Is PlayZap Games (PZP) a good investment?: A Comprehensive Analysis of the Gaming Token's Potential, Risks, and Market Outlook

Introduction: PlayZap Games (PZP) Investment Position and Market Outlook

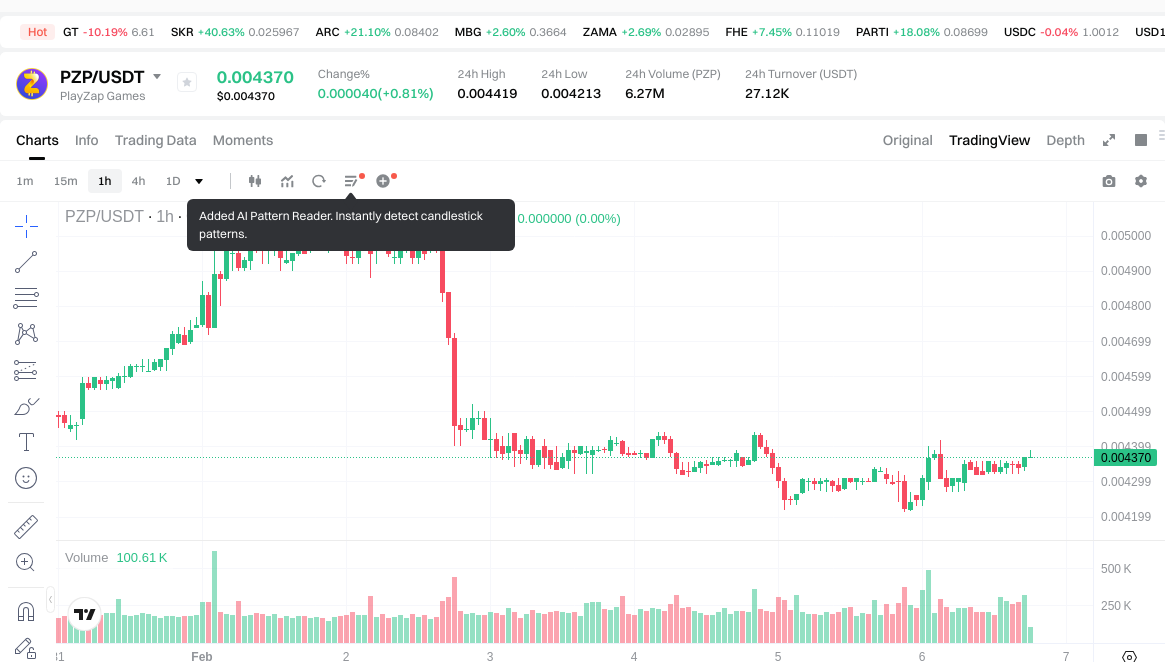

PZP is a notable asset in the cryptocurrency field. As of February 2026, PlayZap Games maintains a market capitalization of approximately $363,473, with a circulating supply of about 82,795,701 tokens, and the current price stands around $0.00439. Positioned as a mobile-first gaming platform token, PZP has gradually become a focal point for investors discussing "Is PlayZap Games (PZP) a good investment?" The token ranks 3293 in the market, with a 24-hour trading volume of $27,072.63 and a market dominance of 0.000027%. With a total supply of 150,000,000 tokens and a circulating ratio of 55.2%, PZP represents a segment of the blockchain gaming sector. This article will comprehensively analyze PZP's investment characteristics, historical performance, future price outlook, and investment risks to provide reference information for investors.

I. PlayZap Games (PZP) Price History Review and Current Investment Value

PZP Historical Price Movement and Investment Performance

-

2023: PlayZap Games (PZP) experienced significant volatility, reaching a peak price near $0.57 in November 2023, representing a substantial increase from its early trading levels. This surge reflected initial market enthusiasm for blockchain gaming platforms.

-

2024: The token entered a prolonged correction phase, with prices declining significantly throughout the year as the broader blockchain gaming sector faced headwinds and investor skepticism regarding monetization models.

-

2025-2026: PZP continued its downward trajectory, with prices falling from approximately $0.0044 to the current range. The token declined from higher levels to around $0.0042-$0.0044, reflecting ongoing market challenges and reduced investor interest in mobile gaming tokens.

Current PZP Investment Market Status (February 2026)

- PZP current price: $0.00439

- 24-hour trading volume: $27,072.63

- Market capitalization: $363,473.13

- Circulating supply: 82,795,701 PZP (55.2% of total supply)

- Historical trading range: $0.004185 to $0.569705

Click to view real-time PZP market price

The token's current valuation represents a significant decline from its peak levels, with a fully diluted market cap of $658,500. Trading activity remains relatively modest, with daily volume under $30,000, indicating limited liquidity and market participation. The project maintains deployment on the BSC blockchain, with approximately 8,037 token holders as of the latest data.

II. Core Factors Affecting Whether PZP is a Good Investment (Is PlayZap Games(PZP) a Good Investment)

Supply Mechanism and Scarcity (PZP investment scarcity)

- Maximum supply capped at 150,000,000 tokens → influences price dynamics and investment value

- Current circulating supply at 82,795,701 tokens (approximately 55.2% of total supply) → affects immediate market liquidity

- Investment significance: Fixed supply structure provides a foundational element for evaluating long-term investment potential

Institutional Investment and Mainstream Adoption (Institutional investment in PZP)

- Holder base data: 8,037 addresses currently hold PZP tokens

- Platform presence: Listed on 1 exchange, indicating limited mainstream trading accessibility

- Current market participation: 24-hour trading volume of $27,072.63 reflects modest market activity levels

Macroeconomic Environment's Impact on PZP Investment

- Broader cryptocurrency market conditions influence PZP's investment landscape

- Market capitalization at $363,473.13 with 0.000027% market dominance → positions PZP as a smaller-cap digital asset

- Price performance shows -84.39% change over 1-year period, -12.97% over 30 days, and +1.15% over 24 hours → reflects volatility patterns common in emerging crypto assets

Technology and Ecosystem Development (Technology & Ecosystem for PZP investment)

- Mobile-first gaming platform architecture: Provides unified application with multiple integrated games

- Competitive gaming features: Daily live leagues, group competitions, and PvP formats drive user engagement

- BEP20 token standard deployment: Operates within the Binance Smart Chain ecosystem

- Platform launch: Commenced operations in April 2023, representing relatively early-stage development phase

III. PZP Future Investment Forecast and Price Outlook (Is PlayZap Games (PZP) Worth Investing in 2026-2031)

Short-term Investment Forecast (2026, Short-term PZP Investment Outlook)

- Conservative Forecast: $0.00266 - $0.00368

- Neutral Forecast: $0.00437 - $0.00511

- Optimistic Forecast: $0.00585 - $0.00710

Mid-term Investment Outlook (2027-2029, Mid-term PlayZap Games (PZP) Investment Forecast)

-

Market Stage Expectation: The mid-term period may witness gradual price fluctuation as the platform continues to develop its gaming ecosystem and expand its user base. Market conditions and competitive dynamics within the mobile gaming sector could influence token performance.

-

Investment Return Forecast:

- 2027: $0.00383 - $0.00710

- 2028: $0.00348 - $0.00733

- 2029: $0.00571 - $0.00927

-

Key Catalysts: User growth, new game launches, partnership announcements, and broader adoption of blockchain gaming could serve as potential drivers.

Long-term Investment Outlook (Is PZP a Good Long-term Investment?)

- Baseline Scenario: $0.00584 - $0.00799 (2030) (assumes steady ecosystem development and consistent user engagement)

- Optimistic Scenario: $0.00825 - $0.01255 (2031) (assumes accelerated adoption, successful ecosystem expansion, and favorable market conditions)

- Risk Scenario: Below $0.00266 (in cases of prolonged market downturns, reduced user activity, or intensified competition)

View PZP long-term investment and price forecast: Price Prediction

2026-2031 Long-term Outlook

- Base Scenario: $0.00437 - $0.00799 (corresponding to stable progress and steady mainstream application growth)

- Optimistic Scenario: $0.00825 - $0.01255 (corresponding to large-scale adoption and favorable market environment)

- Transformative Scenario: Above $0.01255 (if the ecosystem achieves breakthrough progress and mainstream penetration)

- 2031-12-31 Forecast High: $0.01255 (based on optimistic development assumptions)

Disclaimer: The above content is for informational purposes only and does not constitute investment advice. Cryptocurrency investments involve risks, and past performance does not guarantee future results. Investors should conduct independent research and consider their risk tolerance before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00585312 | 0.004368 | 0.00266448 | 0 |

| 2027 | 0.0071036784 | 0.00511056 | 0.00383292 | 16 |

| 2028 | 0.00732854304 | 0.0061071192 | 0.003481057944 | 39 |

| 2029 | 0.0092706069456 | 0.00671783112 | 0.005710156452 | 53 |

| 2030 | 0.010552369123296 | 0.0079942190328 | 0.005835779893944 | 82 |

| 2031 | 0.012518947005364 | 0.009273294078048 | 0.008253231729462 | 111 |

IV. PZP Investment Strategy and Risk Management (How to invest in gaming tokens)

Investment Strategy (PZP investment strategy)

Long-term Holding (HODL PZP)

For conservative investors, a long-term holding approach may be considered based on the platform's fundamentals and ecosystem development. This strategy involves accumulating tokens during market corrections and maintaining positions through market cycles, focusing on the project's user growth and game portfolio expansion rather than short-term price movements.

Active Trading

Active traders may utilize technical analysis and swing trading strategies based on PZP's historical price volatility. The token has demonstrated significant price fluctuations, with a 24-hour change of 1.15% and a 7-day decline of 2.71%. Traders should establish clear entry and exit points, monitor trading volume patterns, and implement stop-loss mechanisms to manage downside risk.

Risk Management (Risk management for PZP investment)

Asset Allocation Ratios

- Conservative Investors: Limit exposure to 1-3% of total portfolio, prioritizing established cryptocurrencies with higher market capitalization

- Aggressive Investors: May allocate 5-10% to gaming sector tokens, including PZP, as part of a diversified cryptocurrency portfolio

- Professional Investors: Can consider higher allocations based on comprehensive due diligence and risk tolerance

Risk Hedging Strategies

Implement multi-asset portfolio diversification by combining gaming tokens with established cryptocurrencies, stablecoins, and traditional assets. Consider utilizing hedging instruments such as options or futures contracts where available to mitigate downside risk during volatile market conditions.

Secure Storage Solutions

For PZP token storage, utilize a combination of hot and cold wallet solutions:

- Hot Wallets: For active trading and frequent transactions, use reputable exchanges or mobile wallets with robust security features

- Cold Wallets: For long-term holdings, hardware wallets such as Ledger or Trezor provide enhanced security against online threats

- Multi-Signature Wallets: Advanced users may implement multi-signature solutions for additional security layers

V. PZP Investment Risks and Challenges (Risks of investing in gaming tokens)

Market Risks

High Volatility: PZP has experienced substantial price fluctuations, with a 1-year decline of 84.39% and a 30-day decrease of 12.97%. The current price of $0.00439 represents a significant deviation from its historical high of $0.569705 recorded on November 12, 2023. Such volatility can result in rapid capital losses and requires careful position sizing.

Limited Market Depth: With a market capitalization of approximately $363,473 and 24-hour trading volume of $27,073, PZP demonstrates relatively low liquidity compared to major cryptocurrencies. This limited market depth may increase susceptibility to price manipulation and large order impact on market prices.

Regulatory Risks

Policy Uncertainty: Cryptocurrency regulations vary significantly across jurisdictions and continue to evolve. Gaming tokens face additional scrutiny regarding gambling regulations, user protection standards, and cross-border payment compliance. Changes in regulatory frameworks could materially impact token utility and market accessibility.

Compliance Requirements: Future regulatory developments may impose stricter compliance obligations on gaming platforms, potentially affecting operational costs and token economics.

Technical Risks

Network Security Vulnerabilities: As a BEP20 token deployed on Binance Smart Chain, PZP's security depends on both the underlying blockchain infrastructure and the project's smart contract implementation. Potential vulnerabilities in smart contracts or gaming platform architecture could expose users to hacking attempts or fund loss.

Platform Development Risk: The success of PZP is closely tied to PlayZap Games' ability to maintain and expand its gaming ecosystem. Technical challenges in game development, user experience optimization, or platform scalability could negatively impact token demand and utility.

VI. Conclusion: Is gaming token a Good Investment?

Investment Value Summary

PZP represents exposure to the mobile gaming sector within the cryptocurrency ecosystem. While the platform provides a unified application for multiple casual games with competitive features, the token has experienced substantial price decline over the past year. The project's long-term potential depends on user adoption, game portfolio quality, and competitive positioning within the gaming sector.

Investor Recommendations

✅ Beginners: Consider dollar-cost averaging strategies with small position sizes, prioritize secure wallet storage using hardware solutions, and allocate only funds that can be afforded to lose completely. Focus on understanding the gaming platform's fundamentals before committing capital.

✅ Experienced Investors: Implement swing trading strategies based on technical analysis and market sentiment indicators, maintain diversified exposure across gaming tokens and broader cryptocurrency categories, and regularly rebalance portfolio allocations based on market conditions and project developments.

✅ Institutional Investors: Conduct comprehensive due diligence on platform metrics including daily active users, game retention rates, and revenue models. Consider strategic long-term allocation as part of thematic exposure to blockchain gaming sector, subject to risk management frameworks and liquidity constraints.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk of capital loss. This content is provided for informational purposes only and does not constitute investment advice, financial guidance, or trading recommendations. Investors should conduct independent research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is the current market position of PlayZap Games (PZP)?

As of February 2026, PZP holds a market capitalization of approximately $363,473, ranking 3293 in the cryptocurrency market with a 0.000027% market dominance. The token currently trades at $0.00439 with a 24-hour trading volume of $27,072.63. PZP operates on the Binance Smart Chain as a BEP20 token, with a circulating supply of 82,795,701 tokens representing 55.2% of the total supply capped at 150,000,000. The token has approximately 8,037 holders and is listed on 1 exchange, indicating relatively limited mainstream accessibility compared to major cryptocurrencies.

Q2: How has PZP's price performed historically?

PZP has experienced significant price volatility since its launch. The token reached its peak price of $0.569705 in November 2023, reflecting initial market enthusiasm for blockchain gaming platforms. However, from 2024 through early 2026, PZP entered a prolonged correction phase with substantial declines. The current price of $0.00439 represents an 84.39% decrease over the past year, with a 30-day decline of 12.97%. This performance reflects broader challenges in the blockchain gaming sector and reduced investor interest in mobile gaming tokens during this period.

Q3: What are the primary risk factors for investing in PZP?

PZP investment involves multiple risk categories. Market risks include high volatility demonstrated by the 84.39% annual decline and limited market depth with only $27,073 in daily trading volume, which increases susceptibility to price manipulation. Regulatory risks stem from evolving cryptocurrency policies and gaming-specific compliance requirements across different jurisdictions. Technical risks encompass potential smart contract vulnerabilities, platform security concerns, and development execution challenges. The token's relatively low liquidity, small market capitalization, and limited exchange availability also contribute to elevated investment risk compared to established cryptocurrencies.

Q4: What investment strategies are suitable for PZP holders?

Conservative investors should consider a long-term holding strategy with portfolio allocation limited to 1-3% of total assets, focusing on the platform's ecosystem development rather than short-term price movements. Active traders may employ swing trading strategies based on technical analysis, given PZP's demonstrated volatility, while maintaining strict stop-loss mechanisms. Portfolio diversification across gaming tokens, established cryptocurrencies, and traditional assets is recommended for risk mitigation. Secure storage using hardware wallets is essential for long-term holdings, while hot wallets may be suitable for active trading positions. Dollar-cost averaging can help manage entry point risk for accumulation strategies.

Q5: What factors could influence PZP's future price performance?

Several key factors may impact PZP's price trajectory through 2031. Platform-specific catalysts include user growth metrics, new game launches, partnership announcements, and enhanced gaming features that drive token utility. Broader market conditions, cryptocurrency adoption trends, and blockchain gaming sector sentiment will significantly influence price action. Technical developments such as platform scalability improvements and ecosystem expansion may support long-term value creation. Regulatory clarity regarding gaming tokens and compliance frameworks could affect market accessibility. Price forecasts range from conservative scenarios of $0.00266-$0.00368 in 2026 to optimistic long-term projections of $0.00825-$0.01255 by 2031, depending on adoption rates and market conditions.

Q6: How does PZP compare to other gaming cryptocurrency tokens?

PZP positions itself as a mobile-first gaming platform token within the competitive blockchain gaming sector. With its relatively small market capitalization of $363,473 and modest daily trading volume, PZP represents a micro-cap gaming token compared to established gaming cryptocurrencies. The platform's unified application approach with multiple integrated games, daily live leagues, and PvP formats provides differentiation features. However, the token's limited exchange availability, reduced holder base of approximately 8,000 addresses, and 55.2% circulating supply ratio indicate early-stage market penetration. The project's April 2023 launch represents relatively recent entry into the gaming token space, requiring time to establish competitive positioning and demonstrate sustainable user engagement.

Q7: What are the token economics and supply dynamics of PZP?

PZP operates with a fixed maximum supply of 150,000,000 tokens, providing a foundational scarcity element for long-term valuation. Currently, 82,795,701 tokens are in circulation, representing 55.2% of the total supply, with the remaining tokens presumably allocated for ecosystem development, team incentives, or future distribution. The token utilizes the BEP20 standard on Binance Smart Chain, offering transaction efficiency and integration with the BSC ecosystem. With a fully diluted market cap of $658,500 at current prices, the token's complete supply impact on market dynamics remains a consideration for investors. The circulating-to-total supply ratio suggests ongoing token releases may occur, potentially affecting supply-demand equilibrium and price stability over time.

Q8: Is PZP suitable for different investor profiles?

PZP suitability varies significantly across investor profiles. Beginners should approach with extreme caution, limiting exposure to funds they can afford to lose completely, implementing dollar-cost averaging for small position accumulation, and prioritizing secure storage education before investing. Experienced cryptocurrency investors may consider PZP as a speculative allocation within a diversified gaming token portfolio, utilizing technical analysis for tactical positioning while maintaining strict risk management protocols. Institutional investors should conduct comprehensive due diligence on platform metrics including daily active users, retention rates, and revenue models before considering strategic allocations. All investor categories must recognize the high-risk nature of micro-cap gaming tokens, significant volatility potential, and limited liquidity constraints inherent in PZP's current market structure.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Leverage Trading Guide

Comprehensive Guide to Cryptocurrency Day Trading

What Is a Token Generation Event?

How to Sell PI Coin (Pi Network Cryptocurrency)

A Precise Understanding of Recession and Economic Crisis