What is KYO: A Comprehensive Guide to Understanding the Kyoto Protocol and Its Global Impact on Climate Change

Kyo Finance's Positioning and Significance

In 2024, the Kyo Finance team launched Kyo Finance (KYO), aiming to address fragmented liquidity across multiple blockchain ecosystems and inefficient cross-chain trading experiences. As a comprehensive liquidity technology platform with cross-chain solver technology, Kyo Finance plays a key role in decentralized finance (DeFi) and cross-chain interoperability.

As of 2026, Kyo Finance has established itself as an emerging player in the multi-chain liquidity space, backed by notable investors including Startale, Soneium Spark Fund, TBV, BuzzBridge Capital, and Castrum Capital, with approximately 1,962 token holders and a presence across multiple blockchain networks. This article will provide an in-depth analysis of its technical architecture, market performance, and future potential.

Origin and Development History

Background

Kyo Finance was created by its development team in 2024, aiming to solve the challenges of liquidity fragmentation and inefficient cross-chain asset transfers in the multi-chain blockchain environment. It emerged during the rapid expansion of Layer 2 solutions and the growing demand for seamless cross-chain experiences, with the goal of providing advanced decentralized exchange (DEX) experiences through white-label solutions and connecting various chains via cross-chain solver technology. Kyo Finance's launch brought new possibilities for DeFi users and protocols seeking efficient multi-chain liquidity solutions.

Key Milestones

- 2024: Platform development and initial community building phase.

- December 2025: Token listing on Gate.com and other exchanges, with trading pairs launching on December 10, 2025.

- Early 2026: Continued ecosystem development with growing holder base surpassing 1,900 participants.

With support from prominent venture capital firms and blockchain infrastructure providers, Kyo Finance continues to enhance its technology, security features, and real-world applications in the DeFi space.

How Kyo Finance Works

Decentralized Architecture

Kyo Finance operates on a decentralized network infrastructure across multiple blockchain ecosystems, eliminating reliance on centralized intermediaries. The platform's cross-chain solver technology enables nodes and liquidity providers to collaborate in facilitating efficient asset transfers, ensuring transparency and resilience while granting users greater control over their transactions.

Blockchain Foundation

Kyo Finance leverages blockchain technology as its foundation, with the KYO token deployed on Ethereum as an ERC-20 token. Transactions and liquidity operations are recorded on public, immutable ledgers across connected chains. The platform's cross-chain aggregation technology allows it to connect various blockchain networks, enabling seamless liquidity flow without requiring users to trust centralized entities. This architecture enhances interoperability while maintaining the security guarantees of underlying blockchains.

Security Mechanisms

Kyo Finance implements standard cryptographic security practices to protect user transactions:

- Private keys (secured by users) authorize transactions and asset movements

- Public addresses (visible on-chain) verify ownership and transaction validity

This cryptographic framework ensures that funds remain secure, with transactions maintaining pseudonymous privacy characteristics typical of blockchain systems. The platform's white-label DEX solutions incorporate additional security layers designed to protect liquidity providers and traders across multiple chain environments.

KYO's Market Performance

Circulation Overview

As of 04 February 2026, KYO's circulating supply stands at 36,700,000 tokens, with a total supply of 200,000,000 tokens and a maximum supply cap of 200,000,000 tokens, indicating a fixed supply model.

The current circulation ratio is approximately 18.35%, suggesting a significant portion of tokens remains to be released into circulation, which may influence supply-demand dynamics over time.

Price Fluctuations

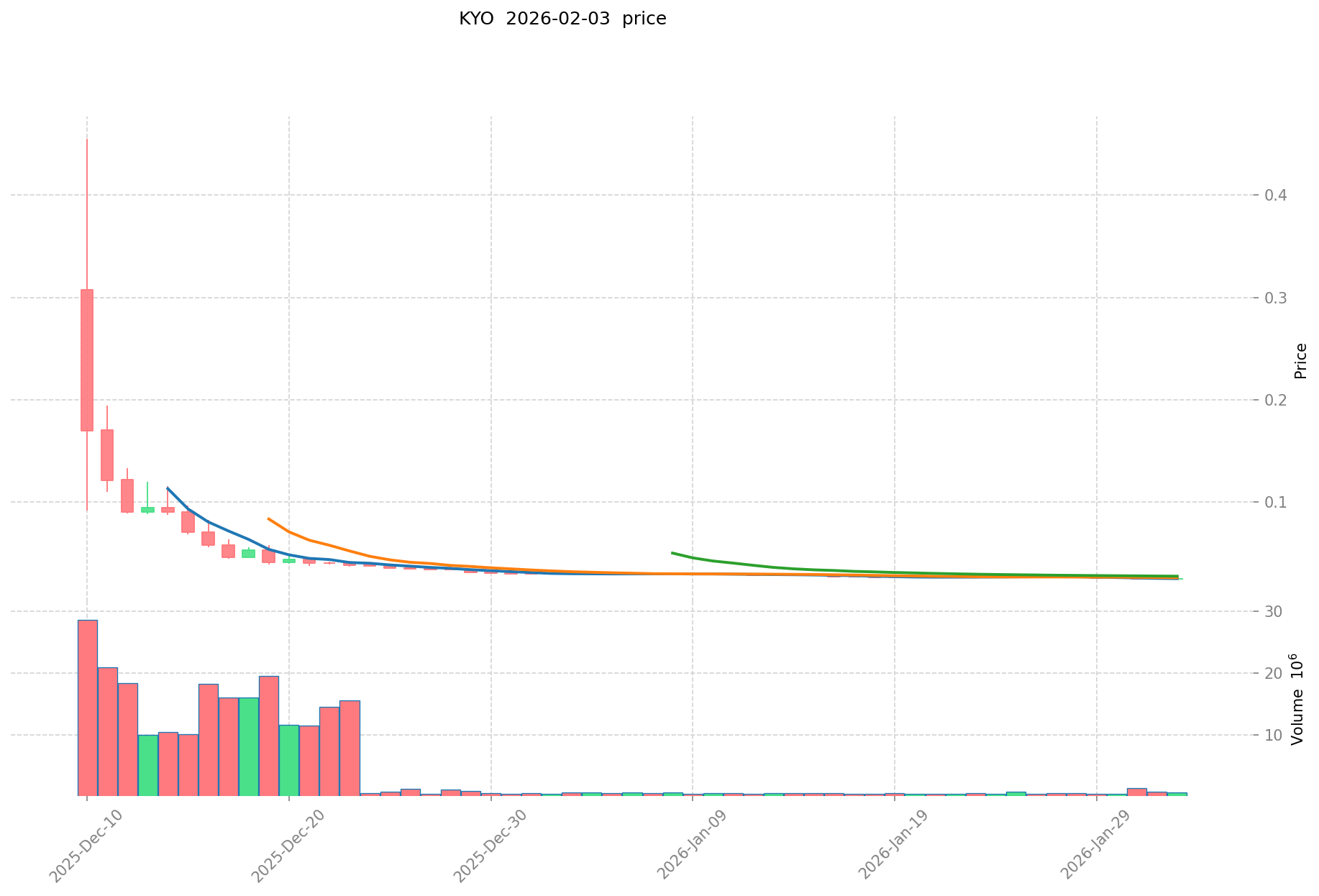

KYO reached its all-time high of $0.4552 on 10 December 2025, reflecting strong market interest during its early trading period.

The token experienced its all-time low of $0.0242 on 01 February 2026, representing significant price volatility within a relatively short timeframe.

As of the latest update, KYO is trading at $0.02531, showing a 1.11% increase over the past 24 hours. However, the token has experienced a -7.53% decline over the past 7 days and a -16.34% decrease over the past 30 days, indicating recent downward price pressure.

Click to view the current KYO market price

On-Chain Metrics

- Market Capitalization: Approximately $928,877, positioning KYO at rank 2559 among cryptocurrencies

- 24-Hour Trading Volume: $19,067.03, reflecting current market liquidity

- Holder Count: 1,962 addresses, indicating the current level of token distribution and community participation

- Market Share: 0.00018% of the total cryptocurrency market

Kyo Finance Ecosystem Applications and Partners

Core Use Cases

Kyo Finance's ecosystem supports multiple applications:

- DeFi: The platform provides decentralized exchange services through its comprehensive liquidity technology platform, enabling efficient cross-chain trading experiences.

- Cross-Chain Solutions: Kyo Finance leverages cross-chain solver technology to connect various blockchain ecosystems, facilitating seamless liquidity aggregation across multiple chains.

Strategic Partnerships

Kyo Finance has established collaborations with Startale, Soneium Spark Fund, TBV, BuzzBridge Capital, and Castrum Capital, enhancing its technical capabilities and market influence. These partnerships provide a solid foundation for Kyo Finance's ecosystem expansion.

Challenges and Controversies

Kyo Finance faces the following challenges:

- Market Volatility: The token has experienced price fluctuations, with a 7-day decline of approximately 7.53% and a 30-day decrease of around 16.34%

- Competition Pressure: The platform operates in a competitive DEX landscape with numerous established protocols

- Adoption Scale: With a current holder count of 1,962, the platform continues to work towards broader user adoption

These issues have sparked discussions within the community and market, while also driving Kyo Finance's continuous innovation.

Kyo Finance Community and Social Media Atmosphere

Community Activity

Kyo Finance's community shows engagement with 1,962 token holders as of February 2026.

On X platform, related posts and hashtags (such as #KYO) generate discussions within the crypto community.

Platform launches and partnership announcements have contributed to community engagement.

Social Media Sentiment

Sentiment on X presents varied perspectives:

- Supporters praise Kyo Finance's cross-chain technology and white-label DEX solutions, viewing it as an innovative approach to multi-chain liquidity.

- Critics focus on price volatility and market cap considerations.

Recent trends reflect mixed sentiment amid broader market conditions.

Trending Topics

X users discuss Kyo Finance's cross-chain technology implementation, liquidity aggregation capabilities, and white-label solutions, showcasing both its transformative potential and the challenges in achieving mainstream adoption.

More Information Sources for Kyo Finance

- Official Website: Visit Kyo Finance Official Website for features, use cases, and latest updates.

- Documentation: Kyo Finance Documentation details its technical architecture, objectives, and vision.

- X Updates: On X platform, Kyo Finance actively maintains @kyofinance, with posts covering technical developments, community activities, and partnership news.

Kyo Finance Future Roadmap

- Ongoing Development: Continuing enhancement of cross-chain solver technology, improving liquidity aggregation and DEX performance

- Ecosystem Goals: Expanding white-label solutions and supporting broader multi-chain integration

- Long-term Vision: Becoming a leading cross-chain liquidity infrastructure provider

How to Participate in Kyo Finance?

- Purchase Channels: Buy KYO on Gate.com and other supporting exchanges

- Storage Solutions: Use compatible Ethereum wallets such as MetaMask to securely store KYO tokens

- Explore the Platform: Visit the official website to learn about cross-chain trading and white-label DEX solutions

- Join the Community: Participate in discussions through Discord at the official server

Summary

Kyo Finance redefines cross-chain liquidity through blockchain technology, offering decentralized exchange capabilities, cross-chain connectivity, and white-label solutions. Its investor backing from notable funds, technical innovation, and market presence position it within the crypto landscape. Despite facing market volatility and competitive pressures, Kyo Finance's technological approach and clear development direction give it potential in the future of decentralized finance. Whether you are a newcomer or an experienced participant, Kyo Finance presents opportunities worth exploring.

FAQ

What is Crypto KYO (Know Your Owner)? What role does it play in cryptocurrency?

Crypto KYO (Know Your Owner) is an identity verification measure used by crypto platforms to confirm user authenticity, prevent money laundering, and combat illegal activities. It ensures transaction compliance and enhances security within the cryptocurrency ecosystem.

What is the difference between KYO and KYC? Why do crypto projects need to implement KYO policies?

KYO (Know Your Origin) traces fund sources to prevent illicit activities, while KYC (Know Your Customer) verifies customer identities. Crypto projects implement KYO to track transaction origins, comply with regulations, and enhance security by monitoring fund flows throughout the blockchain ecosystem.

How to perform KYO verification in cryptocurrency trading? What information needs to be provided?

KYO verification typically requires identity documents (passport, ID card), facial recognition, proof of address (utility bills), and bank account information. Some platforms may request additional income or employment verification depending on their requirements.

What is the impact of KYC on cryptocurrency user privacy and security?

KYC reduces fraud risks and protects users from malicious activities by verifying identities. However, it requires sharing personal information, which may impact privacy. This verification helps secure transactions while potentially limiting anonymity for some users.

Which mainstream crypto exchanges or projects have implemented KYO requirements?

Major exchanges and blockchain projects have progressively adopted KYO(Know Your Offering)standards as regulatory frameworks evolve. KYO requirements are increasingly implemented across platforms to ensure transparency and compliance with securities regulations in crypto offerings.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is MOBI: A Comprehensive Guide to Amazon's E-Book File Format and Its Uses

What is ALMANAK: A Comprehensive Guide to Digital Calendar and Event Management Systems

Proof of Work vs Proof of Stake: Which Is Superior?

What is RWAINC: A Comprehensive Guide to Real-World AI and Networking Capabilities

The Most Promising Cryptocurrencies: Where to Invest