Is Nodecoin (NC) a good investment?: A Comprehensive Analysis of Features, Risks, and Market Potential

Introduction: Nodecoin (NC) Investment Position and Market Outlook

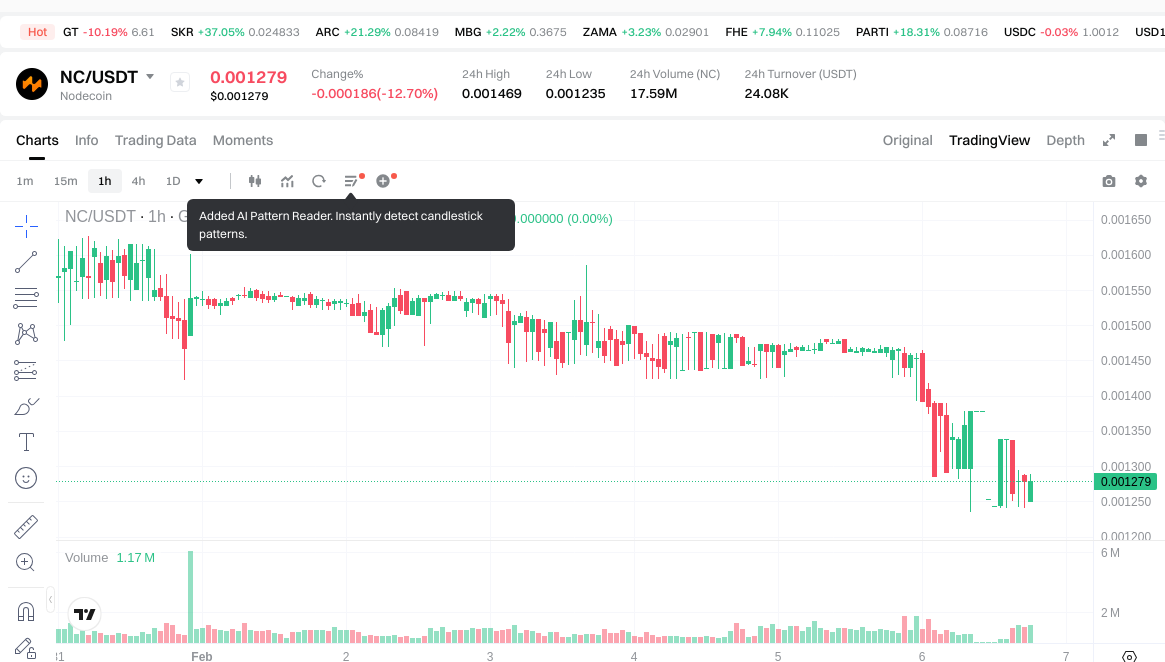

NC is a notable asset in the cryptocurrency sector, operating as the native token of Nodepay, a real-time predictive intelligence platform. Since its launch in January 2025, NC has established its presence in the decentralized bandwidth-sharing and AI data retrieval space. As of February 06, 2026, NC maintains a market capitalization of approximately $370,284, with a circulating supply of around 295,990,695 tokens. The current price stands at approximately $0.001251, reflecting notable volatility in recent trading periods. With its positioning in aggregating user signals, social activity, and on-chain data for market sentiment analysis, NC has become a subject of interest among investors evaluating whether Nodecoin (NC) represents a viable investment opportunity. This article provides a comprehensive analysis of NC's investment characteristics, historical price movements, future price outlook, and associated risks to support informed decision-making.

I. Nodecoin (NC) Price History Review and Investment Value Status

Historical Price Performance and Investment Returns

- January 2025: NC launched at an initial offering price of $0.1, presenting early-stage opportunities for participants in the token distribution phase

- January 2025: The token reached a notable price level of $0.335 on January 17, 2025, reflecting initial market reception following its launch

- Early 2026: Market conditions evolved, with NC trading at approximately $0.001251 as of February 6, 2026, indicating price adjustments over the months following launch

Current NC Investment Market Status (February 2026)

- Current NC Price: $0.001251 (as of February 6, 2026)

- 24-Hour Trading Volume: $23,030.51

- Circulating Supply: 295,990,695 NC tokens (approximately 29.6% of total supply)

- Market Capitalization: $370,284.36

Click to view real-time NC market price

II. Core Factors Affecting Whether NC is a Good Investment

Supply Mechanism and Scarcity (NC Investment Scarcity)

-

Supply Structure → Influences Price and Investment Value

- Nodecoin (NC) has a maximum supply of 1,000,000,000 tokens, with approximately 295,990,695 tokens currently in circulation, representing a circulating ratio of 29.6%.

- The circulating supply ratio indicates that a substantial portion of tokens remains locked or unvested, which may create potential selling pressure when released.

- The relationship between circulating supply and maximum supply suggests controlled token distribution, which can influence medium-term price dynamics.

-

Investment Significance: Scarcity Remains a Key Factor for Long-term Investment

- With less than one-third of total supply circulating, the gradual release schedule may impact investment returns depending on unlock mechanisms and market absorption capacity.

- The token's supply distribution pattern is relevant for assessing potential dilution effects on holder value.

Institutional Investment and Mainstream Adoption (Institutional Investment in NC)

-

Holder Base Trends: As of February 6, 2026, Nodecoin has approximately 128,161 token holders.

- The holder count reflects a relatively dispersed ownership structure, though specific data on institutional investor participation is not detailed in available materials.

- The trading volume of $23,030.51 over 24 hours suggests moderate market liquidity for a project at this market capitalization level.

-

Exchange Listings: NC is listed on 7 exchanges, including Gate.com, which provides basic market access but may limit exposure compared to assets on major tier-one platforms.

- The exchange presence indicates foundational infrastructure for trading but does not represent widespread mainstream adoption.

Macroeconomic Environment's Impact on NC Investment

-

Monetary Policy and Interest Rate Changes → Alter Investment Attractiveness

- As a smaller-cap digital asset, NC's investment appeal may be influenced by broader risk appetite in crypto markets, which correlates with global monetary conditions.

- Higher interest rate environments typically reduce speculative investment flows into higher-risk crypto assets.

-

Market Positioning Considerations

- Unlike larger cryptocurrencies positioned as inflation hedges or "digital gold," NC operates as a utility token within the Nodepay platform ecosystem, linking its investment value more closely to platform adoption and usage metrics.

Technology and Ecosystem Development (Technology & Ecosystem for NC Investment)

-

Platform Foundation: Nodepay Functions as a Real-time Predictive Intelligence Platform

- The project aggregates user signal inputs, social activity, and on-chain data to provide structured market sentiment analysis and actionable insights.

- Built upon a decentralized bandwidth-sharing network where users contribute unused internet resources to support AI data retrieval operations.

-

Evolution into Signal and Prediction Engine

- The infrastructure development enables Nodepay to deliver verifiable real-time intelligence driven by verified human signals and market behavior patterns.

- The platform's positioning as a next-generation network for predictive intelligence represents its core value proposition for token utility.

-

Ecosystem Application: Investment Value Tied to Platform Utility

- NC token utility within the Nodepay ecosystem connects investment value to platform adoption rates, user engagement metrics, and the competitive positioning of its intelligence services.

- The success of decentralized bandwidth-sharing mechanics and AI-powered prediction services may influence long-term token demand dynamics.

III. NC Future Investment Forecast and Price Outlook (Is Nodecoin(NC) worth investing in 2026-2031)

Short-term Investment Outlook (2026, short-term NC investment outlook)

- Conservative forecast: $0.00080128 - $0.001252

- Neutral forecast: $0.001252 - $0.00155248

- Optimistic forecast: $0.00155248 and above

Mid-term Investment Outlook (2027-2029, mid-term Nodecoin(NC) investment forecast)

- Market stage expectation: Following its listing in January 2025, NC has experienced considerable volatility. The mid-term period may witness gradual ecosystem development as the platform expands its real-time predictive intelligence capabilities and user signal aggregation.

- Investment return forecast:

- 2027: $0.0008273216 - $0.0017948672

- 2028: $0.001406727168 - $0.00175840896

- 2029: $0.0011413672704 - $0.0022827345408

- Key catalysts: Platform adoption growth, AI data retrieval network expansion, verified human signals integration, broader market sentiment towards predictive intelligence platforms, and potential partnerships within the decentralized bandwidth-sharing ecosystem.

Long-term Investment Outlook (Is NC a good long-term investment?)

- Base scenario: $0.001346813379072 - $0.002535178125312 (assuming steady ecosystem development and moderate user adoption through 2030)

- Optimistic scenario: $0.00124184115982 - $0.002461103389463 (assuming accelerated platform adoption, significant AI data retrieval demand, and favorable market conditions through 2031)

- Risk scenario: Below $0.001 (under conditions of prolonged market downturn, limited platform adoption, or increased competitive pressure)

Click to view NC long-term investment and price prediction: Price Prediction

2026-02-06 - 2031 Long-term Outlook

- Base scenario: $0.001346813379072 - $0.002535178125312 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.00124184115982 - $0.002461103389463 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.003 (contingent upon breakthrough ecosystem developments and mainstream penetration)

- 2031-12-31 predicted high: $0.002461103389463 (based on optimistic development assumptions)

Disclaimer: The above forecasts are based on historical data, current market trends, and project fundamentals. Cryptocurrency markets are highly volatile and subject to numerous unpredictable factors. These predictions do not constitute investment advice, and investors should conduct independent research and consider their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00155248 | 0.001252 | 0.00080128 | 0 |

| 2027 | 0.0017948672 | 0.00140224 | 0.0008273216 | 12 |

| 2028 | 0.00175840896 | 0.0015985536 | 0.001406727168 | 27 |

| 2029 | 0.0022827345408 | 0.00167848128 | 0.0011413672704 | 34 |

| 2030 | 0.002535178125312 | 0.0019806079104 | 0.001346813379072 | 58 |

| 2031 | 0.002461103389463 | 0.002257893017856 | 0.00124184115982 | 80 |

IV. Nodecoin (NC) Investment Strategy and Risk Management (How to invest in Nodecoin)

Investment Methodology (Nodecoin investment strategy)

Long-term Holding (HODL Nodecoin)

Long-term holding represents a passive investment approach suitable for investors with a stable risk tolerance. This strategy involves purchasing NC tokens and holding them through market cycles, avoiding frequent trading. Given Nodecoin's position as a real-time predictive intelligence platform built on decentralized bandwidth-sharing infrastructure, long-term holders may benefit from the platform's development and ecosystem expansion. However, investors should note that NC has experienced significant price volatility, with a year-to-date decline of 97.84%, indicating substantial market risks.

Active Trading

Active trading strategies rely on technical analysis and swing trading approaches. Traders can utilize price momentum, support and resistance levels, and volume indicators to identify entry and exit points. NC's 24-hour trading volume of approximately $23,030 suggests relatively limited liquidity, which may impact execution for larger position sizes. The token has shown notable intraday volatility, with 24-hour price fluctuations ranging between $0.001235 and $0.001469, providing potential opportunities for short-term traders while also presenting increased risk exposure.

Risk Management (Risk management for Nodecoin investment)

Asset Allocation Ratio

- Conservative Investors: May consider allocating 1-3% of their crypto portfolio to NC, maintaining majority holdings in established digital assets

- Aggressive Investors: Could allocate 5-10% to NC as part of a diversified altcoin strategy, accepting higher volatility for potential returns

- Professional Investors: May employ dynamic allocation based on market conditions, technical indicators, and fundamental developments, with position sizing adjusted according to risk-reward assessments

Risk Hedging Solutions

Investors can implement multi-asset portfolio strategies to mitigate concentration risk. This may include combining NC holdings with other digital assets across different categories, such as established cryptocurrencies, stablecoins, and tokens from various sectors. Additionally, position sizing discipline and stop-loss mechanisms can help manage downside exposure during adverse market movements.

Secure Storage

NC tokens are deployed on the Solana blockchain with contract address B89Hd5Juz7JP2dxCZXFJWk4tMTcbw7feDhuWGb3kq5qE. For security purposes, investors should consider:

- Cold Wallets: Hardware wallets supporting Solana ecosystem tokens provide offline storage, reducing exposure to online security threats

- Hot Wallets: Software wallets with established security protocols can be used for smaller holdings and active trading positions

- Hardware Wallet Recommendations: Devices compatible with Solana network that support SPL tokens, ensuring proper backup of recovery phrases and implementation of additional security measures

V. Nodecoin (NC) Investment Risks and Challenges (Risks of investing in Nodecoin)

Market Risk

NC exhibits substantial price volatility, characteristic of smaller market capitalization digital assets. The token has declined 97.84% over the past year and 31.69% over the past 30 days, demonstrating significant downside potential. With a market capitalization of approximately $370,284 and a market cap to fully diluted valuation ratio of 29.6%, the token's price discovery process remains ongoing. The circulating supply represents only about 29.6% of the maximum supply of 1 billion tokens, suggesting potential future dilution effects. Limited trading volume relative to market cap may result in wider bid-ask spreads and increased susceptibility to price impact from larger transactions.

Regulatory Risk

Cryptocurrency regulatory frameworks vary significantly across jurisdictions and continue to evolve. Digital assets face ongoing scrutiny from regulatory bodies worldwide, with potential implications for trading accessibility, taxation, and legal classification. Changes in regulatory approaches could affect NC's availability on exchanges, particularly in jurisdictions implementing stricter oversight measures. Investors should monitor regulatory developments in their respective countries and understand the legal implications of holding and trading digital assets.

Technical Risk

As a platform built on decentralized infrastructure aggregating user signals and on-chain data, Nodecoin faces technical considerations including:

- Network Security: Potential vulnerabilities in smart contract implementation or underlying blockchain infrastructure could expose users to security risks

- Platform Development: The evolution from a bandwidth-sharing network to a predictive intelligence platform requires ongoing technical development and successful implementation of planned features

- Dependency on Solana Network: NC's functionality relies on the Solana blockchain's performance, availability, and security; network disruptions or technical issues affecting Solana could impact NC token operations

VI. Conclusion: Is Nodecoin a Good Investment?

Investment Value Summary

Nodecoin (NC) operates as a real-time predictive intelligence platform leveraging decentralized bandwidth-sharing infrastructure to provide market sentiment analysis and actionable insights. The project has transitioned from a network resource-sharing model to a signal and prediction engine, positioning itself within the intersection of decentralized infrastructure and market intelligence.

However, the token has experienced substantial price depreciation, with a 97.84% decline over the past year and continued downward pressure across shorter timeframes. The current price of $0.001251 represents a significant decrease from its previous levels. With a relatively small market capitalization and limited trading volume, NC exhibits characteristics typical of higher-risk digital assets, including elevated volatility and liquidity constraints.

Investor Recommendations

✅ Beginners: Consider starting with smaller position sizes as part of a diversified learning portfolio. Utilize dollar-cost averaging to mitigate timing risk and prioritize secure storage solutions with hardware wallets. Focus on understanding the project fundamentals and blockchain technology before allocating significant capital.

✅ Experienced Investors: May explore swing trading opportunities based on technical analysis while maintaining strict risk management protocols. Consider NC as a speculative component within a broader portfolio strategy, with position sizing reflecting the asset's volatility profile and liquidity characteristics.

✅ Institutional Investors: Should conduct comprehensive due diligence on the project's technical infrastructure, team credentials, competitive positioning, and roadmap execution capabilities. Any allocation should align with strategic portfolio objectives and risk tolerance parameters, with consideration for liquidity constraints and market depth.

⚠️ Important Notice: Cryptocurrency investments carry substantial risk, including the potential for complete loss of capital. This analysis is provided for informational purposes only and does not constitute investment advice. Investors should conduct their own research, consider their financial situation and risk tolerance, and consult with qualified financial advisors before making investment decisions. Past performance does not indicate future results, and the volatile nature of digital assets requires careful consideration and appropriate risk management.

VII. FAQ

Q1: Is Nodecoin (NC) a good investment in 2026?

NC presents a high-risk, speculative investment opportunity rather than a conservative choice for 2026. The token has experienced a 97.84% decline over the past year, with a current price of $0.001251 and a relatively small market capitalization of approximately $370,284. While the platform's positioning as a real-time predictive intelligence platform offers potential utility, the substantial price depreciation, limited trading volume ($23,030 over 24 hours), and early-stage development status indicate significant investment risks. Conservative investors should approach cautiously, while those with higher risk tolerance might consider small allocations (1-5% of crypto portfolio) as part of a diversified strategy. The investment viability depends heavily on platform adoption, ecosystem development, and broader market conditions.

Q2: What is the realistic price prediction for Nodecoin (NC) by 2030?

Based on current fundamentals and market positioning, the base scenario forecasts NC trading between $0.001346813379072 and $0.002535178125312 by 2030, assuming steady ecosystem development and moderate platform adoption. The optimistic scenario, contingent upon accelerated user growth and favorable market conditions, projects prices reaching $0.00124184115982 to $0.002461103389463 by 2031. However, these predictions face considerable uncertainty due to NC's high volatility, limited market liquidity, and dependence on successful platform evolution from bandwidth-sharing network to predictive intelligence engine. Investors should note that cryptocurrency price forecasts carry inherent uncertainty, and actual results may vary significantly based on adoption rates, competitive dynamics, and broader market sentiment.

Q3: What are the main risks of investing in Nodecoin (NC)?

The primary risks include substantial market volatility (97.84% year-over-year decline), limited liquidity with modest trading volume, and potential dilution as only 29.6% of the 1 billion token maximum supply currently circulates. Technical risks involve dependency on Solana network performance and successful development of the predictive intelligence platform. Regulatory uncertainty across jurisdictions poses additional challenges, as evolving cryptocurrency regulations could affect trading accessibility and legal classification. The relatively small holder base (128,161 addresses) and limited exchange listings (7 exchanges) suggest concentrated market structure and restricted mainstream access. Additionally, the project's transition from bandwidth-sharing to AI-powered prediction services requires successful execution and market validation, with uncertain timelines and outcomes.

Q4: How should beginners approach investing in Nodecoin (NC)?

Beginners should start with minimal allocations (1-3% of their crypto portfolio) to limit exposure while gaining experience with volatile digital assets. Employ dollar-cost averaging to mitigate timing risk, purchasing small amounts regularly rather than investing lump sums. Prioritize secure storage using hardware wallets compatible with Solana SPL tokens (contract address: B89Hd5Juz7JP2dxCZXFJWk4tMTcbw7feDhuWGb3kq5qE), ensuring proper backup of recovery phrases. Before investing, understand the project fundamentals, including Nodepay's real-time predictive intelligence platform concept and decentralized bandwidth-sharing infrastructure. Focus on educational objectives initially, treating NC as a learning opportunity within a diversified portfolio rather than a primary investment vehicle. Never invest capital that cannot be afforded as a complete loss.

Q5: What factors could drive Nodecoin (NC) price appreciation?

Several catalysts could potentially support NC price growth, including successful platform adoption as users increasingly utilize Nodepay's predictive intelligence services and verified human signal aggregation. Expansion of the AI data retrieval network and demonstrated utility in market sentiment analysis could drive demand for NC tokens. Strategic partnerships within the decentralized bandwidth-sharing ecosystem and integration with additional platforms might expand use cases. Broader market recovery in the cryptocurrency sector, particularly for altcoins and infrastructure tokens, would likely benefit NC. Technical developments that enhance platform capabilities, such as improved prediction accuracy or expanded data sources, could attract user engagement. However, these positive scenarios require successful execution against competitive alternatives and depend on overall risk appetite in digital asset markets.

Q6: How does Nodecoin (NC) compare to other cryptocurrency investments?

NC operates in a distinct niche as a predictive intelligence platform token, differentiating it from established cryptocurrencies like Bitcoin (positioned as digital gold) or Ethereum (smart contract platform). With a market capitalization of $370,284 and 7 exchange listings, NC represents a micro-cap, early-stage project compared to top-tier digital assets with billions in market value and widespread institutional adoption. The token's 97.84% annual decline contrasts sharply with more established assets that have shown greater price stability. NC's utility is specifically tied to the Nodepay ecosystem's success, whereas larger cryptocurrencies benefit from broader use cases and network effects. The risk-return profile skews toward higher risk and uncertainty, making NC suitable primarily for speculative allocations rather than core portfolio holdings. Investors comparing NC to other options should evaluate liquidity, adoption metrics, and development progress carefully.

Q7: What is the best strategy for trading Nodecoin (NC)?

Active traders can employ technical analysis strategies given NC's notable intraday volatility, with 24-hour price fluctuations ranging between $0.001235 and $0.001469. Utilize support and resistance levels, volume indicators, and momentum signals to identify potential entry and exit points. However, the limited trading volume ($23,030 daily) requires careful position sizing to avoid significant price impact, particularly for larger orders. Implement strict risk management protocols, including stop-loss orders and defined position sizes based on account balance and risk tolerance. Long-term holders may prefer dollar-cost averaging to smooth out volatility exposure while accumulating positions over time. Diversification remains critical—avoid concentration in NC alone, maintaining exposure across multiple asset classes and cryptocurrency categories. Monitor platform development milestones, partnership announcements, and ecosystem metrics that could influence token demand and price direction.

Q8: Where can I safely buy and store Nodecoin (NC)?

NC is available for trading on 7 exchanges, including Gate.com, which provides established infrastructure for purchasing the token. When selecting an exchange, prioritize platforms with strong security track records, regulatory compliance, and adequate liquidity for your transaction sizes. After purchase, transfer NC tokens to secure storage rather than leaving them on exchanges for extended periods. Hardware wallets supporting Solana ecosystem tokens offer the highest security for long-term holdings, providing offline storage that protects against online threats. Ensure the wallet supports SPL tokens and verify the correct contract address (B89Hd5Juz7JP2dxCZXFJWk4tMTcbw7feDhuWGb3kq5qE) before transactions. Software wallets can serve for smaller holdings and active trading positions, but implement strong passwords, two-factor authentication, and secure backup of recovery phrases. Never share private keys or seed phrases, and verify all transaction details before confirming transfers.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Leverage Trading Guide

Comprehensive Guide to Cryptocurrency Day Trading

What Is a Token Generation Event?

How to Sell PI Coin (Pi Network Cryptocurrency)

A Precise Understanding of Recession and Economic Crisis