Is Refund (RFD) a good investment?: A Comprehensive Analysis of Market Potential and Risk Factors

Introduction: Refund (RFD) Investment Position and Market Prospects

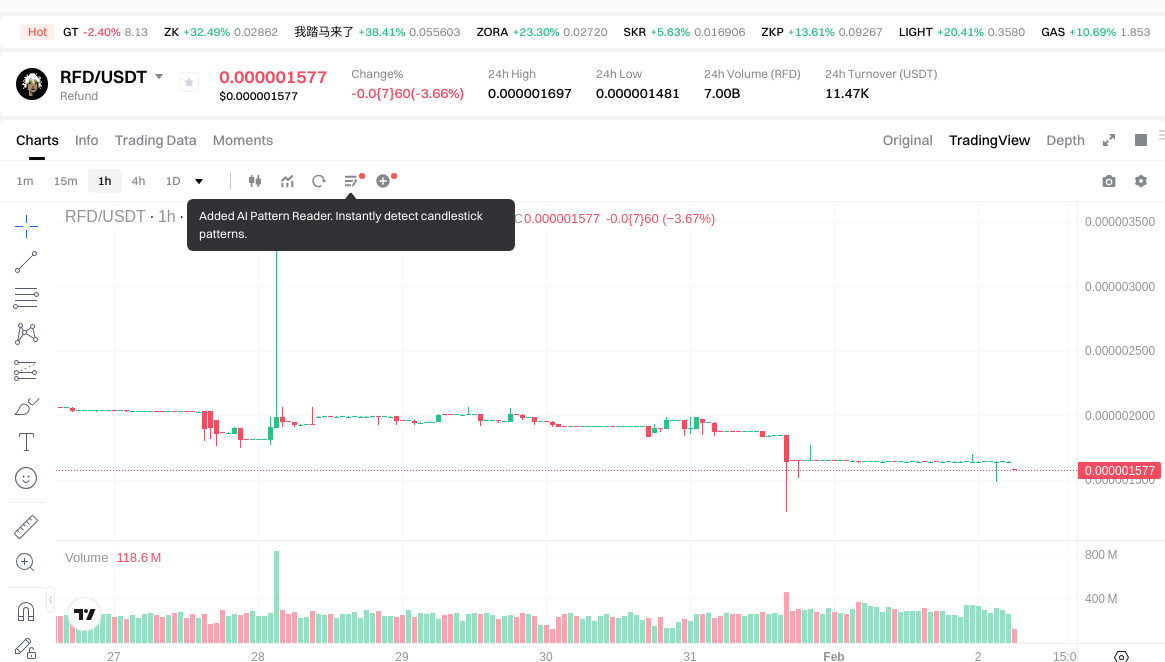

RFD is a cryptocurrency asset in the digital asset sector. As of February 2, 2026, RFD holds a market capitalization of approximately $1,577,000, with a circulating supply of 1,000,000,000,000 tokens, and the current price stands at around $0.000001577. Positioned as a meme token, RFD has drawn attention in discussions regarding "Is Refund (RFD) a good investment?" among market participants. This article provides a comprehensive analysis of RFD's investment characteristics, historical price movements, future price projections, and associated investment risks to serve as a reference for investors.

I. Refund (RFD) Price History Review and Current Investment Value

RFD Historical Price Trends and Investment Returns (Refund(RFD) investment performance)

- 2023: Token launch in May → Initial price established at $0.00004

- 2023: Price reached peak level → RFD traded at $0.0001436 during May

- 2024: Market adjustment phase → Price declined from elevated levels to $0.0000005 in November

- 2025-2026: Ongoing volatility period → Price fluctuated between various levels, with recent 7-day decline of 23.05%

Current RFD Investment Market Status (February 2026)

- RFD current price: $0.000001577

- 24-hour trading volume: $11,450.33

- Market capitalization: $1,577,000

- Circulating supply ratio: 100% (1,000,000,000,000 tokens)

- Token holder base: Approximately 7,000 holders

- Recent price performance: 1-hour change of -3.36%, 24-hour change of -3.66%, 30-day decline of 26.04%

Click to view real-time RFD market price

II. Core Factors Influencing Whether RFD is a Good Investment

Supply Mechanism and Scarcity (RFD Investment Scarcity)

- Total Supply and Circulation → Impact on Price and Investment Value

Refund (RFD) operates with a maximum supply of 1,000,000,000,000 tokens, with the entire supply currently in circulation (100% circulating ratio). This full circulation means there is no additional token inflation expected, which eliminates the dilution pressure that partially circulated tokens may face. From a scarcity perspective, the fixed supply creates a defined market cap ceiling, potentially supporting price stability if demand increases.

Historically, RFD reached a notable price level of $0.0001436 in May 2023, significantly higher than its current trading price of approximately $0.000001577 as of February 2026. The substantial decline from this level suggests that scarcity alone has not been sufficient to maintain elevated valuations, indicating that demand-side factors and broader market sentiment play crucial roles in price determination.

- Investment Significance: Fixed Supply as a Foundation

The complete circulation of RFD's supply means that scarcity is already established at the protocol level. For long-term investment considerations, this fixed supply model removes uncertainty around future token unlocks or inflationary mechanisms. However, investors should note that scarcity does not guarantee price appreciation; it must be accompanied by sustained demand, utility, or adoption to meaningfully impact investment value.

Institutional Investment and Mainstream Adoption (Institutional Investment in RFD)

- Holder Distribution and Market Participation

Refund currently has approximately 7,000 token holders. While this indicates some level of community participation, the holder count remains relatively modest compared to more widely adopted cryptocurrencies. The available data does not provide specific information on institutional holdings or significant corporate adoption of RFD.

- Launch Context and Initial Market Activity

RFD gained attention at its launch on May 19, 2023, partly due to its association with a notable industry figure. Early market activity saw the token's market capitalization reaching elevated levels shortly after launch. However, subsequent trading patterns show significant volatility and price decline from initial peaks.

Macroeconomic Environment Impact on RFD Investment

- Market Position and External Factors

With a market capitalization of approximately $1,577,000 and a market dominance of 0.000057% as of February 2026, RFD occupies a micro-cap position within the broader cryptocurrency market. Tokens at this scale are generally more susceptible to overall market sentiment shifts, regulatory developments, and macroeconomic conditions affecting risk appetite in digital assets.

The broader macroeconomic environment, including monetary policy changes, inflation trends, and geopolitical uncertainties, can influence investor behavior toward speculative assets. However, RFD's specific positioning as a meme token means its price movements may be more directly tied to community sentiment and social media trends rather than serving as a macroeconomic hedge.

Technology and Ecosystem Development (Technology & Ecosystem for RFD Investment)

- Technical Infrastructure

RFD is deployed on the Ethereum network with the contract address 0x955d5c14c8d4944da1ea7836bd44d54a8ec35ba1. The Ethereum blockchain provides established infrastructure, security, and interoperability with decentralized applications and services within the Ethereum ecosystem.

- Project Classification and Utility Considerations

Refund is categorized as a meme token. Unlike protocol tokens with specific utility functions, governance mechanisms, or ecosystem services, meme tokens typically derive value primarily from community engagement, social sentiment, and speculative interest rather than fundamental technological features or utility-driven demand.

The available information does not indicate specific technical upgrades, DeFi integrations, NFT applications, or payment system implementations directly associated with RFD. For investment considerations, this suggests that value drivers may differ from those of utility-focused blockchain projects with defined roadmaps for technological development or ecosystem expansion.

III. RFD Future Investment Forecast and Price Outlook (Is Refund(RFD) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term RFD investment outlook)

- Conservative forecast: $0.00000148 - $0.00000158

- Neutral forecast: $0.00000158 - $0.00000177

- Optimistic forecast: $0.00000177 - $0.00000203

Mid-term Investment Outlook (2027-2029, mid-term Refund(RFD) investment forecast)

- Market stage expectation: RFD may experience gradual price adjustments during 2027-2029, with expected fluctuations influenced by broader meme token market sentiment and trading activity patterns.

- Investment return forecast:

- 2027: $0.00000163 - $0.00000190

- 2028: $0.00000133 - $0.00000196

- 2029: $0.00000133 - $0.00000196

- Key catalysts: Market sentiment shifts, trading volume changes, and overall meme token sector performance.

Long-term Investment Outlook (Is RFD a good long-term investment?)

- Base scenario: $0.00000130 - $0.00000194 (assuming stable market conditions and sustained holder interest)

- Optimistic scenario: $0.00000194 - $0.00000258 (assuming increased adoption and favorable market environment)

- Risk scenario: Below $0.00000130 (under extreme market volatility or diminished interest)

Check RFD long-term investment and price forecast: Price Prediction

2026-02-02 - 2031 Long-term Outlook

- Base scenario: $0.00000130 - $0.00000213 USD (corresponding to steady progress and gradual application growth)

- Optimistic scenario: $0.00000213 - $0.00000258 USD (corresponding to expanded adoption and favorable market conditions)

- Transformative scenario: Above $0.00000258 USD (if ecosystem achieves breakthrough developments and mainstream adoption)

- 2031-12-31 projected high: $0.00000258 USD (based on optimistic development assumptions)

Disclaimer: Price forecasts are based on historical data analysis and market trend assessments. Cryptocurrency markets involve substantial volatility and risk. This analysis does not constitute investment advice, and investors should conduct independent research and risk assessment.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00000203433 | 0.000001577 | 0.00000148238 | 0 |

| 2027 | 0.00000189594825 | 0.000001805665 | 0.0000016250985 | 14 |

| 2028 | 0.000001961855022 | 0.000001850806625 | 0.00000133258077 | 17 |

| 2029 | 0.000001963520748 | 0.000001906330823 | 0.000001334431576 | 20 |

| 2030 | 0.000002321910943 | 0.000001934925786 | 0.000001760782465 | 22 |

| 2031 | 0.000002575386221 | 0.000002128418364 | 0.000001298335202 | 34 |

IV. Refund (RFD) Investment Strategy and Risk Management (How to invest in meme tokens)

Investment Methodology (Refund investment strategy)

- Long-term Holding (HODL RFD): Suitable for conservative investors who believe in the long-term potential of meme tokens. Given RFD's high volatility and -64.62% annual decline, this approach requires strong risk tolerance and belief in community-driven recovery.

- Active Trading: Relies on technical analysis and swing trading opportunities. RFD's 24-hour trading volume of approximately $11,450 indicates limited liquidity, which may impact execution of active trading strategies. Traders should monitor short-term price movements within the current range of $0.0000014 to $0.0000017.

Risk Management (Risk management for RFD investment)

- Asset Allocation Ratio:

- Conservative investors: Maximum 1-2% of portfolio in high-risk meme tokens like RFD

- Aggressive investors: Up to 5-10% allocation with strict stop-loss mechanisms

- Professional investors: Strategic positioning with hedging instruments

- Risk Hedging Solutions: Diversified portfolio combining established cryptocurrencies with speculative meme tokens; consider stablecoin reserves for market downturns

- Secure Storage:

- Cold wallets for long-term holdings

- Hot wallets with multi-signature features for active trading

- Hardware wallet recommendations for storing significant RFD positions

V. Refund (RFD) Investment Risks and Challenges (Risks of investing in meme tokens)

- Market Risk: RFD exhibits significant volatility with 24-hour price fluctuation of -3.66%, 7-day decline of -23.05%, and 30-day drop of -26.04%. The token's price distance from its historical high of $0.0001436 (reached on May 23, 2023) indicates substantial downside exposure. Limited trading volume may amplify price swings.

- Regulatory Risk: Meme tokens face uncertain regulatory treatment across jurisdictions. Policy changes regarding cryptocurrency classification, trading restrictions, or taxation could materially impact RFD's accessibility and valuation.

- Technology Risk: As an ERC-20 token deployed on Ethereum, RFD inherits network security considerations. Smart contract vulnerabilities, network congestion, or failed protocol upgrades could affect token functionality. The project's limited technical documentation increases uncertainty.

- Liquidity Risk: With only one exchange listing and approximately $11,450 in daily trading volume, RFD faces significant liquidity constraints that may result in substantial slippage during large transactions.

VI. Conclusion: Is meme token a Good Investment?

-

Investment Value Summary: RFD demonstrates characteristics typical of speculative meme tokens, with considerable price volatility reflected in its -64.62% annual performance. The token's market capitalization of approximately $1.58 million and fully diluted valuation of $1.58 million indicate complete circulation of its 1 trillion token supply. Short-term price movements remain highly unpredictable.

-

Investor Recommendations: ✅ Beginners: Avoid high-risk meme tokens until gaining experience with established cryptocurrencies; if participating, use dollar-cost averaging with minimal allocation and secure wallet storage ✅ Experienced Investors: Consider tactical trading positions with strict risk parameters and stop-loss orders; maintain diversified portfolio exposure ✅ Institutional Investors: Exercise caution with meme token allocations; conduct thorough due diligence on community engagement and project sustainability

⚠️ Disclaimer: Cryptocurrency investment carries substantial risk. This content is for informational purposes only and does not constitute investment advice. Past performance does not guarantee future results. Investors should conduct independent research and consider their financial situation before making investment decisions.

VII. FAQ

Q1: Is Refund (RFD) a good investment in 2026?

RFD carries substantial investment risk due to extreme volatility and limited liquidity. The token has declined 64.62% annually and currently trades at $0.000001577, approximately 99% below its May 2023 peak of $0.0001436. With only $11,450 in daily trading volume and market capitalization of $1.58 million, RFD exhibits characteristics of a high-risk speculative asset. Conservative investors should avoid exposure, while experienced traders may consider tactical positions with strict risk management protocols limiting allocation to 1-2% of portfolio value and implementing stop-loss mechanisms.

Q2: What is the price prediction for RFD through 2031?

Price forecasts suggest modest volatility with limited upside potential. Short-term 2026 projections range from $0.00000148 to $0.00000203 under various scenarios. Mid-term forecasts for 2027-2029 anticipate continued fluctuations between $0.00000133 and $0.00000196. Long-term projections through 2031 estimate a potential high of $0.00000258 under optimistic conditions, representing approximately 63% upside from current levels. However, these forecasts depend on sustained community engagement and favorable market conditions, which remain uncertain for meme tokens.

Q3: What are the main risks of investing in RFD?

RFD faces multiple significant risks: (1) Market Risk - extreme volatility with 26.04% monthly decline and 99% drop from historical highs; (2) Liquidity Risk - minimal trading volume of $11,450 daily creates substantial slippage potential; (3) Regulatory Risk - uncertain legal treatment of meme tokens across jurisdictions may impact accessibility; (4) Technology Risk - limited technical documentation and dependence on Ethereum network security. The token's classification as a meme asset means value derives primarily from community sentiment rather than fundamental utility, increasing speculative risk exposure.

Q4: How does RFD's supply mechanism affect its investment value?

RFD operates with complete supply circulation of 1 trillion tokens (100% circulating ratio), eliminating future inflation concerns. This fixed supply structure provides scarcity at the protocol level, theoretically supporting price stability if demand increases. However, historical performance demonstrates that scarcity alone has proven insufficient to maintain valuation, as RFD has declined 99% from peak levels despite fixed supply. The token's investment value depends more critically on sustained demand drivers, community engagement, and broader meme token market sentiment rather than supply mechanics alone.

Q5: What investment strategy should be used for RFD?

Investment approaches depend on risk tolerance and experience level. Conservative investors should limit exposure to maximum 1-2% of portfolio with long-term holding strategies and secure cold wallet storage. Active traders may employ swing trading techniques within current price ranges of $0.0000014 to $0.0000017, though limited liquidity requires careful position sizing. Risk management essentials include: diversified portfolio allocation combining established cryptocurrencies with speculative positions, stablecoin reserves for market downturns, hardware wallet storage for significant holdings, and strict stop-loss mechanisms. Beginners should avoid meme tokens until gaining experience with less volatile assets.

Q6: How many holders does RFD have and what does this indicate?

RFD currently has approximately 7,000 token holders as of February 2026. This holder count represents modest community participation compared to more established cryptocurrencies. The relatively limited holder base suggests: (1) constrained network effects and community-driven demand potential; (2) concentration risk where large holders may significantly impact price through trading activity; (3) limited mainstream adoption beyond speculative interest. For investment considerations, the holder distribution indicates that RFD remains a niche asset without broad market penetration, which correlates with its micro-cap market position of $1.58 million capitalization and minimal trading activity.

Q7: What role does technology play in RFD's investment potential?

RFD operates as an ERC-20 token on the Ethereum network (contract address: 0x955d5c14c8d4944da1ea7836bd44d54a8ec35ba1), providing established blockchain infrastructure and ecosystem interoperability. However, as a meme token classification, RFD lacks specific utility functions, governance mechanisms, or ecosystem services that drive demand for protocol tokens. Available data shows no technical upgrades, DeFi integrations, or payment system implementations associated with the project. This positions RFD's value drivers primarily around community sentiment and speculative interest rather than technological innovation or utility-based demand, differentiating it from infrastructure-focused blockchain projects with defined development roadmaps.

Q8: Should institutional investors consider RFD allocation?

Institutional investors should exercise significant caution regarding RFD exposure. The token's characteristics present substantial challenges for institutional mandates: (1) extreme volatility with 64.62% annual decline conflicts with risk management frameworks; (2) minimal liquidity of $11,450 daily volume creates execution difficulties for institutional position sizes; (3) limited regulatory clarity surrounding meme tokens introduces compliance uncertainties; (4) absence of fundamental utility or revenue generation contradicts institutional investment criteria. If considering allocation, institutions should conduct comprehensive due diligence on community sustainability, implement strict position limits within alternative asset buckets, establish clear exit strategies, and ensure appropriate governance oversight for speculative digital asset exposure.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks