What is STB: A Comprehensive Guide to Set-Top Box Technology and Its Role in Modern Entertainment

Stabble's Positioning and Significance

In 2025, the Stabble team launched Stabble (STB), aiming to address inefficiencies in stablecoin trading and liquidity fragmentation on decentralized exchanges.

As Solana's new frictionless DEX processing over 50% of stablecoin volume with up to 97% less liquidity than competitors, Stabble plays a critical role in the DeFi and decentralized trading sector.

As of 2026, Stabble has positioned itself as an innovative liquidity solution within the Solana ecosystem, attracting 3,829 holders and an active community of liquidity providers and traders.

This article will provide an in-depth analysis of its technical architecture, market performance, and future potential.

Origin and Development History

Birth Background

Stabble was created by its development team in 2025, aiming to solve liquidity inefficiency and capital underutilization in stablecoin trading on decentralized exchanges.

It emerged during the explosive growth of Solana's DeFi ecosystem, with the goal of providing liquidity providers with expanded yield farming opportunities and hedging tools while optimizing stablecoin trading efficiency.

Stabble's launch brought new possibilities to DeFi participants and liquidity providers seeking better capital efficiency.

Key Milestones

- 2025: Mainnet launch, achieving processing of over 50% of Solana's stablecoin trading volume with significantly reduced liquidity requirements.

- January 2025: Official trading began on Gate.com, expanding market accessibility.

- 2025-2026: Ecosystem growth with holder count reaching 3,829 and continued development of innovative features for LPs.

With support from the Solana ecosystem and its community, Stabble continues to optimize its technology, security, and real-world applications.

How Stabble Works

Decentralized Control

Stabble operates on the Solana blockchain, a distributed network of global nodes, eliminating reliance on centralized intermediaries.

These nodes collaboratively validate transactions, ensuring system transparency and attack resistance, granting users greater autonomy and enhancing network resilience.

Blockchain Foundation

Stabble's blockchain operates on Solana, a public and immutable digital ledger recording every transaction.

Transactions are grouped into blocks and linked through cryptographic hashing to form a secure chain.

Anyone can view records, establishing trust without intermediaries.

Solana's high-performance architecture enables rapid transaction processing and low costs, supporting Stabble's efficient DEX operations.

Consensus Mechanism

Stabble leverages Solana's Proof-of-History (PoH) combined with Proof-of-Stake (PoS) to validate transactions and prevent fraudulent activities such as double-spending.

Validators maintain network security by running nodes and staking SOL tokens, earning rewards for their participation.

This innovative approach delivers high throughput and energy efficiency, enabling Stabble to process stablecoin trades with minimal latency.

Secure Transactions

Stabble uses public-private key cryptography to protect transactions:

- Private keys (similar to secret passwords) are used to sign transactions

- Public keys (similar to account numbers) are used to verify ownership

This mechanism ensures fund security while transactions maintain pseudonymous properties.

The platform's smart contract architecture provides additional security layers for liquidity pools and trading operations.

Stabble (STB) Market Performance

Circulation Overview

As of February 7, 2026, Stabble (STB) has a circulating supply of 206,385,897.67 tokens, with a total supply of 500,000,000 tokens. The maximum supply is capped at 500,000,000 tokens, representing a fixed supply model. Currently, the circulating supply accounts for approximately 7.43% of the total token supply, indicating that a significant portion of tokens remains locked or yet to be released into the market.

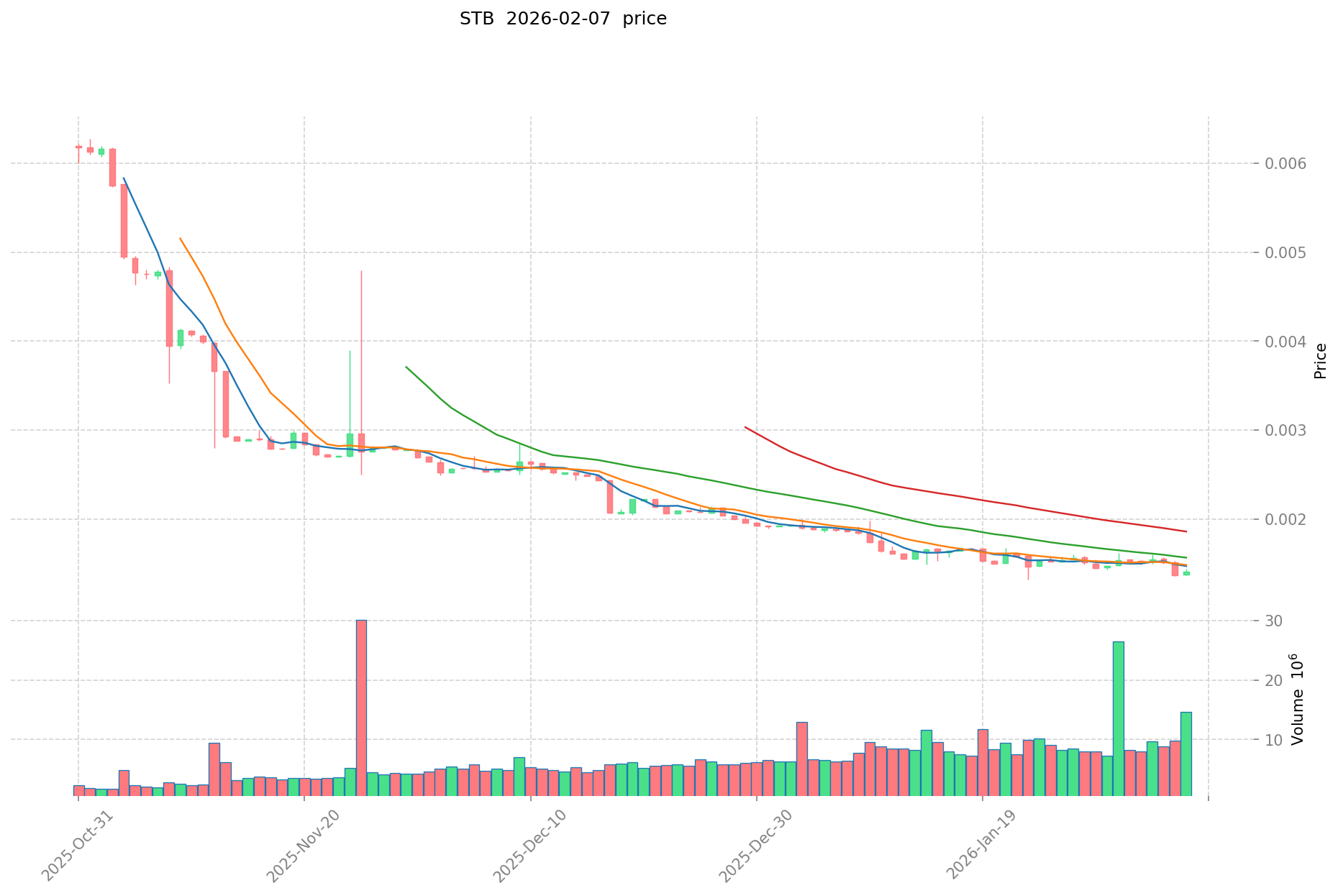

Price Fluctuations

Stabble (STB) reached its historical high price of $0.08 on May 22, 2025, driven by early market enthusiasm and initial trading activity following its launch. The token experienced its lowest price of $0.001317 on January 23, 2026, reflecting broader market corrections and reduced trading momentum. As of the current date, STB is trading at $0.001397, showing a decline of 2.18% over the past 24 hours, 14.23% over the past 7 days, and 24.3% over the past 30 days. These fluctuations demonstrate the volatile nature of the token's early-stage market behavior and sensitivity to market sentiment.

Click to view the current STB market price

On-Chain Metrics

- 24-Hour Trading Volume: $21,419.06 (indicating current market activity levels)

- Number of Holders: 3,829 addresses (reflecting user participation and token distribution)

- Market Capitalization: $288,321.10 (representing the current valuation of circulating tokens)

Stabble Ecosystem Applications and Partners

Core Use Cases

Stabble's ecosystem supports the following applications:

- DeFi: As a frictionless DEX on Solana, Stabble provides decentralized stablecoin trading, processing over 50% of stablecoin volume with significantly reduced liquidity requirements compared to competitors.

- Yield Farming: Stabble introduces innovative features that offer liquidity providers expanded yield farming opportunities and hedging tools, enhancing returns while managing risk.

Strategic Partnerships

The provided materials do not specify strategic partnerships for Stabble. The project focuses on delivering efficient stablecoin exchange infrastructure within the Solana ecosystem.

Challenges and Controversies

Stabble faces the following challenges:

- Market Competition: Operating in a highly competitive DEX landscape where established protocols dominate market share and user trust.

- Price Volatility: The STB token has experienced notable price fluctuations, with a 30-day decline of 24.3% and trading well below its historical range.

- Liquidity Concerns: Despite claiming efficiency advantages, the project's relatively low market cap and limited exchange availability may impact user adoption.

These issues have sparked discussions within the community regarding the project's long-term sustainability and competitive positioning.

Stabble Community and Social Media Sentiment

Community Engagement

Stabble's community shows early-stage growth, with 3,829 holders as of the latest data. The project operates primarily on Solana, with its native token STB deployed at contract address STBuyENwJ1GP4yNZCjwavn92wYLEY3t5S1kVS5kwyS1. Community activity centers around the platform's innovative approach to stablecoin trading efficiency.

Social Media Sentiment

Sentiment on X platform presents mixed perspectives:

- Supporters highlight Stabble's technical efficiency and innovative LP incentive mechanisms, viewing it as a promising solution for stablecoin liquidity optimization.

- Critics express concerns about token price performance, limited exchange listings, and the project's relatively small market presence compared to established DEX protocols.

Recent trends indicate cautious interest as the project navigates its early development phase.

Popular Topics

X users discuss Stabble's liquidity efficiency claims, yield farming mechanisms, and competitive positioning within the Solana DeFi ecosystem, reflecting both enthusiasm for its technical approach and uncertainty about market traction.

More Information Sources for Stabble

- Official Website: Visit Stabble's official website for features, use cases, and latest updates.

- White Paper: Stabble White Paper details its technical architecture, goals, and vision for frictionless stablecoin exchange.

- X Updates: On X platform, Stabble maintains an active presence at @stabbleorg, sharing updates on protocol developments, trading metrics, and community initiatives.

Stabble Future Roadmap

The provided materials do not contain specific roadmap details or timeline milestones for Stabble's development. The project emphasizes its current focus on optimizing stablecoin trading efficiency and expanding yield opportunities for liquidity providers.

How to Participate in Stabble?

- Purchase Options: Buy STB on Gate.com or through decentralized exchanges on Solana

- Storage Solutions: Use Solana-compatible wallets such as Phantom or Solflare to securely store STB tokens

- Provide Liquidity: Access Stabble's DEX platform to supply liquidity and earn yields through innovative farming mechanisms

- Explore the Protocol: Visit the official website and review the white paper to understand trading mechanics and participation opportunities

Summary

Stabble aims to redefine stablecoin trading on Solana through blockchain technology, offering capital efficiency, reduced slippage, and enhanced yield opportunities for liquidity providers. Its innovative approach to processing substantial stablecoin volume with minimal liquidity demonstrates technical differentiation in the DEX landscape. Despite facing price volatility, limited exchange presence, and intense competition, Stabble's efficiency-focused design and commitment to LP value creation position it as a noteworthy development in Solana's DeFi ecosystem. Whether you're a liquidity provider seeking optimized yields or a trader looking for efficient stablecoin exchange, Stabble presents an interesting protocol to monitor as it develops.

FAQ

What is STB crypto token and what is its purpose?

STB is a utility token in the stabble ecosystem designed for governance and staking. Users can lock STB to earn veSTB tokens, enabling ecosystem participation and control while enhancing user engagement and value creation.

How can I buy and store STB tokens?

Purchase STB using a debit/credit card or bank transfer on a centralized exchange. Store your tokens in a secure wallet for safekeeping and full control over your assets.

What is the total supply and current market price of STB?

The total supply of STB is 500 million tokens. The current market price is $0.0001633, with a circulating supply of 98 million and a market cap of $163,305.

Is STB a safe investment and what are the associated risks?

STB carries significant risks including market volatility, liquidity constraints, and regulatory uncertainties. Investors should conduct thorough research and only invest capital they can afford to lose.

What is the difference between STB and other similar cryptocurrency projects?

STB features an innovative decentralized exchange model with rapid growth potential in the Solana ecosystem, while competitors like DOT offer established cross-chain interoperability. STB's unique architecture and ecosystem positioning distinguish it in the market.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Top Crypto Demo Accounts for 2025: Leading Platforms for Free Trading

APR vs. APY in Crypto: What Are the Major Differences?

Comprehensive Guide to IOU Tokens in Cryptocurrency

Which Are the Best Altcoins To Invest In

Cryptocurrency theft surpassed $2 billion in 2025—it's time to reconsider how we store digital assets