency investment?

Generally not recommended for cryptocurrency beginners. KTON presents several challenges for new investors: (1) specialized utility requiring understanding of Darwinia Network's cross-chain infrastructure, (2) limited liquidity constraining position management, (3) minimal mainstream exchange availability increasing operational complexity, (4) high volatility requiring sophisticated risk management, and (5) technical knowledge requirements regarding Substrate frameworks and commitment token mechanisms. Beginners typically benefit more from establishing positions in widely-adopted cryptocurrencies with substantial liquidity, extensive educational resources, and proven track records. If considering KTON participation, beginners should first develop fundamental cryptocurrency knowledge, secure wallet management practices, and maintain extremely conservative position sizing.

Q7: How does KTON's governance utility impact its investment thesis?

Governance functionality adds utility dimension beyond speculative value. KTON holders can participate in on-chain staking to gain network influence and voting rights within the Darwinia Network ecosystem. This dual-function model—compensating RING lock-up participants while enabling governance—creates value tied to network decision-making processes and ecosystem direction. For investors prioritizing active participation over passive holding, governance utility provides engagement opportunities that may enhance long-term alignment with network development. However, governance influence depends on total KTON concentration and active voter participation rates. Investment value from governance utility remains contingent on the Darwinia Network's successful evolution and whether governance mechanisms significantly impact ecosystem trajectory.

Q8: What technical developments could significantly impact KTON's future value?

Several technical catalysts could influence KTON's investment trajectory. Key development areas include: (1) Cross-chain bridging enhancements expanding connectivity between Polkadot parachains and external heterogeneous chains, (2) NFT marketplace expansion leveraging Darwinia's focus on non-standard asset auction infrastructure, (3) Stablecoin interoperability improvements facilitating cross-chain transaction efficiency, (4) EVM compatibility upgrades broadening DeFi application integration, and (5) Substrate framework evolution affecting underlying infrastructure capabilities. Successful execution in these areas could drive ecosystem adoption, increasing KTON's utility value. Conversely, technical setbacks, security vulnerabilities in cross-chain mechanisms, or competitive displacement by alternative bridging solutions could negatively impact investment thesis. Investors should monitor Darwinia Network's development roadmap and technical milestone achievements.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is Tokenomics: A Basic Guide

Top 11 Highest-Paying Freelance Jobs in 2025

What is GameFi and How to Earn with Play-to-Earn

Tokenomics: Understanding Coins and Cryptocurrency Economics

What is wave analysis in cryptocurrency, and how does it work?