SPON vs IMX: A Comprehensive Comparison of Performance, Features, and Use Cases

Introduction: Investment Comparison Between SPON and IMX

In the cryptocurrency market, the comparison between SPON vs IMX has become a topic of interest for investors. Both exhibit significant differences in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

Spheron Network (SPON): Launched in January 2025, it has gained market attention through its positioning as a decentralized computing infrastructure network for AI workloads, offering competitive GPU pricing and community-driven governance.

Immutable (IMX): Operating since November 2021, it has been recognized as a Layer 2 scaling solution for NFTs on Ethereum, addressing scalability challenges while maintaining security and eliminating gas fees for minting and trading.

This article will comprehensively analyze the investment value comparison of SPON vs IMX through historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future forecasts, attempting to address investors' primary question:

"Which is the better buy right now?"

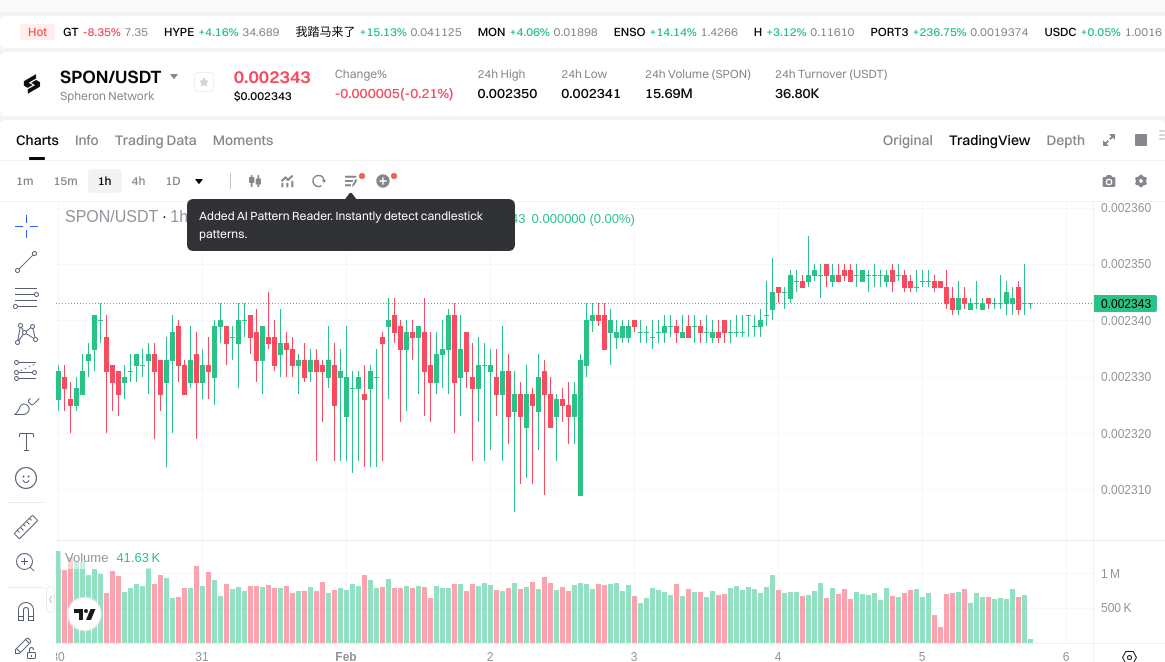

I. Historical Price Comparison and Current Market Status

SPON (Spheron Network) and IMX (Immutable) Historical Price Trends

-

2025: SPON reached an all-time high of $0.1445 in August 2025, reflecting early market interest in its decentralized computing infrastructure. The token subsequently experienced significant price correction.

-

2021: IMX achieved its all-time high of $9.52 in November 2021, driven by strong momentum in the NFT and Layer 2 scaling sector during the broader crypto market bull run.

-

Comparative Analysis: During recent market cycles, SPON declined from its peak of $0.1445 to a low of $0.002304 in January 2026, representing a substantial drawdown. IMX, meanwhile, fell from $9.52 to $0.169685 in February 2026, marking a more severe decline in absolute terms but reflecting longer market exposure since its 2021 launch.

Current Market Status (2026-02-05)

- SPON Current Price: $0.002342

- IMX Current Price: $0.1725

- 24-Hour Trading Volume: SPON $36,971.55 vs IMX $454,551.66

- Market Sentiment Index (Fear & Greed Index): 12 (Extreme Fear)

View real-time prices:

- Check SPON current price Market Price

- Check IMX current price Market Price

II. Core Factors Influencing SPON vs IMX Investment Value

Supply Mechanism Comparison (Tokenomics)

- SPON: The decentralized cloud platform operates with a token supply mechanism designed to support network resource allocation and incentivize participants within its distributed infrastructure ecosystem.

- IMX: Built on blockchain technology with a token structure that facilitates its platform operations and ecosystem development.

- 📌 Historical Pattern: Supply mechanisms play a role in shaping market dynamics, with different tokenomics models potentially influencing adoption rates and network effects over time.

Institutional Adoption and Market Application

- Institutional Holdings: The level of institutional interest in both assets may vary based on their respective use cases and market positioning within the decentralized infrastructure and blockchain technology sectors.

- Enterprise Adoption: Both SPON and IMX are positioned within distinct technological niches - SPON focusing on decentralized cloud services, while IMX emphasizes blockchain-based solutions, each targeting different enterprise application scenarios.

- Regulatory Environment: The regulatory landscape for both projects continues to evolve across different jurisdictions, with varying approaches to decentralized infrastructure and blockchain technology platforms.

Technology Development and Ecosystem Building

- SPON Technology Development: The platform's decentralized cloud infrastructure represents its core technological proposition, with ongoing development aimed at expanding its distributed computing capabilities.

- IMX Technology Evolution: The blockchain technology foundation continues to develop, with focus on enhancing platform functionality and user experience.

- Ecosystem Comparison: Both projects are developing their respective ecosystems, with SPON concentrating on decentralized cloud services and IMX building within the broader blockchain application space, each with different approaches to DeFi integration, NFT support, and smart contract implementation.

Macroeconomic Environment and Market Cycles

- Performance Under Economic Conditions: Both assets may respond differently to varying economic conditions based on their distinct value propositions and market positioning within the crypto sector.

- Macroeconomic Policy Impact: Interest rate fluctuations, monetary policy adjustments, and currency dynamics represent external factors that may influence the broader cryptocurrency market, including both SPON and IMX.

- Geopolitical Considerations: Cross-border technology adoption trends and international developments in blockchain regulation may affect the operational environments for both projects.

III. 2026-2031 Price Forecast: SPON vs IMX

Short-term Forecast (2026)

- SPON: Conservative $0.0016401 - $0.002343 | Optimistic $0.002343 - $0.00344421

- IMX: Conservative $0.139644 - $0.1724 | Optimistic $0.1724 - $0.201708

Mid-term Forecast (2028-2029)

- SPON may enter a phase of gradual accumulation, with projected prices ranging from $0.002949162216 to $0.004310314008 in 2028, and $0.00343577398164 to $0.00392659883616 in 2029

- IMX may enter a phase of moderate expansion, with projected prices ranging from $0.1274679483 to $0.2743801599 in 2028, and $0.1741017731145 to $0.313873619136 in 2029

- Key drivers: institutional capital inflows, ETF development, ecosystem growth

Long-term Forecast (2030-2031)

- SPON: Baseline scenario $0.003504489461272 - $0.00385108732008 (2030) | Optimistic scenario $0.002577147634597 - $0.005522459216994 (2031)

- IMX: Baseline scenario $0.23202126439569 - $0.279543692043 (2030) | Optimistic scenario $0.249632516994399 - $0.433572266358693 (2031)

Disclaimer

SPON:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00344421 | 0.002343 | 0.0016401 | 0 |

| 2027 | 0.0035880702 | 0.002893605 | 0.00188084325 | 23 |

| 2028 | 0.004310314008 | 0.0032408376 | 0.002949162216 | 38 |

| 2029 | 0.00392659883616 | 0.003775575804 | 0.00343577398164 | 61 |

| 2030 | 0.005353011374911 | 0.00385108732008 | 0.003504489461272 | 64 |

| 2031 | 0.005522459216994 | 0.004602049347495 | 0.002577147634597 | 96 |

IMX:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.201708 | 0.1724 | 0.139644 | 0 |

| 2027 | 0.24504074 | 0.187054 | 0.1589959 | 8 |

| 2028 | 0.2743801599 | 0.21604737 | 0.1274679483 | 25 |

| 2029 | 0.313873619136 | 0.24521376495 | 0.1741017731145 | 42 |

| 2030 | 0.37738398425805 | 0.279543692043 | 0.23202126439569 | 62 |

| 2031 | 0.433572266358693 | 0.328463838150525 | 0.249632516994399 | 90 |

IV. Investment Strategy Comparison: SPON vs IMX

Long-term vs Short-term Investment Strategies

- SPON: May appeal to investors interested in emerging decentralized computing infrastructure with higher risk tolerance for early-stage projects in the distributed cloud services sector

- IMX: May attract investors seeking exposure to established blockchain scaling solutions with focus on NFT infrastructure and Layer 2 technology

Risk Management and Asset Allocation

- Conservative Investors: SPON 20% vs IMX 80%

- Aggressive Investors: SPON 50% vs IMX 50%

- Hedging Tools: Stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risks

- SPON: Higher volatility associated with relatively new market entry (launched January 2025), limited trading volume of $36,971.55, and significant price correction from peak levels

- IMX: Market performance correlation with NFT sector sentiment, competition from other Layer 2 solutions, and longer-term price drawdown from 2021 peak

Technical Risks

- SPON: Scalability challenges in decentralized computing infrastructure, network stability considerations in distributed systems

- IMX: Technical dependencies on Ethereum base layer, potential smart contract vulnerabilities, competition from alternative scaling solutions

Regulatory Risks

- Evolving regulatory frameworks for decentralized infrastructure platforms and blockchain technology may impact both projects differently, with SPON's cloud computing focus and IMX's NFT-oriented ecosystem potentially facing distinct compliance considerations across jurisdictions

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- SPON Advantages: Early positioning in decentralized computing infrastructure for AI workloads, potential for growth in emerging distributed cloud services market, lower entry price point

- IMX Advantages: Established presence since 2021, proven Layer 2 technology for NFT ecosystem, higher trading volume indicating greater liquidity

✅ Investment Recommendations:

- Beginner Investors: Consider focusing on more established assets with higher liquidity and longer track records; if interested in either asset, prioritize thorough research and start with smaller position sizes

- Experienced Investors: May evaluate portfolio diversification between emerging infrastructure projects (SPON) and established Layer 2 solutions (IMX) based on individual risk appetite and sector outlook

- Institutional Investors: Conduct comprehensive due diligence on technological fundamentals, regulatory compliance, and long-term ecosystem development prospects before considering either asset class

⚠️ Risk Warning: The cryptocurrency market exhibits extreme volatility. This article does not constitute investment advice.

VII. FAQ

Q1: What is the primary difference between SPON and IMX in terms of use cases?

SPON focuses on decentralized computing infrastructure for AI workloads with competitive GPU pricing, while IMX operates as a Layer 2 scaling solution specifically designed for NFT minting and trading on Ethereum. SPON launched in January 2025 as a distributed cloud services platform targeting the AI and computing infrastructure sector, whereas IMX has been operational since November 2021, establishing itself within the NFT ecosystem by eliminating gas fees and addressing scalability challenges while maintaining Ethereum's security guarantees.

Q2: Which asset has demonstrated greater price stability since launch?

Neither asset has demonstrated strong price stability, though they exhibit different volatility patterns. SPON experienced a significant decline from its August 2025 peak of $0.1445 to $0.002304 in January 2026 within a relatively short timeframe since its launch. IMX has undergone a more extended drawdown from its November 2021 all-time high of $9.52 to $0.169685 in February 2026. IMX shows higher trading volume ($454,551.66 vs SPON's $36,971.55), suggesting greater liquidity but not necessarily stability, as both assets have experienced substantial corrections from their respective peaks.

Q3: How do the tokenomics models of SPON and IMX differ?

SPON operates with a token supply mechanism designed to support network resource allocation and incentivize participants within its distributed infrastructure ecosystem, specifically focusing on decentralized cloud computing services. IMX utilizes a token structure that facilitates platform operations and ecosystem development within its blockchain-based environment. Both implement distinct tokenomics models aligned with their respective use cases—SPON for distributed computing resource allocation and IMX for NFT platform functionality—though specific supply metrics and distribution mechanisms reflect their different technological and market positioning strategies.

Q4: What are the major risks specific to each investment?

SPON faces risks associated with its recent market entry (January 2025), including limited trading volume, higher volatility, scalability challenges in decentralized computing infrastructure, and network stability considerations inherent to distributed systems. IMX confronts different risk factors including correlation with NFT sector sentiment fluctuations, competition from alternative Layer 2 scaling solutions, technical dependencies on Ethereum's base layer, and potential smart contract vulnerabilities. Both assets are subject to evolving regulatory frameworks that may impact decentralized infrastructure platforms and blockchain technology differently across jurisdictions.

Q5: Which investment horizon is more suitable for SPON versus IMX?

SPON may appeal to investors with longer time horizons and higher risk tolerance, given its early-stage positioning in the emerging decentralized computing infrastructure sector, lower entry price point, and limited operational history since January 2025. IMX may be more suitable for investors seeking exposure to established blockchain technology with a proven three-year operational track record, higher liquidity, and positioning within the more mature NFT and Layer 2 scaling sectors. Conservative investors might consider higher IMX allocation (80% IMX vs 20% SPON), while aggressive investors with greater risk appetite might pursue more balanced exposure (50% each), though both require comprehensive due diligence.

Q6: What role does trading volume play in evaluating these assets?

Trading volume serves as a significant indicator of market liquidity and investor interest. IMX demonstrates substantially higher 24-hour trading volume at $454,551.66 compared to SPON's $36,971.55, suggesting greater market depth, easier entry and exit positions, and potentially lower slippage for trades. Higher trading volume typically indicates more established market presence and broader investor participation, which may reduce execution risks for larger transactions. SPON's lower trading volume reflects its recent market entry and may present challenges for investors requiring significant liquidity or executing larger position sizes.

Q7: How do price forecasts compare for SPON and IMX through 2031?

Price forecasts suggest different growth trajectories reflecting each asset's market positioning. SPON's conservative 2026 forecast ranges from $0.0016401 to $0.002343, potentially reaching $0.002577 to $0.005522 by 2031, representing approximately 96% projected growth from current levels. IMX's conservative 2026 forecast ranges from $0.139644 to $0.1724, with potential reach of $0.2496 to $0.4336 by 2031, suggesting approximately 90% projected growth. These forecasts assume continued ecosystem development, institutional adoption, and favorable market conditions, though actual performance may vary significantly based on technological advancement, regulatory developments, and broader cryptocurrency market cycles.

Q8: What factors should institutional investors prioritize when comparing these assets?

Institutional investors should conduct comprehensive due diligence focusing on several critical areas: technological fundamentals and scalability potential of each platform, regulatory compliance frameworks across relevant jurisdictions, long-term ecosystem development prospects and partnership networks, liquidity profiles and market depth for position management, competitive positioning within their respective sectors (decentralized computing infrastructure for SPON, NFT Layer 2 solutions for IMX), operational track records (SPON's limited history versus IMX's three-year presence), and alignment with institutional investment mandates regarding risk parameters, sector exposure, and portfolio diversification objectives. Both assets require thorough evaluation of technical risks, market dynamics, and regulatory considerations before allocation decisions.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Cryptocurrency for Beginners: Which Coin Should You Invest In

A Comprehensive Overview of the Future Potential and Types of Altcoins

Comprehensive Guide to Decentralized Finance (DeFi)

Mining Calculator: How to Calculate Cryptocurrency Mining Profitability

What is Polygon?