A $5.15 Billion “Fire Sale” — A Win-Win Deal

On January 22, 2026, Capital One announced its $5.15 billion acquisition of Brex—an unexpected transaction that saw Silicon Valley’s youngest unicorn acquired by one of Wall Street’s oldest banking giants.

Brex is Silicon Valley’s most sought-after corporate payment card provider. Founded by two Brazilian prodigies at age 20, Brex reached a $1 billion valuation in just one year and hit $100 million in ARR within 18 months. By 2021, its valuation soared to $12.3 billion, earning a reputation as the future of corporate payments and serving more than 25,000 companies, including Anthropic, Robinhood, TikTok, Coinbase, Notion, and other high-profile clients.

Capital One ranks as the sixth-largest bank in the US, holding $470 billion in assets, $330 billion in deposits, and issuing the third-most credit cards nationwide. Founder Richard Fairbank, now 74, established Capital One in 1988 and spent 38 years building it into a financial powerhouse. In 2025, he completed the $35.3 billion acquisition of Discover, marking one of the largest mergers in recent US financial history.

These two companies embody a clash of philosophies: Silicon Valley’s speed and innovation versus Wall Street’s capital and patience.

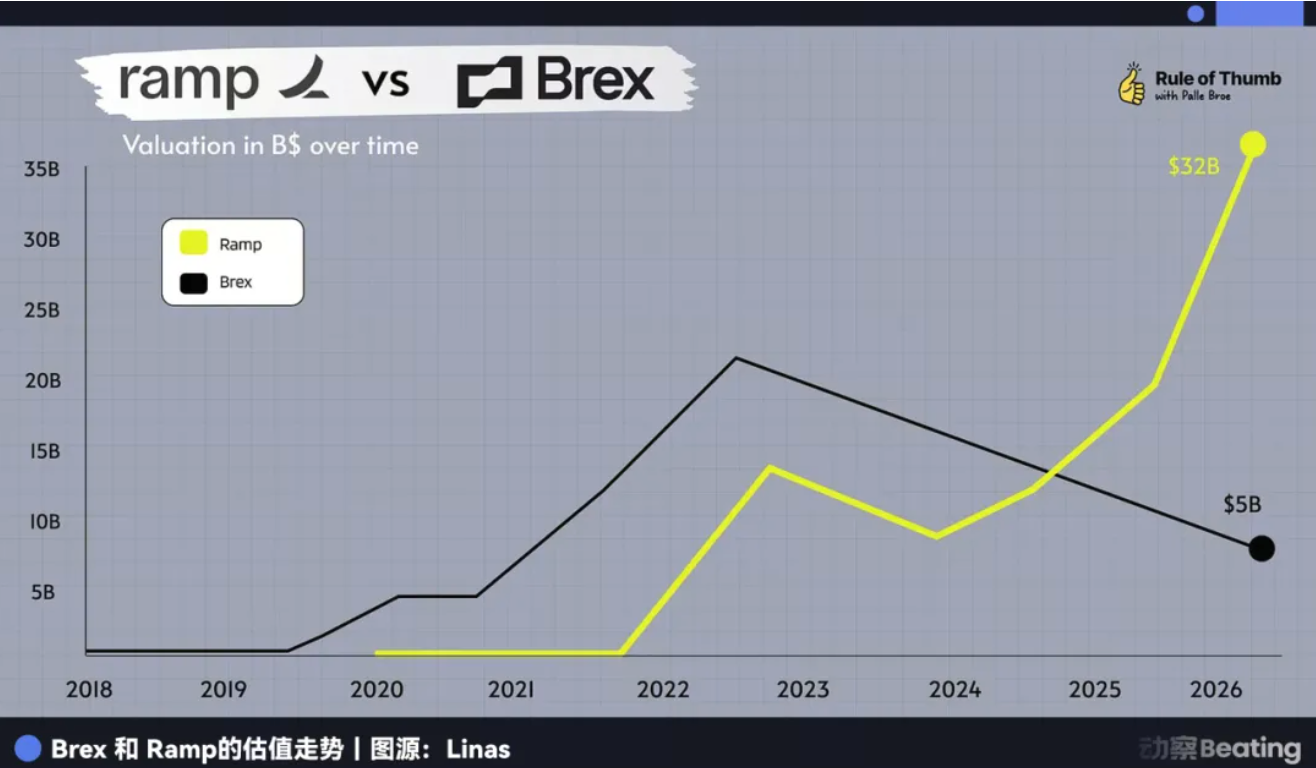

Yet, a paradox lies beneath the data: Brex is still growing at a robust 40–50% rate, with ARR reaching $500 million and a client base exceeding 25,000. Why would a company with such momentum opt to sell—and at a price 58% below its peak valuation?

The Brex team claims the move was about acceleration and scale. But what are they accelerating? Why now? Why Capital One?

The answer to this paradox is rooted in a deeper question: What does time mean in the financial industry?

Brex Had No Choice

After the acquisition announcement, many lamented Brex’s decision not to pursue an IPO. Yet, for the Brex team, this deal came at just the right moment.

Prior to engaging with Capital One, Brex’s leadership focused on raising additional private capital, preparing for an IPO, and continuing as an independent company.

The turning point arrived in Q4 2025. Brex CEO Pedro Franceschi was introduced to Fairbank, the banking titan who had led Capital One for over 38 years. With a simple, compelling logic, Fairbank dismantled Pedro’s resolve.

Fairbank presented Capital One’s balance sheet: $470 billion in assets, $330 billion in deposits, and the third-largest credit card network in the US. By contrast, Brex—despite its slick software and advanced risk algorithms—remained fundamentally constrained by its cost of capital.

In fintech, growth was once the only metric that mattered. But by 2026, fintech companies faced shifting capital market conditions, revised growth expectations, and a rapid acceleration in industry consolidation.

Caplight data shows Brex’s current secondary market valuation at just $3.9 billion. In the post-acquisition review, Brex CFO Dorfman highlighted a pivotal point: “The board believes a 13x gross profit acquisition multiple aligns with the premium standards of top public companies.”

In practical terms, if Brex went public in early 2026, a fintech firm growing at 40% but not fully profitable would struggle to achieve a valuation multiple above 10x. Even a successful IPO would likely result in a market cap below $5 billion, with the risk of long-term liquidity discounts.

On one side: an uncertain IPO path, with post-listing price drops and short-seller attacks. On the other: Capital One’s cash and stock offer, plus instant credibility from a major bank.

If valuation volatility was the only challenge, could Brex simply refine its software and algorithms to survive the capital winter? In reality, that option wasn’t available.

Balance Sheets Swallow the World

For years, Silicon Valley lived by the A16Z mantra: “Software is eating the world.”

Brex’s founders were true believers. But finance hides a rule few software engineers grasp: In the currency wars, user experience is just the surface. The balance sheet is the true operating system.

As a fintech without a banking license, Brex operates as a shell bank. Every credit extension depends on partner banks for funding, and deposit interest income must be shared with those banks.

This model worked in a low-rate era, when capital was plentiful. In a high-rate environment, however, Brex’s business model began to suffocate.

By 2023, Brex’s revenue structure was roughly one-third from deposit spreads, about 6% from SaaS subscriptions, and the rest from credit card transaction fees.

With rates at 5.5%, Brex faced a squeeze from both ends.

On one side, higher funding costs meant clients were unwilling to leave millions in non-interest-bearing Brex accounts—they demanded higher returns, shrinking Brex’s spread.

On the other, rising risk weights meant startup default risk soared. Brex’s real-time risk control system had to become more conservative, slashing credit limits and slowing transaction growth.

Fairbank’s merger announcement included a pointed remark: “We look forward to combining Brex’s leading customer experience with Capital One’s robust balance sheet.” Translation: your code is great, but you lack cheap, abundant capital.

With $330 billion in low-cost deposits, Capital One can generate more than triple the profit on a $100 corporate loan compared to Brex.

Software can transform experiences, but capital can buy those experiences. That’s the harsh truth for fintech in 2026. The software system Brex built over nine years and $1.3 billion in funding is, to Capital One, simply a plugin to be integrated.

But why couldn’t Brex wait out the next rate cycle, as Capital One can? The founders are under 30, with successful track records and personal wealth. Why not keep the company afloat? What ultimately drove them to surrender?

29 Can’t Wait; 74 Can

In finance, time isn’t a friend—it’s the enemy. Only capital can turn the enemy into an ally.

Henrique Dubugras and Pedro Franceschi’s careers are a chronicle of speed: founding a company at 16 and selling it three years later; launching Brex at 20 and reaching unicorn status in two years. They measure success in years—or even months. For them, waiting five to ten years is nearly a full career span.

They believe in speed—rapid trial and error, rapid iteration, rapid success. It’s the Silicon Valley creed, and the biological clock of 20-somethings.

Their opponent: Richard Fairbank.

Fairbank, now 74, founded Capital One in 1988 and spent 38 years building it into America’s sixth-largest bank. He doesn’t believe in speed; he believes in patience. In 2024, he spent $35.3 billion acquiring Discover, a process that took over a year to integrate. In 2026, he spent $5.15 billion acquiring Brex, saying he could take 10 years to integrate it.

These are two entirely different time structures.

Dubugras and Franceschi, both in their twenties, bought time with investors’ money. Brex raised $1.3 billion, and investors expect returns in five to ten years—either through IPO or acquisition.

This acquisition wasn’t investor-driven, but their need for exit was a factor Pedro had to consider. CFO Dorfman repeatedly emphasized providing 100% liquidity for shareholders—a critical point.

More importantly, the founders’ own time is limited. Pedro is 29; he could wait five or ten years, but could he wait 20? Could he, like Fairbank, spend 38 years refining a company? With competitors like Ramp already pulling ahead, IPO windows uncertain, and investor exit pressure mounting, Pedro’s time was running out.

Fairbank, at 74, buys time with depositors’ money. Capital One’s $330 billion in deposits, while theoretically withdrawable at any time, are statistically a stable funding source.

Fairbank can wait five years, ten years—until rates fall, fintech valuations hit bottom, or the ideal acquisition opportunity arises.

This is the asymmetry of time. Fintech’s time is finite, whether for founders or investors; banks’ time is nearly infinite, thanks to stable deposits.

Brex’s story is a lesson for every Silicon Valley fintech founder: No matter how fast you move, you can’t outrun capital’s patience.

The Innovator’s Fate

Brex’s acquisition marks the end of an era—the romantic belief that fintech could fully replace traditional banks.

Looking back over the past two years: In April 2025, American Express acquired expense management software Center. In September 2025, after shuttering its consumer finance division, Goldman Sachs acquired a Boston-based AI lending startup. In January 2026, JPMorgan Chase completed its integration of UK pension tech platform WealthOS.

Fintech companies blaze the trail from zero to one, using venture capital to experiment, educate users, and innovate. But once business models are validated or industry cycles turn downward and valuations revert, traditional banks swoop in like scavengers, harvesting innovation at lower cost.

Brex burned through $1.3 billion in funding, amassed 25,000 premium startup clients, and built a world-class financial engineering team. Now, Capital One takes over—all for $5.15 billion, much of it in stock.

From this perspective, fintech founders aren’t disrupting banks—they’re working for them. It’s a new kind of risk outsourcing: Banks no longer need to take on high-risk R&D internally; they just have to wait.

Brex’s exit shifts the spotlight squarely onto its rival, Ramp.

Currently the only super-unicorn in the sector, Ramp still appears strong. Its ARR is growing, and its balance sheet seems more robust. But its time is also ticking.

Founded in 2019, Ramp has reached the seventh year of the typical VC cycle. Late-stage investors entered in 2021–2022 at valuations above $30 billion, demanding returns that far exceed those expected of Brex.

If the 2026 IPO window remains limited to a handful of highly profitable giants, will Ramp face the same dilemma?

History doesn’t repeat itself exactly, but it does rhyme. Brex’s story shows that in the ancient world of finance, there’s no such thing as a pure software company. When the external environment shifts, fintech’s time disadvantage becomes clear—they must choose between acquisition and prolonged struggle. Pedro chose the former—not as surrender, but as clarity.

But that clarity itself is fintech’s fate.

Just don’t forget: Brex once vowed to disrupt American Express—even setting an office Wi-Fi password as “BuyAmex.”

Statement:

- This article is republished from [动察Beatig]. Copyright belongs to the original authors [Sleepy.txt, Kaori]. If you have any objections to this republication, please contact the Gate Learn team, who will address your concerns promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the authors and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless explicitly referencing Gate, reproduction, distribution, or plagiarism of translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?