RITE vs QNT: A Comprehensive Comparison of Enterprise Blockchain Solutions and Their Market Impact

Introduction: Investment Comparison Between RITE and QNT

In the cryptocurrency market, the comparison between RITE vs QNT has consistently been a topic investors cannot ignore. The two not only show notable differences in market cap ranking, application scenarios, and price performance, but also represent distinct positioning within the crypto asset landscape.

RITE (RITE): Launched in 2022, it has gained market recognition through its positioning in democratizing the creator economy within Web3 film and television content creation, monetization, and consumption ecosystem.

QNT (QNT): Since its launch in 2018, it has been recognized for solving blockchain interoperability through creating the global blockchain operating system Overledger, ranking among the top cryptocurrencies by market capitalization at position 75.

This article will comprehensively analyze the investment value comparison of RITE vs QNT across historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future forecasts, attempting to address investors' most pressing question:

"Which is the better buy right now?"

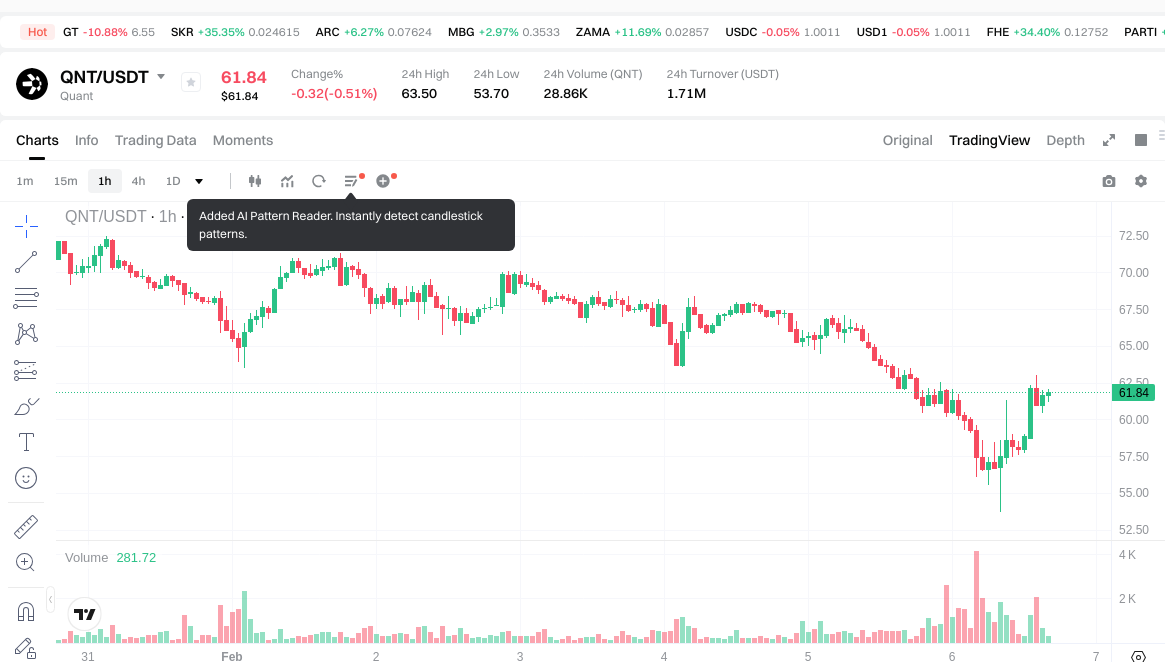

I. Historical Price Comparison and Current Market Status

RITE (Coin A) and QNT (Coin B) Historical Price Trends

-

2024: RITE experienced notable volatility, with its all-time high (ATH) of $0.081853 recorded on January 30, 2024, followed by a significant decline. The token reached its all-time low (ATL) of $0.00016697 on January 12, 2024, reflecting a period of substantial price fluctuation within a short timeframe.

-

2021: QNT saw its ATH of $427.42 on September 11, 2021, during a broader market rally in the crypto sector. This peak represented a substantial increase from its historical low of $0.215773, which was recorded on August 23, 2018.

-

Comparative Analysis: During the market cycle from 2021 to 2024, QNT declined from its peak of $427.42 to approximately $61.87 as of February 6, 2026, representing an 85.5% decrease. In contrast, RITE, which reached its high point in early 2024, has experienced a 99.5% decline from its ATH, trading at $0.0004426 as of the same date. Both tokens have demonstrated significant downward pressure, though RITE's decline has been more pronounced in percentage terms.

Current Market Status (2026-02-06)

- RITE Current Price: $0.0004426

- QNT Current Price: $61.87

- 24-Hour Trading Volume: RITE recorded $14,307.88 compared to QNT's $1,702,673.29, indicating substantially higher liquidity and trading activity for QNT.

- Market Sentiment Index (Fear & Greed Index): 9 (Extreme Fear)

View real-time prices:

- Check RITE current price Market Price

- Check QNT current price Market Price

II. Core Factors Influencing RITE vs QNT Investment Value

Supply Mechanism Comparison (Tokenomics)

- RITE: The supply mechanism details are not available in the reference materials.

- QNT: The supply mechanism specifics are not available in the reference materials.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through scarcity dynamics and inflation/deflation models, though specific historical data for these tokens is not available.

Institutional Adoption and Market Application

- Institutional Holdings: Information regarding institutional preference between RITE and QNT is not available in the reference materials.

- Enterprise Adoption: Details on RITE or QNT application in cross-border payments, settlements, or investment portfolios are not available.

- National Policies: Regulatory attitudes toward these tokens across different jurisdictions are not covered in the reference materials.

Technology Development and Ecosystem Building

- RITE Technology: RITE is described as an ecosystem for content streaming creation and monetization on blockchain, with a vision to support creators from concept to global distribution through decentralized film and television NFTs.

- QNT Technology: QNT's technical development details and potential impact are not available in the reference materials.

- Ecosystem Comparison: Specific implementation details regarding DeFi, NFT, payment systems, and smart contract deployment for either token are not provided.

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environment: Information on which token demonstrates stronger inflation-resistant properties is not available.

- Macroeconomic Monetary Policy: The impact of interest rates and the US Dollar Index on RITE and QNT is not covered in the reference materials.

- Geopolitical Factors: Details regarding cross-border transaction demand and international situations affecting these tokens are not available.

III. 2026-2031 Price Prediction: RITE vs QNT

Short-term Prediction (2026)

- RITE: Conservative $0.000389 - $0.000443 | Optimistic $0.000443 - $0.000571

- QNT: Conservative $32.22 - $61.96 | Optimistic $61.96 - $86.12

Medium-term Prediction (2028-2029)

- RITE may enter a gradual growth phase, with estimated price range of $0.000309 - $0.000828

- QNT may enter an expansion phase, with estimated price range of $55.51 - $122.15

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Prediction (2030-2031)

- RITE: Baseline scenario $0.000539 - $0.000760 | Optimistic scenario $0.000760 - $0.000833

- QNT: Baseline scenario $74.18 - $112.40 | Optimistic scenario $112.40 - $167.48

Disclaimer

RITE:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.000570954 | 0.0004426 | 0.000389488 | 0 |

| 2027 | 0.00070442003 | 0.000506777 | 0.00029393066 | 14 |

| 2028 | 0.0007751660992 | 0.000605598515 | 0.00030885524265 | 36 |

| 2029 | 0.00082845876852 | 0.0006903823071 | 0.000441844676544 | 55 |

| 2030 | 0.000827768386212 | 0.00075942053781 | 0.000539188581845 | 71 |

| 2031 | 0.000833274185112 | 0.000793594462011 | 0.000650747458849 | 79 |

QNT:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 86.1244 | 61.96 | 32.2192 | 0 |

| 2027 | 102.178236 | 74.0422 | 39.982788 | 19 |

| 2028 | 117.18658994 | 88.110218 | 55.50943734 | 42 |

| 2029 | 122.1516007243 | 102.64840397 | 92.383563573 | 65 |

| 2030 | 167.4760034972535 | 112.40000234715 | 74.184001549119 | 81 |

| 2031 | 153.931803214421925 | 139.93800292220175 | 131.541722746869645 | 126 |

IV. Investment Strategy Comparison: RITE vs QNT

Long-term vs Short-term Investment Strategies

-

RITE: May suit investors interested in emerging Web3 content creation ecosystems and decentralized film and television NFT applications. The token's focus on democratizing the creator economy positions it within a niche sector that could experience growth as blockchain-based content platforms develop.

-

QNT: May appeal to investors seeking exposure to blockchain interoperability solutions and enterprise-level infrastructure. The project's positioning in creating cross-blockchain operating systems suggests potential applications in institutional and enterprise contexts.

Risk Management and Asset Allocation

-

Conservative Investors: Consider allocation weighting that reflects liquidity differences, with potentially higher exposure to QNT given its substantially higher 24-hour trading volume of $1,702,673.29 compared to RITE's $14,307.88.

-

Aggressive Investors: May explore higher allocation to emerging projects like RITE for potential upside, while maintaining QNT exposure for relative stability within the cryptocurrency sector.

-

Hedging Tools: Stablecoin allocation, options strategies, and diversified cross-currency portfolios can help manage volatility exposure.

V. Potential Risk Comparison

Market Risk

-

RITE: The token has experienced a 99.5% decline from its all-time high, indicating substantial historical volatility. Current trading volume of $14,307.88 suggests limited liquidity, which may amplify price fluctuations during market movements.

-

QNT: Has declined 85.5% from its 2021 peak of $427.42 to approximately $61.87, reflecting broader market cycle impacts. While demonstrating significant downward pressure, QNT maintains notably higher trading activity compared to RITE.

Technical Risk

-

RITE: As a platform focused on content streaming creation and monetization, technical considerations include ecosystem adoption, network scalability, and platform development progress.

-

QNT: Technical risk factors include interoperability solution implementation, network stability, and security considerations within cross-blockchain operations.

Regulatory Risk

- Both tokens operate within the evolving global regulatory landscape for digital assets. Regulatory developments regarding content platforms, interoperability protocols, and cryptocurrency classification may impact both projects differently based on their specific use cases and jurisdictional operations.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

RITE Characteristics: Positioned within the Web3 content creation and decentralized film and television NFT sector. The project targets the creator economy with a focus on content monetization and distribution.

-

QNT Characteristics: Focuses on blockchain interoperability through the Overledger operating system, maintaining a market cap ranking of 75. Demonstrates higher liquidity with 24-hour trading volume exceeding $1.7 million.

✅ Investment Considerations:

-

New Investors: May consider starting with tokens demonstrating higher liquidity and established market presence, which can provide more stable entry and exit opportunities.

-

Experienced Investors: Can evaluate portfolio diversification across different blockchain sectors, weighing infrastructure projects against application-layer platforms based on risk tolerance and market outlook.

-

Institutional Investors: May prioritize tokens with substantial trading volumes, established market infrastructure, and clear use cases aligned with enterprise adoption trends.

⚠️ Risk Disclaimer: The cryptocurrency market exhibits extreme volatility. This article does not constitute investment advice. Market sentiment as of February 6, 2026 indicates "Extreme Fear" with a Fear & Greed Index of 9, suggesting heightened market uncertainty. Investors should conduct thorough research and consider their financial situation before making investment decisions.

VII. FAQ

Q1: What are the primary differences between RITE and QNT in terms of their core use cases?

RITE focuses on democratizing the Web3 creator economy through content streaming creation and decentralized film and television NFT monetization, while QNT specializes in blockchain interoperability through its Overledger operating system. RITE targets content creators seeking decentralized distribution channels from concept to global audience, positioning itself within the entertainment and media sector of blockchain applications. QNT, conversely, addresses enterprise-level infrastructure needs by enabling cross-blockchain communication and operations, serving as a foundational technology layer rather than an application-specific platform. This fundamental distinction means RITE's value proposition depends on creator economy adoption, whereas QNT's depends on institutional demand for blockchain interoperability solutions.

Q2: How do the liquidity levels of RITE and QNT compare, and why does this matter for investors?

QNT demonstrates substantially higher liquidity with a 24-hour trading volume of $1,702,673.29 compared to RITE's $14,307.88 as of February 6, 2026—a difference of approximately 119 times. Higher liquidity typically enables investors to enter and exit positions with minimal price slippage, reduces the impact of individual trades on market prices, and generally indicates broader market participation and confidence. For RITE, the limited trading volume suggests that larger transactions could significantly move the price, potentially creating challenges for position management. This liquidity differential is particularly relevant for investors planning larger allocations or requiring the ability to adjust positions quickly in response to market conditions.

Q3: What has been the historical price performance of RITE versus QNT from their respective peaks?

RITE has experienced a 99.5% decline from its all-time high of $0.081853 (recorded on January 30, 2024) to its current price of $0.0004426 as of February 6, 2026. QNT has declined 85.5% from its all-time high of $427.42 (recorded on September 11, 2021) to approximately $61.87 over a longer timeframe. While both tokens have experienced substantial downward pressure consistent with broader cryptocurrency market cycles, RITE's more recent launch and steeper percentage decline reflect either more pronounced volatility in emerging projects or specific challenges in gaining market traction. QNT's decline occurred over a longer period spanning multiple market cycles, suggesting more established but still significant cyclical sensitivity.

Q4: According to the price predictions, which token shows higher potential percentage gains by 2031?

Based on the provided predictions, RITE shows a projected price change of 79% from 2026 to 2031, with an optimistic scenario high of $0.000833 compared to its 2026 average of $0.0004426. QNT demonstrates a projected price change of 126% over the same period, with an optimistic scenario reaching $167.48 compared to its 2026 average of $61.96. In absolute percentage terms, QNT's predicted growth trajectory appears more substantial, though both projections assume continued ecosystem development and favorable market conditions. These predictions should be viewed as speculative estimates rather than guaranteed outcomes, as they depend on numerous variables including technological adoption, regulatory developments, and broader market sentiment.

Q5: What type of investor profile might be better suited for RITE versus QNT?

RITE may align with investors who have higher risk tolerance, interest in emerging Web3 content creation ecosystems, and capacity to accept limited liquidity in exchange for potential exposure to nascent market segments. The token's focus on democratizing the creator economy suggests suitability for investors who believe in the long-term transformation of content monetization models. QNT may be more appropriate for investors seeking exposure to infrastructure-level blockchain technology with established market presence, higher liquidity for position management, and interest in enterprise adoption trends. The substantially higher trading volume and longer market history provide relatively more data points for analysis, though neither token eliminates cryptocurrency market volatility risks.

Q6: How does the current market sentiment of "Extreme Fear" (Index: 9) affect investment decisions for RITE and QNT?

The Fear & Greed Index reading of 9 as of February 6, 2026, indicates extreme market pessimism, which historically has coincided with both heightened volatility and potential accumulation opportunities for long-term investors. In this environment, tokens with lower liquidity like RITE may experience more pronounced price swings, as limited trading volumes can amplify both upward and downward movements during sentiment-driven market shifts. QNT's higher liquidity may provide relatively more stability, though it remains exposed to broader market sentiment. Extreme fear conditions typically suggest that near-term price movements may be dominated by sentiment rather than fundamentals, making thorough risk management and position sizing particularly important regardless of which token is selected.

Q7: What are the key risk factors investors should consider when comparing RITE and QNT?

For RITE, primary risks include extreme historical volatility (99.5% decline from ATH), limited liquidity ($14,307.88 daily volume), dependence on Web3 content creation ecosystem adoption, and the challenges of establishing network effects in a competitive creator economy landscape. For QNT, key risks include substantial decline from previous highs (85.5%), exposure to enterprise adoption cycles for interoperability solutions, regulatory uncertainty around cross-blockchain operations, and competition from alternative interoperability protocols. Both tokens face cryptocurrency sector-wide risks including regulatory developments, technological disruption, macroeconomic conditions affecting risk asset valuations, and the inherent volatility of digital asset markets. The different risk profiles suggest that neither token represents a conservative investment option, though they expose investors to distinct sector-specific uncertainties within the broader cryptocurrency ecosystem.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Comprehensive Guide to OpenSea NFT Trading

What Is the DXY Index? Why Should Traders and Investors Monitor This Indicator?

Comprehensive Guide to NGMI and WAGMI in Crypto

![Cryptocurrency Trading Patterns [Illustrated, Fundamentals Edition]](https://gimg.staticimgs.com/learn/6e0f5c52f4da3cf14c7ae5002f14d250fa491fbf.png)

Cryptocurrency Trading Patterns [Illustrated, Fundamentals Edition]

What does financial freedom mean?