#WhenWillBTCRebound?

Calm Before the Storm: Why Is the Market on Standby?

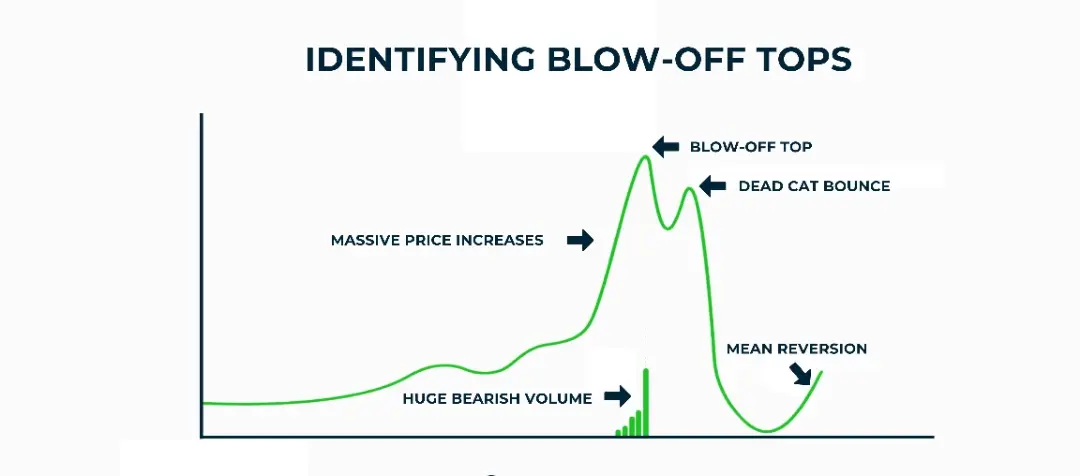

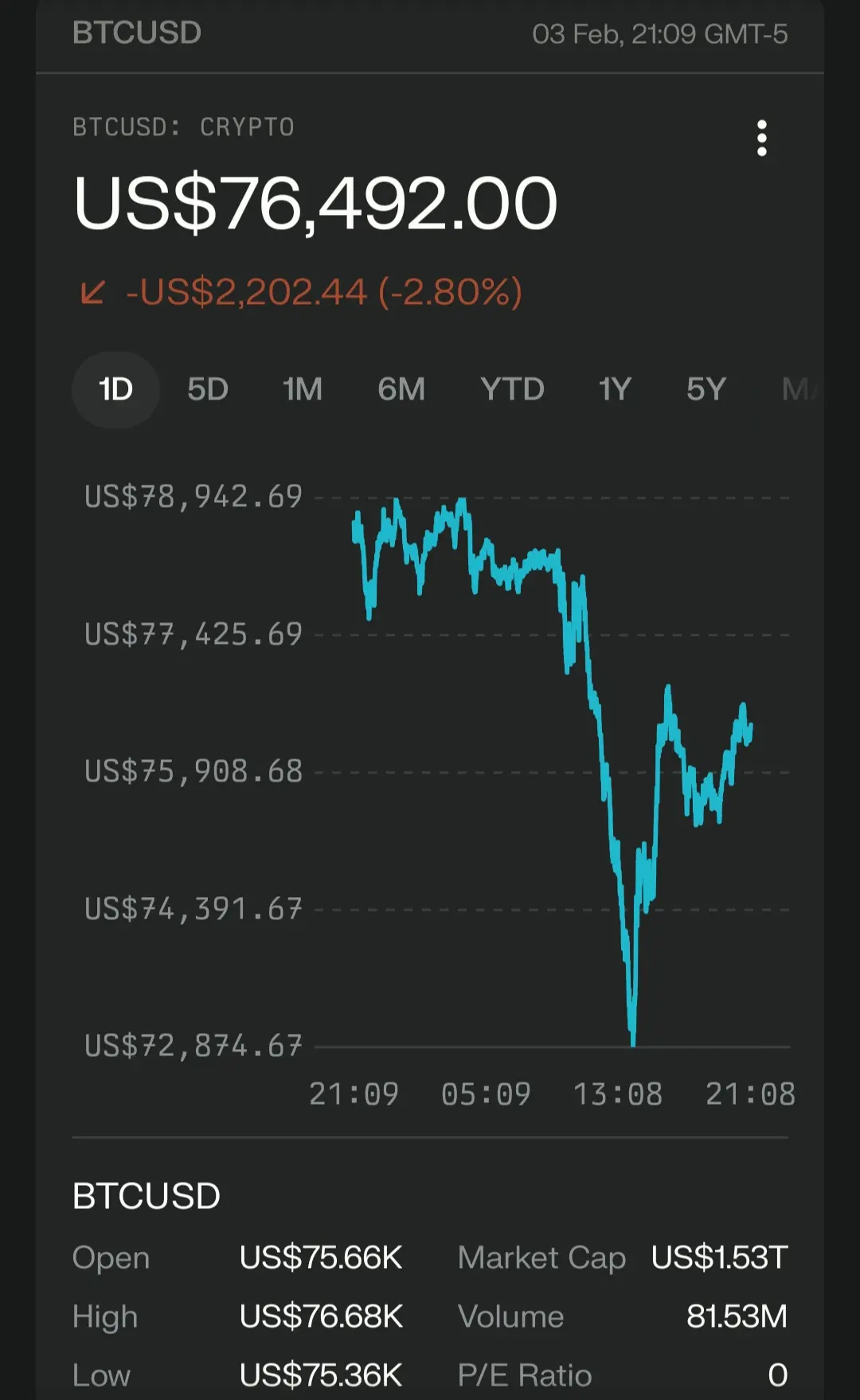

The selling pressure that persisted throughout January 2026 pulled Bitcoin down to the $78,000 - $82,000 range in the early days of February. However, the real story here isn’t the price drop; it’s "smart money" (institutional capital) waiting for the perfect moment to entry into new positions.

Institutional Outflows and Stabilization: While approximately $1.6 billion in outflows from spot ETFs at the end of January spooked short-term investors, the bounce Bitcoin saw from its strong support at $74,000 is proof that the "bulls" are still very much in the game.

Macroeconomic Pressure: Global inflation data and a temporary dip in risk appetite have forced Bitcoin into a "wait-and-see" mode. Yet, historical data repeatedly shows that Bitcoin rises with even greater momentum after such sharp corrections.

When Does the Recovery Begin?

The critical levels and signals that analysts are watching for the rebound to start are quite clear:

The $84,640 Barrier: To confirm that Bitcoin has re-entered a bullish trend, it needs to see sustained closes above this resistance level. If this wall is breached, the psychological target of $100,000 will be back on the radar.

As the price dips, the continued decline of Bitcoin supply on exchanges indicates that major players view this drawdown as a "discount" and are moving assets to cold storage. This supply crunch will cause the price to skyrocket (rebound) the moment demand surges.

Why Is This Perspective Unique?

Because we don't just look at the red candles on a chart and fall into despair. We are aware of Bitcoin’s four-year cycle and the unshakable trust provided by blockchain technology. Contrary to the panicking crowds, this piece reminds us that this "cleansing" process—where weak hands are shaken out—is the very foundation of the next massive rally.

"The stock market is a device for transferring money from the impatient to the patient."

Final Word: Patience Is Your Greatest Capital

If you are following the #WhenWillBTCRebound hashtag, remember this: Bitcoin has never moved in a straight line upward. Behind every major surge lies a "painful" consolidation process like the one we are experiencing today. 2026 continues to be the year Bitcoin solidifies its place in the financial system and expands its practical use cases.

The answer to when Bitcoin will rebound lies technically in breaking the $84,000 level, and philosophically in your faith in this technology.

Calm Before the Storm: Why Is the Market on Standby?

The selling pressure that persisted throughout January 2026 pulled Bitcoin down to the $78,000 - $82,000 range in the early days of February. However, the real story here isn’t the price drop; it’s "smart money" (institutional capital) waiting for the perfect moment to entry into new positions.

Institutional Outflows and Stabilization: While approximately $1.6 billion in outflows from spot ETFs at the end of January spooked short-term investors, the bounce Bitcoin saw from its strong support at $74,000 is proof that the "bulls" are still very much in the game.

Macroeconomic Pressure: Global inflation data and a temporary dip in risk appetite have forced Bitcoin into a "wait-and-see" mode. Yet, historical data repeatedly shows that Bitcoin rises with even greater momentum after such sharp corrections.

When Does the Recovery Begin?

The critical levels and signals that analysts are watching for the rebound to start are quite clear:

The $84,640 Barrier: To confirm that Bitcoin has re-entered a bullish trend, it needs to see sustained closes above this resistance level. If this wall is breached, the psychological target of $100,000 will be back on the radar.

As the price dips, the continued decline of Bitcoin supply on exchanges indicates that major players view this drawdown as a "discount" and are moving assets to cold storage. This supply crunch will cause the price to skyrocket (rebound) the moment demand surges.

Why Is This Perspective Unique?

Because we don't just look at the red candles on a chart and fall into despair. We are aware of Bitcoin’s four-year cycle and the unshakable trust provided by blockchain technology. Contrary to the panicking crowds, this piece reminds us that this "cleansing" process—where weak hands are shaken out—is the very foundation of the next massive rally.

"The stock market is a device for transferring money from the impatient to the patient."

Final Word: Patience Is Your Greatest Capital

If you are following the #WhenWillBTCRebound hashtag, remember this: Bitcoin has never moved in a straight line upward. Behind every major surge lies a "painful" consolidation process like the one we are experiencing today. 2026 continues to be the year Bitcoin solidifies its place in the financial system and expands its practical use cases.

The answer to when Bitcoin will rebound lies technically in breaking the $84,000 level, and philosophically in your faith in this technology.