2025 DATA Price Prediction: Expert Analysis and Future Market Outlook for Cryptocurrency Investors

Introduction: Market Position and Investment Value of DATA

Streamr (DATA) is a decentralized peer-to-peer network that tokenizes streaming data, providing a new method for people and machines to trade data on decentralized P2P networks. Since its launch in 2017, DATA has established itself as a key infrastructure for real-time data exchange and trading. As of December 2025, DATA's market cap stands at approximately $4.26 million, with a circulating supply of around 767 million tokens and a current price of $0.005557. This innovative asset, often recognized as a "data economy enabler," is playing an increasingly vital role in enabling decentralized data applications and facilitating real-time data monetization across various industries.

This article will provide a comprehensive analysis of Streamr's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Streamr (DATA) Market Analysis Report

I. DATA Price History Review and Market Status

DATA Historical Price Evolution

Based on available data, Streamr (DATA) has experienced significant price volatility since its launch in November 2017 at an initial price of $0.055:

-

2021: DATA reached its all-time high (ATH) of $0.209972 on December 3, 2021, representing a peak valuation during the cryptocurrency bull market cycle of that period.

-

2025: DATA declined to its all-time low (ATL) of $0.00513541 on December 19, 2025, marking an 87.48% decline over the past year from previous levels.

DATA Current Market Status

As of December 24, 2025, Streamr (DATA) is trading at $0.005557, with a 24-hour trading volume of $11,856.34. The token demonstrates positive short-term momentum with a +2.69% increase over the past 24 hours and a +2.7% increase in the last hour.

The current market capitalization stands at approximately $4,262,896, with a fully diluted valuation of $5,560,010. The circulating supply totals 767,121,867 DATA tokens out of a maximum supply of 2,000,000,000 tokens, representing 38.36% circulation.

Despite recent short-term gains, DATA faces headwinds with a -2.1% decline over 7 days and a -19.45% decline over 30 days, reflecting broader market pressures. The token is listed on 18 exchanges and has 5,176 unique holders.

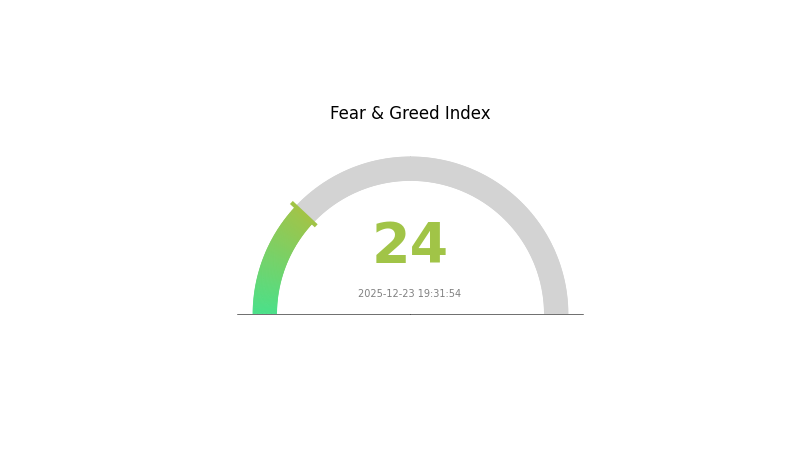

Current market sentiment indicates extreme fear with a VIX reading of 24, typical of volatile market conditions where risk-on assets face selling pressure.

Click to view current DATA market price

Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index standing at 24. This indicates intense market pessimism and heightened risk aversion among investors. During such periods, panic selling often dominates, creating significant downward pressure on digital asset prices. However, history suggests that extreme fear can present contrarian buying opportunities for experienced traders. Investors should exercise caution, conduct thorough research, and consider their risk tolerance before making investment decisions. Market volatility remains elevated, making proper position management essential in this environment.

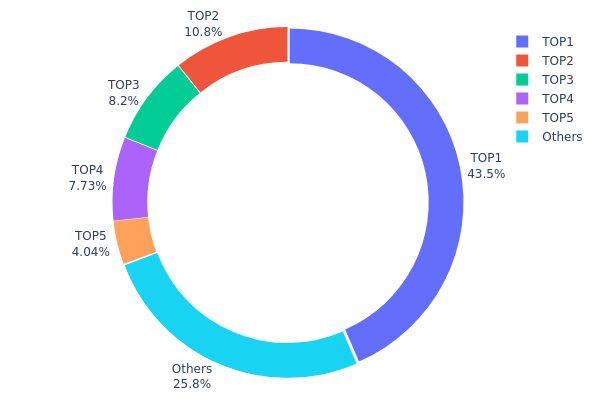

DATA Address Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network, revealing how DATA tokens are distributed among major stakeholders. This metric serves as a critical indicator for assessing market decentralization, identifying potential concentration risks, and understanding the structural dynamics of on-chain asset allocation.

Current data demonstrates a pronounced concentration pattern, with the top five addresses collectively controlling approximately 74.18% of the total token supply. The leading address (0xf977...41acec) commands 43.47% of all holdings, representing a substantial dominant position that significantly influences market dynamics. The second and third largest addresses hold 10.75% and 8.20% respectively, while addresses ranked fourth and fifth maintain 7.73% and 4.03% of the circulating supply. This hierarchical distribution indicates considerable centralization at the upper tier, with the remaining 25.82% dispersed among other market participants.

Such concentration levels present meaningful implications for market structure and potential price volatility. The overwhelming stake held by the top holder creates asymmetric information dynamics and concentrated decision-making power within the ecosystem. While the distribution of remaining tokens across the "Others" category provides some degree of decentralization, the aggregate control by major addresses remains substantial enough to warrant careful monitoring. This structural composition suggests that large-scale liquidations, strategic accumulation, or coordinated movements by principal stakeholders could materially impact price discovery mechanisms and market stability. The current configuration reflects a market structure characterized by significant wealth concentration, typical of tokens in earlier growth phases or those with substantial institutional or entity-based holdings.

Click to view current DATA Address Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 560783.65K | 43.47% |

| 2 | 0x40ec...5bbbdf | 138716.97K | 10.75% |

| 3 | 0x4235...9ce813 | 105800.72K | 8.20% |

| 4 | 0xc7aa...94c16c | 99768.69K | 7.73% |

| 5 | 0x889e...00353f | 52083.50K | 4.03% |

| - | Others | 332869.82K | 25.82% |

II. Core Factors Influencing DATA's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global monetary policy shifts significantly influence DATA's price trajectory. In expansionary monetary environments with increased liquidity, asset prices tend to rise. Conversely, tightening policies can suppress price growth. The strength of global money supply (M2 growth rates) directly affects cryptocurrency valuations.

-

Inflation Hedge Characteristics: DATA exhibits properties relevant to inflation scenarios. When inflation pressures mount, investors seek alternative stores of value, potentially driving demand for digital assets. However, in low-inflation environments, this hedge appeal diminishes.

-

Geopolitical Factors: International tensions and global economic instability can influence risk sentiment in cryptocurrency markets. During periods of heightened geopolitical risk, investors may seek alternative assets or reduce risk exposure, affecting DATA's market performance.

Supply-Demand Dynamics

-

Market Sentiment and Speculation: Supply-demand balance in cryptocurrency markets is heavily influenced by investor sentiment and speculative activity. When market risk appetite increases, traders actively pursue DATA, driving price appreciation. Conversely, risk-averse sentiment suppresses demand and prices.

-

Historical Price Patterns: Data quality and storage cost reductions historically correlate with improved valuations. As storage technology advances and per-unit costs decline, data-related assets become more economically viable, supporting long-term price appreciation.

Three、2025-2030 DATA Price Forecast

2025 Outlook

- Conservative Prediction: $0.00364 - $0.00500

- Neutral Prediction: $0.00500 - $0.00600

- Optimistic Prediction: $0.00638 (requires sustained market momentum and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with steady upward trajectory

- Price Range Forecast:

- 2026: $0.00413 - $0.00796

- 2027: $0.00411 - $0.00878

- 2028: $0.00465 - $0.01095

- Key Catalysts: Ecosystem development maturity, increased institutional adoption, growing market liquidity on major platforms like Gate.com, and positive regulatory clarity

2029-2030 Long-term Outlook

- Base Case: $0.00499 - $0.00998 (assuming steady market conditions and moderate adoption growth)

- Optimistic Case: $0.00931 - $0.01154 (assuming accelerated adoption and positive macroeconomic environment)

- Transformational Case: $0.01154+ (assuming breakthrough in technology implementation and mainstream institutional integration)

Note: Price predictions are subject to significant market volatility. Investors should conduct thorough research on Gate.com and other platforms before making investment decisions. Past performance does not guarantee future results.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00638 | 0.00559 | 0.00364 | 0 |

| 2026 | 0.00796 | 0.00598 | 0.00413 | 7 |

| 2027 | 0.00878 | 0.00697 | 0.00411 | 25 |

| 2028 | 0.01095 | 0.00788 | 0.00465 | 41 |

| 2029 | 0.00998 | 0.00941 | 0.00499 | 69 |

| 2030 | 0.01154 | 0.0097 | 0.00931 | 74 |

Streamr (DATA) Professional Investment Strategy and Risk Management Report

IV. DATA Professional Investment Strategy and Risk Management

DATA Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors, technology enthusiasts, and those believing in decentralized data economy development

- Operational Recommendations:

- Accumulate positions during market downturns, particularly during the current 87.48% yearly decline period, which may present value opportunities for long-term believers

- Set clear entry and exit targets based on your risk tolerance and investment timeline

- Reinvest any potential dividends or rewards from network participation to maximize compound returns

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price points at $0.005313 (24H low) and $0.005637 (24H high) to determine entry and exit positions

- Price Momentum Indicators: Monitor the 24-hour positive momentum of 2.69% against the 7-day negative trend of -2.1% to assess short-term market sentiment

-

Wave Trading Key Points:

- Execute buy orders near support levels and sell near resistance levels

- Consider the 30-day decline of -19.45% when planning position sizing and stop-loss levels

DATA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio

- Active Investors: 3-7% of total portfolio

- Professional Investors: 5-10% of total portfolio, depending on specific strategy implementation

(2) Risk Hedging Solutions

- Position Sizing: Limit individual positions to protect against volatility, especially given DATA's historical high of $0.209972 versus current price of $0.005557

- Diversification Strategy: Combine DATA holdings with other blockchain and decentralized network projects to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold Storage: Hardware wallets for long-term position holding and enhanced security

- Security Precautions: Enable two-factor authentication, use strong passwords, regularly verify contract addresses (0x8f693ca8d21b157107184d29d398a8d082b38b76 on Ethereum), and never share private keys

V. DATA Potential Risks and Challenges

DATA Market Risk

- High Volatility: DATA has experienced an 87.48% decline over one year, indicating extreme price fluctuation and potential for significant losses

- Low Trading Volume: Daily trading volume of $11,856.34 suggests limited liquidity, which may result in slippage during large trades

- Market Capitalization Concentration: Current market cap of approximately $4.26 million represents a small-cap token vulnerable to price manipulation and sudden value swings

DATA Regulatory Risk

- Cryptocurrency Regulatory Uncertainty: Global regulatory frameworks for decentralized data networks remain evolving and unpredictable

- Jurisdictional Compliance: Different countries may impose varying restrictions on data tokenization and trading activities

- Smart Contract Governance: Regulatory changes could affect the Ethereum-based smart contracts underlying the DATA token ecosystem

DATA Technical Risk

- Network Scalability: While Streamr claims horizontal scalability through sharding, real-world performance under high demand remains unproven

- Smart Contract Vulnerabilities: Bugs or exploits in the Ethereum smart contracts could compromise network security and token value

- Protocol Evolution: Planned upgrades to the visualization programming environment and real-time analysis engine may introduce technical challenges

VI. Conclusion and Action Recommendations

DATA Investment Value Assessment

Streamr represents a speculative investment in the emerging decentralized data economy. The project addresses a legitimate use case for tokenized data sharing on peer-to-peer networks, backed by Ethereum smart contracts for financial operations and access control. However, the 87.48% year-over-year decline, low trading volume of $11,856.34, and small market capitalization of $4.26 million indicate significant challenges in market adoption and investor confidence. The token's current price of $0.005557 is substantially below its historical high of $0.209972, suggesting either substantial overvaluation in the past or limited current utility. Potential long-term value exists if the decentralized data marketplace gains adoption among autonomous vehicles, IoT devices, and smart city applications, but this remains highly uncertain.

DATA Investment Recommendations

✅ Beginners: Allocate only 1-3% of total portfolio as a speculative research position; focus on understanding the Streamr network architecture and data marketplace concept before increasing exposure

✅ Experienced Investors: Consider strategic accumulation during extreme weakness (when annual decline accelerates further), use technical analysis tools to identify support levels, and maintain strict position sizing discipline given the extreme volatility

✅ Institutional Investors: Conduct thorough due diligence on network adoption metrics, smart contract audits, and competitive positioning within the decentralized data infrastructure sector before significant capital deployment

DATA Trading Participation Methods

- Spot Trading on Gate.com: Purchase DATA tokens directly and hold in personal wallets or exchange accounts; provides immediate market exposure and liquidity

- DCA (Dollar-Cost Averaging): Execute regular, fixed-amount purchases over extended periods to reduce timing risk and average entry price

- Network Participation: If available, engage with the Streamr network itself to earn DATA through data provisioning or validation activities, combining token acquisition with protocol participation

Cryptocurrency investments carry extremely high risk. This report does not constitute investment advice. All investors should make decisions based on their individual risk tolerance and are strongly encouraged to consult with professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What coin will be worth in 2025?

Bitcoin and Ethereum are expected to maintain strong value through 2025, supported by institutional adoption and technological upgrades. Solana and BNB also show significant growth potential driven by their expanding ecosystems and use cases.

What is the all-time high price of data coin?

The all-time high price of DATA coin is $0.305269, achieved previously. This represents the peak value the token has reached in its trading history.

What is the price prediction for crypto in 2030?

Based on historical growth patterns and market analysis, Bitcoin price prediction for 2030 is approximately $112,799.04, assuming a 5% annual growth rate. However, actual prices depend on market adoption, regulatory changes, and technological developments.

Where to Find Alpha in the 2025 Crypto Spot Market

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 CHZ Price Prediction: Will Chiliz Soar to New Heights in the Crypto Sports Market?

2025 STEEM Price Prediction: Will This Crypto Asset Reach New Heights in the Post-Halving Market?

What is the Current Holding and Fund Flow Situation for Litecoin (LTC) in 2025?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community

ADA Coin (Cardano) Là Gì? Đầu Tư Có Đáng Không? Cách Mua