NAWS vs SAND: Understanding the Key Differences Between Two Essential Natural Materials

Introduction: Investment Comparison Between NAWS and SAND

In the cryptocurrency market, the comparison between NAWS vs SAND has become a topic of interest for investors exploring different segments of the digital asset ecosystem. These two tokens exhibit distinct differences in market capitalization ranking, application scenarios, and price performance, representing contrasting positions within the crypto landscape.

NAWS (NAWS): Launched in 2024, this token serves as the utility asset for a no-code platform enabling users to sell Web2, Web3 content, and DePIN vouchers. Its P2P crypto payment system leverages DEX AI aggregators for transaction efficiency.

SAND (SAND): Introduced in 2020, this token powers The Sandbox, a virtual game world built on Ethereum, where players can create, own, and monetize gaming experiences through non-fungible tokens (NFTs).

This article will provide a comprehensive analysis of NAWS vs SAND across multiple dimensions including historical price trends, supply mechanisms, adoption patterns, technological ecosystems, and future outlook, attempting to address the key question investors are asking:

"Which presents a more suitable investment opportunity based on current market conditions?"

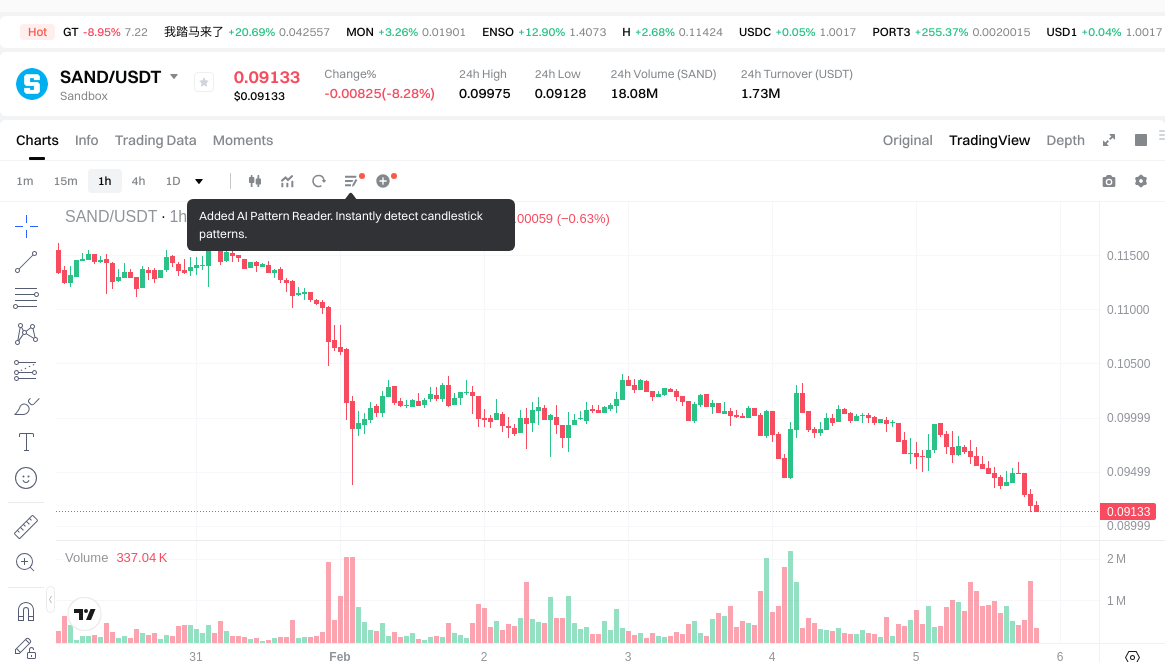

I. Historical Price Comparison and Current Market Status

NAWS (Coin A) and SAND (Coin B) Historical Price Trends

- October 2024: NAWS experienced notable price movements following its launch, with the token reaching $0.05262 on October 8, 2024. The asset subsequently declined to $0.0000801 by October 22, 2024.

- November 2021: SAND was influenced by the metaverse sector expansion, with the price reaching $8.4 on November 25, 2021. The token later experienced downward pressure, touching $0.02897764 on November 4, 2020.

- Comparative Analysis: During recent market cycles, NAWS declined from $0.05262 to $0.00025, representing substantial volatility, while SAND moved from $8.4 to $0.09185, reflecting broader market conditions affecting gaming and metaverse tokens.

Current Market Status (2026-02-05)

- NAWS Current Price: $0.00025

- SAND Current Price: $0.09185

- 24-Hour Trading Volume: $12,415.63 (NAWS) vs $1,714,467.13 (SAND)

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

Check real-time prices:

- View NAWS current price Market Price

- View SAND current price Market Price

II. Core Factors Influencing NAWS vs SAND Investment Value

Supply Mechanism Comparison (Tokenomics)

-

NAWS: The supply mechanism for NAWS focuses on decentralized platform operations, though specific tokenomics details regarding fixed supply or deflationary models are not available in current materials.

-

SAND: SAND operates within The Sandbox ecosystem with a defined token supply structure. In July 2020, The Sandbox conducted a strategic private funding round, selling SAND tokens at an average price of $0.005. The token serves as the core economic medium within the metaverse platform.

-

📌 Historical Pattern: Supply mechanisms influence price cycles through scarcity dynamics and demand-driven appreciation within ecosystem adoption phases.

Institutional Adoption and Market Application

-

Institutional Holdings: SAND has demonstrated notable institutional backing through The Sandbox's parent company Animoca Brands, which specializes in blockchain gaming and NFT investments. Samsung, the Korean technology giant, has participated in investment rounds for The Sandbox.

-

Enterprise Adoption: SAND's application centers on virtual land (LAND) transactions, NFT trading, and metaverse development. The platform has established partnerships with global brands including The Walking Dead, enabling users to experience themed virtual worlds and earn exclusive NFT rewards. NAWS applications in cross-border payments, settlements, or investment portfolios remain unspecified in available materials.

-

National Policy: Regulatory approaches vary across jurisdictions, with blockchain gaming and metaverse platforms facing evolving compliance frameworks in different countries.

Technology Development and Ecosystem Building

-

NAWS Technology: NAWS emphasizes decentralized platform infrastructure, though specific technological upgrades and their potential impacts are not detailed in current materials.

-

SAND Technology Development: The Sandbox leverages blockchain technology to provide transparency, security, and actual ownership of digital assets. The platform utilizes NFT-based virtual land (LAND) to ensure scarcity and ownership rights, allowing players and brands to purchase, develop, rent, or sell land.

-

Ecosystem Comparison: SAND demonstrates significant traction in NFT markets and virtual world development. The platform enables creator economy participation through governance via The Sandbox DAO, where users vote on decisions affecting land ownership, game aesthetics, and interactivity. Transaction fees from virtual land and NFT trading provide sustained platform revenue, while SAND token utility extends to trading, governance participation, and staking rewards.

Macroeconomic Conditions and Market Cycles

-

Performance in Inflationary Environments: Digital assets demonstrate varying responses to inflationary pressures based on their utility and adoption trajectories. Metaverse platforms like The Sandbox may benefit from digital economy expansion during periods of currency devaluation.

-

Macroeconomic Monetary Policy: Interest rate adjustments and US dollar index movements influence digital asset valuations through liquidity conditions and risk appetite shifts in global markets.

-

Geopolitical Factors: Cross-border transaction demand and international developments affect adoption patterns. The Sandbox's expansion attracts more brands and creators, broadening virtual world influence and elevating SAND demand. Global brand partnerships enhance The Sandbox's commercial value, potentially increasing SAND token investment attractiveness. NFT market activity and digital asset transaction volume within The Sandbox correlate with SAND demand fluctuations.

III. 2026-2031 Price Prediction: NAWS vs SAND

Short-term Forecast (2026)

- NAWS: Conservative $0.000177 - $0.000249 | Optimistic $0.000249 - $0.000359

- SAND: Conservative $0.0466 - $0.0914 | Optimistic $0.0914 - $0.130

Mid-term Forecast (2028-2029)

- NAWS may enter a gradual expansion phase, with estimated price range of $0.000193 - $0.000574

- SAND may enter a steady growth phase, with estimated price range of $0.0860 - $0.172

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- NAWS: Baseline scenario $0.000305 - $0.000508 | Optimistic scenario $0.000508 - $0.000682

- SAND: Baseline scenario $0.102 - $0.157 | Optimistic scenario $0.157 - $0.255

Disclaimer

NAWS:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.000359136 | 0.0002494 | 0.000177074 | 0 |

| 2027 | 0.00045335932 | 0.000304268 | 0.00015517668 | 21 |

| 2028 | 0.0005038221678 | 0.00037881366 | 0.0001931949666 | 51 |

| 2029 | 0.00057371328807 | 0.0004413179139 | 0.000322162077147 | 76 |

| 2030 | 0.000558267161083 | 0.000507515600985 | 0.000304509360591 | 103 |

| 2031 | 0.000682100967723 | 0.000532891381034 | 0.000484931156741 | 113 |

SAND:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.1298306 | 0.09143 | 0.0466293 | 0 |

| 2027 | 0.134968966 | 0.1106303 | 0.089610543 | 20 |

| 2028 | 0.1719194862 | 0.122799633 | 0.0859597431 | 33 |

| 2029 | 0.166516302348 | 0.1473595596 | 0.141465177216 | 60 |

| 2030 | 0.1883255171688 | 0.156937930974 | 0.13182786201816 | 70 |

| 2031 | 0.255494951625672 | 0.1726317240714 | 0.101852717202126 | 87 |

IV. Investment Strategy Comparison: NAWS vs SAND

Long-term vs Short-term Investment Strategies

-

NAWS: Suitable for investors focusing on emerging platform ecosystems and early-stage project participation. The token's application in no-code platforms and P2P crypto payment systems may attract users interested in decentralized commerce infrastructure development. Short-term traders should note the significant volatility patterns observed since launch.

-

SAND: Suitable for investors seeking exposure to established metaverse and gaming ecosystems with demonstrated institutional backing. The token's integration within The Sandbox platform, which features brand partnerships and NFT marketplace activity, may appeal to those prioritizing ecosystem maturity and utility-driven demand. Long-term holders may benefit from gradual adoption expansion in virtual world development.

Risk Management and Asset Allocation

-

Conservative Investors: NAWS 10-15% vs SAND 85-90% — allocation favoring established platforms with demonstrated market presence and institutional participation

-

Aggressive Investors: NAWS 30-40% vs SAND 60-70% — balanced exposure incorporating early-stage opportunities while maintaining core positions in proven ecosystems

-

Hedging Instruments: Stablecoin reserves for opportunistic entry points, derivatives for downside protection, cross-asset diversification across different blockchain sectors

V. Potential Risk Comparison

Market Risks

-

NAWS: Limited trading volume ($12,415.63 as of 2026-02-05) presents liquidity challenges during market stress periods. Price volatility patterns indicate susceptibility to broader sentiment shifts in cryptocurrency markets. The token's recent launch history provides limited data for comprehensive cycle analysis.

-

SAND: Exposure to metaverse sector sentiment fluctuations and gaming industry adoption trends. Historical price movements from $8.4 to current levels reflect broader market cycle impacts on gaming tokens. Correlation with NFT market activity introduces additional volatility factors during periods of reduced digital collectible interest.

Technology Risks

-

NAWS: Platform scalability requirements for no-code infrastructure and DEX AI aggregator performance under increased transaction loads. Network stability considerations for P2P payment systems during peak usage periods.

-

SAND: Platform dependency on Ethereum network performance and transaction cost fluctuations. Virtual land (LAND) infrastructure scalability during high-concurrency events. Security considerations for NFT custody and smart contract vulnerabilities within The Sandbox ecosystem.

Regulatory Risks

- Global regulatory frameworks for blockchain gaming platforms continue evolving, with varying approaches across jurisdictions affecting operational parameters. Metaverse-related digital asset classifications face ongoing policy development in multiple regions. Decentralized payment systems encounter different compliance requirements depending on geographical implementation, potentially impacting cross-border functionality for both platforms.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

NAWS Advantages: Early-stage positioning in decentralized commerce infrastructure, no-code platform utility enabling broader user participation, P2P payment system integration with DEX aggregators for transaction efficiency

-

SAND Advantages: Established ecosystem within The Sandbox metaverse platform, demonstrated institutional backing from Animoca Brands and strategic partners like Samsung, NFT marketplace integration with brand collaborations including The Walking Dead, governance participation through The Sandbox DAO, proven utility across virtual land transactions and creator economy applications

✅ Investment Recommendations:

-

Novice Investors: Consider SAND for initial cryptocurrency exposure due to established ecosystem presence, demonstrated institutional participation, and clearer utility within gaming and metaverse sectors. Allocate limited capital to NAWS only after understanding volatility patterns and liquidity constraints.

-

Experienced Investors: Evaluate portfolio diversification through measured NAWS allocation (15-25%) while maintaining SAND core position (75-85%) to balance early-stage opportunity exposure with established platform stability. Monitor ecosystem developments and adoption metrics for both projects.

-

Institutional Investors: Focus on SAND for larger capital deployment given superior liquidity conditions, institutional participation track record, and established partnership networks. NAWS may warrant small strategic allocations (5-10%) for emerging infrastructure exposure within diversified digital asset portfolios.

⚠️ Risk Disclaimer: The cryptocurrency market exhibits extreme volatility characteristics. This analysis does not constitute investment advice. Conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What are the main differences between NAWS and SAND in terms of their use cases?

NAWS serves as a utility token for a no-code platform focused on decentralized commerce and P2P crypto payments, while SAND powers The Sandbox metaverse gaming ecosystem. NAWS primarily facilitates Web2, Web3 content sales and DePIN voucher transactions through DEX AI aggregators, targeting decentralized commerce infrastructure. In contrast, SAND enables virtual land (LAND) ownership, NFT trading, and monetization of gaming experiences within an established blockchain-based virtual world where creators can build, own, and profit from digital assets.

Q2: Which token presents higher liquidity for trading purposes?

SAND demonstrates significantly higher liquidity with 24-hour trading volume of $1,714,467.13 compared to NAWS's $12,415.63 as of February 5, 2026. This substantial difference—approximately 138 times greater trading volume—means SAND offers better price stability during market volatility, easier entry and exit positions, and reduced slippage on large transactions. NAWS's limited liquidity may result in wider bid-ask spreads and difficulty executing sizable trades without impacting market price, making it more suitable for smaller position sizes and longer holding periods.

Q3: How do institutional backing levels compare between these two projects?

SAND possesses substantially stronger institutional support through The Sandbox's parent company Animoca Brands and strategic investors like Samsung, while NAWS's institutional backing remains undocumented in available materials. The Sandbox has established partnerships with global brands including The Walking Dead, demonstrating commercial validation and enterprise adoption. This institutional participation provides SAND with greater credibility, potential for ecosystem expansion, and reduced counterparty risk. NAWS, as a 2024 launch, has yet to demonstrate comparable institutional relationships or enterprise partnerships.

Q4: What are the primary risk factors investors should consider for each token?

For NAWS, key risks include extreme liquidity constraints ($12,415.63 daily volume), limited operational history since its 2024 launch, significant price volatility (declined from $0.05262 to $0.00025), and unspecified tokenomics details. For SAND, primary risks encompass exposure to metaverse sector sentiment cycles, dependency on Ethereum network performance and gas fees, correlation with NFT market fluctuations, and gaming industry adoption trends. Both face regulatory uncertainties as global frameworks for blockchain gaming and decentralized payment systems continue evolving across different jurisdictions.

Q5: Which token is more suitable for conservative versus aggressive investment strategies?

Conservative investors should prioritize SAND with 85-90% allocation due to its established ecosystem, demonstrated institutional backing, superior liquidity, and proven utility within The Sandbox platform. SAND's four-year operational history provides more data for risk assessment and cycle analysis. Aggressive investors might consider 30-40% NAWS allocation balanced with 60-70% SAND positioning, accepting higher volatility and liquidity risks in exchange for potential early-stage appreciation if the no-code platform gains adoption. However, all investors should maintain stablecoin reserves and implement proper risk management regardless of strategy.

Q6: How do the 2026-2031 price predictions compare between NAWS and SAND?

Price forecasts suggest SAND will maintain significantly higher absolute values throughout the prediction period. For 2026, SAND's conservative range spans $0.0466-$0.0914 (optimistic $0.0914-$0.130), while NAWS ranges from $0.000177-$0.000249 (optimistic $0.000249-$0.000359). By 2031, SAND's baseline scenario projects $0.102-$0.157 (optimistic $0.157-$0.255), compared to NAWS's $0.000305-$0.000508 (optimistic $0.000508-$0.000682). These predictions reflect SAND's established market position and ecosystem maturity versus NAWS's early-stage development status, though both remain speculative and subject to cryptocurrency market volatility.

Q7: What ecosystem developments should investors monitor for each project?

For NAWS, monitor platform adoption metrics including user growth on the no-code infrastructure, transaction volume through P2P payment systems, DEX aggregator performance improvements, and any emerging enterprise partnerships or use case expansions. For SAND, track virtual land (LAND) sales volume, new brand collaborations and metaverse partnerships, NFT marketplace activity within The Sandbox, governance participation through The Sandbox DAO, creator economy growth indicators, and technical upgrades addressing Ethereum scalability challenges. Additionally, observe regulatory developments affecting blockchain gaming and metaverse platforms across major jurisdictions for both projects.

Q8: What role does market sentiment currently play in these token valuations?

The current Fear & Greed Index reading of 12 (Extreme Fear) as of February 5, 2026, indicates significantly negative market sentiment affecting both tokens. This environment typically suppresses valuations across cryptocurrency markets, particularly impacting lower-liquidity assets like NAWS more severely than established tokens like SAND. SAND's connection to the metaverse and gaming sectors creates additional sentiment dependencies on NFT market activity and virtual world adoption trends. During extreme fear periods, investors demonstrate preference for liquid, established assets with proven utility, potentially widening the performance gap between SAND's institutional backing and NAWS's emerging platform status.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

7 Ideas for Beginners To Create Digital Art

The link between Elon Musk's "America Party" and the world of cryptocurrencies

How to Buy Cryptocurrency: Top Strategies

Cryptocurrency for Beginners: Which Coin Should You Invest In

A Comprehensive Overview of the Future Potential and Types of Altcoins