STRIKE vs SAND: Which Token Will Dominate the Crypto Market in 2024?

Introduction: Investment Comparison Between STRIKE and SAND

In the cryptocurrency market, the comparison between STRIKE vs SAND has consistently been a topic that investors cannot bypass. The two not only exhibit distinct differences in market cap rankings, application scenarios, and price performance, but also represent different positioning within the crypto asset landscape.

StrikeBit AI (STRIKE): Launched in 2025, it has gained market recognition through its positioning as a Modular Agent Protocol (MAP) that enables users to build, expand, and compose intelligent multi-agent systems for scalable collaboration.

Sandbox (SAND): Since its launch in 2020, it has been recognized as a virtual game world platform, becoming one of the cryptocurrencies with significant trading volume and market presence in the metaverse and gaming sector.

This article will comprehensively analyze the investment value comparison between STRIKE vs SAND, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future forecasts, attempting to answer the question that investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

STRIKE (Coin A) and SAND (Coin B) Historical Price Trends

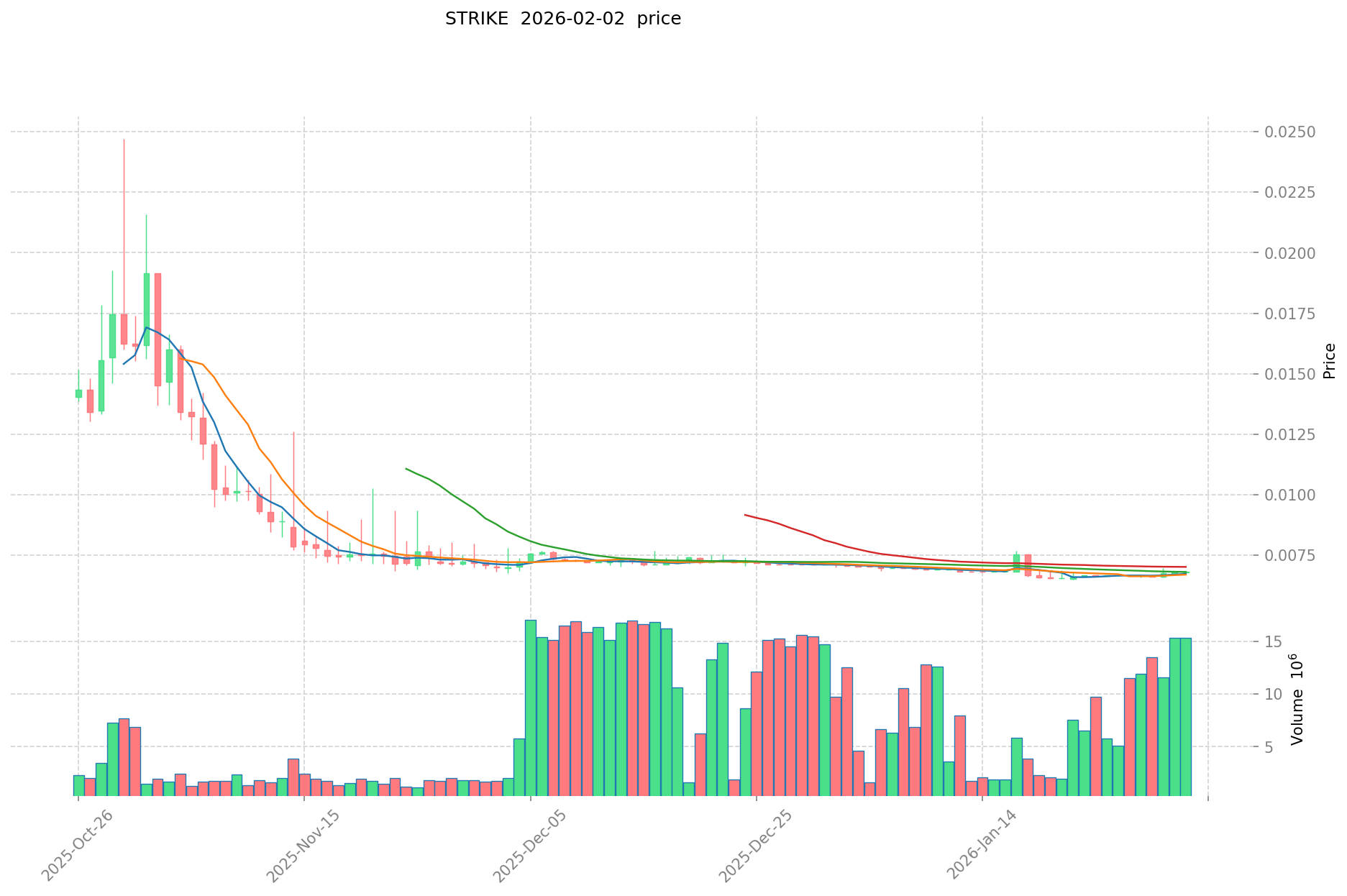

- 2025: STRIKE experienced notable volatility following its launch in October, with the price reaching an all-time high of $0.03015 on October 1, 2025.

- 2021: SAND was significantly influenced by the metaverse boom, with its price surging to an all-time high of $8.40 on November 25, 2021.

- Comparative Analysis: During the market correction phase, STRIKE declined from its peak of $0.03015 to a low of $0.006487 recorded on January 22, 2026, while SAND experienced a more substantial drawdown from its historical high of $8.40 to its all-time low of $0.02897764 on November 4, 2020, before recovering to current levels.

Current Market Status (February 2, 2026)

- STRIKE Current Price: $0.006816

- SAND Current Price: $0.0972

- 24-Hour Trading Volume: STRIKE $104,030.95 vs SAND $1,127,125.94

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

View real-time prices:

- Check STRIKE current price Market Price

- Check SAND current price Market Price

II. Core Factors Influencing STRIKE vs SAND Investment Value

Supply Mechanism Comparison (Tokenomics)

- STRIKE: The supply mechanism details are not specified in available materials, requiring further technical documentation review to determine whether it follows a fixed supply, inflationary, or deflationary model.

- SAND: The supply mechanism characteristics remain unspecified in current reference materials, necessitating additional research into its token distribution model and emission schedule.

- 📌 Historical Pattern: Supply mechanisms can influence price cycles through scarcity effects and market expectations, though specific historical data for these tokens requires further analysis.

Institutional Adoption and Market Application

- Institutional Holdings: Current data does not provide specific information regarding institutional preference between STRIKE and SAND, as institutional investment patterns vary based on risk assessment frameworks and portfolio strategies.

- Enterprise Adoption: The comparative application of STRIKE versus SAND in cross-border payments, settlement systems, and investment portfolios remains undocumented in available materials.

- National Policies: Regulatory attitudes toward these specific tokens differ across jurisdictions, with various countries maintaining distinct approaches to digital asset classification and oversight.

Technical Development and Ecosystem Building

- STRIKE Technical Upgrades: Specific technical development roadmaps and upgrade schedules are not detailed in reference materials, requiring direct project documentation review.

- SAND Technical Development: Current technical advancement initiatives and their potential market implications are not comprehensively covered in available sources.

- Ecosystem Comparison: The relative positioning of STRIKE and SAND within DeFi applications, NFT integrations, payment systems, and smart contract implementations requires detailed ecosystem analysis beyond available reference materials.

Macroeconomic Conditions and Market Cycles

- Performance in Inflationary Environments: The comparative inflation-hedging characteristics of STRIKE versus SAND depend on multiple factors including market liquidity, adoption rates, and broader economic conditions, which require ongoing empirical assessment.

- Macroeconomic Monetary Policy: Interest rate adjustments and US dollar index movements can influence digital asset valuations through capital flow dynamics and risk appetite shifts, affecting both tokens through broader market sentiment.

- Geopolitical Factors: Cross-border transaction demand and international developments may impact digital asset adoption patterns, though specific effects on STRIKE and SAND require context-specific evaluation.

III. 2026-2031 Price Prediction: STRIKE vs SAND

Short-term Forecast (2026)

- STRIKE: Conservative $0.005452 - $0.006815 | Optimistic $0.006815 - $0.0100862

- SAND: Conservative $0.089362 - $0.0982 | Optimistic $0.0982 - $0.12275

Medium-term Forecast (2028-2029)

- STRIKE may enter a consolidation phase, with estimated price range of $0.00763 - $0.01072 in 2028, potentially expanding to $0.00598 - $0.01322 by 2029

- SAND may enter an expansion phase, with estimated price range of $0.0820 - $0.1802 in 2028, potentially reaching $0.1431 - $0.2131 by 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem growth

Long-term Forecast (2030-2031)

- STRIKE: Baseline scenario $0.00583 - $0.01144 (2030) | Optimistic scenario $0.00806 - $0.01624 (2031)

- SAND: Baseline scenario $0.1151 - $0.1827 (2030) | Optimistic scenario $0.1602 - $0.3272 (2031)

Disclaimer

STRIKE:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0100862 | 0.006815 | 0.005452 | 0 |

| 2027 | 0.008704118 | 0.0084506 | 0.00802807 | 24 |

| 2028 | 0.01072169875 | 0.008577359 | 0.00763384951 | 25 |

| 2029 | 0.01321985455875 | 0.009649528875 | 0.0059827079025 | 41 |

| 2030 | 0.014979446149106 | 0.011434691716875 | 0.005831692775606 | 67 |

| 2031 | 0.016244694787578 | 0.01320706893299 | 0.008056312049124 | 93 |

SAND:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.12275 | 0.0982 | 0.089362 | 1 |

| 2027 | 0.13809375 | 0.110475 | 0.0994275 | 13 |

| 2028 | 0.18021234375 | 0.124284375 | 0.0820276875 | 27 |

| 2029 | 0.213147703125 | 0.152248359375 | 0.1431134578125 | 56 |

| 2030 | 0.2685661059375 | 0.18269803125 | 0.1150997596875 | 87 |

| 2031 | 0.327166499460937 | 0.22563206859375 | 0.160198768701562 | 132 |

IV. Investment Strategy Comparison: STRIKE vs SAND

Long-term vs Short-term Investment Strategies

- STRIKE: May appeal to investors focused on emerging AI-driven protocol infrastructure and early-stage technology adoption, particularly those with higher risk tolerance for newer market entrants

- SAND: May suit investors interested in established metaverse and gaming ecosystems, seeking exposure to virtual world development and digital asset integration

Risk Management and Asset Allocation

- Conservative Investors: STRIKE 20-30% vs SAND 70-80%

- Aggressive Investors: STRIKE 50-60% vs SAND 40-50%

- Hedging Tools: Stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- STRIKE: Higher volatility exposure due to recent launch in 2025, limited historical price data, and smaller trading volumes ($104,030.95 in 24-hour volume as of February 2, 2026)

- SAND: Historical drawdown from $8.40 peak to lower price levels demonstrates susceptibility to sector-specific sentiment shifts, particularly related to metaverse adoption cycles

Technical Risk

- STRIKE: Scalability considerations for multi-agent system infrastructure, network stability assessment pending longer operational history

- SAND: Platform technical requirements for virtual world hosting, potential integration challenges with evolving gaming technologies

Regulatory Risk

- Global regulatory frameworks continue to evolve differently across jurisdictions, with varying approaches to digital asset classification that may impact both tokens through compliance requirements, licensing considerations, and cross-border transaction policies

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- STRIKE Advantages: Positioned in the emerging AI agent infrastructure sector, launched during 2025 with focus on modular protocol architecture

- SAND Advantages: Established market presence since 2020, recognized positioning within metaverse and gaming sectors, higher trading volume ($1,127,125.94 vs $104,030.95)

✅ Investment Recommendations:

- Beginning Investors: Consider starting with SAND given its longer operational history and higher liquidity, while maintaining diversified exposure across multiple asset classes

- Experienced Investors: Evaluate portfolio allocation based on sector preferences between AI infrastructure (STRIKE) and metaverse applications (SAND), with risk assessment aligned to individual investment frameworks

- Institutional Investors: Conduct comprehensive due diligence on both assets' technical architecture, market positioning, and regulatory compliance status before portfolio integration

⚠️ Risk Disclosure: Cryptocurrency markets exhibit substantial volatility. This content does not constitute investment advice. Market conditions as of February 2, 2026 show a Fear & Greed Index of 14 (Extreme Fear), indicating heightened market uncertainty.

VII. FAQ

Q1: What is the main difference between STRIKE and SAND in terms of their core technology?

STRIKE is a Modular Agent Protocol (MAP) focused on AI-driven infrastructure that enables users to build and compose intelligent multi-agent systems for scalable collaboration, while SAND is a virtual game world platform designed for metaverse and gaming applications. STRIKE represents emerging AI protocol infrastructure launched in 2025, targeting developers and enterprises building autonomous agent networks. In contrast, SAND has been operational since 2020 as an established metaverse ecosystem, facilitating virtual world creation, digital asset ownership, and gaming experiences within its platform.

Q2: Which asset has demonstrated greater price stability historically?

SAND has shown relatively greater historical stability due to its longer operational history since 2020. SAND reached its all-time high of $8.40 on November 25, 2021, and has established a trading pattern over multiple market cycles. STRIKE, launched in October 2025, has a limited historical dataset with its all-time high of $0.03015 recorded on October 1, 2025, followed by a decline to $0.006487 by January 22, 2026. The shorter operational period means STRIKE lacks the extensive price history needed to assess long-term volatility patterns compared to SAND's multi-year trading record.

Q3: What are the liquidity differences between STRIKE and SAND?

SAND demonstrates significantly higher liquidity than STRIKE based on 24-hour trading volume data. As of February 2, 2026, SAND recorded $1,127,125.94 in 24-hour trading volume compared to STRIKE's $104,030.95, representing approximately 10.8 times greater trading activity. Higher liquidity typically translates to tighter bid-ask spreads, easier position entry and exit, and reduced price slippage for larger transactions. This liquidity advantage makes SAND more accessible for investors requiring faster trade execution or managing larger position sizes.

Q4: How do the price predictions for 2030 compare between STRIKE and SAND?

The baseline 2030 price forecasts show STRIKE ranging between $0.00583 - $0.01144, while SAND is projected between $0.1151 - $0.1827, indicating approximately 10-16 times higher absolute price levels for SAND. However, percentage growth projections from current levels (February 2, 2026) show STRIKE with potential 67% price appreciation and SAND with 87% appreciation by 2030 in baseline scenarios. The optimistic 2031 scenarios suggest STRIKE could reach $0.00806 - $0.01624 (93% growth) while SAND may achieve $0.1602 - $0.3272 (132% growth), reflecting higher growth expectations for the established metaverse asset.

Q5: What type of investor profile is better suited for STRIKE versus SAND?

STRIKE may appeal to investors with higher risk tolerance seeking exposure to emerging AI infrastructure protocols, comfortable with newer market entrants, and interested in early-stage technology adoption with limited historical performance data. SAND may suit investors preferring established ecosystems with longer operational histories, seeking exposure to metaverse and gaming sector development, and prioritizing higher liquidity for flexible position management. Conservative investors might consider a 70-80% SAND and 20-30% STRIKE allocation, while aggressive investors could evaluate a more balanced 40-50% SAND and 50-60% STRIKE distribution based on risk assessment frameworks.

Q6: What are the primary risk factors differentiating STRIKE and SAND investments?

STRIKE's primary risks stem from its recent launch timeline (October 2025), resulting in limited historical data for volatility assessment, lower trading volumes increasing execution risk, and uncertainty around the adoption trajectory of AI agent protocol infrastructure. SAND's key risks relate to its historical price volatility demonstrated by the drawdown from $8.40 peak to current levels, dependence on metaverse sector sentiment cycles, and technical requirements for maintaining a scalable virtual world platform. Both assets face evolving regulatory landscapes, though STRIKE's newer status may present additional compliance uncertainties as global frameworks continue developing standards for AI-focused digital assets.

Q7: How does the current market sentiment affect STRIKE vs SAND investment decisions?

As of February 2, 2026, the Fear & Greed Index registers 14 (Extreme Fear), indicating heightened market uncertainty affecting both assets. In such conditions, SAND's established market presence, higher liquidity ($1,127,125.94 24-hour volume), and longer operational history may provide relatively greater resilience during market stress periods. STRIKE's lower trading volume ($104,030.95) and shorter track record could experience amplified volatility during extreme fear phases, potentially creating both higher risk and opportunity depending on investor risk tolerance. Conservative strategies during extreme fear environments typically favor assets with stronger liquidity profiles and established market positioning like SAND.

Q8: What institutional considerations differentiate STRIKE and SAND investments?

Institutional investors evaluating STRIKE versus SAND face distinct due diligence requirements. For STRIKE, institutions must assess the emerging AI agent protocol sector's growth trajectory, evaluate the technical architecture of modular multi-agent systems, and consider the limited operational history since its 2025 launch when modeling risk parameters. SAND requires institutional analysis of metaverse sector adoption trends, virtual world platform scalability, and integration capabilities with evolving gaming technologies, while benefiting from a longer operational history since 2020 for historical performance modeling. Both assets require comprehensive regulatory compliance review, with SAND's established presence potentially offering more clarity on classification frameworks across jurisdictions, while STRIKE's AI-focused positioning may present evolving regulatory considerations as global standards develop for AI-driven digital assets.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

How Active Is KOGE Community and Ecosystem With 500+ Members on BNB Chain?

What is cryptocurrency fundamental analysis and how does it evaluate whitepaper, use cases, and team background in 2026?

How to Use On-Chain Data Analysis Tools to Track Active Addresses and Whale Movements

What is AIR: A Comprehensive Guide to Artificial Intelligence Revolution and Its Impact on Modern Society

What is SPEC: A Comprehensive Guide to Understanding the Standard Performance Evaluation Corporation