What Is Altcoin Season?

What Is Altcoin Season?

Derived from the term "alternative coin," an altcoin refers to any cryptocurrency other than Bitcoin. In simple terms, altcoin season represents a period when alternative cryptocurrencies experience significant price surges and outperform Bitcoin in terms of returns and market performance.

Markets with low capitalization have the potential to provide higher returns compared to their larger counterparts. It is considerably easier for an asset with a low market cap to increase significantly in value than for an asset with a higher market cap, as smaller movements in capital can create larger percentage gains. This mathematical reality makes altcoins particularly attractive during periods of market expansion.

Altcoin season is characterized by a flurry of trading activity as market participants seek to diversify their portfolios and capitalize on the potential gains these alternative digital assets offer. This phenomenon is closely intertwined with broader crypto market cycles, which exhibit alternating periods of bullish and bearish trends. Understanding these cycles is essential for traders looking to maximize their opportunities during altcoin season.

Crypto Market Cycles

To understand altcoin season, we must examine the crypto market cycles that govern the ebb and flow of digital asset prices. These cycles typically alternate between periods of bullish sentiment, known as bull markets, and bearish sentiment, referred to as bear markets. Each phase creates distinct conditions that influence how altcoins perform relative to Bitcoin.

Bull and Bear Markets

During a bull market, the overall cryptocurrency market experiences sustained upward price trends across most assets. This creates a favorable environment for altcoins to thrive as investors actively seek opportunities to maximize their returns by diversifying their holdings beyond Bitcoin. The increased risk appetite during bull markets often leads to capital flowing from established cryptocurrencies into smaller, more speculative altcoin projects.

Altcoin season often coincides with a surge in trading activity as market participants attempt to seize the momentum and ride the wave of the expanding market. Trading volumes increase dramatically, new projects gain attention, and previously overlooked altcoins can experience exponential growth in short periods.

Conversely, during bear markets, risk appetite decreases and capital typically flows back into Bitcoin or exits the market entirely. Understanding these cyclical patterns helps traders anticipate when altcoin season might emerge.

Bitcoin Dominance

Bitcoin dominance represents the share of Bitcoin's market capitalization in relation to the total market capitalization of all cryptocurrencies combined. This metric serves as a crucial indicator for identifying altcoin season. When Bitcoin dominance is high, it indicates that Bitcoin is the dominant force in the market, with capital concentrated in the leading cryptocurrency.

During altcoin season, the dominance of Bitcoin tends to decrease as capital flows into alternative digital assets, enabling them to outperform BTC and capture a larger share of the total cryptocurrency market. A declining Bitcoin dominance chart often signals the beginning of altcoin season, as traders rotate their capital from Bitcoin into altcoins seeking higher returns. Monitoring Bitcoin dominance provides valuable insight into market dynamics and helps traders time their entry into altcoin positions.

Factors Influencing Altcoin Season

Several interconnected factors contribute to the emergence and intensity of altcoin season. These factors can influence market sentiment, drive price movements, and shape the overall landscape for altcoin investments. Understanding these catalysts helps traders anticipate and prepare for altcoin season conditions.

Market Sentiment

Market sentiment, which reflects the collective psychology of traders and investors, plays a crucial role in triggering and sustaining altcoin seasons. Sentiment can shift rapidly based on news, technical developments, and broader economic conditions.

Traders looking for quick profits may sell their BTC holdings and switch to alternative cryptocurrencies if interest in Bitcoin declines or stagnates. Additionally, the high price of Bitcoin may discourage potential cryptocurrency buyers, leading them to choose alternative coins with lower entry prices instead. This psychological barrier creates opportunities for altcoins to attract new capital.

Meme coins tend to experience simultaneous price increases or "pumps" during periods of heightened market enthusiasm. Cryptocurrencies like Dogecoin or Shiba Inu often gain popularity and attention primarily through social media platforms, online communities, and word-of-mouth marketing. When a particular meme coin starts gaining traction and generates hype, it can create positive sentiment and excitement among investors. This collective enthusiasm can lead to coordinated buying activity and simultaneously drive up the prices of multiple meme coins.

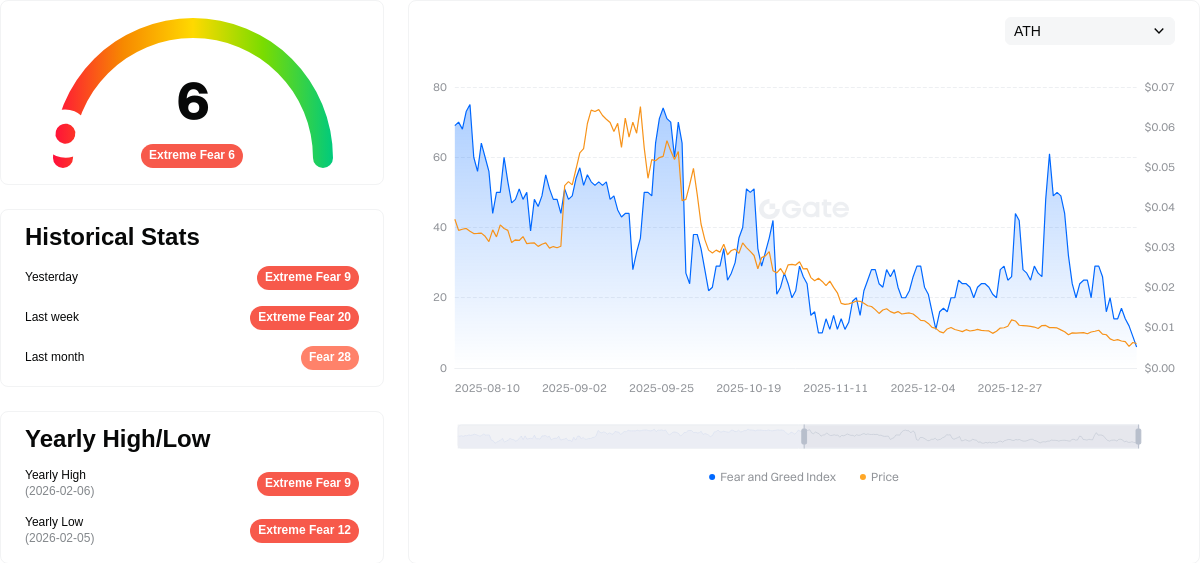

The Crypto Fear and Greed Index serves as an excellent tool to monitor market sentiment in real-time. The index takes into account various factors and data points, such as price volatility, trading volume, social media activity, surveys, and market momentum, to determine the prevailing sentiment in the market. Extreme greed readings often coincide with altcoin season conditions.

News and Events

News and events within the crypto space can significantly impact the timing and intensity of altcoin season. Major announcements, strategic partnerships, regulatory developments, or technological breakthroughs can create a surge of interest and investment in specific altcoins, driving prices higher and potentially triggering broader altcoin season conditions.

The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has attracted significant attention and investment in specific altcoins associated with these sectors. Positive developments, such as successful DeFi projects achieving high total value locked (TVL) or popular NFT sales breaking records, can drive up demand for relevant altcoins. These sector-specific catalysts often create mini altcoin seasons within particular niches before spreading to the broader market.

Regulatory clarity or favorable regulatory decisions can also trigger altcoin rallies, as they reduce uncertainty and encourage institutional participation in the market.

Technological Developments

Technological advancements in the altcoin sector serve as powerful catalysts for altcoin seasons. New projects with innovative features, blockchain upgrades that improve scalability or security, or novel use cases introduced by altcoins can attract significant attention and investment. These developments may position certain altcoins as potential game-changers, igniting rallies in their prices and drawing capital away from Bitcoin.

A rollup, in the context of blockchain technology, is a layer-2 scaling solution that aims to improve the scalability and efficiency of a blockchain network by processing transactions off the main chain while maintaining security guarantees. Users tend to favor rollups that create blockchain-native tokens, as these tokens often provide governance rights and value capture mechanisms. Optimism and Arbitrum are perhaps the most prominent and highly anticipated rollups that have released tokens, creating significant trading opportunities during their launches.

Other technological developments such as successful mainnet launches, protocol upgrades, or integration with major platforms can serve as catalysts for individual altcoin rallies that contribute to broader altcoin season dynamics.

How to Identify Altcoin Season

Identifying altcoin season early is crucial for traders looking to capitalize on the market's potential. Several indicators and metrics can help in recognizing this phenomenon before it reaches peak intensity, allowing for strategic positioning.

The Altcoin Season Index provides a quantitative measure of altcoin performance relative to Bitcoin. This index is defined as the percentage of the top 50 altcoins that have a 90-day return on investment greater than Bitcoin. The calculation involves dividing the number of outperforming altcoins by the total number of altcoins tracked (50 in this case) and multiplying the result by 100.

When the Altcoin Season Index exceeds 75%, it indicates that at least 75% of the top altcoins are outperforming Bitcoin, signaling a strong altcoin season. Conversely, when the index falls below 25%, it suggests Bitcoin is dominating the market. Several market analysis platforms provide altcoin season indices that track the performance of a basket of altcoins relative to Bitcoin. These indexes give traders a comprehensive overview of market dynamics and indicate when altcoin season is in full swing.

Market Capitalization Analysis

Monitoring the market capitalization of altcoins can also provide valuable insights into the emergence of altcoin season. During this period, the total market cap of altcoins increases significantly relative to Bitcoin's market cap, indicating a shift in investor sentiment and increased demand for alternative cryptocurrencies.

Watching the performance of top altcoins, such as ETH, SOL, DOGE, and others, can indicate a shift in interest from BTC. When multiple large-cap altcoins begin outperforming Bitcoin simultaneously, it often signals the beginning of a broader altcoin season. Traders can track these metrics through various cryptocurrency data platforms that provide real-time market capitalization data and historical comparisons.

How to Prepare for Altcoin Season

Create a Plan

Creating a comprehensive plan is the most important consideration when preparing for altcoin season. Without a clear strategy, traders risk making emotional decisions during periods of high volatility and potentially missing opportunities or incurring significant losses.

One effective strategy is to buy in early, before the season reaches full intensity. Before the season sets in, you should already have purchased your "shopping list" of target altcoins while the market is in a downturn or consolidation phase. By the time the mania ensues, these assets will be difficult to purchase at reasonable prices or may have already experienced significant appreciation. Being prepared with pre-identified positions is key to maximizing returns during altcoin season.

Your plan should include specific entry and exit criteria, position sizing rules, and risk management parameters to guide your trading decisions.

Conduct Thorough Research

Remember that research and education are your most valuable allies in navigating altcoin season successfully. Not all sectors in crypto behave the same way or perform as well as they did in previous cycles. Trends have a strong influence on cryptocurrency markets, and what worked in past altcoin seasons may not work in future ones.

The best altcoins to hold in your portfolio are solid projects with strong fundamentals that align with current market trends. This includes evaluating factors such as the project's technology, team, community support, tokenomics, and real-world use cases. Understanding the narrative driving each sector helps identify which altcoins are likely to benefit most during altcoin season.

Staying informed about technological developments, regulatory changes, and market sentiment through reputable sources helps traders make informed decisions about which altcoins to include in their portfolios.

Diversify Your Portfolio

Diversifying your portfolio is a strategy that allows you to hedge against unforeseen circumstances and reduce concentration risk. There are many theories on how you should allocate your portfolio, but it primarily depends on your personal risk tolerance, investment timeline, and financial goals.

The general idea is to maintain some hard assets that can withstand a market downturn while also holding more speculative positions that can capture upside during altcoin season. The following list gives a brief overview of asset classes in order of importance:

-

Store of Value: Hard assets like gold and silver tend to hold their value during market downturns. In crypto, Bitcoin and Ethereum are considered digital gold and silver respectively, providing stability during volatile periods.

-

Yield-Bearing Assets: Assets that produce a steady stream of income typically come in two flavors: low-yield low-risk options such as stablecoin lending, and high-yield high-risk options such as liquidity provision in decentralized exchanges. These assets provide passive income while maintaining exposure to the crypto market.

-

Cash and Stablecoins: While stores of value are considered a hedge against inflation, cash or cash equivalents are considered a hedge against volatility. Maintaining a portion of your portfolio in stablecoins allows you to quickly capitalize on opportunities during altcoin season without needing to transfer funds from traditional banking systems.

-

Altcoins: This category consists of gems and unicorn projects that could potentially increase in value by orders of magnitude during altcoin season. They may also include riskier and more speculative assets with higher potential returns but also higher risk of loss.

Exercise Patience

Markets can start slowly and often test investors' patience before altcoin season reaches full intensity. Maintaining discipline in your investment strategy and not being swayed by short-term market fluctuations is important for long-term success.

As the saying goes, "You make money when you buy and you lose money when you sell." It is extremely difficult to time the market perfectly. Traders rarely buy in at the absolute lowest price and sell at the highest price. Instead, focus on buying quality altcoins at reasonable valuations and selling when your predetermined targets are reached.

Avoiding the temptation to chase pumps or panic sell during temporary dips helps preserve capital and maximize returns over the course of altcoin season.

Trading Strategies During Altcoin Season

Navigating altcoin season requires specific trading strategies to mitigate risks and maximize potential gains. The high volatility and rapid price movements characteristic of this period demand disciplined approaches and clear risk management.

Altcoin seasons present opportunities for traders to diversify their portfolios beyond Bitcoin. By investing in a range of promising altcoins across different sectors, traders can potentially benefit from the performance of multiple assets and reduce their exposure to the volatility of a single cryptocurrency. This diversification approach helps spread risk while maintaining exposure to the upside potential of altcoin season.

Technical analysis tools, such as chart patterns, indicators, and volume analysis, can assist traders in identifying potential entry and exit points during altcoin season. By studying price charts and identifying key support and resistance levels, traders can make more informed trading decisions. Common technical indicators used during altcoin season include moving averages, relative strength index (RSI), and volume profiles.

Whale watching is an excellent way to predict market volatility and potential price movements. It refers to the practice of monitoring the activities of individuals or institutional investors that hold significant amounts of capital in specific cryptocurrencies. By analyzing the transactions and movements of these whales through blockchain explorers and whale alert services, traders and investors attempt to identify potential market trends, anticipate price movements, and make informed trading decisions. Large whale accumulation often precedes significant price increases, while whale distribution may signal upcoming corrections.

Risks and Opportunities in Altcoin Season

While altcoin season can present lucrative opportunities for substantial returns, it also carries inherent risks that traders should be aware of and actively manage. Understanding both sides of this equation is essential for successful navigation of altcoin season.

Altcoin seasons are often characterized by heightened market volatility, with prices capable of moving 50% or more in a single day. Rapid price movements can result in significant gains but can also lead to substantial losses if positions are not properly managed. Traders should exercise caution, set stop-loss orders at appropriate levels, and manage risk effectively to protect their capital. The emotional intensity of altcoin season can lead to poor decision-making if traders don't maintain discipline.

Some altcoins, especially those with smaller market caps, may suffer from low liquidity during altcoin season despite increased trading activity. This can make entering and exiting positions at desired prices challenging, potentially resulting in slippage or increased trading costs. Low liquidity can also make altcoins more susceptible to price manipulation and sudden crashes when large holders decide to sell.

Additionally, the proliferation of new projects during altcoin season increases the risk of scams, rug pulls, and failed projects. Conducting thorough due diligence before investing in any altcoin is essential to avoid falling victim to fraudulent schemes.

Ride the Altcoin Season Wave

Altcoin season represents a period of heightened activity and potential opportunities within the crypto market. Traders and investors can diversify their portfolios, capitalize on price movements, and potentially outperform Bitcoin during this phase. Understanding the dynamics of altcoin season, monitoring market sentiment through various indicators, and employing appropriate trading strategies can help market participants navigate this exciting and dynamic period in the world of cryptocurrencies.

As the cryptocurrency market continues to evolve and mature, altcoin season is likely to remain a focal point for traders seeking to maximize their returns and explore the diverse offerings of the cryptocurrency ecosystem. By staying informed, maintaining discipline, and managing risk effectively, traders can position themselves to benefit from the opportunities that altcoin season presents while protecting their capital from the inherent risks of this volatile market phase.

FAQ

What is Altcoin Season and its relationship with Bitcoin bull market?

Altcoin Season refers to a market period when altcoins significantly outperform Bitcoin, typically occurring in the latter half of a bull market. Capital flows from Bitcoin to alternative cryptocurrencies, driving their valuations higher during this phase.

How to identify when Altcoin Season starts? What are the key indicators to reference?

Monitor the Altcoin Season Index and Bitcoin dominance decline. Key indicators include rising altcoin market cap relative to Bitcoin, TOTAL3 trend on TradingView, and 75% of top 50 altcoins outperforming Bitcoin over 90 days. When these metrics align strongly, altcoin season begins.

What are the risks of investing in altcoins during Altcoin Season? How should you select investment targets?

Altcoin investments carry high volatility and manipulation risks. Select projects with real utility, strong fundamentals, and active development teams. Avoid speculative or unproven projects to maximize returns during this season.

Altcoin Season通常持续多长时间?历史上发生过几次?

Altcoin Season typically lasts 6 to 14 weeks, with strongest gains in the first 3 to 5 weeks. Historically, it has occurred multiple times, with the 2021 season lasting approximately 12 weeks, during which over 75% of altcoins experienced significant appreciation.

Does Bitcoin Dominance decline mean Altcoin Season is coming?

Bitcoin dominance falling below 60% historically often signals potential Altcoin season. Current dominance at 57% may indicate an upcoming Altcoin season, though this is not a guaranteed indicator.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Crypto Demo Accounts for 2025: Leading Platforms for Free Trading

APR vs. APY in Crypto: What Are the Major Differences?

Comprehensive Guide to IOU Tokens in Cryptocurrency

Which Are the Best Altcoins To Invest In

Cryptocurrency theft surpassed $2 billion in 2025—it's time to reconsider how we store digital assets