MDX vs APT: A Comprehensive Comparison of Advanced Threat Detection and Prevention Technologies

Introduction: MDX vs APT Investment Comparison

In the cryptocurrency market, the comparison between MDX vs APT has consistently been a topic that investors cannot avoid. The two not only exhibit significant differences in market cap ranking, application scenarios, and price performance, but also represent distinct crypto asset positioning. MDX (MDX): Since its launch in 2021, it has gained market recognition by positioning itself as a decentralized exchange based on the fund pool concept, implementing a dual-chain DEX model on Huobi Eco Chain and Ethereum, and supporting dual mining mechanisms for liquidity and trading. APT (APT): Since its launch in 2022, it has been recognized as a high-performance PoS Layer 1 blockchain, utilizing the Move programming language and Move virtual machine for application development, focusing on delivering secure and scalable blockchain infrastructure. This article will comprehensively analyze the investment value comparison of MDX vs APT around historical price trends, supply mechanisms, institutional adoption, technical ecosystem, and future predictions, attempting to answer the question that concerns investors most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

Historical Price Trends of MDX (Coin A) and APT (Coin B)

-

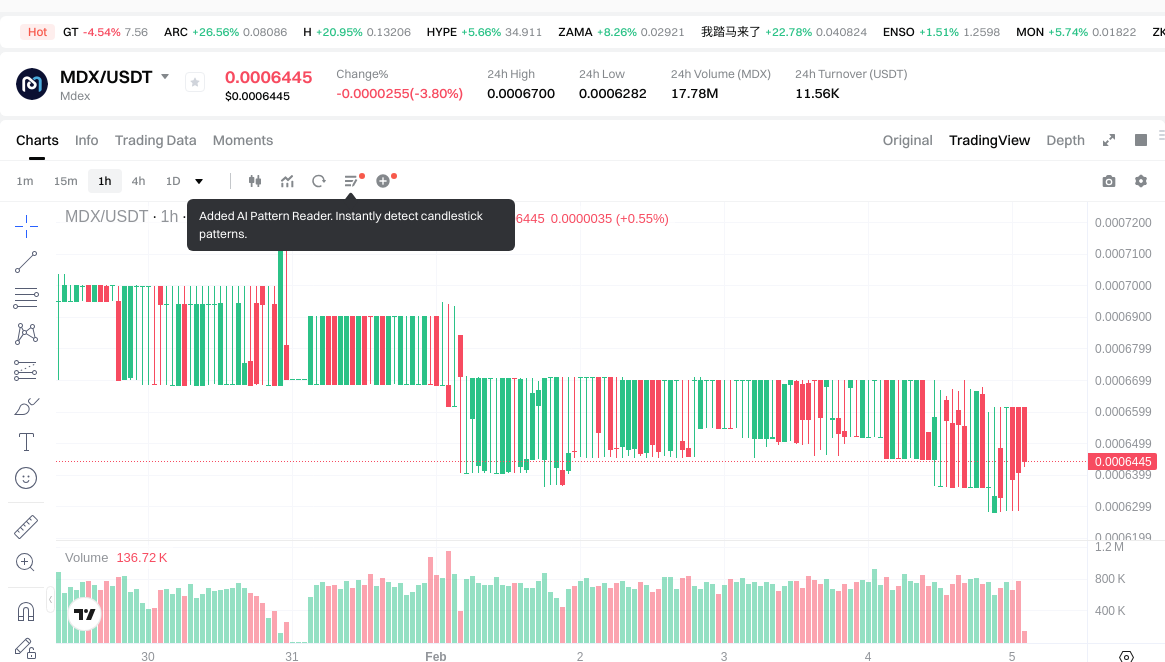

2021: MDX experienced notable price movement, reaching its all-time high of $10.06 on February 22, 2021. This peak occurred during a period of heightened interest in decentralized exchanges and the Huobi Eco Chain ecosystem.

-

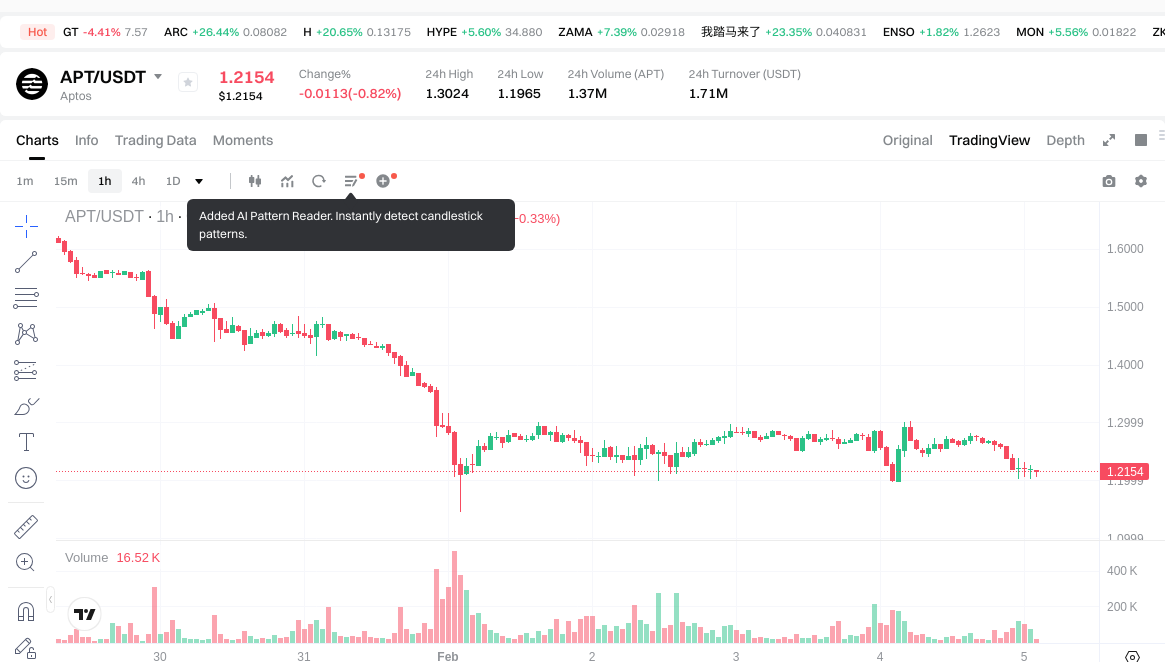

2022: APT launched its mainnet in October 2022, introducing its high-performance Layer-1 blockchain to the market. Following its launch, the token attracted attention from the Web3 community due to its innovative Move programming language and scalability features.

-

2023: APT reached its all-time high of $19.92 on January 26, 2023, driven by growing adoption of its blockchain infrastructure and expanding DeFi applications within its ecosystem.

-

Comparative Analysis: Throughout market cycles, MDX declined significantly from its peak of $10.06 to its all-time low of $0.000629 recorded on February 5, 2026, representing a substantial downturn. In contrast, APT demonstrated relative resilience, declining from $19.92 to $1.20 on February 4, 2026, though still experiencing considerable depreciation during the broader market correction.

Current Market Situation (February 5, 2026)

- MDX Current Price: $0.0006613

- APT Current Price: $1.2214

- 24-Hour Trading Volume: MDX recorded $11,534.54, while APT registered significantly higher activity at $1,720,262.75

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

Check real-time prices:

- View MDX current price Market Price

- View APT current price Market Price

II. Core Factors Influencing MDX vs APT Investment Value

Supply Mechanism Comparison (Tokenomics)

-

MDX: The provided materials do not contain specific information regarding MDX's supply mechanism, including whether it employs a fixed supply model, deflationary model, or other tokenomic structures.

-

APT: The provided materials do not contain specific information regarding APT's supply mechanism, including details about halving mechanisms, emission schedules, or total supply caps.

-

📌 Historical Pattern: Supply mechanisms have historically influenced price cycles through scarcity dynamics, emission rate adjustments, and market expectations. Assets with deflationary models or programmed supply reductions tend to experience distinct cyclical patterns compared to those with inflationary or unlimited supply structures.

Institutional Adoption and Market Application

-

Institutional Holdings: The provided materials do not contain comparative data on institutional preference or holding patterns between MDX and APT.

-

Enterprise Adoption: The materials do not provide specific information regarding MDX or APT's application in cross-border payments, settlement systems, or institutional investment portfolios.

-

National Policies: The materials do not contain information about regulatory attitudes or policy positions from different countries specifically toward MDX or APT.

Technical Development and Ecosystem Building

-

MDX Technical Upgrades: The provided materials do not contain information about MDX's technical roadmap, upgrade schedules, or potential impacts on its ecosystem.

-

APT Technical Development: The provided materials do not contain information about APT's technical development initiatives or their potential market impact.

-

Ecosystem Comparison: The materials do not provide specific data comparing DeFi integration, NFT market presence, payment system adoption, or smart contract implementation between MDX and APT ecosystems.

Macroeconomic Environment and Market Cycles

-

Performance in Inflationary Environments: The provided materials do not contain comparative analysis regarding which asset demonstrates stronger anti-inflation characteristics.

-

Macroeconomic Monetary Policy: The materials do not provide specific analysis of how interest rate changes, US dollar index movements, or central bank policies differentially affect MDX versus APT.

-

Geopolitical Factors: The materials do not contain information about how cross-border transaction demand, international tensions, or geopolitical developments specifically impact MDX or APT investment value.

III. 2026-2031 Price Forecast: MDX vs APT

Short-term Forecast (2026)

- MDX: Conservative range $0.000561 - $0.000645 | Optimistic range $0.000645 - $0.000754

- APT: Conservative range $0.932 - $1.210 | Optimistic range $1.210 - $1.501

Mid-term Forecast (2028-2029)

- MDX may enter a gradual accumulation phase, with estimated price range between $0.000571 and $0.001203

- APT may enter a steady growth phase, with estimated price range between $1.164 and $2.017

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- MDX: Baseline scenario $0.000631 - $0.001034 | Optimistic scenario $0.001447 - $0.001600

- APT: Baseline scenario $1.231 - $1.784 | Optimistic scenario $2.213 - $2.658

Disclaimer

MDX:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.000754065 | 0.0006445 | 0.000560715 | -2 |

| 2027 | 0.000888088775 | 0.0006992825 | 0.000384605375 | 5 |

| 2028 | 0.00093654905225 | 0.0007936856375 | 0.000738127642875 | 20 |

| 2029 | 0.001202513109376 | 0.000865117344875 | 0.000570977447617 | 30 |

| 2030 | 0.001447341317975 | 0.001033815227125 | 0.000630627288546 | 56 |

| 2031 | 0.00160034597159 | 0.00124057827255 | 0.000793970094432 | 87 |

APT:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 1.500648 | 1.2102 | 0.931854 | 0 |

| 2027 | 1.57229184 | 1.355424 | 0.89457984 | 10 |

| 2028 | 1.6395208704 | 1.46385792 | 1.4199421824 | 19 |

| 2029 | 2.01719621376 | 1.5516893952 | 1.1637670464 | 27 |

| 2030 | 2.2127090775552 | 1.78444280448 | 1.2312655350912 | 46 |

| 2031 | 2.658106001553408 | 1.9985759410176 | 1.69878954986496 | 63 |

IV. Investment Strategy Comparison: MDX vs APT

Long-term vs Short-term Investment Strategies

-

MDX: May appeal to investors seeking high-risk, speculative opportunities in the decentralized exchange sector. Given its current low price point and significant depreciation from historical peaks, it represents a highly volatile asset that could attract traders looking for short-term price movements rather than long-term holding strategies.

-

APT: May suit investors interested in Layer-1 blockchain infrastructure with focus on technical innovation and ecosystem development. The Move programming language foundation and relatively higher market activity suggest potential appeal for those seeking exposure to scalable blockchain platforms with mid-to-long-term growth perspectives.

Risk Management and Asset Allocation

-

Conservative Investors: MDX 5-10% vs APT 90-95% allocation may reflect risk-adjusted positioning, given APT's relatively higher trading volume and infrastructure-focused value proposition compared to MDX's current market conditions.

-

Aggressive Investors: MDX 30-40% vs APT 60-70% allocation could represent higher risk tolerance, acknowledging MDX's speculative nature while maintaining substantial exposure to APT's ecosystem potential.

-

Hedging Tools: Stablecoin allocation for capital preservation, options strategies for downside protection, cross-asset portfolio diversification to mitigate single-token concentration risk.

V. Potential Risk Comparison

Market Risk

-

MDX: Exhibits substantial price volatility with significant historical depreciation from $10.06 to $0.0006613, indicating heightened sensitivity to market sentiment shifts. The extremely low 24-hour trading volume of $11,534.54 suggests limited liquidity, which may amplify price swings during market stress periods.

-

APT: Demonstrates considerable price fluctuation, declining from $19.92 to $1.2214, though maintaining relatively higher trading activity at $1,720,262.75. The current market sentiment index of 14 (Extreme Fear) indicates broader market uncertainty affecting both assets.

Technical Risk

-

MDX: Scalability considerations and network stability factors may influence platform reliability, though specific technical vulnerabilities are not detailed in available information.

-

APT: Infrastructure development risks related to blockchain scalability, network performance under increased transaction loads, and potential security considerations inherent to emerging Layer-1 platforms.

Regulatory Risk

- Global regulatory developments may affect MDX and APT differently based on their respective use cases. Decentralized exchange protocols and Layer-1 blockchain infrastructures face evolving regulatory frameworks across jurisdictions, with potential impacts on operational parameters, compliance requirements, and market accessibility.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

MDX Characteristics: Represents a highly speculative position in the decentralized exchange sector with extremely low current valuation and minimal trading activity. Historical price movements indicate substantial volatility.

-

APT Characteristics: Offers exposure to Layer-1 blockchain infrastructure with Move programming language foundation, relatively higher market activity, and positioning in the scalable blockchain platform segment.

✅ Investment Considerations:

-

New Investors: May consider focusing on understanding fundamental blockchain concepts and market dynamics before engaging with highly volatile assets. Starting with assets demonstrating higher liquidity and established market presence could provide more stable learning environments.

-

Experienced Investors: Could evaluate portfolio diversification strategies that account for different risk profiles, considering MDX's speculative nature versus APT's infrastructure-focused positioning. Risk management through position sizing and stop-loss mechanisms may be appropriate.

-

Institutional Investors: Might assess these assets within broader crypto exposure frameworks, considering liquidity requirements, regulatory compliance considerations, and alignment with investment mandates focused on either speculative opportunities or infrastructure development themes.

⚠️ Risk Disclosure: Cryptocurrency markets exhibit extreme volatility. This content does not constitute investment advice. Market conditions, regulatory environments, and technical developments may significantly impact asset values. Investors should conduct independent research and consider their risk tolerance before making investment decisions.

VII. FAQ

Q1: What are the main differences between MDX and APT in terms of their core technology and use cases?

MDX is a decentralized exchange (DEX) protocol operating on a dual-chain model across Huobi Eco Chain and Ethereum, while APT is a Layer-1 blockchain infrastructure utilizing the Move programming language. MDX focuses on facilitating decentralized trading through liquidity pools and dual mining mechanisms for liquidity providers and traders. In contrast, APT positions itself as a high-performance Proof-of-Stake blockchain platform designed to deliver secure and scalable infrastructure for decentralized application development, emphasizing technical innovation in blockchain architecture rather than exchange functionality.

Q2: Given the current market conditions showing Extreme Fear (index of 14), is this an appropriate time to invest in either MDX or APT?

Market timing during extreme fear conditions requires careful risk assessment rather than emotional decision-making. The Fear & Greed Index of 14 indicates widespread market pessimism, which historically can present opportunities for long-term investors with appropriate risk tolerance, but also signals heightened volatility and potential for further downside. MDX's extremely low trading volume of $11,534.54 suggests severe liquidity constraints that could amplify price movements, while APT's comparatively higher volume of $1,720,262.75 provides somewhat better market depth. Investors should prioritize capital preservation strategies, position sizing appropriate to their risk profile, and avoid deploying capital that cannot withstand potential further depreciation.

Q3: How do the historical price movements of MDX and APT compare in terms of volatility and risk?

MDX has demonstrated extreme volatility, declining approximately 99.99% from its all-time high of $10.06 (February 2021) to its current price of $0.0006613, representing one of the most dramatic depreciations in the comparison. APT has shown significant but comparatively less severe depreciation, falling approximately 93.87% from its peak of $19.92 (January 2023) to $1.2214. The magnitude of MDX's decline suggests substantially higher risk exposure, potentially indicating either fundamental value deterioration, loss of market interest, or structural challenges within its ecosystem. APT's price trajectory, while still reflecting considerable downside, demonstrates relatively greater price stability and market resilience during the broader correction period.

Q4: What should investors consider when allocating between MDX and APT in their portfolio?

Portfolio allocation should reflect individual risk tolerance, investment timeframe, and market outlook. Conservative investors might consider a 5-10% MDX to 90-95% APT allocation, recognizing MDX's highly speculative nature versus APT's relatively more established infrastructure positioning. Aggressive investors with higher risk tolerance could potentially allocate 30-40% to MDX and 60-70% to APT, acknowledging the greater volatility and potential for amplified gains or losses with MDX. Critical considerations include MDX's minimal liquidity presenting exit challenges during market stress, APT's stronger trading activity enabling more efficient position management, and the importance of maintaining adequate stablecoin reserves for capital preservation and opportunistic rebalancing during market fluctuations.

Q5: Are there specific regulatory risks that differentiate MDX and APT as investment options?

Regulatory considerations differ based on functional classification and jurisdictional frameworks. MDX, as a decentralized exchange protocol, may face regulatory scrutiny related to securities trading regulations, anti-money laundering compliance requirements, and evolving frameworks governing decentralized financial services across various jurisdictions. APT, as a Layer-1 blockchain infrastructure, may encounter regulatory examination concerning network operation standards, validator requirements, and potential classification questions regarding its native token's utility versus security characteristics. Both assets operate in rapidly evolving regulatory environments where policy developments in major markets including the United States, European Union, and Asian jurisdictions could materially impact operational parameters, market accessibility, and compliance obligations, potentially affecting token valuations and investor access differently based on their respective use cases and technical architectures.

Q6: What are the projected price ranges for MDX and APT through 2031, and what factors could influence these forecasts?

Short-term forecasts (2026) project MDX in a conservative range of $0.000561-$0.000645 and optimistic range of $0.000645-$0.000754, while APT forecasts suggest conservative range of $0.932-$1.210 and optimistic range of $1.210-$1.501. Long-term projections (2030-2031) indicate MDX baseline scenario of $0.000631-$0.001034 with optimistic scenario reaching $0.001447-$0.001600, compared to APT's baseline of $1.231-$1.784 and optimistic scenario of $2.213-$2.658. Key factors influencing these forecasts include institutional capital inflows, potential ETF developments, ecosystem expansion, macroeconomic conditions, regulatory clarity, technological advancements, and broader cryptocurrency market cycles. These projections carry substantial uncertainty given historical volatility, evolving market dynamics, and the inherent difficulty of forecasting speculative asset valuations over multi-year timeframes.

Q7: For new cryptocurrency investors, which asset presents a more suitable entry point: MDX or APT?

New investors should prioritize educational foundation and risk management over immediate market entry. APT may present a relatively more appropriate consideration for beginners due to its higher trading volume ($1,720,262.75 versus MDX's $11,534.54), suggesting better liquidity for position entry and exit, as well as its positioning in the more established Layer-1 blockchain infrastructure category. MDX's extremely low price point and minimal trading activity create substantial risks including severe liquidity constraints, potential difficulty executing trades at desired prices, and heightened vulnerability to price manipulation. New investors should consider starting with smaller position sizes, focusing on understanding fundamental blockchain concepts, market dynamics, and risk management principles before engaging with highly speculative assets. Building knowledge through assets with greater market stability, established track records, and adequate liquidity provides more sustainable learning environments than exposure to extremely volatile, low-liquidity positions.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Comprehensive Guide to Trading Systems

What Does DYOR Mean in Crypto?

How to Profit from Investing in Esports — A Comprehensive Guide

Comprehensive Guide to Fiat Currency

What is mobile mining, and can you earn money with it?