Wauwda

Aún no hay contenido

Wauwda

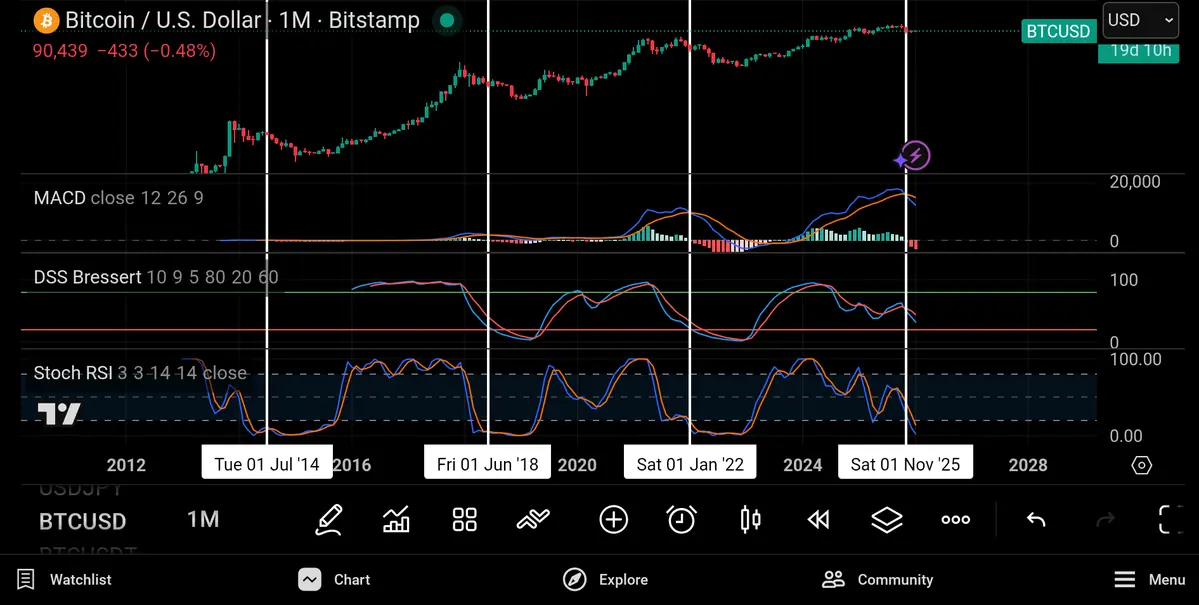

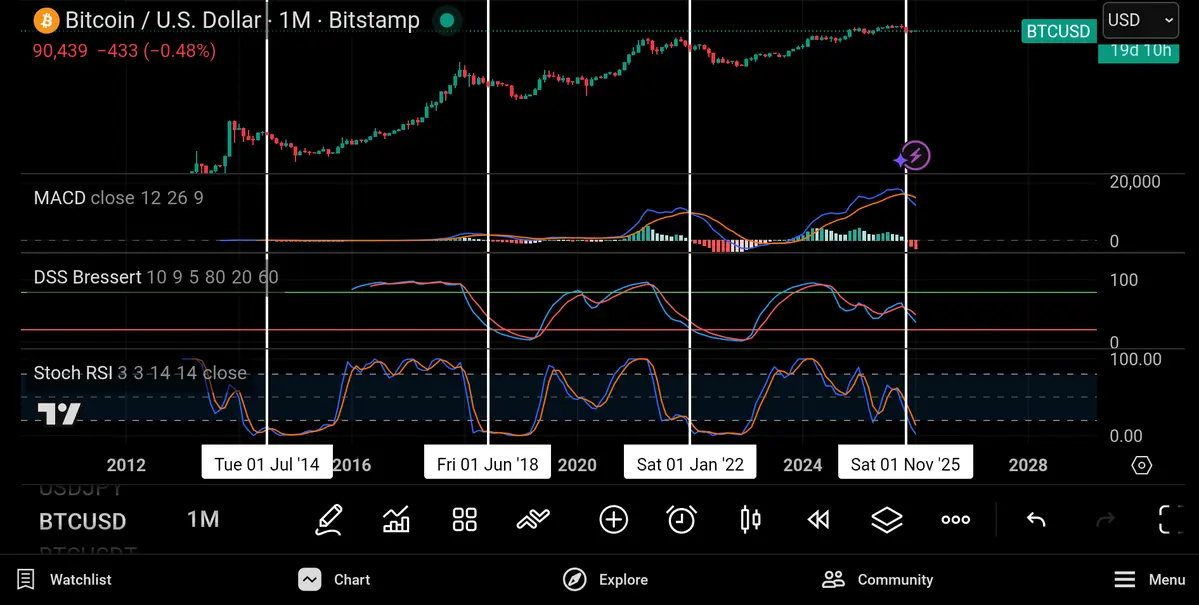

El MACD 5D bajó más que en el mercado bajista anterior

Ver originales

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

Teniendo precaución aquí

Veamos qué pasa

Ver originalesVeamos qué pasa

- Recompensa

- Me gusta

- 1

- Republicar

- Compartir

GateUser-6aca4c9a :

:

Lo siento, señor, hago todo lo posible por arreglarlo.Las cruces de DSS Bressert / Stochastic RSI de 2W se están acercando para muchas altcoins

Históricamente, esas han sido los movimientos más explosivos

Estoy analizando proyectos como $INJ, $SUI, $RENDER, $LINK, $KAS y $TAO

Volveré a cubrir las small caps en un futuro cercano, el momento está cerca ✍🏼

Ver originalesHistóricamente, esas han sido los movimientos más explosivos

Estoy analizando proyectos como $INJ, $SUI, $RENDER, $LINK, $KAS y $TAO

Volveré a cubrir las small caps en un futuro cercano, el momento está cerca ✍🏼

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

Durante la cima de 2021, mi sistema dijo que la cima había llegado, pero no vendí lo suficiente porque escuché a otras personas

En el fondo del último mercado bajista, mi sistema volvió a decir que el fondo había llegado, y ignore a todos los que me decían que estaba equivocado. Tenía razón

En esta próxima cima, me mantendré fiel a mi sistema

Ver originalesEn el fondo del último mercado bajista, mi sistema volvió a decir que el fondo había llegado, y ignore a todos los que me decían que estaba equivocado. Tenía razón

En esta próxima cima, me mantendré fiel a mi sistema

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$OTHERS se está preparando para un gran movimiento en los marcos de tiempo de 5D, 1W y 2W

Como mencioné hace un tiempo, necesitábamos algo de tiempo para que ocurriera este movimiento

Creo que finalmente estamos cerca

Ver originalesComo mencioné hace un tiempo, necesitábamos algo de tiempo para que ocurriera este movimiento

Creo que finalmente estamos cerca

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

⌛ Cruce MACD de 5D

✅ Cruce DSS Bressert de 5D

✅ Cruce Stocástico RSI de 5D

✅ Ruptura y prueba de la línea de tendencia

Ver originales✅ Cruce DSS Bressert de 5D

✅ Cruce Stocástico RSI de 5D

✅ Ruptura y prueba de la línea de tendencia

- Recompensa

- 1

- 1

- Republicar

- Compartir

DEATHLESS :

:

¡Feliz Año Nuevo! 🤑$OTHERSBTC Intento de cruce MACD mensual II

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$RENDER 2W Cruce del RSI estocástico confirmado

También cerca de hacer un cruce de DSS Bressert de 2W y MACD

Se ve bien

También cerca de hacer un cruce de DSS Bressert de 2W y MACD

Se ve bien

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

✅ Cruce MACD 5D

✅ Cruce DSS Bressert 5D

✅ Cruce RSI Estocástico 5D

Ver originales✅ Cruce DSS Bressert 5D

✅ Cruce RSI Estocástico 5D

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

$MSTR podría ser una oportunidad asimétrica para los mínimos del mercado bajista

Ver originales

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Los osciladores 1M y 2M están cambiando a bajista ✍🏼

Cualquier movimiento explosivo al alza para $BTC probablemente sea el último antes de que esté listo para encontrar el próximo fondo macro ( en algún momento a finales de 2026 - principios de 2027)

Espero que las altcoins tengan un rendimiento superior durante este rally de alivio/trampa alcista ( mirando; BTC.D, USDT.D, ETHBTC, OTHERS.D) pero después de eso saldré de los mercados, esperando el próximo fondo macro

Cualquier movimiento explosivo al alza para $BTC probablemente sea el último antes de que esté listo para encontrar el próximo fondo macro ( en algún momento a finales de 2026 - principios de 2027)

Espero que las altcoins tengan un rendimiento superior durante este rally de alivio/trampa alcista ( mirando; BTC.D, USDT.D, ETHBTC, OTHERS.D) pero después de eso saldré de los mercados, esperando el próximo fondo macro

BTC-0,56%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir

Los osciladores 1M y 2M están cambiando a bajista ✍🏼

Cualquier movimiento explosivo al alza para $BTC probablemente sea el último antes de que esté listo para encontrar el próximo fondo macro ( en algún momento a finales de 2026 - principios de 2027)

Espero que las altcoins tengan un rendimiento superior durante este rally de alivio/trampa alcista ( mirando; BTC.D, USDT.D, ETHBTC, OTHERS.D) pero después de eso saldré de los mercados, esperando el próximo fondo macro

Cualquier movimiento explosivo al alza para $BTC probablemente sea el último antes de que esté listo para encontrar el próximo fondo macro ( en algún momento a finales de 2026 - principios de 2027)

Espero que las altcoins tengan un rendimiento superior durante este rally de alivio/trampa alcista ( mirando; BTC.D, USDT.D, ETHBTC, OTHERS.D) pero después de eso saldré de los mercados, esperando el próximo fondo macro

BTC-0,56%

- Recompensa

- Me gusta

- 1

- Republicar

- Compartir

GateUser-042c9272 :

:

¿La señal alcanzará un nuevo ATH?No puedo decirlo en voz alta porque el algoritmo lo esconderá

Pero algo muy específico está a punto de caer

Y debería hacernos felices

Ver originalesPero algo muy específico está a punto de caer

Y debería hacernos felices

- Recompensa

- 1

- Comentar

- Republicar

- Compartir

Cuando el DSS Bressert y el RSI Estocástico alcanzan condiciones de sobreventa y cruzan al alza simultáneamente en el marco temporal semanal

Todos confirmaron un fondo local

$BTC lo acaba de hacer de nuevo

Veamos si esto se traslada al marco temporal de 2 semanas y si estamos alcanzando un nuevo máximo histórico o un máximo más bajo

Todos confirmaron un fondo local

$BTC lo acaba de hacer de nuevo

Veamos si esto se traslada al marco temporal de 2 semanas y si estamos alcanzando un nuevo máximo histórico o un máximo más bajo

BTC-0,56%

- Recompensa

- Me gusta

- Comentar

- Republicar

- Compartir