TEN vs ENJ: A Comprehensive Comparison of Two Leading Blockchain Gaming Tokens

Introduction: Investment Comparison Between TEN and ENJ

In the cryptocurrency market, the comparison between TEN vs ENJ has consistently been a topic investors cannot overlook. The two not only exhibit significant differences in market cap ranking, application scenarios, and price performance, but also represent distinct positioning within the crypto asset landscape.

TEN (TEN): Launched in 2024, it has garnered market recognition as a privacy Layer 2 solution for Ethereum, bringing smart transparency to smart contracts through Trusted Execution Environment (TEE) technology.

ENJ (ENJ): Since its launch in 2017, it has been positioned as a gaming and virtual goods ecosystem token, serving one of the largest online gaming community platforms with over 18.7 million registered players.

This article will comprehensively analyze the investment value comparison between TEN vs ENJ around historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future projections, attempting to address the most pressing question for investors:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

Historical Price Trends of TEN (Coin A) and ENJ (Coin B)

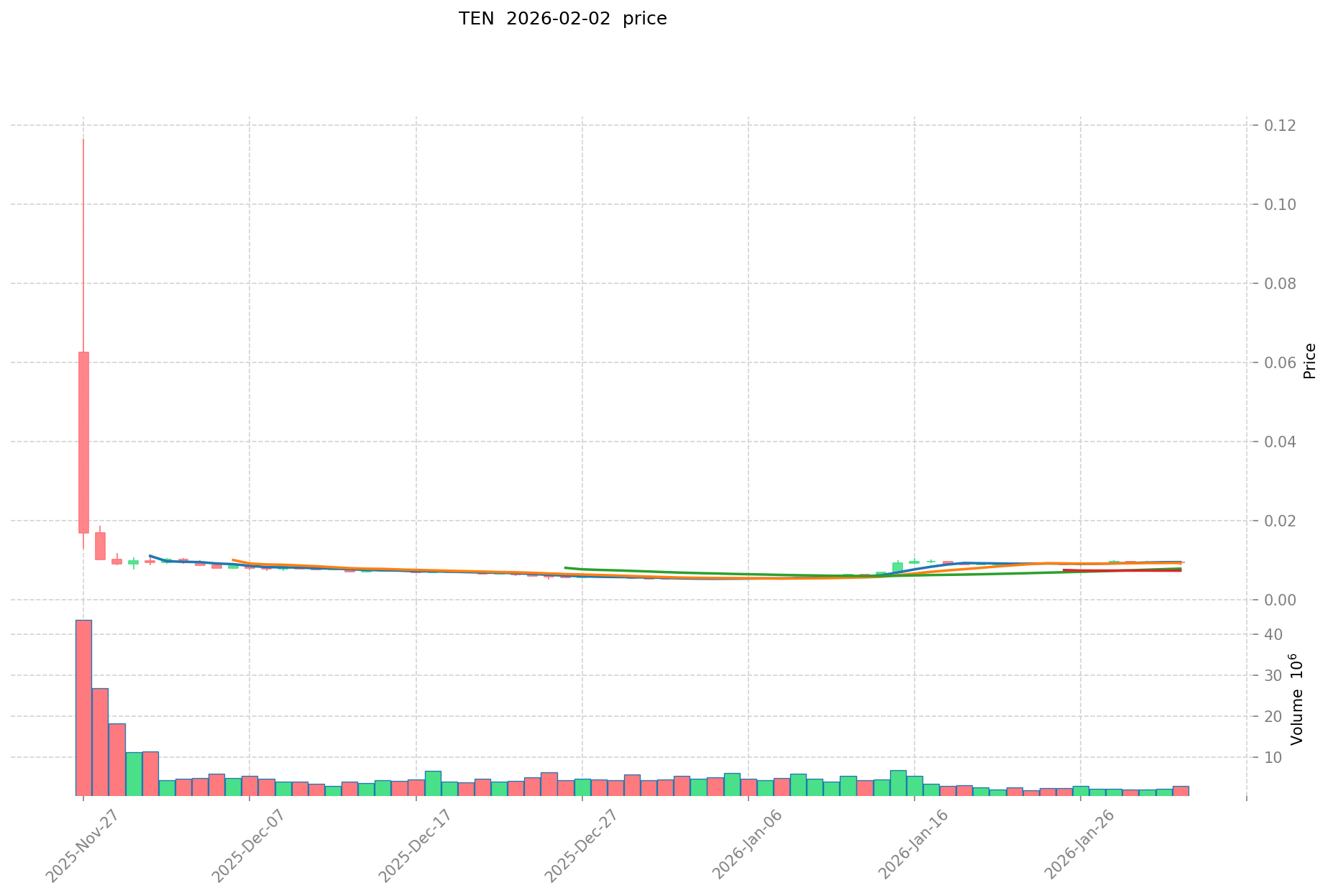

- 2025: TEN experienced significant price volatility following its launch in November 2025, reaching an all-time high of $0.11662 on November 27, 2025, before declining.

- 2021: ENJ achieved its peak price of $4.82 on November 25, 2021, during the broader crypto market rally, demonstrating strong market interest in NFT-related projects.

- Comparative Analysis: During the crypto market downturn, TEN declined from its peak of $0.11662 to a low of $0.005094 on December 25, 2025, representing a substantial correction. In contrast, ENJ has experienced a prolonged downtrend from its 2021 high of $4.82 to current levels near $0.02377, reflecting the extended bear market conditions affecting the NFT gaming sector.

Current Market Status (February 2, 2026)

- TEN Current Price: $0.00945

- ENJ Current Price: $0.02377

- 24-Hour Trading Volume: TEN recorded $24,958.98 compared to ENJ's $170,692.47, indicating significantly higher liquidity for ENJ

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

Check real-time prices:

- View TEN current price Market Price

- View ENJ current price Market Price

II. Core Factors Influencing TEN vs ENJ Investment Value

Supply Mechanism Comparison (Tokenomics)

-

ENJ: Fixed maximum supply capped at 1 billion tokens, creating potential scarcity dynamics as demand increases. The token economics incorporate a value-locking mechanism where ENJ is locked in smart contracts when developers mint NFTs, and released upon item sale, creating deflationary pressure through asset backing.

-

TEN: Reference materials do not provide sufficient information regarding TEN's supply mechanism or tokenomics structure.

-

📌 Historical Pattern: ENJ's supply scarcity model, combined with NFT minting demand, has historically supported price appreciation during periods of increased NFT market activity and ecosystem expansion.

Institutional Adoption and Market Application

-

Institutional Holdings: Reference materials indicate ENJ gained regulatory approval as Japan's first gaming token authorized for legal trading by the Japan Virtual Currency Exchange Association in January 2021, suggesting a degree of institutional acceptance in regulated markets.

-

Enterprise Adoption: ENJ demonstrates application in gaming ecosystems, NFT marketplaces, and digital asset management through the Enjin Wallet. The platform enables developers to integrate blockchain-based items across multiple gaming platforms without coding requirements. TEN's enterprise adoption patterns are not documented in available materials.

-

Policy Environment: ENJ has achieved compliance status in Japan's regulatory framework. Enjin's acceptance as a participant in the United Nations Global Compact demonstrates alignment with international sustainability standards. Comparative regulatory treatment of TEN is not available in reference materials.

Technology Development and Ecosystem Building

-

ENJ Technology Evolution: The platform operates on Ethereum as an ERC-20 compatible token, with JumpNet facilitating gas-free NFT and ENJ transactions. The ecosystem includes integrated products such as Enjin Beam, Marketplace, and Wallet for seamless user experience. The development roadmap includes commitment to net-zero emissions and carbon-neutral NFTs by 2030.

-

TEN Technology Development: Reference materials do not contain information regarding TEN's technical infrastructure or development trajectory.

-

Ecosystem Comparison: ENJ demonstrates established presence in NFT creation, gaming integration, digital asset trading, and cross-platform compatibility through its SDK (Software Development Kit). The platform supports use cases in gaming, art, music, and sports-based NFT projects. TEN's ecosystem development status is not documented in available materials.

Macroeconomic Factors and Market Cycles

-

Performance in Inflationary Environments: Reference materials suggest ENJ's value proposition relates to digital asset ownership and NFT market growth rather than traditional inflation-hedging characteristics. The token's supply cap may provide some scarcity-based value retention, though this differs from traditional inflation hedges.

-

Macroeconomic Monetary Policy: As an Ethereum-based token, ENJ's performance may be influenced by factors affecting the broader cryptocurrency market, including interest rate policies and dollar index movements. Specific comparative analysis with TEN is not available in reference materials.

-

Geopolitical Factors: ENJ's integration with international gaming platforms and cross-border digital asset trading may benefit from increased demand for decentralized virtual economies. The platform's regulatory compliance in Japan and participation in UN initiatives suggests positioning for international market access. Comparative geopolitical impacts on TEN are not documented in available materials.

III. 2026-2031 Price Prediction: TEN vs ENJ

Short-term Forecast (2026)

- TEN: Conservative $0.0070-$0.0095 | Optimistic $0.0095-$0.0133

- ENJ: Conservative $0.0138-$0.0237 | Optimistic $0.0237-$0.0275

Mid-term Forecast (2028-2029)

- TEN may enter a consolidation phase, with projected price range of $0.0084-$0.0154

- ENJ may enter a growth phase, with projected price range of $0.0159-$0.0428

- Key drivers: institutional capital inflows, ETF adoption, ecosystem development

Long-term Forecast (2030-2031)

- TEN: Baseline scenario $0.0137-$0.0169 | Optimistic scenario $0.0169-$0.0193

- ENJ: Baseline scenario $0.0215-$0.0423 | Optimistic scenario $0.0423-$0.0488

Disclaimer

TEN:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0132524 | 0.009466 | 0.00700484 | 0 |

| 2027 | 0.01476696 | 0.0113592 | 0.007497072 | 20 |

| 2028 | 0.0145000188 | 0.01306308 | 0.0094054176 | 38 |

| 2029 | 0.015435335328 | 0.0137815494 | 0.008406745134 | 45 |

| 2030 | 0.01928314392048 | 0.014608442364 | 0.0138780202458 | 54 |

| 2031 | 0.018979288319308 | 0.01694579314224 | 0.013726092445214 | 79 |

ENJ:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0275384 | 0.02374 | 0.0137692 | 0 |

| 2027 | 0.027177552 | 0.0256392 | 0.015127128 | 7 |

| 2028 | 0.03142596744 | 0.026408376 | 0.01531685808 | 11 |

| 2029 | 0.0427974141456 | 0.02891717172 | 0.015904444446 | 21 |

| 2030 | 0.048765918388608 | 0.0358572929328 | 0.02151437575968 | 50 |

| 2031 | 0.044850302000346 | 0.042311605660704 | 0.027925659736064 | 77 |

IV. Investment Strategy Comparison: TEN vs ENJ

Long-term vs Short-term Investment Strategies

-

TEN: May appeal to investors seeking exposure to emerging privacy-focused Layer 2 solutions with higher risk tolerance for early-stage projects. The token's recent launch in November 2025 and subsequent price volatility suggest suitability for tactical short-term trading strategies rather than long-term holding positions, given limited historical performance data.

-

ENJ: May suit investors interested in established NFT and gaming ecosystem exposure with regulatory compliance in select jurisdictions. The token's multi-year operational history, regulatory approval in Japan, and integration with gaming platforms suggest positioning for medium to long-term investment horizons aligned with NFT market adoption cycles.

Risk Management and Asset Allocation

-

Conservative Investors: Allocation consideration of TEN 20-30% vs ENJ 70-80% may reflect ENJ's longer operational track record, regulatory compliance status, and established ecosystem partnerships compared to TEN's early-stage development.

-

Aggressive Investors: Allocation consideration of TEN 50-60% vs ENJ 40-50% may reflect higher risk appetite for early-stage privacy technology projects with potential upside, balanced against ENJ's established market position in the NFT gaming sector.

-

Hedging Instruments: Portfolio risk management may incorporate stablecoin allocations (USDT, USDC) for liquidity preservation, options contracts for downside protection, and cross-asset diversification across different cryptocurrency sectors to mitigate concentration risk.

V. Potential Risk Comparison

Market Risks

-

TEN: The token exhibits high price volatility following its recent launch, with price declining substantially from $0.11662 (November 27, 2025) to $0.005094 (December 25, 2025). Limited trading volume of $24,958.98 compared to ENJ suggests lower liquidity and potential for significant price slippage during market stress periods.

-

ENJ: The token has experienced prolonged price decline from its 2021 peak of $4.82 to current levels near $0.02377, reflecting broader NFT market contraction. Price performance remains dependent on NFT adoption trends, gaming industry integration, and competitive dynamics within the blockchain gaming sector.

Technical Risks

-

TEN: Reference materials do not provide sufficient information regarding TEN's technical infrastructure, scalability solutions, or network stability metrics for comprehensive risk assessment.

-

ENJ: As an Ethereum-based ERC-20 token, ENJ inherits technical dependencies on Ethereum network performance, including gas fee fluctuations and network congestion. The JumpNet implementation for gas-free transactions introduces additional technical layers requiring ongoing maintenance. Smart contract vulnerabilities in NFT minting and value-locking mechanisms represent potential security considerations.

Regulatory Risks

- Regulatory treatment differs significantly between jurisdictions. ENJ has achieved compliance status in Japan through authorization by the Japan Virtual Currency Exchange Association, providing regulatory clarity in that market. TEN's regulatory status across different jurisdictions is not documented in available materials. Evolving global cryptocurrency regulations, including potential restrictions on privacy-focused technologies or NFT-related assets, may impact both tokens differently based on their technical characteristics and use cases.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

TEN Considerations: Early-stage privacy Layer 2 solution with Trusted Execution Environment technology launched in November 2025. Limited operational history and price volatility present higher risk profile. Trading volume of $24,958.98 indicates developing liquidity conditions.

-

ENJ Considerations: Established gaming and NFT ecosystem token operational since 2017 with regulatory approval in Japan. Integration with gaming platforms serving over 18.7 million registered players demonstrates existing user adoption. Fixed maximum supply of 1 billion tokens with deflationary mechanics through NFT value-locking. Trading volume of $170,692.47 indicates relatively stronger liquidity compared to TEN.

✅ Investment Considerations:

-

Emerging Market Participants: ENJ may present more suitable entry characteristics given longer operational track record, regulatory compliance in select jurisdictions, and established ecosystem partnerships. The token's integration with gaming platforms provides clearer use case visibility compared to early-stage projects.

-

Experienced Market Participants: Portfolio allocation between TEN and ENJ may reflect individual risk tolerance, investment time horizon, and sector exposure preferences. ENJ offers exposure to NFT gaming sector with established infrastructure, while TEN represents early-stage privacy technology with higher uncertainty and potential volatility.

-

Institutional Participants: ENJ's regulatory approval in Japan, participation in United Nations Global Compact, and commitment to carbon-neutral NFTs by 2030 may align with institutional ESG (Environmental, Social, Governance) considerations and compliance requirements. TEN's institutional adoption patterns are not documented in available materials.

⚠️ Risk Disclosure: The cryptocurrency market demonstrates extreme volatility. This analysis does not constitute investment advice, financial guidance, or recommendations to buy, sell, or hold any digital assets. Market participants should conduct independent research, assess personal risk tolerance, and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is the primary difference between TEN and ENJ in terms of use cases?

TEN is a privacy Layer 2 solution for Ethereum utilizing Trusted Execution Environment (TEE) technology to provide smart transparency to smart contracts, while ENJ is an established gaming and NFT ecosystem token serving over 18.7 million registered players across gaming platforms. TEN focuses on privacy infrastructure for decentralized applications launched in November 2025, whereas ENJ, operational since 2017, specializes in blockchain-based gaming items, NFT creation, and virtual asset management with regulatory approval in Japan as the country's first authorized gaming token.

Q2: How does the liquidity comparison between TEN and ENJ impact trading considerations?

ENJ demonstrates significantly higher liquidity with 24-hour trading volume of $170,692.47 compared to TEN's $24,958.98. This liquidity differential means ENJ offers lower potential price slippage during order execution, tighter bid-ask spreads, and easier position entry/exit for both retail and institutional participants. TEN's lower trading volume suggests developing market depth and higher potential for price volatility during periods of concentrated buying or selling pressure, which may require more sophisticated order execution strategies.

Q3: What regulatory advantages does ENJ possess compared to TEN?

ENJ holds regulatory approval as Japan's first gaming token authorized for legal trading by the Japan Virtual Currency Exchange Association since January 2021, providing clear compliance status in a major cryptocurrency market. Additionally, ENJ's participation in the United Nations Global Compact demonstrates alignment with international sustainability standards. TEN's regulatory status across different jurisdictions is not documented in available reference materials, creating uncertainty regarding compliance positioning in regulated markets and potential institutional adoption pathways.

Q4: How do the tokenomics differ between TEN and ENJ?

ENJ implements a fixed maximum supply capped at 1 billion tokens with a deflationary value-locking mechanism—when developers mint NFTs, ENJ tokens are locked in smart contracts and released upon item sale, creating scarcity dynamics through asset backing. This supply structure creates potential appreciation pressure as NFT minting demand increases. Reference materials do not provide sufficient information regarding TEN's supply mechanism, maximum token cap, emission schedule, or deflationary/inflationary characteristics, limiting comparative tokenomics analysis.

Q5: What are the key risk factors for investing in TEN versus ENJ?

TEN presents higher volatility risk evidenced by substantial price decline from $0.11662 (November 27, 2025) to $0.005094 (December 25, 2025), limited operational history since its November 2025 launch, and lower liquidity conditions. ENJ faces market cycle risks tied to NFT adoption trends and gaming industry integration, with price declining from $4.82 (November 2021) to current levels near $0.02377, reflecting prolonged bear market conditions in the NFT gaming sector. ENJ's technical dependencies on Ethereum network performance and smart contract security represent additional considerations.

Q6: Which token is more suitable for long-term holding strategies?

ENJ may present more suitable characteristics for long-term holding strategies given its multi-year operational history since 2017, regulatory compliance in Japan, established ecosystem with over 18.7 million registered players, and integration across gaming platforms through SDK tools. The token's fixed supply cap, deflationary mechanics through NFT minting, and commitment to carbon-neutral NFTs by 2030 provide clearer long-term value propositions. TEN's recent launch in November 2025 and limited operational track record suggest suitability for tactical short-term trading strategies rather than long-term investment positions.

Q7: How do institutional adoption patterns differ between TEN and ENJ?

ENJ demonstrates measurable institutional adoption through regulatory approval in Japan's cryptocurrency exchange framework, participation in the United Nations Global Compact for sustainability standards, and integration with established gaming platforms serving enterprise clients. The platform's compliance status and ESG commitment (carbon-neutral NFTs by 2030) align with institutional investment criteria and governance requirements. TEN's institutional adoption patterns, enterprise partnerships, and regulatory positioning are not documented in available reference materials, limiting assessment of institutional acceptance levels.

Q8: What price performance can investors expect from TEN versus ENJ through 2031?

Price projections for 2026 suggest TEN conservative range of $0.0070-$0.0095 (optimistic $0.0095-$0.0133) compared to ENJ conservative range of $0.0138-$0.0237 (optimistic $0.0237-$0.0275). Long-term forecasts for 2031 indicate TEN baseline scenario of $0.0137-$0.0169 (optimistic $0.0169-$0.0193) versus ENJ baseline scenario of $0.0215-$0.0423 (optimistic $0.0423-$0.0488). These projections suggest ENJ demonstrates higher absolute price levels across forecast horizons, though actual performance depends on ecosystem development, institutional adoption, macroeconomic conditions, and sector-specific catalysts for NFT gaming and privacy technology markets.

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

What are the new trends in the NFT market in 2025?

NFT Treasure Hunting: Top Strategies for Web3 Collectors in 2025

How to Create and Sell NFTs: A Step-by-Step Guide for Beginners

The technical principles and application scenarios of 2025 NFTs

How to Create an NFT in 2025: A Step-by-Step Guide

Top 7 GPUs Previously Used for Ethereum Mining in 2025

Top 7 Cloud Gaming Services

Top 7 Specialized Ethereum Mining Rigs for 2025

Participating in DAO Communities in the Web3 Era and Prominent DAOs

Top 10 Crypto Exchanges for Beginners: Best Choices