KP3R vs SOL: Which Decentralized Job Protocol and Blockchain Network Offers Better Investment Potential in 2024?

Introduction: KP3R vs SOL Investment Comparison

In the cryptocurrency market, the comparison between KP3R vs SOL has consistently been a topic investors cannot overlook. The two differ markedly in market cap ranking, application scenarios, and price performance, representing distinct crypto asset positioning. KP3R (Keep3rV1): Launched in 2020, it has gained market recognition through its positioning as a decentralized work matching platform connecting external developers with project teams requiring task execution. SOL (Solana): Since its 2020 launch, it has been regarded as a high-performance blockchain protocol, ranking among the cryptocurrencies with substantial global trading volume and market capitalization. This article will comprehensively analyze the investment value comparison of KP3R vs SOL around historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to address the question investors care about most:

"Which is the better buy right now?"

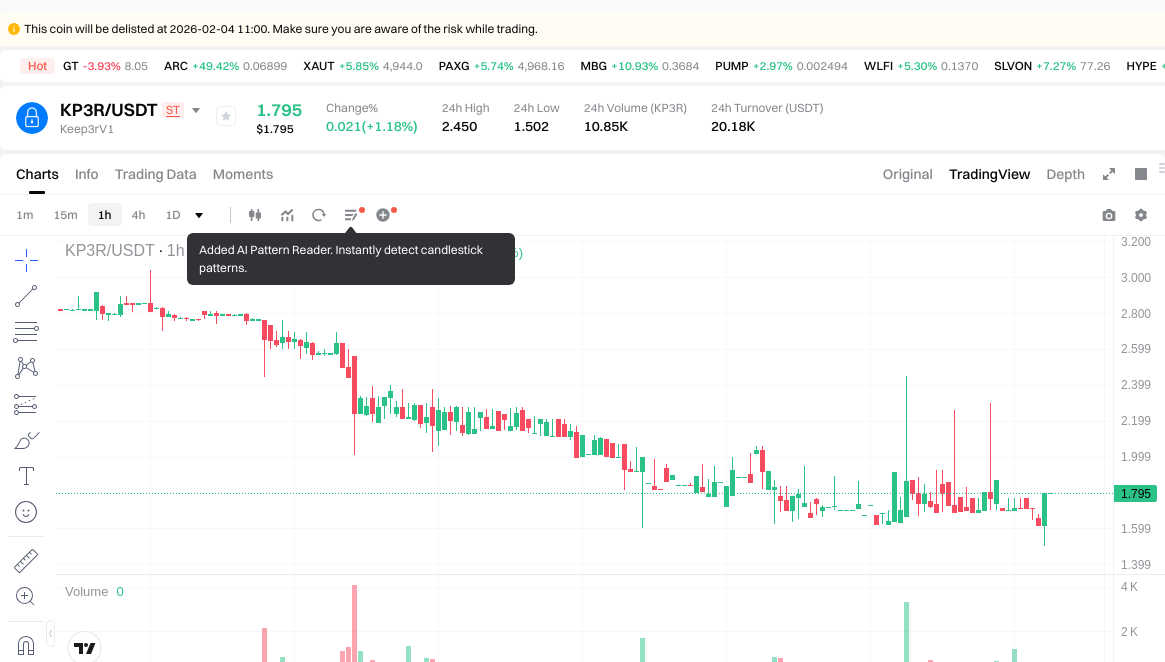

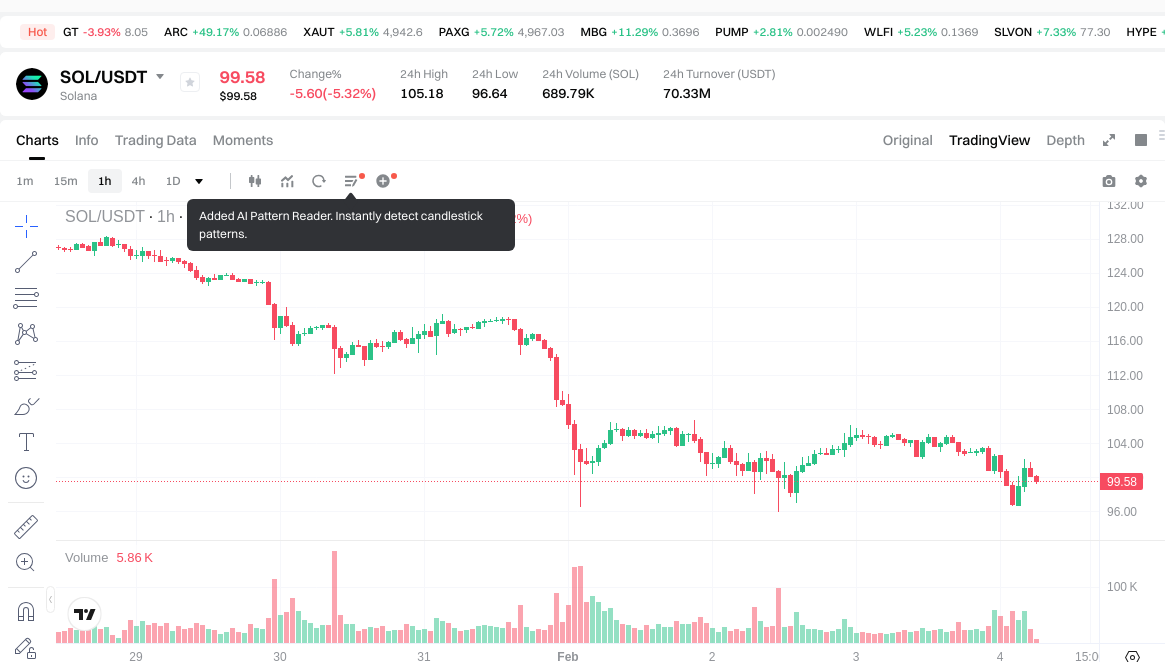

I. Historical Price Comparison and Current Market Status

KP3R (Coin A) and SOL (Coin B) Historical Price Trends

- 2020: KP3R was launched through a public auction at $0.22, experiencing price fluctuations between $0.50 and $1.50 during its first three months of trading.

- 2020: SOL began trading in March 2020 at $0.22, with prices fluctuating between $0.50 and $1.50 during the first three months, before rallying to $4.735 by August 2020.

- 2021: KP3R reached a notable price level of $1,995.53 on November 13, 2021, representing a period of elevated market activity.

- 2021: SOL demonstrated substantial growth during the first quarter with price increases, ultimately reaching a peak of $253 in November 2021.

- 2025-2026: KP3R experienced a decline, with prices dropping to $1.72 on February 4, 2026.

- 2025-2026: SOL reached a high of $293.31 on January 19, 2025, before declining to $100.11 by February 4, 2026.

- Comparative Analysis: During the recent market cycle, KP3R declined from $1,995.53 to $1.795, while SOL decreased from $293.31 to $100.11, with both tokens experiencing significant corrections from their respective peaks.

Current Market Status (February 4, 2026)

- KP3R Current Price: $1.795

- SOL Current Price: $100.11

- 24-Hour Trading Volume: KP3R $20,220.99 vs SOL $70,154,179.69

- Market Sentiment Index (Fear & Greed Index): 17 (Extreme Fear)

View Real-Time Prices:

- Check KP3R Current Price Market Price

- Check SOL Current Price Market Price

II. Core Factors Influencing KP3R vs SOL Investment Value

Supply Mechanism Comparison (Tokenomics)

- KP3R: Features a limited supply mechanism, which may contribute to potential scarcity-driven value dynamics within the Keep3r Network ecosystem.

- SOL: The supply mechanism details were not extensively covered in the reference materials, though market demand and blockchain network adoption appear to be significant factors.

- 📌 Historical Pattern: Supply constraints combined with ecosystem expansion may influence periodic price movements, though specific historical cycles require further observation.

Institutional Adoption and Market Applications

- Institutional Holdings: Reference materials indicate that institutional adoption represents a key factor for KP3R's investment value, though comparative data with SOL was not extensively detailed.

- Enterprise Adoption: KP3R operates within the decentralized job marketplace and DeFi automation space, while SOL's enterprise applications across payment systems and smart contract platforms show different use case trajectories.

- Regulatory Environment: The materials note that macroeconomic announcements, central bank policies, and cryptocurrency-specific developments (such as protocol upgrades or ETF approvals) may impact both assets, though specific national policies were not detailed.

Technology Development and Ecosystem Construction

- KP3R Technology Progress: The Keep3r Network focuses on continuous technical and ecosystem development within decentralized task automation, though the materials note relatively slower expansion compared to some competitors.

- SOL Technology Development: SOL's blockchain network adoption and market dynamics represent core value drivers, with smart contract and DeFi ecosystem development being relevant factors.

- Ecosystem Comparison: Both projects operate in distinct niches—KP3R in decentralized job marketplace and automation services, while SOL spans broader DeFi, NFT, and smart contract applications.

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: The materials reference macroeconomic factors including inflation reports as potential influences, though specific anti-inflation characteristics were not comparatively analyzed.

- Macroeconomic Monetary Policy: Interest rate adjustments, central bank announcements, and investor sentiment represent factors that may affect exchange rates and valuations for both assets.

- Geopolitical Factors: Global market supply and demand dynamics, including cross-border transaction needs, may influence both KP3R and SOL valuations, though specific geopolitical scenarios were not detailed in the reference materials.

III. 2026-2031 Price Forecast: KP3R vs SOL

Short-term Forecast (2026)

- KP3R: Conservative $1.36-$1.80 | Optimistic $1.80-$2.42

- SOL: Conservative $90.49-$99.44 | Optimistic $99.44-$132.26

Medium-term Forecast (2028-2029)

- KP3R may enter a gradual growth phase, with estimated price range of $1.63-$3.57

- SOL may enter a consolidation and expansion phase, with estimated price range of $92.10-$178.30

- Key drivers: institutional capital flows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- KP3R: Baseline scenario $2.46-$3.80 | Optimistic scenario $3.80-$5.09

- SOL: Baseline scenario $130.26-$188.88 | Optimistic scenario $188.88-$270.10

Disclaimer

KP3R:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 2.42325 | 1.795 | 1.3642 | 0 |

| 2027 | 2.7418625 | 2.109125 | 1.24438375 | 17 |

| 2028 | 3.0318671875 | 2.42549375 | 1.6250808125 | 35 |

| 2029 | 3.5745714140625 | 2.72868046875 | 2.0465103515625 | 52 |

| 2030 | 4.443792577382812 | 3.15162594140625 | 2.458268234296875 | 75 |

| 2031 | 5.088930407588671 | 3.797709259394531 | 3.493892518642968 | 111 |

SOL:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 132.2552 | 99.44 | 90.4904 | 0 |

| 2027 | 129.749312 | 115.8476 | 66.033132 | 15 |

| 2028 | 171.9178384 | 122.798456 | 92.098842 | 22 |

| 2029 | 178.303358112 | 147.3581472 | 135.569495424 | 47 |

| 2030 | 214.93659350592 | 162.830752656 | 130.2646021248 | 62 |

| 2031 | 270.1036525057728 | 188.88367308096 | 154.8846119263872 | 88 |

IV. Investment Strategy Comparison: KP3R vs SOL

Long-term vs Short-term Investment Strategies

- KP3R: May appeal to investors focused on decentralized automation infrastructure and niche DeFi utility applications, with consideration for its limited supply mechanism and specialized ecosystem positioning.

- SOL: May appeal to investors seeking exposure to broad-scale blockchain adoption across DeFi, NFT, and smart contract applications, with emphasis on network effect expansion and institutional adoption trajectory.

Risk Management and Asset Allocation

- Conservative Investors: KP3R 20-30% vs SOL 70-80% allocation may reflect differentiated risk exposure, with larger allocation toward established network infrastructure.

- Aggressive Investors: KP3R 40-50% vs SOL 50-60% allocation may reflect higher tolerance for specialized ecosystem volatility and potential asymmetric returns.

- Hedging Tools: Stablecoin allocations, options strategies, and cross-asset diversification approaches may be considered within broader portfolio construction frameworks.

V. Potential Risk Comparison

Market Risk

- KP3R: Lower liquidity levels reflected in 24-hour trading volume ($20,220.99) may present execution challenges during market volatility periods, with limited market depth potentially amplifying price fluctuations.

- SOL: Higher trading volume ($70,154,179.69) suggests improved liquidity conditions, though substantial price corrections from peaks ($293.31 to $100.11) indicate exposure to broad market sentiment shifts and macroeconomic factors.

Technical Risk

- KP3R: Ecosystem expansion pace and developer adoption represent ongoing considerations within the decentralized task automation niche, with network effects dependent on continuous protocol development.

- SOL: Network scalability, validation infrastructure, and historical network stability considerations remain relevant factors in assessing long-term technical sustainability and operational resilience.

Regulatory Risk

- Global regulatory developments regarding decentralized work platforms and smart contract protocols may affect both assets differently based on their respective use cases, jurisdictional presence, and compliance frameworks, though specific policy impacts remain uncertain.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary

- KP3R Characteristics: Specialized positioning within decentralized automation and job marketplace infrastructure, limited supply mechanism, niche ecosystem focus with lower liquidity profile.

- SOL Characteristics: Broad blockchain infrastructure adoption across multiple use cases, substantial trading volume and market capitalization, extensive institutional consideration and ecosystem diversity.

✅ Investment Considerations

- Novice Investors: May consider starting with more established blockchain infrastructure assets offering higher liquidity and broader market participation, with gradual exposure to specialized protocols as understanding develops.

- Experienced Investors: May evaluate portfolio allocation based on risk tolerance, with consideration for diversification across different blockchain use cases, ecosystem maturity stages, and liquidity profiles.

- Institutional Investors: May assess both assets within broader digital asset allocation frameworks, considering factors including liquidity depth, regulatory clarity, ecosystem development roadmaps, and alignment with institutional investment mandates.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate substantial volatility. This content does not constitute investment advice. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What are the main differences between KP3R and SOL in terms of market positioning?

KP3R focuses on decentralized task automation and job marketplace infrastructure, while SOL operates as a broad-scale blockchain infrastructure supporting DeFi, NFTs, and smart contracts. KP3R serves a specialized niche within the Keep3r Network ecosystem, connecting external developers with project teams requiring task execution. In contrast, SOL provides comprehensive blockchain infrastructure with extensive institutional adoption and diverse application scenarios. The 24-hour trading volume comparison ($20,220.99 for KP3R vs $70,154,179.69 for SOL) reflects their significantly different market liquidity profiles and investor participation levels.

Q2: How have KP3R and SOL performed historically from their 2020 launches?

Both assets experienced substantial growth cycles followed by corrections, though at different scales. KP3R launched at $0.22 and reached a notable peak of $1,995.53 in November 2021 before declining to $1.795 by February 2026. SOL also began trading at $0.22 in March 2020, achieved a peak of $253 in November 2021, reached $293.31 in January 2025, and subsequently corrected to $100.11 by February 2026. While both tokens demonstrated similar initial pricing and experienced the 2021 bull market peak, their subsequent price movements and market capitalizations diverged significantly, reflecting their different ecosystem scales and adoption trajectories.

Q3: What are the projected price ranges for KP3R and SOL through 2031?

For KP3R, short-term 2026 projections range from $1.36-$2.42, with medium-term 2028-2029 estimates of $1.63-$3.57, and long-term 2030-2031 baseline scenarios of $2.46-$3.80 (optimistic $3.80-$5.09). For SOL, 2026 projections range from $90.49-$132.26, medium-term 2028-2029 estimates of $92.10-$178.30, and 2030-2031 baseline scenarios of $130.26-$188.88 (optimistic $188.88-$270.10). These forecasts assume various scenarios driven by institutional capital flows, ecosystem expansion, and broader market cycle dynamics, though actual performance may vary significantly based on multiple factors including regulatory developments and technological advancement.

Q4: How should investors allocate between KP3R and SOL based on risk tolerance?

Conservative investors may consider allocations of 20-30% KP3R and 70-80% SOL, reflecting larger exposure to established blockchain infrastructure with higher liquidity. Aggressive investors might allocate 40-50% KP3R and 50-60% SOL, accepting higher exposure to specialized ecosystem volatility for potential asymmetric returns. These allocation frameworks reflect differentiated risk profiles, with SOL offering greater liquidity depth and broader institutional adoption, while KP3R presents niche positioning within decentralized automation infrastructure. Portfolio construction should also incorporate stablecoin allocations, options strategies, and cross-asset diversification approaches based on individual investment objectives.

Q5: What are the primary risks associated with investing in KP3R versus SOL?

KP3R faces market risk from lower liquidity levels (24-hour volume of $20,220.99), which may create execution challenges during volatility periods and amplify price fluctuations due to limited market depth. Technical risks include ecosystem expansion pace and developer adoption within the specialized decentralized task automation niche. SOL encounters market risk through exposure to broad sentiment shifts, as evidenced by substantial corrections from peaks, despite higher trading volume ($70,154,179.69) suggesting improved liquidity. Technical considerations for SOL include network scalability, validation infrastructure stability, and operational resilience factors. Both assets face regulatory uncertainty regarding decentralized protocols, though impacts may differ based on their respective use cases and jurisdictional presence.

Q6: Which cryptocurrency is more suitable for novice investors?

Novice investors may find SOL more suitable initially due to its higher liquidity profile, broader market participation, and established blockchain infrastructure across multiple use cases. The substantial 24-hour trading volume ($70,154,179.69) facilitates easier entry and exit positions compared to KP3R's more limited liquidity. SOL's extensive ecosystem diversity and institutional consideration provide more accessible entry points for understanding blockchain fundamentals. However, gradual exposure to specialized protocols like KP3R can be incorporated as understanding develops. Regardless of choice, novice investors should conduct independent research, start with modest allocations, and consult qualified financial advisors before making investment decisions in these volatile cryptocurrency markets.

Q7: How do macroeconomic factors affect KP3R and SOL differently?

Both assets respond to macroeconomic factors including inflation reports, interest rate adjustments, central bank announcements, and investor sentiment shifts, though their sensitivity levels may differ. SOL's broader market capitalization and institutional adoption may result in greater correlation with traditional market cycles and macroeconomic policy changes. KP3R's specialized positioning within decentralized automation infrastructure may demonstrate different sensitivity patterns to these factors, though its lower liquidity could amplify volatility during macroeconomic uncertainty. Global market supply and demand dynamics, including cross-border transaction needs and regulatory developments, influence both assets, though specific impacts depend on their respective use cases, ecosystem maturity, and market positioning within the broader cryptocurrency landscape.

Q8: What factors should institutional investors consider when evaluating KP3R versus SOL?

Institutional investors should assess liquidity depth, with SOL's significantly higher trading volume providing advantages for large-scale position management and execution. Regulatory clarity represents a critical consideration, as both assets face evolving frameworks affecting decentralized protocols, though impacts may vary based on jurisdictional presence and compliance infrastructure. Ecosystem development roadmaps should be evaluated, comparing KP3R's specialized focus on decentralized task automation against SOL's comprehensive blockchain infrastructure supporting diverse applications. Additional factors include alignment with institutional investment mandates, custody solutions availability, risk management framework compatibility, and integration with existing digital asset allocation strategies. Both assets should be analyzed within broader portfolio construction frameworks considering correlation patterns, volatility profiles, and long-term infrastructure development trajectories.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top 7 Play to Earn Cryptocurrencies

What is Tokenomics: A Basic Guide

Is Ani Grok Companion (ANI) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability for 2024

Is LayerEdge (EDGEN) a good investment?: A Comprehensive Analysis of Token Potential, Market Position, and Risk Factors

Is WeSendit (WSI) a good investment?: A Comprehensive Analysis of the Platform's Potential Returns and Risk Factors