LIY vs RUNE: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

Introduction: Investment Comparison Between LIY and RUNE

In the cryptocurrency market, the comparison between LIY vs RUNE has been a topic that investors cannot avoid. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

LIY (Lily): Launched in 2025, it has gained market recognition through its positioning as a next-generation live commerce platform with web3 token incentive protocol, aiming to unify the web3 commerce market in the Asia-Pacific region.

RUNE (THORChain): Since its launch in 2019, it has been positioned as a highly optimized multi-chain protocol using pBFT consensus, supporting cross-chain transactions and order matching at the protocol level.

This article will comprehensively analyze the investment value comparison of LIY vs RUNE around historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, and attempt to answer the question that investors are most concerned about:

"Which is the better buy right now?"

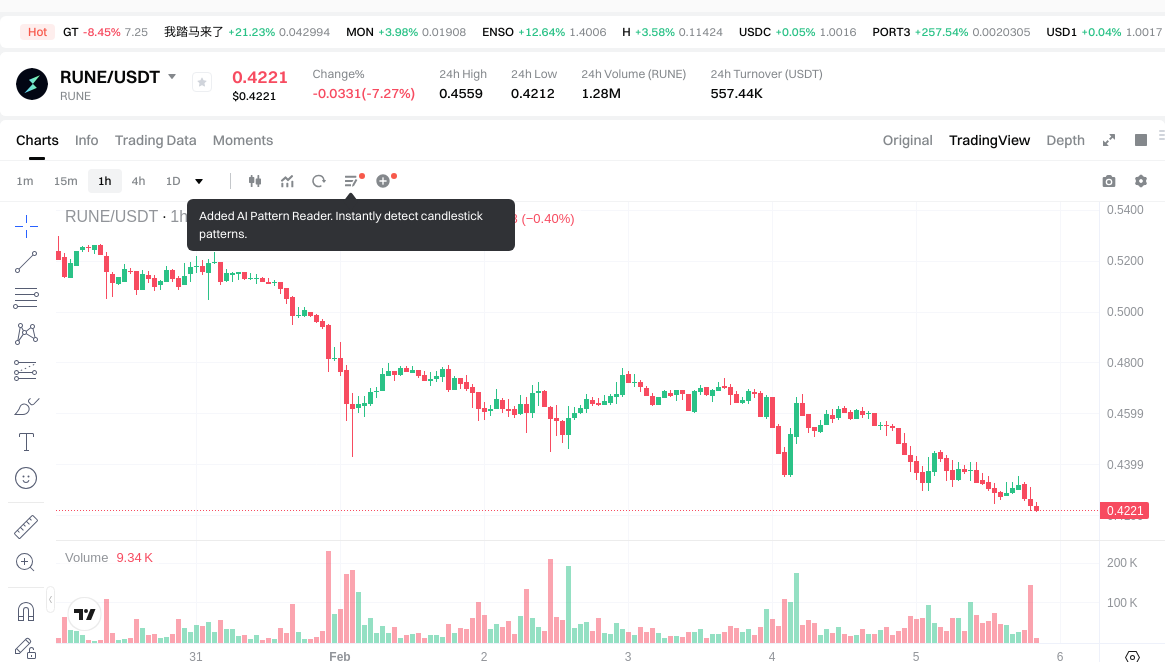

I. Historical Price Comparison and Current Market Status

LIY and RUNE Historical Price Trends

- 2025-01-15: LIY reached a price peak of $0.0575, marking a notable point in its early trading period.

- 2025-02-10: LIY recorded its lowest price at $0.000322, representing a significant decline from its earlier peak.

- 2021-05-19: RUNE achieved its all-time high of $20.87 during a period of broader market expansion.

- 2019-09-28: RUNE established its historical low at $0.00851264 in its early market phase.

- 2026-02-03: RUNE recorded a recent low of approximately $0.4391.

- Comparative Analysis: During different market cycles, LIY demonstrated volatility between its high of $0.0575 and low of $0.000322 within a relatively short timeframe, while RUNE experienced a more extended price range between $20.87 and $0.00851264 over several years, with recent trading near lower historical levels.

Current Market Status (2026-02-05)

- LIY current price: $0.002607

- RUNE current price: $0.4246

- 24-hour trading volume: LIY $44,185.97 vs RUNE $555,240.01

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

View real-time prices:

- View LIY current price Market Price

- View RUNE current price Market Price

II. Core Factors Influencing LIY vs RUNE Investment Value

Supply Mechanism Comparison (Tokenomics)

- LIY: Operates within an emerging Web3 commercial ecosystem with innovative incentive mechanisms designed to support regional business ecosystem development in the Asia-Pacific area.

- RUNE: Functions as part of the digital asset infrastructure, featuring mechanisms tailored to support cross-chain liquidity provision and decentralized exchange operations.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through inflation rates, distribution schedules, and token utility within their respective ecosystems.

Institutional Adoption and Market Application

- Institutional Holdings: Both tokens serve different market segments, with LIY focusing on Web3 business applications and RUNE concentrating on DeFi infrastructure.

- Enterprise Adoption: LIY demonstrates positioning in regional commercial ecosystems, while RUNE has established presence in decentralized finance protocols and cross-chain liquidity solutions.

- National Policies: Regulatory approaches vary across jurisdictions, with DeFi-focused projects like RUNE potentially facing different compliance frameworks compared to business-oriented tokens like LIY.

Technology Development and Ecosystem Building

- LIY Technology Direction: Oriented toward Web3 commercial ecosystem integration with emphasis on incentive mechanism innovation and regional market penetration.

- RUNE Technology Framework: Designed to facilitate cross-chain asset exchanges and liquidity provision through decentralized protocols.

- Ecosystem Comparison: LIY targets business ecosystem applications, while RUNE has established presence in DeFi protocols, with both tokens serving distinct use cases in the blockchain landscape.

Macroeconomic Environment and Market Cycles

- Inflationary Context: Digital assets respond differently to macroeconomic conditions based on their utility, adoption rates, and market positioning.

- Monetary Policy Impact: Interest rate changes and currency index fluctuations can affect capital flows into various crypto asset categories.

- Geopolitical Factors: Cross-border transaction demands and international developments may influence adoption patterns differently across business-focused and DeFi-oriented tokens.

III. 2026-2031 Price Prediction: LIY vs RUNE

Short-term Forecast (2026)

- LIY: Conservative $0.00247665 - $0.002607 | Optimistic $0.002607 - $0.00370194

- RUNE: Conservative $0.350592 - $0.4224 | Optimistic $0.4224 - $0.59136

Mid-term Forecast (2028-2029)

- LIY may enter a phase of gradual appreciation, with projected prices ranging from $0.001817921061 to $0.004705207452 in 2028, and $0.00355599617736 to $0.0047551111674 in 2029

- RUNE may enter a consolidation and growth phase, with projected prices ranging from $0.523252224 to $0.602021376 in 2028, and $0.47168656128 to $0.80943743232 in 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- LIY: Baseline scenario $0.002489197324152 - $0.0044449952217 (2030) | Optimistic scenario $0.004021831676594 - $0.005878061681176 (2031)

- RUNE: Baseline scenario $0.4384064539008 - $0.69588326016 (2030) | Optimistic scenario $0.773369861178816 - $1.172528499206592 (2031)

Disclaimer

LIY:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00370194 | 0.002607 | 0.00247665 | 0 |

| 2027 | 0.0039746322 | 0.00315447 | 0.0016087797 | 21 |

| 2028 | 0.004705207452 | 0.0035645511 | 0.001817921061 | 36 |

| 2029 | 0.0047551111674 | 0.004134879276 | 0.00355599617736 | 58 |

| 2030 | 0.005867393692644 | 0.0044449952217 | 0.002489197324152 | 70 |

| 2031 | 0.005878061681176 | 0.005156194457172 | 0.004021831676594 | 97 |

RUNE:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.59136 | 0.4224 | 0.350592 | 0 |

| 2027 | 0.6183936 | 0.50688 | 0.4916736 | 19 |

| 2028 | 0.602021376 | 0.5626368 | 0.523252224 | 32 |

| 2029 | 0.80943743232 | 0.582329088 | 0.47168656128 | 37 |

| 2030 | 0.9672777316224 | 0.69588326016 | 0.4384064539008 | 63 |

| 2031 | 1.172528499206592 | 0.8315804958912 | 0.773369861178816 | 95 |

IV. Investment Strategy Comparison: LIY vs RUNE

Long-term vs Short-term Investment Strategies

- LIY: May appeal to investors interested in emerging Web3 commercial ecosystem development and regional Asia-Pacific market penetration, with consideration for early-stage project characteristics and associated volatility patterns.

- RUNE: May suit investors seeking exposure to decentralized finance infrastructure and cross-chain liquidity protocols, with attention to established market presence since 2019 and DeFi sector dynamics.

Risk Management and Asset Allocation

- Conservative Investors: Consider diversified allocation approaches, such as LIY 20-30% vs RUNE 70-80%, accounting for differing volatility profiles and market maturity levels between early-stage and established projects.

- Aggressive Investors: May explore higher allocation ranges like LIY 50-60% vs RUNE 40-50%, with recognition of increased exposure to price fluctuations and market sentiment shifts.

- Hedging Instruments: Portfolio risk management tools include stablecoin reserves, options strategies for downside protection, and multi-asset combinations to reduce concentration risk.

V. Potential Risk Comparison

Market Risks

- LIY: Faces volatility patterns associated with newer market entrants, demonstrated by price movements between $0.0575 and $0.000322 within its trading history, alongside considerations of lower liquidity levels as reflected in 24-hour trading volume of $44,185.97.

- RUNE: Subject to broader DeFi sector fluctuations and cross-chain protocol adoption trends, with current trading near historical lower ranges at $0.4246 compared to previous levels, influenced by overall market sentiment indicators showing extreme fear conditions.

Technical Risks

- LIY: Considerations include platform scalability requirements for Web3 commercial applications, network stability during ecosystem expansion phases, and integration challenges within regional business frameworks.

- RUNE: Technical considerations encompass cross-chain protocol security, liquidity pool mechanics, network consensus stability, and potential vulnerabilities inherent in decentralized exchange infrastructure.

Regulatory Risks

- Global regulatory frameworks may impact these tokens differently, with business-oriented platforms like LIY potentially subject to commercial application regulations in Asia-Pacific jurisdictions, while DeFi-focused protocols like RUNE may encounter evolving cross-border transaction compliance requirements and decentralized finance oversight developments across multiple regulatory environments.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- LIY Characteristics: Positioned within emerging Web3 commercial ecosystem development, targeting Asia-Pacific regional markets with innovative incentive mechanisms, demonstrating early-stage growth patterns with associated volatility considerations.

- RUNE Characteristics: Established presence in decentralized finance infrastructure since 2019, facilitating cross-chain liquidity and asset exchanges through protocol-level mechanisms, with longer market track record and DeFi sector positioning.

✅ Investment Considerations:

- Beginner Investors: Consider starting with smaller position sizes in both assets, prioritize understanding fundamental differences between business ecosystem tokens and DeFi infrastructure protocols, and maintain diversified exposure across multiple asset categories to manage volatility.

- Experienced Investors: May evaluate strategic allocation based on sector preferences between Web3 commercial applications and DeFi infrastructure, assess risk-reward profiles considering historical price ranges and current market positioning, and implement active monitoring strategies aligned with market cycle phases.

- Institutional Investors: Could examine long-term ecosystem development trajectories, evaluate liquidity conditions and market depth for position sizing, consider correlation patterns with broader crypto market segments, and assess regulatory landscape implications for each token category.

⚠️ Risk Disclosure: Cryptocurrency markets exhibit substantial volatility characteristics. This analysis does not constitute investment advice. Market participants should conduct independent research, assess personal risk tolerance levels, and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What are the main differences between LIY and RUNE in terms of market positioning?

LIY is a next-generation Web3 commercial platform token launched in 2025, focusing on live commerce with token incentive protocols in the Asia-Pacific region, while RUNE is an established DeFi infrastructure token since 2019, designed for cross-chain liquidity provision and decentralized exchange operations. LIY targets business ecosystem applications with regional market penetration strategies, whereas RUNE concentrates on protocol-level cross-chain asset exchanges and liquidity solutions within the decentralized finance sector.

Q2: How do the historical price ranges of LIY and RUNE compare?

LIY has demonstrated significant volatility within a relatively short timeframe, with prices ranging from a high of $0.0575 (January 2025) to a low of $0.000322 (February 2025), while RUNE has experienced a broader price range over several years, from an all-time high of $20.87 (May 2021) to a historical low of $0.00851264 (September 2019). As of February 2026, LIY trades at $0.002607 and RUNE at $0.4246, reflecting their different market maturity levels and adoption phases.

Q3: What supply mechanism differences exist between LIY and RUNE?

LIY operates within an emerging Web3 commercial ecosystem featuring innovative incentive mechanisms designed to support regional business development in the Asia-Pacific area, while RUNE functions as digital asset infrastructure with mechanisms tailored for cross-chain liquidity provision and decentralized exchange operations. These supply mechanisms influence price cycles differently through their respective inflation rates, distribution schedules, and token utility within distinct ecosystem frameworks—LIY focusing on business applications and RUNE concentrating on DeFi infrastructure.

Q4: What are the projected price ranges for LIY and RUNE through 2031?

For 2026, LIY projections range from $0.00247665 to $0.00370194, while RUNE ranges from $0.350592 to $0.59136. By 2031, LIY's optimistic scenario projects $0.004021831676594 to $0.005878061681176, representing approximately 97% growth from 2026 baseline, while RUNE's optimistic scenario projects $0.773369861178816 to $1.172528499206592, representing approximately 95% growth. These forecasts reflect different growth trajectories based on ecosystem development phases, institutional adoption patterns, and market cycle positioning.

Q5: What allocation strategies should different investor types consider for LIY vs RUNE?

Conservative investors may consider diversified allocations such as 20-30% LIY versus 70-80% RUNE, accounting for LIY's early-stage characteristics and RUNE's established market presence, while aggressive investors might explore 50-60% LIY versus 40-50% RUNE with recognition of increased volatility exposure. Portfolio risk management should incorporate stablecoin reserves, options strategies for downside protection, and multi-asset combinations to reduce concentration risk, with allocation decisions informed by individual risk tolerance, investment timeframes, and sector preferences between Web3 commercial applications and DeFi infrastructure.

Q6: How do liquidity levels differ between LIY and RUNE?

Current 24-hour trading volumes reveal significant liquidity differences, with LIY recording $44,185.97 compared to RUNE's $555,240.01. This approximately 12.5x difference in trading volume indicates RUNE maintains substantially higher market liquidity, which typically facilitates larger position entries and exits with reduced price impact, while LIY's lower liquidity levels may present considerations for investors regarding order execution and potential slippage during volatile market conditions.

Q7: What technical risks should investors consider for each token?

LIY faces technical considerations including platform scalability requirements for Web3 commercial applications, network stability during ecosystem expansion phases, and integration challenges within regional business frameworks. RUNE's technical risks encompass cross-chain protocol security, liquidity pool mechanics, network consensus stability, and potential vulnerabilities inherent in decentralized exchange infrastructure. Both tokens carry distinct technical risk profiles aligned with their respective use cases—business ecosystem development for LIY versus DeFi protocol operations for RUNE.

Q8: How might regulatory developments differently impact LIY and RUNE?

Regulatory implications vary based on token utility and jurisdictional frameworks.

Business-oriented platforms like LIY may encounter commercial application regulations in Asia-Pacific jurisdictions, particularly concerning Web3 commerce activities and regional business operations, while DeFi-focused protocols like RUNE face evolving cross-border transaction compliance requirements and decentralized finance oversight developments across multiple regulatory environments. Global regulatory frameworks continue developing for both commercial Web3 applications and DeFi infrastructure, requiring investors to monitor jurisdiction-specific policy changes that could affect token operations and adoption trajectories.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How to Buy Cryptocurrency: Top Strategies

Cryptocurrency for Beginners: Which Coin Should You Invest In

A Comprehensive Overview of the Future Potential and Types of Altcoins

Comprehensive Guide to Decentralized Finance (DeFi)

Mining Calculator: How to Calculate Cryptocurrency Mining Profitability