MV vs ARB: A Comprehensive Comparison of Market Value and Arbitrage Strategies in Modern Finance

Introduction: Investment Comparison Between MV and ARB

In the cryptocurrency market, the comparison between MV vs ARB has consistently been a topic of interest for investors. Both differ significantly in market cap ranking, application scenarios, and price performance, representing distinct crypto asset positioning.

MV (GensoKishi Metaverse): Launched in 2023, this token has gained market recognition as the GameFi version of a 13-year-old MMORPG "Elemental Knights," focusing on NFT-based in-game item creation and trading.

ARB (Arbitrum): Since its launch in 2023, it has been recognized as an Ethereum scaling solution, serving as one of the leading Layer 2 protocols with widespread adoption across Web3 applications.

This article will provide a comprehensive analysis of MV vs ARB investment value comparison, covering historical price trends, supply mechanisms, institutional adoption, technical ecosystem, and future predictions, attempting to answer investors' most pressing question:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

MV and ARB Historical Price Trends

- 2022: MV reached a notable price level of $1.66 on February 9, 2022, marking a significant point in its trading history.

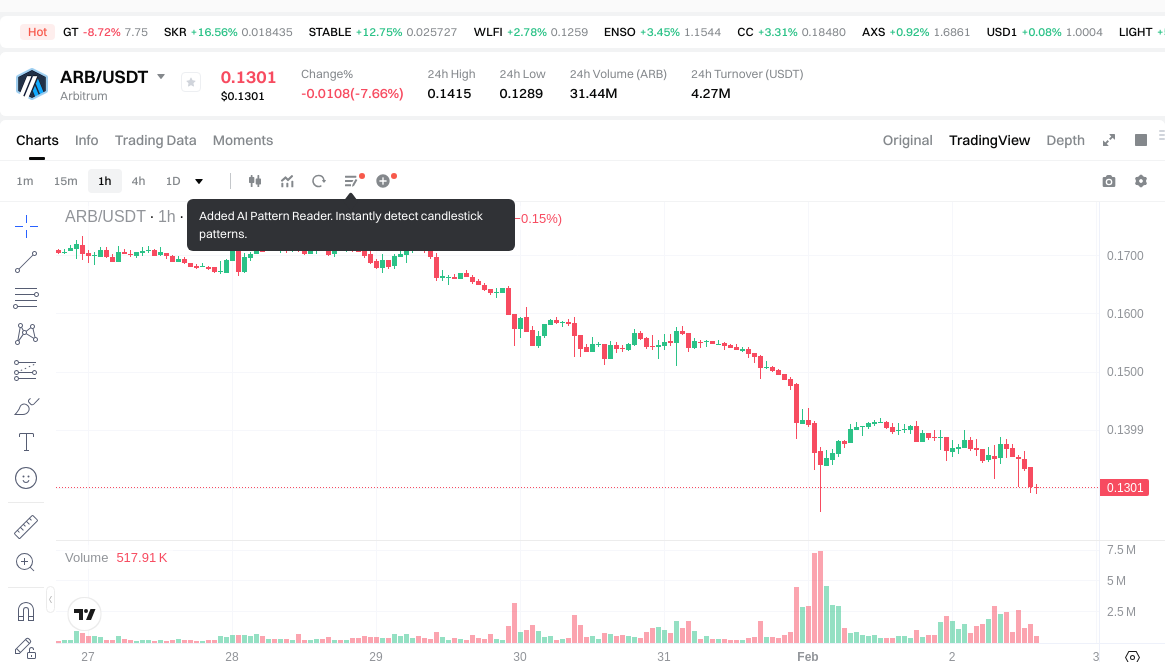

- 2024: ARB experienced considerable market attention, with its price reaching $2.39 on January 12, 2024, representing a key milestone in its development.

- Comparative Analysis: During recent market cycles, MV has moved from its peak of $1.66 to approximately $0.00373, while ARB has declined from $2.39 to around $0.1289.

Current Market Dynamics (February 2, 2026)

- MV Current Price: $0.003737

- ARB Current Price: $0.1289

- 24-Hour Trading Volume: MV recorded $34,882.05 compared to ARB's $4,216,419.10

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

View real-time prices:

- Check MV current price at Market Price

- Check ARB current price at Market Price

II. Core Factors Influencing MV vs ARB Investment Value

Supply Mechanism Comparison (Tokenomics)

The supply mechanisms of digital assets represent fundamental elements that shape their long-term value trajectories. Different tokenomic designs create distinct economic incentives and potential price dynamics. Understanding these structural differences may provide insight into how supply-side factors could influence investment considerations over time.

📌 Historical patterns suggest that supply mechanisms tend to interact with demand cycles, potentially contributing to periodic price fluctuations in cryptocurrency markets.

Institutional Adoption and Market Applications

- Institutional Holdings: Institutional participation patterns can vary significantly across different digital assets, influenced by factors such as regulatory clarity, custody solutions, and portfolio allocation strategies.

- Enterprise Adoption: Digital assets serve various functions within enterprise ecosystems, including cross-border payment facilitation, settlement mechanisms, and portfolio diversification instruments. The extent of adoption varies based on technical infrastructure, compliance requirements, and business use cases.

- Regulatory Landscape: Jurisdictional approaches to cryptocurrency regulation differ substantially across markets, with varying degrees of clarity and restrictiveness that may affect institutional participation and retail access.

Technical Development and Ecosystem Building

Technological evolution and ecosystem development represent ongoing processes within blockchain networks. Protocol upgrades, scalability solutions, and interoperability enhancements continue to shape the functional capabilities of different platforms. The maturity and diversity of applications built on various networks—including decentralized finance protocols, digital collectibles, payment systems, and smart contract implementations—reflect different stages of ecosystem development and adoption trajectories.

Macroeconomic Environment and Market Cycles

- Inflationary Context: Digital assets exhibit varying correlations with traditional inflation hedges, influenced by factors such as supply characteristics, market maturity, and investor perception.

- Monetary Policy Impact: Interest rate adjustments, central bank balance sheet policies, and currency valuations can affect capital flows into and out of cryptocurrency markets, though the magnitude and direction of these effects may vary across different market conditions.

- Geopolitical Considerations: International payment infrastructure needs, sanctions environments, and cross-border transaction demands can influence the perceived utility and adoption of certain digital assets in specific contexts.

III. 2026-2031 Price Prediction: MV vs ARB

Short-term Forecast (2026)

- MV: Conservative $0.00246642 - $0.003737 | Optimistic $0.003737 - $0.00392385

- ARB: Conservative $0.102858 - $0.1302 | Optimistic $0.1302 - $0.153636

Medium-term Forecast (2028-2029)

- MV may enter a consolidation phase, with projected price range of $0.00246985804 - $0.00569660806 in 2028, potentially reaching $0.0039205012743 - $0.0051789337821 by 2029

- ARB may enter an expansion phase, with projected price range of $0.1336938519 - $0.2271184713 in 2028, potentially reaching $0.120340574403 - $0.217389424728 by 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- MV: Baseline scenario $0.003807242348598 - $0.00500952940605 (2030) | Optimistic scenario $0.004741018629885 - $0.007033379286094 (2031)

- ARB: Baseline scenario $0.13784818700163 - $0.205743562689 (2030) | Optimistic scenario $0.193820723231172 - $0.31525057393022 (2031)

Disclaimer

MV:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00392385 | 0.003737 | 0.00246642 | 0 |

| 2027 | 0.004136859 | 0.003830425 | 0.00225995075 | 2 |

| 2028 | 0.00569660806 | 0.003983642 | 0.00246985804 | 6 |

| 2029 | 0.0051789337821 | 0.00484012503 | 0.0039205012743 | 29 |

| 2030 | 0.005410291758534 | 0.00500952940605 | 0.003807242348598 | 34 |

| 2031 | 0.007033379286094 | 0.005209910582292 | 0.004741018629885 | 39 |

ARB:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.153636 | 0.1302 | 0.102858 | 0 |

| 2027 | 0.18023586 | 0.141918 | 0.12630702 | 8 |

| 2028 | 0.2271184713 | 0.16107693 | 0.1336938519 | 23 |

| 2029 | 0.217389424728 | 0.19409770065 | 0.120340574403 | 48 |

| 2030 | 0.26129432461503 | 0.205743562689 | 0.13784818700163 | 57 |

| 2031 | 0.31525057393022 | 0.233518943652015 | 0.193820723231172 | 79 |

IV. Investment Strategy Comparison: MV vs ARB

Long-term vs Short-term Investment Strategies

-

MV: May appeal to investors with higher risk tolerance who are interested in GameFi sector exposure and NFT-based gaming ecosystems. The asset exhibits characteristics associated with early-stage blockchain gaming projects, which historically demonstrate significant volatility and speculative trading patterns.

-

ARB: May suit investors seeking exposure to Ethereum Layer 2 infrastructure development. As a scaling solution with established ecosystem presence, it represents a different risk-return profile compared to gaming-focused tokens, potentially aligning with portfolios focused on blockchain infrastructure rather than application-layer assets.

Risk Management and Asset Allocation

Asset allocation strategies vary based on individual risk profiles, investment horizons, and portfolio objectives. Different investor types may consider various approaches:

-

Conservative Allocation Approach: Investors with lower risk tolerance might consider limiting exposure to highly volatile assets, potentially favoring established infrastructure tokens over application-layer gaming tokens. A conservative framework might involve minimal allocation to speculative assets (under 5-10% of crypto portfolio), with preference for assets demonstrating institutional adoption patterns.

-

Growth-oriented Allocation Approach: Investors comfortable with higher volatility might explore different allocation ratios, potentially weighting infrastructure assets more heavily while maintaining measured exposure to sector-specific tokens. Such approaches might involve 60-80% allocation to established Layer 2 solutions and 20-40% to emerging gaming tokens, adjusted based on market conditions.

-

Risk Mitigation Instruments: Portfolio risk management may incorporate stablecoin reserves for liquidity management, derivatives for downside protection, and cross-asset diversification strategies to reduce correlated risks within the cryptocurrency sector.

V. Potential Risk Comparison

Market Risk

-

MV: The token exhibits characteristics common to gaming-focused digital assets, including concentrated trading volumes ($34,882.05 in 24-hour period) and price volatility associated with sentiment-driven trading. Gaming tokens historically demonstrate sensitivity to broader GameFi sector trends, regulatory developments affecting NFT markets, and shifts in user engagement with blockchain gaming platforms.

-

ARB: As a Layer 2 infrastructure token, it faces market risks related to Ethereum ecosystem developments, competition from alternative scaling solutions, and broader cryptocurrency market cycles. Trading volumes ($4,216,419.10 in 24-hour period) suggest different liquidity characteristics compared to smaller-cap gaming tokens. Price movements may correlate with Ethereum network activity and Layer 2 adoption trends.

Technical Risk

-

MV: Gaming-focused blockchain projects face technical challenges including user experience optimization, integration complexity between blockchain and gaming mechanics, scalability requirements for handling gaming transactions, and maintaining active player engagement over time.

-

ARB: Layer 2 solutions encounter technical considerations including cross-chain bridge security, transaction finality mechanisms, validator decentralization, and maintaining network stability during high-traffic periods. Infrastructure protocols require ongoing technical maintenance and upgrades to address emerging challenges.

Regulatory Risk

Regulatory frameworks for digital assets continue to evolve across jurisdictions, with varying approaches to token classification, securities law applicability, and operational requirements. Gaming tokens with NFT components may face scrutiny related to virtual asset regulations, consumer protection frameworks, and gambling law considerations in certain markets. Infrastructure tokens serving as protocol governance or utility mechanisms encounter different regulatory interpretations regarding their functional classification and compliance obligations.

Jurisdictional differences in regulatory treatment may affect exchange listing availability, institutional participation capabilities, and retail investor access across different markets.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary

-

MV Characteristics: Represents exposure to blockchain gaming sector with focus on NFT-based item trading within an established MMORPG franchise. Trading at $0.003737 with relatively concentrated market activity, it exhibits characteristics associated with emerging GameFi projects.

-

ARB Characteristics: Functions as governance and utility token for an established Ethereum Layer 2 scaling solution with demonstrated ecosystem adoption. Trading at $0.1289 with broader market participation, it represents infrastructure-layer exposure within blockchain technology stack.

✅ Investment Considerations

-

For Newer Market Participants: Consider fundamental education regarding blockchain infrastructure versus application-layer tokens before allocation decisions. Understanding technical differences, use case distinctions, and risk characteristics may inform more aligned investment choices. Starting with established infrastructure assets while researching sector-specific opportunities could provide structured exposure progression.

-

For Experienced Participants: Portfolio construction might involve evaluating correlation characteristics, liquidity profiles, and ecosystem development trajectories. Experienced investors may assess technical roadmap execution, adoption metrics, and competitive positioning when comparing infrastructure and application-layer assets.

-

For Institutional Participants: Due diligence frameworks typically encompass custody solutions, regulatory compliance assessments, liquidity analysis, and alignment with investment mandates. Infrastructure tokens may align more readily with certain institutional allocation frameworks due to custody availability and regulatory clarity, while gaming tokens might require specialized evaluation criteria.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate substantial volatility and contain significant loss potential. This analysis does not constitute investment advice, financial guidance, or recommendations for specific allocation decisions. Market participants should conduct independent research, consult qualified financial advisors, and carefully evaluate personal risk tolerance before making investment decisions.

VII. FAQ

Q1: What are the main differences between MV and ARB tokens?

MV is a GameFi token focused on NFT-based gaming ecosystems within the Elemental Knights MMORPG, while ARB serves as the governance token for Arbitrum, an Ethereum Layer 2 scaling solution. The fundamental difference lies in their use cases: MV operates at the application layer targeting gaming communities, whereas ARB functions at the infrastructure layer serving the broader Web3 ecosystem. This distinction translates into different adoption patterns, with ARB demonstrating significantly higher trading volumes ($4.2M vs $34.8K daily) and broader institutional recognition due to its critical role in Ethereum's scaling roadmap.

Q2: Which token presents higher risk for investors?

MV carries substantially higher risk compared to ARB. As a gaming-focused token with concentrated trading volumes and dependency on a single game franchise, MV faces sector-specific volatility, user retention challenges, and regulatory uncertainties surrounding NFT gaming models. ARB, while still volatile, benefits from infrastructure-layer positioning, established ecosystem adoption, and clearer regulatory frameworks for utility tokens. The 100x difference in daily trading volume indicates significantly different liquidity profiles, with MV potentially facing sharper price movements during market stress periods.

Q3: How do institutional adoption patterns differ between MV and ARB?

ARB demonstrates substantially broader institutional adoption as an Ethereum Layer 2 solution, benefiting from integration across DeFi protocols, custody solutions, and enterprise blockchain implementations. Its infrastructure role positions it within institutional portfolio frameworks focused on core blockchain technology. MV, as a gaming token, attracts primarily retail participants and gaming-focused funds, with limited institutional presence due to sector concentration, lower liquidity, and nascent regulatory frameworks for blockchain gaming assets. This adoption gap reflects fundamentally different market positioning and risk-return profiles.

Q4: What are the price prediction outlooks for MV vs ARB through 2031?

Based on projected scenarios, ARB shows higher absolute growth potential with predicted ranges from $0.102-$0.153 (2026) to $0.193-$0.315 (2031), representing potential 79% growth over five years. MV projections suggest more modest appreciation from $0.002-$0.003 (2026) to $0.004-$0.007 (2031), with 39% projected growth. These forecasts reflect different ecosystem maturity levels and adoption trajectories, with ARB benefiting from infrastructure-layer demand growth while MV depends on GameFi sector expansion and successful game franchise evolution.

Q5: Which token better suits conservative investment strategies?

ARB aligns more closely with conservative cryptocurrency allocation frameworks due to infrastructure positioning, established ecosystem adoption, higher liquidity, and clearer regulatory treatment. Conservative investors seeking crypto exposure might consider ARB as part of a blockchain infrastructure allocation, potentially comprising 5-10% of overall portfolio with risk mitigation through stablecoin reserves. MV represents significantly higher risk appropriate only for aggressive, sector-specific allocations, typically under 1-2% of total portfolio for investors specifically seeking GameFi exposure with high risk tolerance.

Q6: How do technical risks compare between MV and ARB ecosystems?

ARB faces infrastructure-layer technical risks including bridge security vulnerabilities, validator centralization concerns, and network stability during congestion periods. However, these risks are mitigated by extensive security audits, established developer community, and continuous protocol improvements. MV confronts application-layer challenges including user experience optimization, blockchain-gaming integration complexity, player retention mechanics, and dependency on single-game franchise success. Gaming tokens historically face higher abandonment rates when user engagement declines, creating existential risks absent in infrastructure protocols.

Q7: What market conditions would favor MV over ARB performance?

MV would likely outperform ARB during specific GameFi sector bull markets characterized by renewed interest in blockchain gaming, major game launches, celebrity endorsements, or regulatory clarity for NFT gaming models. Historical patterns suggest gaming tokens demonstrate explosive but short-lived rallies during sector enthusiasm periods. Additionally, major franchise announcements, strategic partnerships, or successful game expansions could drive MV appreciation independent of broader market conditions. However, such scenarios represent tactical trading opportunities rather than fundamental investment theses.

Q8: How should portfolio allocation differ between long-term and short-term strategies for these tokens?

Long-term allocation strategies favor ARB due to infrastructure fundamentals, ecosystem sustainability, and alignment with Ethereum scaling roadmap extending through 2030s. Conservative long-term portfolios might allocate 60-80% to infrastructure tokens like ARB with minimal gaming token exposure. Short-term trading strategies might tactically rotate into MV during GameFi sector momentum periods, utilizing technical analysis and sentiment indicators while maintaining strict stop-loss discipline. Short-term ARB strategies could focus on Ethereum ecosystem catalysts, protocol upgrades, and Layer 2 adoption milestones as trading signals.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?