JustLend DAO ecosystem benefits continue to increase: Accelerating the deflationary process.

On January 15, JustLend DAO, the core DeFi lending protocol within the TRON ecosystem, announced a major milestone: the completion of its second large-scale JST buyback and burn, further accelerating the token’s deflationary benefits.

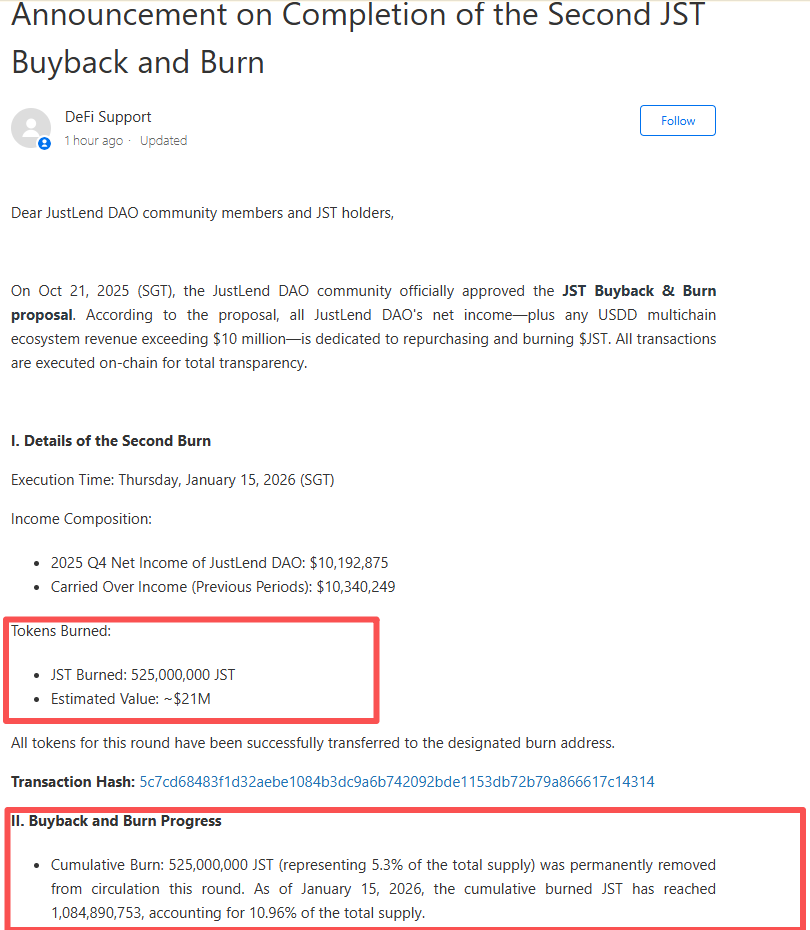

The official announcement detailed that 525 million JST tokens were repurchased and burned in this round, representing over $21 million in value and roughly 5.3% of JST’s total supply. This move further strengthens the token’s deflationary foundation.

Including the first burn, since the JST buyback and burn initiative began last October, the total JST repurchased and burned has surged past 1 billion tokens—about 11% of the overall supply. In under three months, more than 1 billion tokens have been eliminated. The scale and efficiency of this deflationary effort are rare in the industry, injecting renewed confidence into a recently subdued market.

This successful JST buyback and burn not only ensures the ongoing and effective implementation of the burn plan, accelerating the release of deflationary rewards, but also fundamentally demonstrates JustLend DAO’s robust and sustainable ecosystem profitability.

Exceeding Expectations: Over 1 Billion JST Burned in Two Rounds, Accelerating Deflation

As of January 15, 2026, JST has completed two large-scale buyback and burn rounds, with a cumulative total exceeding 1.08 billion tokens (precisely 1,084,890,753), amounting to 10.96% of the total supply and involving more than $38.7 million in capital. Both the scale and execution efficiency of these burns place JustLend DAO at the forefront of the DeFi industry.

The JST burn initiative began in October 2025, when the JustLend DAO community approved a proposal to allocate all protocol earnings—both existing and future net income—as well as USDD multi-chain ecosystem income exceeding $10 million, wholly toward JST buybacks. All buyback transactions are executed transparently on-chain, ensuring traceable and verifiable fund flows.

Funding for JST buybacks and burns comes from two main sources: JustLend DAO’s existing and future net income, and excess income over $10 million from the USDD multi-chain ecosystem. At launch, JustLend DAO drew over $59.08 million USDT from existing earnings and adopted a staged approach: “30% immediate burn in the first batch + 70% burned quarterly after interest accrual,” balancing short-term deflation with long-term value growth.

The first burn was completed in October 2025, utilizing 30% of the funds to burn 560 million JST—5.6% of the total supply. The remaining 70% was deposited into JustLend DAO’s SBM USDT lending market to accrue value, scheduled for quarterly execution over four periods.

This January 15, JustLend DAO published the “Announcement on Completion of the Second JST Token Buyback and Burn,” marking the successful conclusion of the second large-scale JST buyback and burn. This round burned 525 million JST, or 5.3% of the total supply, with a token value of approximately $21 million.

With both rounds now complete:

First Round (October 2025): Burned about 556 million JST, equating to $17.72 million and 5.66% of total supply.

Second Round (January 2026): Burned 525 million JST, worth $21 million and 5.3% of total supply.

Importantly, the second JST buyback and burn exceeded expectations. Unlike many market moves, the funding for this round increased despite volatility, far surpassing initial projections and generating strong community enthusiasm.

To date, JST’s cumulative burn has surpassed 1.08 billion tokens, or 10.96% of the total supply, with total funding for both rounds exceeding $38.7 million. This level of deflationary strength and capital commitment ranks among the top globally in DeFi.

All JST buyback and burn operations are executed on-chain in a decentralized manner by the Grants DAO community. Every fund transfer and burn record is transparently preserved on-chain. Users can review burn batches, on-chain transactions, and key metrics via the dedicated Grants DAO page and the “Transparency” dashboard on the JustLend DAO website—delivering true information transparency and earning user trust for JST’s ecosystem development.

JustLend DAO Profitability Validated Again: Q4 2025 Net Income Exceeds $10 Million

This successful JST buyback and burn not only regularizes the burn initiative but, with its above-expected capital scale, directly showcases JustLend DAO’s robust ecosystem operations and sustainable profitability—providing core support for JST’s long-term deflationary mechanism.

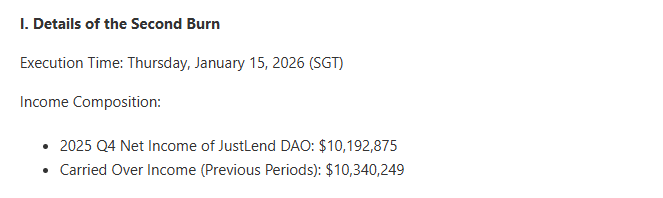

Initial burn plan data indicated that 70% of JustLend DAO’s existing income would be allocated for buybacks over four quarters, with each quarter burning about $10.34 million. In reality, this round’s buyback and burn capital exceeded $21 million—more than double the preset amount.

Under the quarterly burn schedule, capital not only remained steady but increased, surpassing community and market expectations. This growth is driven by JustLend DAO’s intrinsic profitability, in stark contrast to market operations reliant on fundraising or token inflation for “pseudo-deflation.”

The latest burn announcement revealed that 100% of the second-round burn funds came from JustLend DAO’s platform income, including the planned quarterly earnings of $10.34 million and an additional $10.19 million in net income from Q4 2025.

This dual-source funding model—“existing income base + new net income”—accelerates JST buyback and burn, with real cash flow validating the protocol’s healthy and abundant financial status, dispelling concerns about future funding gaps.

The additional net income of over $10 million in Q4 2025 further demonstrates JustLend DAO’s strong profitability. JST buybacks and burns are deeply rooted in ecosystem business growth, not detached from real protocol value. JustLend DAO’s resilient profitability ensures the long-term effectiveness of its deflationary mechanism.

Currently, JustLend DAO retains about $31.02 million in existing income, to be gradually allocated for future buybacks and burns. The combination of “over $30 million in existing income plus continuous net protocol income” provides strong support for ongoing JST burns.

This means JST buyback and burn is not a short-term marketing stunt, but a regular, long-term value-creation initiative anchored in protocol earnings. It establishes a clear and stable long-term deflationary cycle for JST, fundamentally different from short-term buybacks common in crypto, supporting JST’s long-term stability and growth.

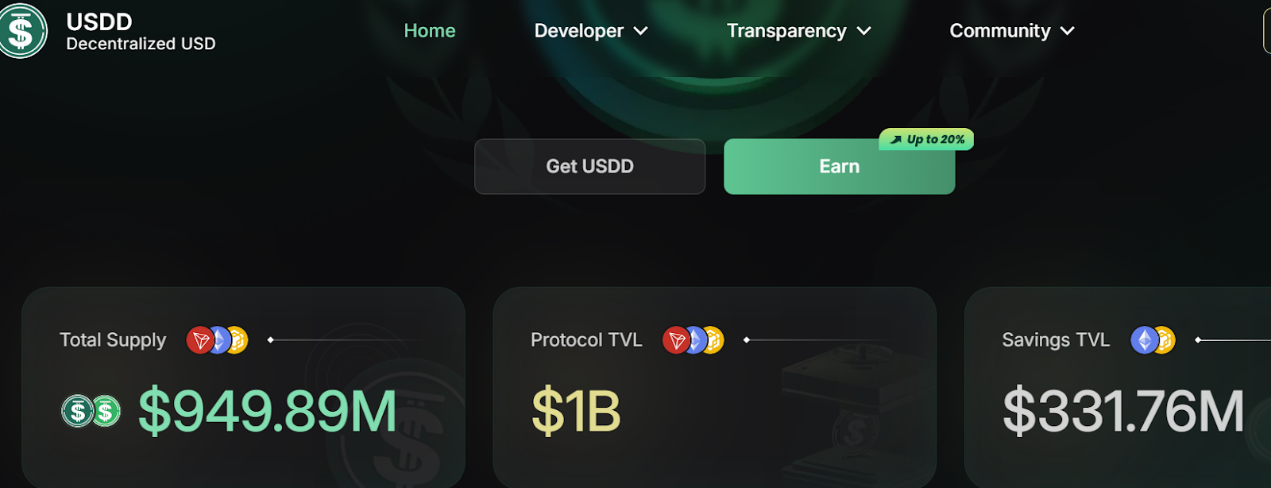

USDD stablecoin ecosystem, another potential core funding source, is experiencing rapid growth, providing ample momentum for JST’s deflationary mechanism. USDD has achieved cross-chain deployment, covering major networks like Ethereum and BNB Chain. As of January 15, USDD’s supply reached $960 million, and total value locked (TVL) on related platforms exceeded $1 billion. As the USDD ecosystem expands, future excess income will provide incremental funding for JST buybacks and burns, further strengthening deflation and boosting JST’s value.

In summary, JST’s deflationary mechanism is not simply a linear “token burn = supply contraction.” It’s built on the real, sustainable dual-ecosystem income from JustLend DAO and USDD, tightly linking deflationary strength with ecosystem profitability, and overcoming the industry’s “meaningless deflation without income support” dilemma—laying an irreversible foundation for JST’s long-term value growth.

JustLend DAO Ecosystem Income Powers Deflation and Drives JST Value Growth

JustLend DAO uses real ecosystem income as its core engine, continually intensifying JST buybacks and burns to deepen deflation. This creates a virtuous value cycle: “ecosystem activity rises → protocol profitability grows → buyback and burn intensity increases → token scarcity rises → ecosystem appeal strengthens”—forming a self-reinforcing growth loop.

As JST buybacks and burns become routine, the sizable reserve fund pool will continue to deliver deflationary rewards. With the steady expansion of the JustLend DAO ecosystem, JST’s value logic grows ever stronger, and market performance increasingly reflects its long-term potential.

Deflationary results show JST supply has decreased by 1.08 billion tokens, or 10.96% of total supply. Large-scale burns directly shrink circulating supply. With a fixed total supply, each burn further reduces circulating tokens, enhancing scarcity and driving JST into a long-term upward trajectory.

JST’s value potential is already widely recognized. On January 8, CoinMarketCap reported JST’s market cap surpassed $400 million, with 24-hour trading volume up 21.92% and a monthly price increase of 10.82%. The simultaneous growth in volume and market cap reflects strong market confidence in JustLend DAO’s ecosystem.

As the buyback initiative progresses, JST’s circulating supply will shrink further, increasing scarcity and likely driving another round of value growth. More importantly, JustLend DAO and USDD’s dual-ecosystem profitability continues to strengthen, further amplifying JST’s deflationary momentum and value growth.

JustLend DAO’s ongoing product matrix enhancements and healthy operational growth continually inject real income into buybacks, providing lasting momentum for JST’s deflationary mechanism.

As TRON ecosystem’s core financial infrastructure, JustLend DAO has evolved from a single lending protocol into a comprehensive DeFi solution—integrating asset lending, liquid staking, energy rental, and gas optimization. This complete product matrix offers multiple drivers for ecosystem revenue growth:

- SBM Lending Market: The ecosystem’s foundation, enabling users to earn yield or borrow via collateral, optimizing asset allocation;

- sTRX Liquid Staking: TRON’s preferred TRX staking portal, where users stake TRX and receive sTRX liquidity certificates.

- Energy Rental Service: Flexible “rent anytime” energy rental, lowering the barrier for on-chain operations.

- GasFree Smart Wallet: Deducts fees directly from transferred tokens. With platform subsidies, users pay only about 1 USDT per USDT transfer, greatly improving transaction ease.

Driven by this diverse product matrix, JustLend DAO’s key metrics are rising across the board. According to DeFiLlama, JustLend DAO ranks third globally in lending, trailing only multi-chain protocols Aave and Morpho. Notably, JustLend DAO is single-chain, standing out in a multi-chain competitive landscape and highlighting its leading position and user recognition within TRON.

As of January 15, JustLend DAO’s platform TVL reached approximately $7.038 billion, with cumulative community incentives exceeding $192 million, serving over 480,000 users worldwide. In the SBM Lending Market, supply assets exceed $4.2 billion, and borrowed assets total $200 million—both leading the industry in scale and activity.

On the income side, the Transparency dashboard shows that as of January 15, cumulative net income exceeds $72.69 million, with $69.7 million extracted and $2.99 million retained, reflecting a healthy, robust financial structure and providing solid funding for buybacks and burns.

JustLend DAO’s net income currently comes solely from SBM Lending Market and sTRX liquid staking, with sTRX as the core revenue driver. Of the $69.7 million extracted, sTRX contributed $68.81 million, while SBM Lending Market added about $2.25 million.

As sTRX staking continues to grow, its revenue contribution is expected to rise further. Latest data shows sTRX staking exceeds 9.3 billion TRX, with over 13,500 participating addresses and an annualized yield of 7.23%, all trending upward. SBM Lending Market also excelled, with Q4 2025 interest fees hitting $2.2 million (borrower-paid interest only)—a record high, reflecting ongoing lending expansion.

Meanwhile, Energy Rental and GasFree Smart Wallet—two high-frequency, essential services—are emerging as new growth engines for JustLend DAO. The base rate for energy rental dropped from 15% to 8% on January 9; today, renting 100,000 units of energy costs about 6.21 TRX (equivalent to staking 10,674 TRX for energy, enough for two contract transactions), with total rental addresses rising to 73,000. GasFree Smart Wallet has processed over $46.3 billion in transactions, serving more than 2.5 million accounts and saving users $3.64 million in fees.

Looking ahead, revenue from Energy Rental and GasFree will be gradually included in JustLend DAO’s platform income statistics, becoming new growth drivers and further expanding JST buyback funding sources. As diversified business revenue continues to flow into buybacks and burns, JST’s deflationary strength and value growth will rise in tandem, continually raising the token’s long-term value ceiling.

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [**]. If you have any objections to this republication, please contact the Gate Learn team for prompt handling in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is specifically mentioned, do not copy, distribute, or plagiarize translated articles.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?