SHM vs LTC: Understanding the Key Differences Between Simple Harmonic Motion and Lithium-Ion Battery Technology

Introduction: Investment Comparison Between SHM and LTC

In the cryptocurrency market, the comparison between SHM vs LTC has consistently been a topic investors cannot avoid. The two not only show distinct differences in market cap ranking, application scenarios, and price performance, but also represent different positioning within the crypto asset landscape.

Shardeum (SHM): Launched in 2025, it has garnered market attention through its positioning as the world's first auto-scaling layer-1 blockchain designed to address scalability challenges while maintaining true decentralization.

Litecoin (LTC): Since its launch in 2011, it has been regarded as a peer-to-peer cryptocurrency, representing one of the cryptocurrencies with considerable global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between SHM vs LTC through historical price trends, supply mechanisms, institutional adoption, technical ecosystem, and future predictions, attempting to address the question investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Overview

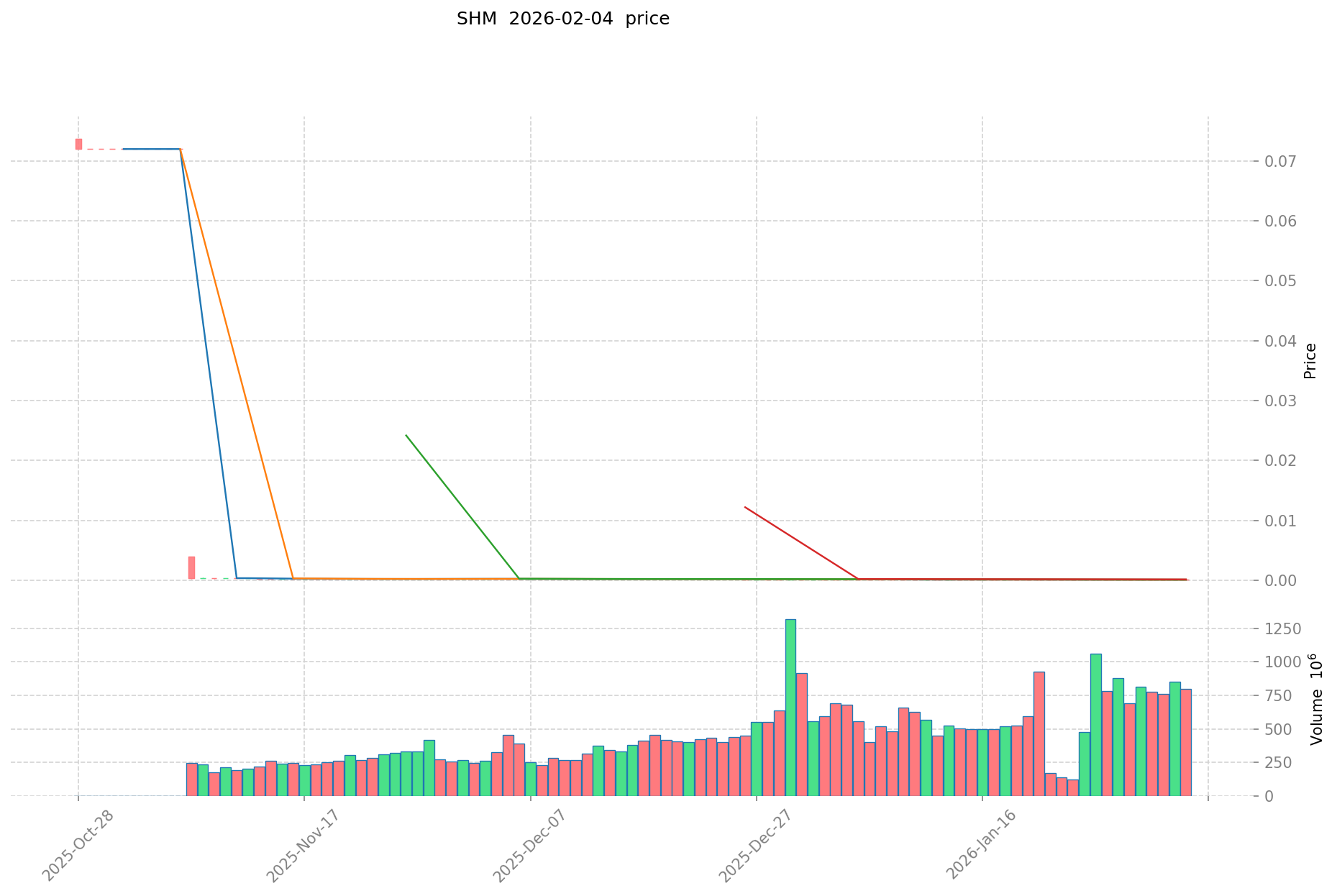

Price Trends of SHM (Coin A) and LTC (Coin B)

- 2025: SHM experienced significant volatility, with its price reaching $0.65 in May 2025. However, by January 2026, the token declined to $0.0000961.

- 2011-2021: LTC, created by Charlie Lee, demonstrated relatively stable growth over its decade-long history. The token reached its all-time high of $410.26 in May 2021 during a broader crypto market rally.

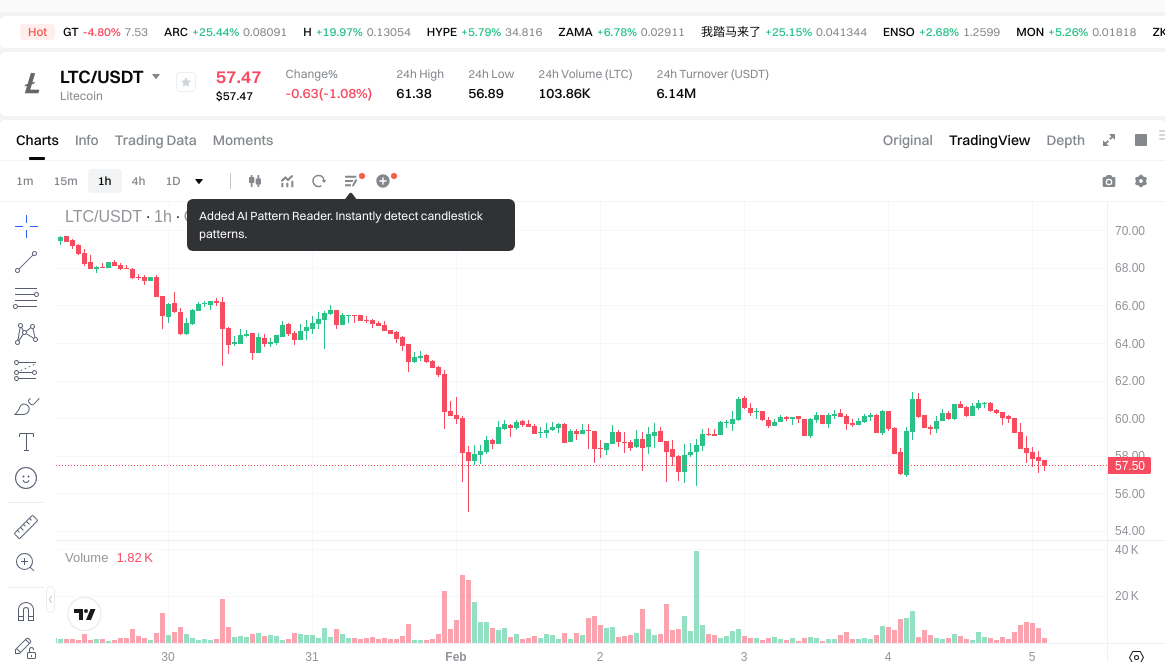

- Comparative Analysis: During the recent market cycle, SHM experienced a substantial decline from its peak of $0.65 to its current level, while LTC has shown more moderate volatility, trading between $56.89 and $61.38 over recent periods.

Current Market Status (February 5, 2026)

- SHM Current Price: $0.00009864

- LTC Current Price: $57.52

- 24-Hour Trading Volume: SHM recorded $84,885.06 compared to LTC's $6,100,064.02

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

View real-time prices:

- Check SHM current price Market Price

- Check LTC current price Market Price

II. Core Factors Influencing SHM vs LTC Investment Value

Regulatory Environment and Market Acceptance

- Regulatory policies: Government attitudes and regulatory frameworks directly impact market acceptance of crypto assets, influencing their investment value relative to fiat currencies.

- Policy clarity: Well-defined and supportive regulatory policies can enhance investor confidence in crypto assets, promoting market growth and broader adoption.

- Market sentiment: Regulatory developments shape institutional and retail participation levels, affecting liquidity and price discovery mechanisms.

Market Capitalization and Circulation Metrics

- Circulating supply: The current circulating quantity of tokens multiplied by current price determines market capitalization, serving as a fundamental valuation metric.

- Circulation rate: The ratio of circulating supply to total supply provides insight into token distribution and potential future supply pressure.

- Global market share: Each asset's circulating market cap as a percentage of total crypto market capitalization indicates relative market positioning and competitive standing.

Technology Innovation and Development

- Technical advancement: Ongoing technological improvements and protocol upgrades can enhance network capabilities and user experience.

- Innovation impact: New features, scalability solutions, and performance enhancements may influence investor perception and adoption rates.

- Development activity: Active development communities and consistent technical progress signal long-term viability and competitive positioning.

Investment Risk Considerations

- Market volatility: Crypto assets exhibit price fluctuations influenced by various market dynamics and external factors.

- Competitive landscape: The presence of alternative assets and evolving market conditions create dynamic investment environments.

- Institutional factors: Professional investment activities and strategic allocation decisions contribute to market structure and liquidity profiles.

III. 2026-2031 Price Forecast: SHM vs LTC

Short-term Forecast (2026)

- SHM: Conservative $0.0000837165 - $0.00009849 | Optimistic $0.00009849 - $0.0001398558

- LTC: Conservative $30.5651 - $57.67 | Optimistic $57.67 - $61.7069

Mid-term Forecast (2028-2029)

- SHM may enter a gradual accumulation phase, with projected price range of $0.000134671335645 - $0.000176322264195 in 2028, potentially reaching $0.000080365466637 - $0.000187519422153 by 2029

- LTC may enter a consolidation phase, with projected price range of $54.41199102 - $89.84305494 in 2028, potentially reaching $55.1206122984 - $91.1021231043 by 2029

- Key drivers: institutional capital flows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- SHM: Baseline scenario $0.000146666976612 - $0.00017254938425 (2030) | Optimistic scenario $0.000108421405593 - $0.000266459386628 (2031)

- LTC: Baseline scenario $79.6378013102925 - $88.0207277640075 (2030) | Optimistic scenario $79.05099645853245 - $103.969245342200287 (2031)

Disclaimer

SHM:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0001398558 | 0.00009849 | 0.0000837165 | 0 |

| 2027 | 0.000158499957 | 0.0001191729 | 0.000114405984 | 20 |

| 2028 | 0.000176322264195 | 0.0001388364285 | 0.000134671335645 | 40 |

| 2029 | 0.000187519422153 | 0.000157579346347 | 0.000080365466637 | 59 |

| 2030 | 0.000194980804203 | 0.00017254938425 | 0.000146666976612 | 74 |

| 2031 | 0.000266459386628 | 0.000183765094226 | 0.000108421405593 | 86 |

LTC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 61.7069 | 57.67 | 30.5651 | 0 |

| 2027 | 66.851064 | 59.68845 | 44.169453 | 3 |

| 2028 | 89.84305494 | 63.269757 | 54.41199102 | 9 |

| 2029 | 91.1021231043 | 76.55640597 | 55.1206122984 | 33 |

| 2030 | 88.0207277640075 | 83.82926453715 | 79.6378013102925 | 45 |

| 2031 | 103.969245342200287 | 85.92499615057875 | 79.05099645853245 | 49 |

IV. Investment Strategy Comparison: SHM vs LTC

Long-term vs Short-term Investment Strategies

- SHM: May be suitable for investors focused on emerging blockchain scalability solutions and early-stage technological development, with higher risk tolerance for volatile assets

- LTC: May be suitable for investors seeking established market presence and historical performance track records in the peer-to-peer cryptocurrency segment

Risk Management and Asset Allocation

- Conservative investors: SHM 10-15% vs LTC 20-30%

- Aggressive investors: SHM 25-35% vs LTC 30-40%

- Hedging instruments: stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- SHM: Exhibits substantial price volatility, as evidenced by the decline from $0.65 in May 2025 to $0.0000961 by January 2026, with relatively lower trading volume of $84,885.06

- LTC: Demonstrates established market participation with trading volume of $6,100,064.02, though subject to broader cryptocurrency market sentiment fluctuations, currently operating in an Extreme Fear environment (Fear & Greed Index: 14)

Technical Risk

- SHM: Scalability implementation and network stability considerations during early deployment phase

- LTC: Network security considerations and mining distribution dynamics

Regulatory Risk

- Global regulatory developments may impact both assets differently, with established cryptocurrencies potentially facing different compliance requirements compared to newer blockchain platforms

- Policy clarity variations across jurisdictions may influence market acceptance and institutional adoption patterns for both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- SHM advantages: Represents exposure to auto-scaling layer-1 blockchain technology targeting scalability challenges

- LTC advantages: Demonstrates longer operational history since 2011, with established market capitalization and trading infrastructure

✅ Investment Recommendations:

- Beginning investors: Consider focusing on assets with established market presence and lower volatility profiles while developing understanding of cryptocurrency market dynamics

- Experienced investors: May evaluate portfolio diversification across different risk profiles, balancing established assets with emerging technology exposures based on individual risk tolerance

- Institutional investors: Consider market capitalization, liquidity metrics, regulatory compliance factors, and alignment with strategic allocation frameworks

⚠️ Risk Disclosure: Cryptocurrency markets exhibit extreme volatility. This content does not constitute investment advice.

VII. FAQ

Q1: What is the current price difference between SHM and LTC?

As of February 5, 2026, SHM is trading at $0.00009864 while LTC is trading at $57.52, representing a substantial price differential. This difference reflects their distinct market positioning, with LTC maintaining a significantly higher nominal price point due to its established market presence since 2011 and larger market capitalization. SHM's lower price reflects its recent launch in 2025 and early-stage development phase, though price alone should not be the sole consideration for investment decisions.

Q2: Which asset has higher trading volume and what does this indicate?

LTC demonstrates considerably higher trading volume at $6,100,064.02 compared to SHM's $84,885.06 over the 24-hour period. This significant volume difference indicates LTC's superior market liquidity and broader market participation, making it easier for investors to execute trades without substantial price impact. Higher trading volume typically suggests greater market acceptance, more established exchange listings, and stronger institutional involvement, which can contribute to more stable price discovery mechanisms.

Q3: What are the main technological differences between SHM and LTC?

SHM positions itself as the world's first auto-scaling layer-1 blockchain designed to address scalability challenges while maintaining decentralization. LTC operates as a peer-to-peer cryptocurrency launched in 2011, focusing on transaction processing with established network security. The fundamental difference lies in their design philosophy: SHM emphasizes scalability innovation and dynamic network adjustment, while LTC represents a proven, stable cryptocurrency infrastructure with over a decade of operational history.

Q4: How volatile has SHM been compared to LTC historically?

SHM has exhibited extreme volatility, declining from a peak of $0.65 in May 2025 to $0.0000961 by January 2026, representing a substantial price correction. In contrast, LTC has demonstrated relatively moderate volatility, with its all-time high of $410.26 in May 2021 and current trading range between $56.89 and $61.38. This volatility difference reflects SHM's early-stage market dynamics and lower liquidity compared to LTC's more established market structure and broader investor base.

Q5: What are the projected price ranges for both assets by 2030?

According to baseline forecasts, SHM is projected to trade between $0.000146666976612 and $0.00017254938425 by 2030, while LTC is forecasted to range between $79.6378013102925 and $88.0207277640075. These projections suggest potential growth for both assets, though investors should note that cryptocurrency price predictions are subject to numerous market variables, technological developments, regulatory changes, and broader market sentiment factors that can significantly influence actual outcomes.

Q6: Which asset is more suitable for beginning investors?

LTC may be more appropriate for beginning investors due to its established market presence, higher liquidity, longer operational history, and relatively lower volatility profile compared to SHM. The higher trading volume and broader market acceptance of LTC provide newcomers with more stable entry and exit opportunities while learning cryptocurrency market dynamics. Beginning investors should prioritize understanding market fundamentals and risk management before considering exposure to newer, more volatile assets like SHM.

Q7: How does the current market sentiment affect both assets?

The current Fear & Greed Index reading of 14 indicates Extreme Fear in the cryptocurrency market, which typically affects all digital assets but may impact newer projects like SHM more severely due to lower liquidity and risk-off investor behavior. During extreme fear conditions, investors tend to favor established assets with proven track records, potentially benefiting LTC's relative stability. However, both assets remain subject to broader market sentiment shifts, and extreme fear conditions can present both risks and potential accumulation opportunities for long-term investors.

Q8: What are the main risk factors investors should consider when comparing these assets?

Investors should evaluate multiple risk dimensions: SHM faces technical implementation risks related to its scalability solutions and early-stage development, combined with substantial price volatility and lower liquidity. LTC encounters network security considerations, mining distribution dynamics, and competition from newer blockchain technologies. Both assets face regulatory uncertainty, with global policy developments potentially impacting established cryptocurrencies and emerging platforms differently. Market risk remains significant for both, as evidenced by the current Extreme Fear market environment and historical price fluctuations.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Comprehensive Guide to Trading Systems

What Does DYOR Mean in Crypto?

How to Profit from Investing in Esports — A Comprehensive Guide

Comprehensive Guide to Fiat Currency

What is mobile mining, and can you earn money with it?