Is Statter Network (STT) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in 2024

Introduction: Statter Network (STT) Investment Position and Market Outlook

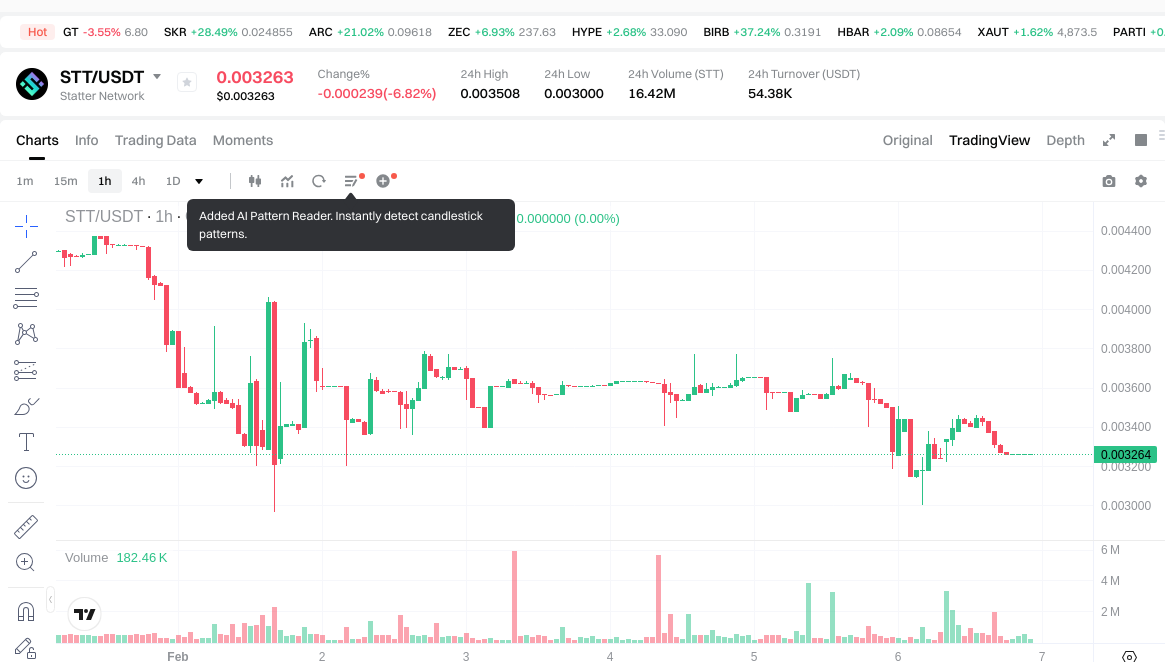

STT is a significant asset in the cryptocurrency field. Since its launch in 2023, it has been developing within the metaverse infrastructure sector. As of 2026, Statter Network has a market capitalization of approximately $348,786, with a circulating supply of around 106,891,350 tokens, and the current price maintains around $0.003263. Positioned as a full-service public blockchain platform for the metaverse ecosystem, STT has gradually become a focal point for investors discussing "Is Statter Network (STT) a good investment?" This article will comprehensively analyze STT's investment value, historical trends, future price predictions, and investment risks to provide reference for investors.

I. Statter Network (STT) Price History Review and Current Investment Value

STT Historical Price Performance and Investment Returns

- June 2023: STT launched with an initial offering price of $0.5, marking its entry into the metaverse blockchain infrastructure market

- April 2024: Price reached $1.43 during the market's bullish phase, representing a significant appreciation from launch levels

- 2024-2025: Market correction phase saw substantial price decline, with STT experiencing a 98.3% drawdown over the one-year period

- November 2025: Price approached lower support levels around $0.00261 amid broader market volatility

- February 2026: Current trading reflects continued market uncertainty with recent 30-day decline of 48.4%

Current STT Investment Market Status (February 2026)

- Current STT Price: $0.003263

- 24-Hour Trading Volume: $54,137.87

- Market Capitalization: $348,786.48

- Circulating Supply: 106.89 million STT (5.74% of total supply)

- Fully Diluted Market Cap: $6.07 million

- Recent Price Movements:

- 1-Hour: +0.038%

- 24-Hour: -7.03%

- 7-Day: -24.03%

- 30-Day: -48.4%

- 1-Year: -98.3%

Click to view real-time STT market price

Note: STT's investment value remains closely tied to the development trajectory of metaverse ecosystem adoption and the project's ability to deliver on its infrastructure commitments. The token currently trades at a 99.3% discount from its initial offering price, with limited exchange availability potentially affecting liquidity. Investors should consider the project's positioning as a metaverse-focused blockchain platform when evaluating potential opportunities.

II. Core Factors Affecting Whether STT is a Good Investment (Is Statter Network(STT) a Good Investment)

Supply Mechanism and Scarcity (STT investment scarcity)

- Maximum supply capped at 1,861,000,000 STT tokens → influences price dynamics and investment value

- Current circulating supply of 106,891,350 tokens represents approximately 5.74% of maximum supply → indicates substantial future supply expansion potential

- Historical price movement: STT traded at $1.43 in April 2024, compared to $0.00261 in November 2025 → demonstrates significant price volatility

- Investment implication: low circulation ratio suggests future supply releases may impact token scarcity and pricing structure

Institutional Investment and Mainstream Adoption (Institutional investment in STT)

- Exchange availability: STT currently trades on 1 exchange platform with 24-hour trading volume of $54,137.87

- Limited trading venue exposure may constrain institutional access and liquidity depth

- Adoption indicators: holder data and institutional positioning information not available in current materials

Macroeconomic Environment's Impact on STT Investment

- Price performance context: STT declined 98.3% over one-year period and 48.4% over 30-day period as of February 6, 2026

- Market capitalization of $348,786.48 represents 0.00025% market share → indicates minor position in broader crypto ecosystem

- Market sentiment indicator shows neutral to negative positioning amid broader market conditions

Technology and Ecosystem Development (Technology & Ecosystem for STT investment)

- Platform positioning: Statter Network serves as infrastructure for metaverse ecosystem, targeting developers, creators, and users

- Technical focus: high-performance and high-security infrastructure designed for metaverse applications

- Price forecasts present mixed outlook: some analyses project February 2026 target of $0.006183 based on 0.42% monthly growth rate, while technical indicators show sell signals

- Ecosystem application scope: metaverse-focused use cases may provide specialized niche positioning but limited diversification compared to broader blockchain platforms

III. STT Future Investment Forecast and Price Outlook (Is Statter Network (STT) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term STT investment outlook)

- Conservative forecast: $0.0029367 - $0.003263

- Neutral forecast: $0.003263 - $0.00375

- Optimistic forecast: $0.00375 - $0.00466609

Mid-term Investment Outlook (2027-2029, mid-term Statter Network (STT) investment forecast)

-

Market stage expectation: STT may experience a phase of gradual recovery and stabilization following the significant decline observed in 2025. The token could see moderate price fluctuations as the project continues to develop its metaverse infrastructure and potentially attracts developer adoption.

-

Investment return forecast:

- 2027: $0.00281482695 - $0.00408348135

- 2028: $0.00253512830025 - $0.005955539499

- 2029: $0.00289407027546 - $0.00643681147473

-

Key catalysts: Potential factors may include technical developments in metaverse infrastructure, ecosystem expansion, partnership announcements, and broader market sentiment toward metaverse-related blockchain projects.

Long-term Investment Outlook (Is STT a good long-term investment?)

- Base scenario: $0.003427976343519 - $0.006998785034684 (assuming steady platform development and moderate user adoption)

- Optimistic scenario: $0.006508870082256 - $0.010078250449945 (assuming successful ecosystem expansion and favorable market conditions)

- Risk scenario: Below $0.003 (under conditions of prolonged market downturn or limited platform adoption)

For detailed STT long-term investment and price forecast: Price Prediction

2026-02-06 to 2031 Long-term Outlook

- Base scenario: $0.003427976343519 - $0.005713293905865 (corresponding to steady progress and gradual mainstream application enhancement)

- Optimistic scenario: $0.006508870082256 - $0.010078250449945 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.010078250449945 (if the ecosystem achieves breakthrough developments and mainstream popularity)

- 2031-12-31 forecast high: $0.010078250449945 (based on optimistic development assumptions)

Disclaimer: The above forecasts are derived from predictive models and historical data analysis. Cryptocurrency markets are highly volatile and influenced by numerous unpredictable factors. These forecasts should not be construed as investment advice. Investors should conduct independent research and consider their own risk tolerance before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00466609 | 0.003263 | 0.0029367 | 0 |

| 2027 | 0.00408348135 | 0.003964545 | 0.00281482695 | 21 |

| 2028 | 0.005955539499 | 0.004024013175 | 0.00253512830025 | 23 |

| 2029 | 0.00643681147473 | 0.004989776337 | 0.00289407027546 | 52 |

| 2030 | 0.008284276163504 | 0.005713293905865 | 0.003427976343519 | 75 |

| 2031 | 0.010078250449945 | 0.006998785034684 | 0.006508870082256 | 114 |

IV. Statter Network Investment Strategy and Risk Management (How to invest in Metaverse Infrastructure)

Investment Methodology (Statter Network investment strategy)

-

Long-term Holding (HODL STT): Suitable for conservative investors who believe in the long-term development of metaverse infrastructure. Given STT's positioning as a full-service public blockchain platform for the metaverse ecosystem, investors with conviction in the metaverse sector may consider accumulating positions during market downturns.

-

Active Trading: Relies on technical analysis and swing trading strategies. The token has demonstrated significant volatility, with 24-hour price fluctuations ranging from $0.003 to $0.003511. Traders can utilize technical indicators and chart patterns to identify entry and exit points, though this approach requires continuous market monitoring and risk tolerance.

Risk Management (Risk management for STT investment)

-

Asset Allocation Ratio:

- Conservative investors: Limit exposure to 1-3% of total portfolio

- Aggressive investors: May allocate 5-10% depending on risk tolerance

- Professional investors: Can consider higher allocations with appropriate hedging strategies

-

Risk Hedging Solutions: Implement multi-asset portfolio diversification by combining STT with established cryptocurrencies and traditional assets. Consider using stop-loss orders and position sizing strategies to manage downside risk.

-

Secure Storage:

- Cold Wallets: Hardware wallets recommended for long-term holdings

- Hot Wallets: Use reputable exchange wallets only for active trading portions

- Hardware Wallet Recommendations: Leading industry solutions that support native coins

V. Statter Network Investment Risks and Challenges (Risks of investing in Metaverse Infrastructure)

-

Market Risk: STT exhibits substantial volatility, with a 98.3% decline over the past year and a 48.4% drop in the last 30 days. The token's price has fluctuated between its low of $0.00261 and high of $1.43. Such extreme price movements indicate heightened market risk and potential for significant capital loss.

-

Regulatory Risk: As a metaverse-focused blockchain platform, STT faces regulatory uncertainties across different jurisdictions. Evolving policies regarding virtual assets, metaverse platforms, and blockchain infrastructure could impact the project's operations and token valuation.

-

Technology Risk: While Statter Network positions itself as a high-performance and high-security infrastructure platform, any blockchain project faces potential technical vulnerabilities, network security threats, or challenges in protocol upgrades that could affect system stability and user confidence.

-

Liquidity Risk: With limited exchange listings (only 1 exchange recorded) and relatively low 24-hour trading volume of $54,137.87, STT may face liquidity constraints that could result in wider bid-ask spreads and difficulty executing larger trades without significant price impact.

-

Market Capitalization Risk: The token's circulating market cap of approximately $348,786 represents only 5.74% of its fully diluted valuation, indicating substantial potential token supply increases that could create downward price pressure.

VI. Conclusion: Is Metaverse Infrastructure a Good Investment?

-

Investment Value Summary: Statter Network (STT) represents a specialized investment in the emerging metaverse infrastructure sector. While the project aims to provide comprehensive services for metaverse developers, creators, and users, the token has experienced severe price volatility and substantial value decline. The long-term investment potential depends heavily on the broader adoption of metaverse technologies and the platform's ability to attract and retain developers and users within its ecosystem.

-

Investor Recommendations:

✅ Beginners: Consider dollar-cost averaging with minimal allocation and secure wallet storage. Start with educational research on metaverse technologies before committing capital.

✅ Experienced Investors: May explore swing trading opportunities given volatility patterns, while maintaining diversified portfolio exposure across multiple sectors.

✅ Institutional Investors: Conduct thorough due diligence on the platform's technical architecture, team credentials, and ecosystem development before considering strategic allocation.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including the potential loss of principal. This content is for informational purposes only and does not constitute investment advice. Investors should conduct independent research and consult financial advisors before making investment decisions.

VII. FAQ

Q1: Is Statter Network (STT) currently a good short-term investment opportunity?

Based on current market conditions, STT presents significant short-term risks rather than opportunities. The token has declined 48.4% over the past 30 days and 7.03% in the last 24 hours, trading at $0.003263 with limited liquidity ($54,137.87 daily volume). Technical indicators show sell signals, and the token trades on only one exchange, creating potential exit challenges. Short-term traders should approach with extreme caution and implement strict risk management protocols, including stop-loss orders and position sizing not exceeding 1-3% of total portfolio value.

Q2: What percentage of my crypto portfolio should I allocate to STT?

Conservative investors should limit STT exposure to 1-3% of their total portfolio, while aggressive investors with higher risk tolerance may consider 5-10% allocation. Given STT's 98.3% decline over the past year and its position as a specialized metaverse infrastructure token, concentration risk is substantial. The token's low market capitalization ($348,786) and limited exchange availability necessitate careful position sizing. Professional investors with hedging capabilities might consider higher allocations, but only with appropriate risk mitigation strategies in place.

Q3: How does STT's tokenomics affect its long-term investment potential?

STT's tokenomics present both opportunities and challenges for long-term investors. The current circulating supply of 106.89 million tokens represents only 5.74% of the maximum supply of 1.861 billion tokens. This low circulation ratio indicates substantial future supply expansion potential, which could create downward price pressure as additional tokens enter the market. However, if the Statter Network ecosystem achieves meaningful adoption and demand growth, this supply structure could provide upside potential. Investors must weigh the dilution risk against the project's ability to generate sufficient ecosystem demand to absorb future token releases.

Q4: What are the main risks I should consider before investing in STT?

Five primary risks warrant careful consideration: (I) Market Risk - evidenced by 98.3% annual decline and extreme volatility; (II) Liquidity Risk - trading on only one exchange with limited daily volume creates potential exit difficulties; (III) Regulatory Risk - uncertain regulatory treatment of metaverse-focused blockchain platforms across jurisdictions; (IV) Technology Risk - potential for technical vulnerabilities or security challenges in platform infrastructure; (V) Market Capitalization Risk - small market cap and low circulating supply percentage suggest potential for significant future token dilution. These factors compound to create an investment profile suitable only for risk-tolerant investors.

Q5: What is the realistic price outlook for STT by 2030?

Conservative projections suggest STT could trade between $0.003427 and $0.008284 by 2030, assuming steady platform development and moderate adoption. This represents potential gains of 5% to 154% from current levels. The optimistic scenario, contingent upon successful ecosystem expansion and favorable market conditions, projects a range of $0.006508 to $0.010078, representing potential returns of 99% to 209%. However, these forecasts depend on numerous factors including metaverse sector growth, platform execution, and broader cryptocurrency market conditions. A risk scenario of prices remaining below $0.003 exists under conditions of prolonged market downturn or limited platform adoption.

Q6: How does Statter Network compare to other metaverse infrastructure investments?

Statter Network occupies a specialized niche as a full-service public blockchain platform specifically designed for metaverse ecosystem infrastructure. While this focused positioning provides potential differentiation, it also limits diversification compared to broader blockchain platforms. The project's current metrics - including its minimal market capitalization ($348,786), single exchange listing, and 98.3% price decline - indicate it operates at an earlier stage with higher risk/reward characteristics than established metaverse infrastructure competitors. Investors comparing STT to alternative metaverse investments should evaluate relative liquidity, ecosystem traction, developer activity, and partnership networks.

Q7: What security measures should I implement when holding STT tokens?

For long-term STT holdings, hardware wallets (cold storage) provide optimal security by keeping private keys offline and protected from potential exchange hacks or online threats. Active traders should maintain only necessary trading portions in reputable exchange wallets (hot wallets), transferring majority holdings to cold storage. Given STT's limited exchange availability, investors should verify the security credentials and insurance coverage of available trading platforms. Implement multi-factor authentication, regular security audits of wallet software, and never share private keys or seed phrases with any party.

Q8: What catalysts could drive STT price appreciation in 2026-2027?

Potential near-term catalysts include: (I) Expansion to additional cryptocurrency exchanges, improving liquidity and accessibility; (II) Partnership announcements with metaverse platforms or gaming ecosystems; (III) Technical milestone achievements in platform infrastructure development; (IV) Growing developer adoption and ecosystem application launches; (V) Broader market recovery in metaverse-related blockchain projects. However, investors should note that STT currently shows bearish technical indicators and limited trading activity, suggesting catalysts would need to be substantial to reverse prevailing negative sentiment. Monitor official project announcements, GitHub development activity, and trading volume trends for early signals of potential momentum shifts.

XRP Price Analysis 2025: Market Trends and Investment Outlook

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

Mastering the Crypto Fear and Greed Index: 2025 Trading Strategies

What Is the Best Crypto ETF in 2025: Top Performers and Beginner's Guide

What is SwissCheese (SWCH) and How Does It Democratize Investment?

What Is the Best AI Crypto in 2025?

Digital Nomads & Web3: Traveling and Working Around the World

Top 8 NEAR Wallets

Comprehensive Guide to Understanding and Managing FUD in Cryptocurrency Markets

Bitcoin Pizza Day Explained: The Story of the First BTC Transaction

Are NFTs obsolete? A comprehensive look at NFT applications