NC vs ETH: A Comprehensive Comparison of Network Capabilities and Transaction Efficiency in Blockchain Technology

Introduction: NC vs ETH Investment Comparison

In the cryptocurrency market, the comparison between NC and ETH remains a topic of significant interest to investors. The two assets demonstrate notable differences in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

Nodecoin (NC): Launched in January 2025, this token operates as part of a real-time predictive intelligence platform that aggregates user signal inputs, social activity, and on-chain data. Built upon a decentralized bandwidth-sharing network, it has evolved into a signal and prediction engine.

Ethereum (ETH): Since its launch in July 2014, Ethereum has been recognized as a foundational blockchain platform supporting smart contracts and decentralized applications (DApps). Operating through Ether, it stands among the cryptocurrencies with substantial global trading volume and market capitalization.

This article will provide a comprehensive analysis of the investment value comparison between NC and ETH, examining historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future outlook, while addressing the question many investors consider:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

Historical Price Trends of NC (Coin A) and ETH (Coin B)

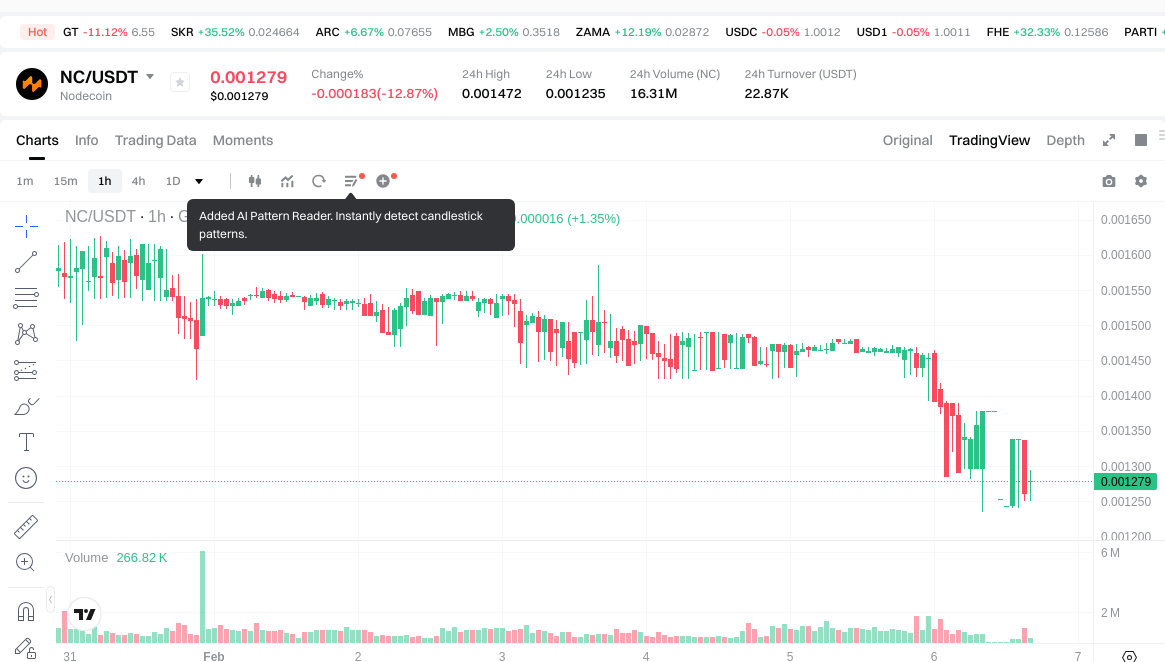

- 2025: NC experienced significant volatility following its launch in January 2025, with an initial price of $0.1 and reaching a peak of $0.335 on January 17, 2025.

- 2015-2025: ETH launched in 2015 at approximately $0.31 and reached notable milestones, including an all-time high of $4,946.05 in August 2025, driven by network upgrades and broader ecosystem adoption.

- Comparative Analysis: During recent market cycles, NC declined from its peak of $0.335 to a low of $0.001235 as of February 6, 2026, representing a decline of over 99%. In contrast, ETH, while also experiencing downward pressure, moved from its August 2025 high of $4,946.05 to approximately $1,899.03 on February 6, 2026, reflecting a decline of approximately 61%.

Current Market Conditions (February 6, 2026)

- NC Current Price: $0.001279

- ETH Current Price: $1,899.03

- 24-Hour Trading Volume: NC recorded $22,701.38 in trading volume, while ETH demonstrated significantly higher liquidity with $918,858,874.96 in volume.

- Market Sentiment Index (Fear & Greed Index): 9 (Extreme Fear)

View real-time prices:

- View NC current price Market Price

- View ETH current price Market Price

II. Core Factors Influencing NC vs ETH Investment Value

Supply Mechanism Comparison (Tokenomics)

- NC: The token operates within a decentralized AI infrastructure framework with supply characteristics tied to network participation and bandwidth-sharing rewards. The token's economic model emphasizes utility-driven distribution through platform engagement.

- ETH: Ethereum transitioned to a deflationary model following The Merge, implementing EIP-1559's burn mechanism where a portion of transaction fees is permanently removed from circulation. This creates potential scarcity pressure during periods of high network activity.

- 📌 Historical Pattern: Supply mechanisms have demonstrated influence on price cycles, with deflationary assets showing sensitivity to demand fluctuations during market expansion phases.

Institutional Adoption and Market Application

- Institutional Holdings: ETH has established presence in institutional portfolios, with recognized custody solutions and regulatory frameworks in multiple jurisdictions. NC remains in early-stage institutional evaluation.

- Enterprise Adoption: ETH maintains deployment across DeFi protocols, tokenization platforms, and enterprise blockchain solutions. NC focuses on AI infrastructure and bandwidth-sharing networks with emerging enterprise interest.

- Policy Environment: Regulatory frameworks for ETH vary by jurisdiction, with some regions providing clarity on classification. NC operates in evolving regulatory territory for AI-related digital assets.

Technology Development and Ecosystem Construction

- NC Technology Development: Focuses on decentralized AI platform infrastructure with bandwidth-sharing mechanisms designed to support computational resource distribution.

- ETH Technology Evolution: Ongoing scaling improvements through Layer 2 solutions, sharding research, and protocol optimizations aimed at enhancing transaction throughput and reducing costs.

- Ecosystem Comparison: ETH maintains established presence across DeFi applications, NFT marketplaces, payment systems, and smart contract platforms. NC concentrates on AI infrastructure with developing ecosystem partnerships.

Macroeconomic Conditions and Market Cycles

- Performance in Inflation Environments: ETH's deflationary supply mechanism and established market position provide certain characteristics during inflation periods. NC's correlation with macroeconomic factors remains less established due to shorter market history.

- Macroeconomic Policy Impact: Interest rate adjustments and dollar strength influence both assets through capital flow dynamics and risk appetite shifts in digital asset markets.

- Geopolitical Considerations: Cross-border transaction demand and international developments affect adoption patterns, with ETH benefiting from existing infrastructure and NC positioned in emerging AI technology sectors.

III. 2026-2031 Price Forecast: NC vs ETH

Short-term Forecast (2026)

- NC: Conservative $0.00117668 - $0.001279 | Optimistic $0.001279 - $0.00138132

- ETH: Conservative $1694.18 - $1903.57 | Optimistic $1903.57 - $2684.03

Medium-term Forecast (2028-2029)

- NC may enter a gradual growth phase, with estimated price range of $0.00142460 - $0.00204644

- ETH may enter an expansion phase, with estimated price range of $2684.44 - $4240.84

- Key drivers: institutional capital flows, ETF developments, ecosystem expansion

Long-term Forecast (2031)

- NC: Baseline scenario $0.00118183 - $0.00222988 | Optimistic scenario $0.00222988 - $0.00325562

- ETH: Baseline scenario $4048.79 - $4174.01 | Optimistic scenario $4174.01 - $4883.60

Disclaimer

NC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00138132 | 0.001279 | 0.00117668 | 0 |

| 2027 | 0.0018356208 | 0.00133016 | 0.001064128 | 4 |

| 2028 | 0.001915297384 | 0.0015828904 | 0.00142460136 | 23 |

| 2029 | 0.00204643985364 | 0.001749093892 | 0.0016616391974 | 36 |

| 2030 | 0.002561985278307 | 0.00189776687282 | 0.001670034848081 | 48 |

| 2031 | 0.003255619070322 | 0.002229876075563 | 0.001181834320048 | 74 |

ETH:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 2684.0337 | 1903.57 | 1694.1773 | 0 |

| 2027 | 3417.7647565 | 2293.80185 | 1559.785258 | 20 |

| 2028 | 3569.7291290625 | 2855.78330325 | 2684.436305055 | 50 |

| 2029 | 4240.83820532625 | 3212.75621615625 | 2923.6081567021875 | 69 |

| 2030 | 4621.22854131915 | 3726.79721074125 | 2459.686159089225 | 96 |

| 2031 | 4883.595064955334 | 4174.0128760302 | 4048.792489749294 | 119 |

IV. Investment Strategy Comparison: NC vs ETH

Long-term vs Short-term Investment Strategies

-

NC: May appeal to investors with higher risk tolerance who focus on emerging AI infrastructure opportunities and are comfortable with early-stage project volatility. The asset's price movement patterns suggest consideration for speculative allocation rather than core portfolio positioning.

-

ETH: May suit investors seeking exposure to established blockchain infrastructure with institutional adoption pathways. The asset's longer market history and ecosystem development suggest potential consideration for medium to long-term allocation strategies.

Risk Management and Asset Allocation

-

Conservative Investors: NC 2-5% vs ETH 10-20% - Conservative portfolios may emphasize established assets with institutional infrastructure while limiting exposure to early-stage projects.

-

Aggressive Investors: NC 10-15% vs ETH 25-35% - Higher risk tolerance portfolios may consider increased allocation to both assets while maintaining diversification across the crypto asset class.

-

Hedging Tools: Stablecoin allocation for liquidity management, options strategies for downside protection, cross-asset diversification to mitigate single-asset concentration risk.

V. Potential Risk Comparison

Market Risk

-

NC: Demonstrates heightened volatility characteristics with price declines exceeding 99% from peak levels. Limited trading volume of $22,701.38 as of February 6, 2026, indicates lower liquidity conditions that may amplify price movement during market stress periods.

-

ETH: Exhibits established market cycles with correlation to broader crypto market trends. Trading volume of $918,858,874.96 provides greater liquidity infrastructure, though remains subject to sentiment-driven volatility and macroeconomic conditions.

Technical Risk

-

NC: Decentralized AI infrastructure remains in development stages with evolving technical architecture. Network participation mechanisms and bandwidth-sharing protocols require continued evaluation of operational stability and scalability capacity.

-

ETH: Scaling solutions through Layer 2 implementations and ongoing protocol optimizations introduce technical complexity. Network upgrades and consensus mechanism transitions require monitoring for implementation outcomes and ecosystem adaptation.

Regulatory Risk

- Global regulatory developments affect both assets through varying frameworks. ETH operates under established classification approaches in certain jurisdictions, while NC exists in evolving regulatory territory for AI-related digital assets. Policy shifts regarding securities classification, taxation frameworks, and cross-border transaction regulations may influence adoption trajectories differently for each asset.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

NC Characteristics: Represents exposure to decentralized AI infrastructure development with early-stage positioning in bandwidth-sharing networks. The asset demonstrates significant volatility patterns and limited institutional adoption at present.

-

ETH Characteristics: Maintains established infrastructure across smart contract platforms, DeFi protocols, and enterprise applications. The asset benefits from institutional custody solutions, regulatory clarity in multiple jurisdictions, and deflationary supply mechanism following network upgrades.

✅ Investment Considerations:

-

Beginning Investors: May consider focusing on assets with established market infrastructure, institutional custody solutions, and regulatory clarity. Portfolio construction should emphasize risk management principles and diversification across asset classes.

-

Experienced Investors: May evaluate allocation strategies based on risk tolerance, market cycle positioning, and portfolio diversification objectives. Technical analysis of supply mechanisms, ecosystem development, and institutional adoption patterns can inform allocation decisions.

-

Institutional Investors: May assess assets through frameworks evaluating custody infrastructure, regulatory compliance pathways, liquidity characteristics, and correlation with traditional asset classes. Due diligence processes should examine technical architecture, governance mechanisms, and adoption trajectories.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate significant volatility characteristics. This analysis does not constitute investment advice, financial recommendations, or predictions of future performance. Asset allocation decisions should consider individual risk tolerance, investment objectives, and consultation with qualified financial advisors.

VII. FAQ

Q1: What are the main differences between NC and ETH in terms of market maturity and liquidity?

ETH demonstrates significantly higher market maturity and liquidity compared to NC. As of February 6, 2026, ETH recorded a 24-hour trading volume of $918,858,874.96, while NC showed only $22,701.38 in volume. ETH has operated since July 2014 with established institutional custody solutions, regulatory frameworks in multiple jurisdictions, and widespread integration across DeFi protocols and enterprise applications. In contrast, NC launched in January 2025 and remains in early-stage development within the decentralized AI infrastructure sector, with limited institutional adoption and lower liquidity conditions that may amplify price movements during market volatility.

Q2: How do the supply mechanisms of NC and ETH affect their investment characteristics?

ETH operates under a deflationary supply model following The Merge, implementing EIP-1559's burn mechanism where transaction fees are permanently removed from circulation, creating potential scarcity pressure during high network activity periods. NC utilizes a utility-driven distribution model tied to network participation and bandwidth-sharing rewards within its decentralized AI infrastructure framework. The deflationary nature of ETH has historically shown sensitivity to demand fluctuations during market expansion phases, while NC's supply characteristics remain less established due to its shorter market history and evolving tokenomics structure.

Q3: What risk profiles should investors consider when comparing NC and ETH?

NC presents heightened risk characteristics with price volatility exceeding 99% decline from peak levels ($0.335 to $0.001235), limited trading volume, and early-stage technical development in decentralized AI infrastructure. ETH exhibits established market cycles with greater liquidity infrastructure but remains subject to sentiment-driven volatility and macroeconomic conditions. Regulatory risk differs between the assets: ETH operates under established classification approaches in certain jurisdictions, while NC exists in evolving regulatory territory for AI-related digital assets. Conservative investors may consider limiting NC exposure to 2-5% while allocating 10-20% to ETH, whereas aggressive portfolios might consider 10-15% NC and 25-35% ETH allocations.

Q4: How do institutional adoption levels differ between NC and ETH?

ETH maintains substantial institutional presence with recognized custody solutions, regulatory clarity in multiple jurisdictions, and deployment across enterprise blockchain solutions, DeFi protocols, and tokenization platforms. Major financial institutions have integrated ETH infrastructure, and ETF developments have expanded institutional access pathways. NC remains in early-stage institutional evaluation with limited enterprise adoption, focusing primarily on AI infrastructure and bandwidth-sharing networks with emerging partnership developments. This adoption gap significantly affects liquidity characteristics, price stability, and investment infrastructure availability between the two assets.

Q5: What are the projected price trajectories for NC and ETH through 2031?

Short-term forecasts for 2026 show NC in a range of $0.00117668 - $0.00138132, while ETH is projected between $1,694.18 - $2,684.03. By 2031, baseline scenarios suggest NC may reach $0.00118183 - $0.00222988 (optimistic: $0.00222988 - $0.00325562), representing potential growth of 74% from current levels. ETH's 2031 baseline projection ranges from $4,048.79 - $4,174.01 (optimistic: $4,174.01 - $4,883.60), indicating potential growth of 119% from current prices. These projections assume continued ecosystem development, institutional capital flows, and favorable macroeconomic conditions, though actual performance may vary significantly based on market cycles and technological developments.

Q6: Which asset is more suitable for different investor profiles?

Beginning investors may prioritize ETH due to its established market infrastructure, institutional custody solutions, regulatory clarity, and lower relative volatility compared to NC. The asset provides exposure to blockchain technology through a platform with extensive ecosystem development and liquidity characteristics. Experienced investors with higher risk tolerance may consider NC for speculative allocation (2-10% of portfolio) alongside core ETH positions, recognizing the early-stage nature and volatility patterns of AI infrastructure projects. Institutional investors typically focus on ETH given its compliance pathways, custody infrastructure, and correlation analysis with traditional asset classes, though some may evaluate NC through venture-style allocation frameworks for emerging technology exposure.

Q7: How do technological development trajectories differ between NC and ETH?

ETH focuses on scaling improvements through Layer 2 solutions, sharding research, and protocol optimizations aimed at enhancing transaction throughput while reducing costs. The platform maintains established presence across smart contract applications, DeFi protocols, NFT marketplaces, and payment systems with ongoing consensus mechanism refinements. NC concentrates on decentralized AI platform infrastructure with bandwidth-sharing mechanisms designed to support computational resource distribution. The project remains in earlier development stages with evolving technical architecture and network participation protocols. ETH benefits from years of battle-tested infrastructure and developer ecosystem maturity, while NC represents emerging technology with less proven operational history.

Q8: What macroeconomic factors should investors monitor when comparing these assets?

Interest rate adjustments influence both assets through capital flow dynamics and risk appetite shifts in digital asset markets, with ETH showing more established correlation patterns due to longer market history. Dollar strength affects cross-border transaction demand and international adoption, particularly impacting ETH's payment infrastructure use cases. Inflation environments interact differently with each asset: ETH's deflationary supply mechanism following The Merge provides certain characteristics during inflation periods, while NC's macroeconomic correlation remains less established. Geopolitical developments affecting regulatory frameworks, institutional adoption pathways, and technology infrastructure investment create varying impacts based on each asset's market positioning and adoption stage.

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

What is Ethereum: A 2025 Guide for Crypto Enthusiasts and Investors

How does Ethereum's blockchain technology work?

What are smart contracts and how do they work on Ethereum?

Ethereum Price Analysis: 2025 Market Trends and Web3 Impact

What Is the DXY Index? Why Should Traders and Investors Monitor This Indicator?

Comprehensive Guide to NGMI and WAGMI in Crypto

![Cryptocurrency Trading Patterns [Illustrated, Fundamentals Edition]](https://gimg.staticimgs.com/learn/6e0f5c52f4da3cf14c7ae5002f14d250fa491fbf.png)

Cryptocurrency Trading Patterns [Illustrated, Fundamentals Edition]

Ocean Protocol: Striking a Balance Between Data Monetization and Privacy Protection

Games with Cashouts: Top 23 Projects for Earning