RIVER price soared 1,900% in just one month: Key drivers behind the River protocol and the rise of the omnichain stablecoin narrative

RIVER Market Performance: New Highs Driven by Intense Short Squeeze

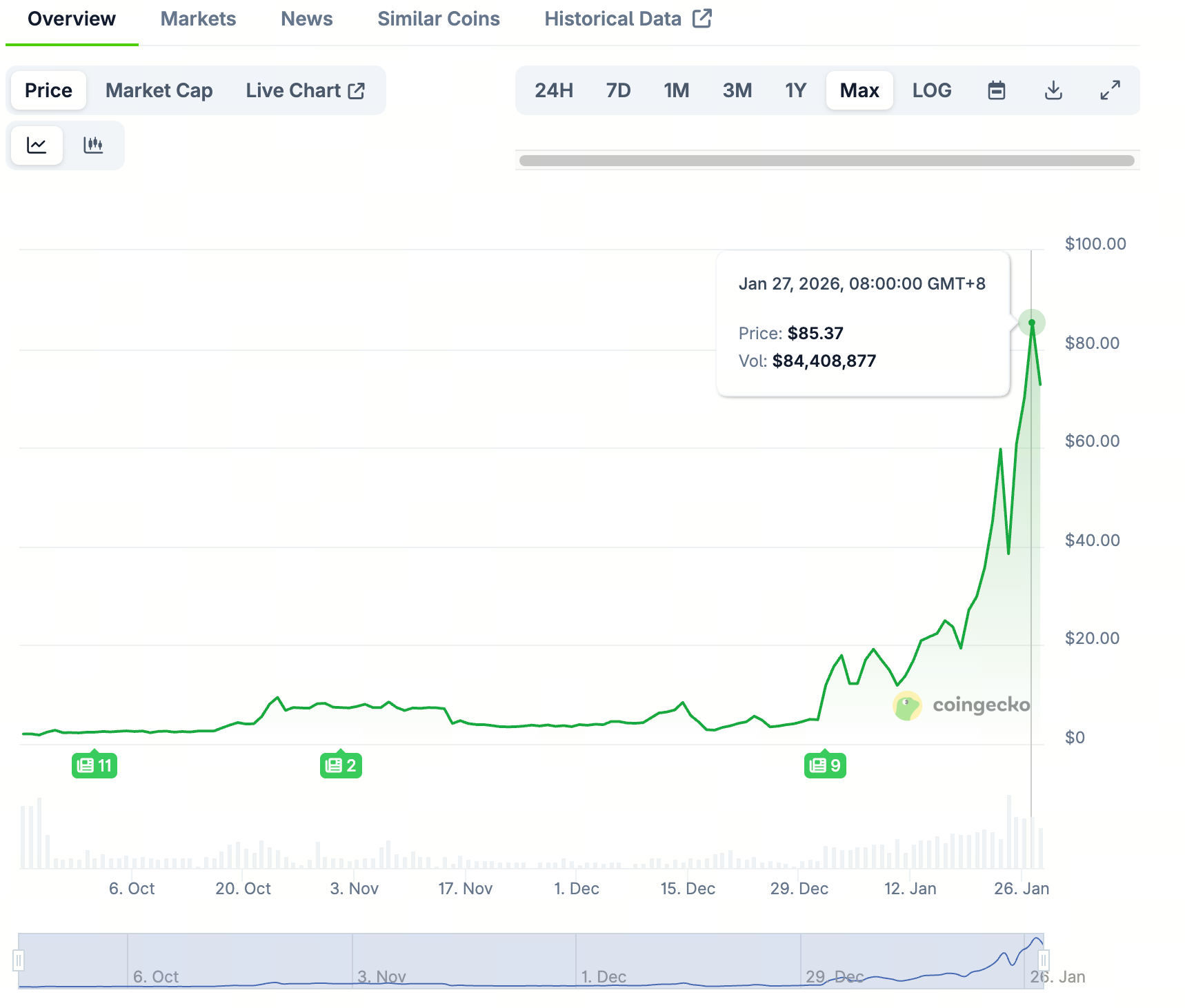

Recently, the crypto market spotlight has been on River (RIVER). According to Coingecko data, RIVER’s price has repeatedly broken resistance, hitting a peak of $80 on January 27 and posting a monthly gain of about 1900%.

Image source: CoinGecko

- Market capitalization: Circulating market cap briefly topped $1.4 billion, propelling RIVER into the global top 80.

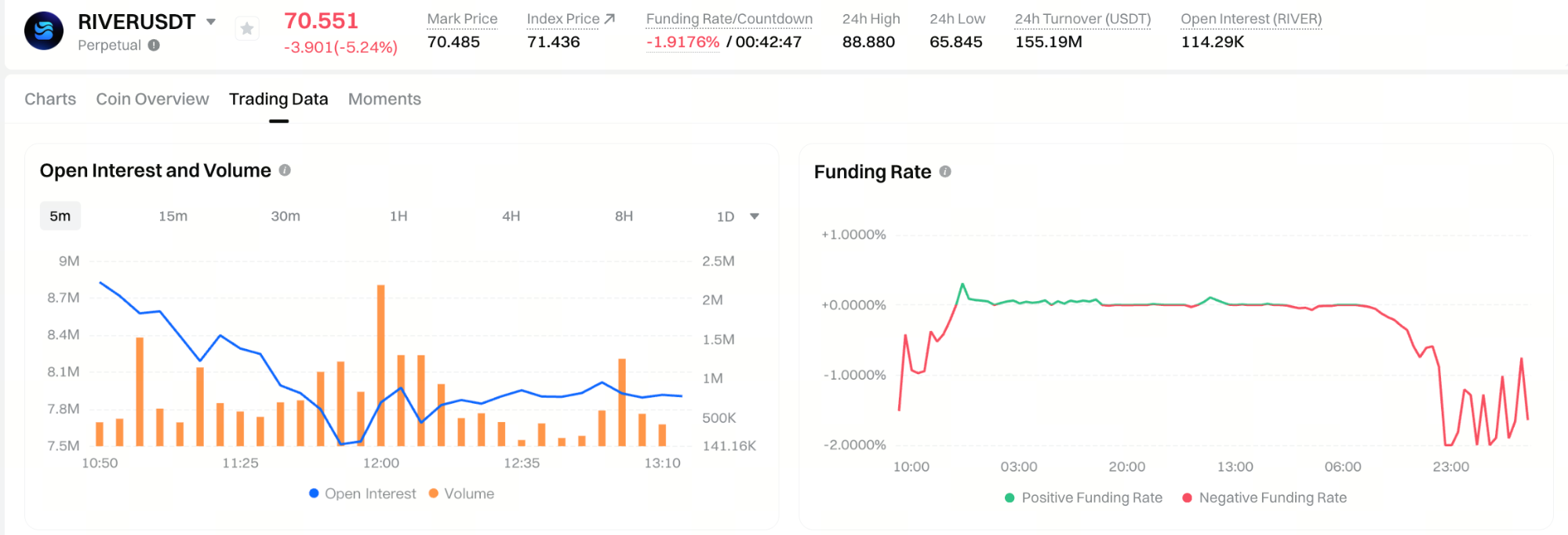

- Funding rate alert: RIVER currently shows a negative funding rate, signaling overcrowded short positions. This classic short squeeze dynamic is the primary force behind the outsized price rally beyond fundamentals.

What Is the River? Key Components and Chain Abstraction Technology

River is an innovative cross-chain stablecoin protocol built on the LayerZero OFT standard. It enables users to collateralize assets on one chain and mint the stablecoin satUSD natively on another—no bridge or asset wrapping required. River’s edge is its solution to the complexity of cross-chain asset bridging and wrapping.

River’s core product suite includes:

- satUSD: Native cross-chain stablecoin, pegged 1:1 to the US dollar

- satUSD+: Yield token that distributes protocol income and rewards to satUSD stakers

- Stability Pool: Absorbs liquidation risk and preserves system stability

- Multi-chain deployment: Supports Ethereum, BNB Chain, Base, Arbitrum, Sui, TRON, and other major ecosystems

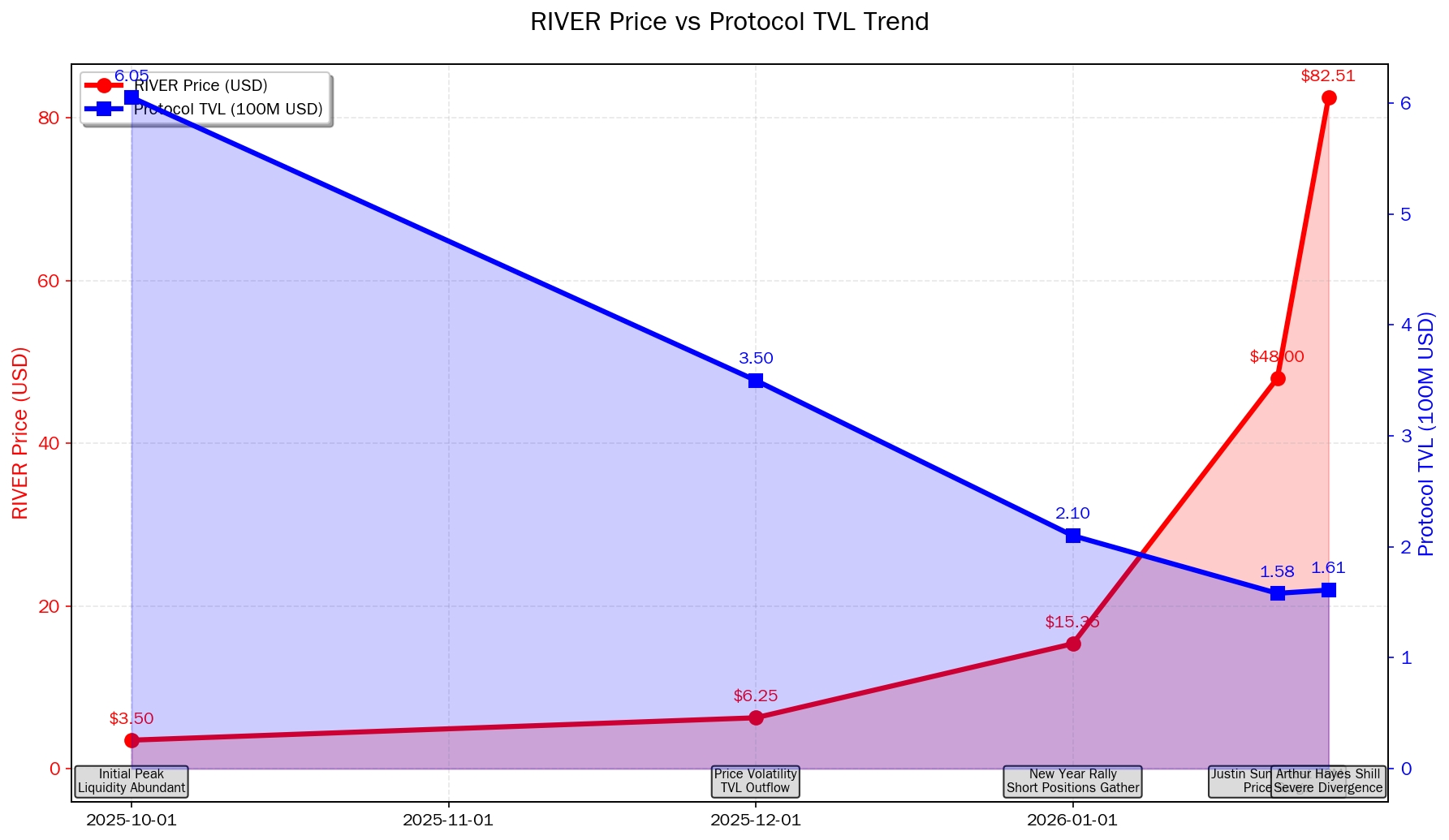

According to DeFiLlama’s latest data, River protocol’s current TVL is $160 million, with a peak TVL of $605 million in October 2025.

Data source: DeFiLlama, CoinGecko

RIVER: Recent Developments and Price Surge Analysis

RIVER’s strong rally is the result of combined factors—capital inflows, ecosystem expansion, and shifting sentiment.

Frequent funding news has played a major role. On January 23, River announced a $12 million strategic round led by Arthur Hayes’ Maelstrom Fund, The Spartan Group, and several NASDAQ-listed US and European institutions. Earlier, on January 21, the project secured an $8 million strategic investment from Justin Sun’s TRON DAO, bringing satUSD into the TRON ecosystem.

This capital supports River in deepening stablecoin liquidity and integrating satUSD into trading, lending, staking, and yield scenarios.

River has also ramped up multi-chain ecosystem expansion. On January 20, River announced a strategic partnership with Sui, aiming to bring multi-chain liquidity and yield opportunities to the Sui ecosystem—offering institutions, developers, and users more efficient capital utilization.

RIVER’s rally has also been fueled by leading industry voices like Arthur Hayes. Earlier this month, Hayes highlighted RIVER’s surge on social media, stating it “needs listings on more CEXs and DEXs,” such as Binance and Bybit. Despite the broader crypto market downturn, RIVER climbed steadily from $19.

Gate contract data shows RIVER remains at a negative funding rate, pointing to crowded short positions and strong short squeeze momentum. As prices rise, forced short covering can further accelerate the rally.

Image source: Gate official website

Summary: River’s Future Price Outlook and Risks

In the near term, RIVER is extremely overbought, with significant profit-taking pressure and a high likelihood of technical correction.

While technicals remain strong, the gap between high market cap and low TVL suggests the current price is driven more by speculation and expectations. The nearly 20x monthly surge is clearly not the result of fundamental improvement.

If River’s expansion in the Sui and Tron ecosystems proceeds smoothly—driving new TVL growth and ecosystem applications—and if the new Smart Vault and Prime Vault successfully attract additional capital, plus new contract products or more exchange listings, RIVER’s price could see further upside.

Overall, River’s story extends beyond a single chain ecosystem, targeting the fundamental need for cross-chain liquidity integration. Its success hinges on satUSD’s ability to establish deep liquidity pools and use cases across major ecosystems, River’s chain abstraction technology delivering a seamless user experience, and whether its user-focused yield strategies can sustain attractive risk-adjusted returns over time.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?