2025 MLT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: MLT's Market Position and Investment Value

Media Licensing Token (MLT) is the native token of the MILC platform, a revolutionary open marketplace designed to transform the media content industry through blockchain and AI technology. Since its launch in 2021, MLT has emerged as a key utility token enabling seamless media licensing solutions. As of December 2025, MLT's market capitalization stands at $4,655,000 USD, with a circulating supply of approximately 146.4 million tokens, currently trading at $0.023275 per token. This innovative asset, recognized as a "one-click licensing solution" for the media industry, is playing an increasingly important role in streamlining media licensing, contracts, approvals, and payments within the global content distribution ecosystem.

This article will conduct a comprehensive analysis of MLT's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. MLT Price History Review and Market Overview

MLT Historical Price Evolution

-

November 2021: MLT reached its all-time high of $0.728855, marking the peak of the token's market performance since its launch in May 2021 at an initial price of $0.2004.

-

2021-2025: Following the initial launch period, MLT entered a prolonged downtrend, declining significantly from its historical peak through market cycles and broader cryptocurrency market conditions.

-

April 2025: MLT reached its all-time low of $0.00556696, reflecting sustained bearish pressure and market consolidation over the extended period.

MLT Current Market Status

As of December 24, 2025, MLT is trading at $0.023275, representing a -3.61% decline over the past 24 hours. The token's 24-hour trading range spans from a low of $0.022768 to a high of $0.036998.

MLT's market metrics reveal:

- Market Capitalization: $3,407,494.00

- Fully Diluted Valuation: $4,655,000.00

- Circulating Supply: 146,401,460.93 MLT (73.20% of total supply)

- Total Supply: 200,000,000 MLT

- 24-Hour Trading Volume: $12,939.59

- Market Rank: 1777

The token exhibits extended weakness across multiple timeframes, with declines of -11.95% over 7 days, -27.11% over 30 days, and -27.15% over the past year. The current market sentiment reflects "Extreme Fear" (VIX: 24), indicating heightened market uncertainty.

MLT maintains a market dominance of 0.00014% in the broader cryptocurrency ecosystem, with 5,074 token holders actively participating in the network.

Check the current MLT market price on Gate.com

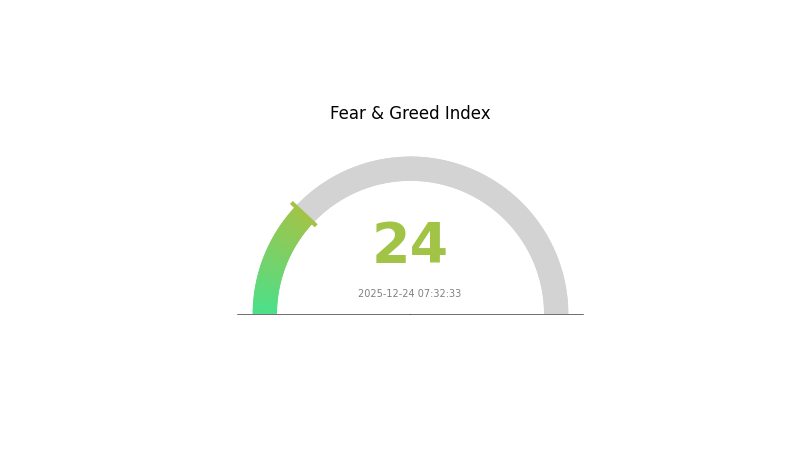

MLT Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently in extreme fear territory with an index reading of 24. This indicates heightened anxiety and pessimism among investors, suggesting significant risk aversion. During such periods, market volatility typically increases and prices may experience downward pressure. However, extreme fear historically presents buying opportunities for long-term investors. Consider reviewing your portfolio strategy and risk management on Gate.com, where you can monitor real-time market data and sentiment indicators to make informed trading decisions.

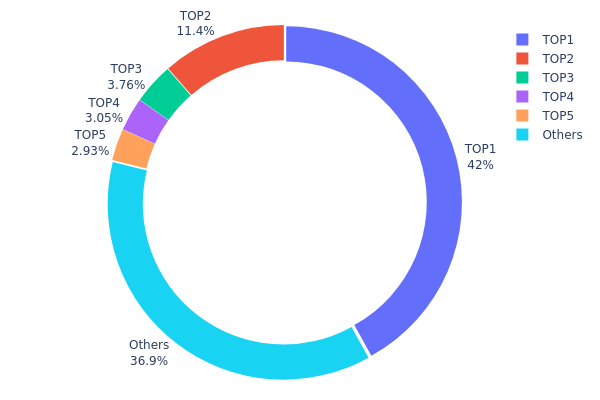

MLT Holdings Distribution

The address holdings distribution chart illustrates the concentration of MLT tokens across on-chain addresses, revealing how wealth is dispersed throughout the network. This metric serves as a critical indicator of market structure, decentralization level, and potential vulnerability to coordinated price movements or market manipulation.

MLT currently exhibits a notable degree of concentration in its top holders. The leading address controls 41.95% of total holdings, while the top two addresses collectively account for 53.37% of the circulating supply. This concentration is further reinforced by the top five addresses maintaining 63.1% of all tokens, leaving only 36.9% distributed among remaining holders. Such distribution patterns suggest a significant vulnerability to market manipulation, as a coordinated action by the top holders could substantially influence price dynamics and market sentiment.

The current holdings structure reflects a relatively centralized distribution model, which poses both opportunities and risks for the broader ecosystem. While concentration in early investors or institutional holders is common during development phases, the present levels indicate limited decentralization maturity. The dominance of a single address at approximately 42% substantially exceeds industry best-practice thresholds for healthy market decentralization. This asymmetric distribution may constrain organic price discovery mechanisms and increase the probability of sudden liquidations or strategic exits that could trigger significant volatility. For long-term ecosystem health, progressive diversification of holdings across a broader stakeholder base would be essential to enhance market resilience and reduce systemic risks associated with large-scale holder actions.

Click to view the current MLT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x533e...ff9648 | 83900.68K | 41.95% |

| 2 | 0x262f...901974 | 22855.85K | 11.42% |

| 3 | 0xd507...27714a | 7520.38K | 3.76% |

| 4 | 0x9b3d...5d7ae6 | 6099.74K | 3.04% |

| 5 | 0x9642...2f5d4e | 5861.60K | 2.93% |

| - | Others | 73761.75K | 36.9% |

II. Core Factors Affecting MLT's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: MLT's price movements are influenced by broader monetary cycles and market liquidity conditions. When monetary expansion occurs, improved market liquidity tends to support asset valuations positively.

-

Inflation Hedge Properties: As a digital asset, MLT may serve as a hedge mechanism during inflationary periods, though its effectiveness depends on broader market adoption and macroeconomic stability.

Market Sentiment and Regulatory Factors

MLT's price trajectory is shaped by market sentiment, macroeconomic trends, technological innovation, regulatory policy, and market demand dynamics. These interconnected factors create complex price discovery mechanisms where market participants aggregate information to establish equilibrium prices.

Note: The provided source materials contain limited specific information about MLT's supply mechanics, institutional holdings, enterprise adoption, specific technological upgrades, or ecosystem applications. To provide a comprehensive analysis with these additional sections, more detailed and MLT-specific documentation would be required.

Three、2025-2030 MLT Price Forecast

2025 Outlook

- Conservative Forecast: $0.01606 - $0.02328

- Neutral Forecast: $0.02328

- Optimistic Forecast: $0.03096 (requiring sustained market interest and positive fundamental developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual growth momentum building across the market cycle

- Price Range Predictions:

- 2026: $0.02440 - $0.03308

- 2027: $0.02047 - $0.04244

- Key Catalysts: Increased adoption metrics, ecosystem expansion, strategic partnerships, and overall market sentiment improvement in the digital asset space

2028-2030 Long-term Outlook

- Base Case Scenario: $0.03191 - $0.03772 (assuming steady adoption and moderate market growth)

- Optimistic Scenario: $0.03627 - $0.04244 (assuming accelerated ecosystem development and broader institutional participation)

- Transformative Scenario: $0.04964 (assuming breakthrough utility adoption, significant market expansion, and positive regulatory clarity)

- 2030-12-24: MLT reaches $0.04964 (representing 69% cumulative appreciation from 2025 baseline levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03096 | 0.02328 | 0.01606 | 0 |

| 2026 | 0.03308 | 0.02712 | 0.0244 | 16 |

| 2027 | 0.04244 | 0.0301 | 0.02047 | 29 |

| 2028 | 0.03772 | 0.03627 | 0.03192 | 55 |

| 2029 | 0.0418 | 0.03699 | 0.02553 | 58 |

| 2030 | 0.04964 | 0.0394 | 0.03191 | 69 |

Media Licensing Token (MLT) Investment Strategy & Risk Management Report

IV. MLT Professional Investment Strategy and Risk Management

MLT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Content industry enthusiasts, blockchain believers, and long-term value investors who support decentralized media licensing innovation

- Operational Recommendations:

- Dollar-cost averaging (DCA): Accumulate MLT tokens gradually over 6-12 months to reduce entry price volatility and market timing risk

- Establish core positions: Set a target allocation percentage and maintain discipline during market fluctuations

- Secure storage: Keep tokens in secure wallets and enable multi-signature protection for large holdings

(2) Active Trading Strategy

- Market Analysis Focus:

- Price Action Monitoring: Track MLT's 24-hour volume and volatility patterns against its 24H price change of -3.61%

- Support and Resistance Levels: Identify key levels using historical price data (ATH: $0.728855 on 2021-11-30, ATL: $0.00556696 on 2025-04-09)

- Trading Entry Points:

- Consider accumulation during downward trends when market sentiment weakens

- Monitor volume activity on Gate.com to confirm breakout or breakdown signals

MLT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total cryptocurrency portfolio

- Active Investors: 3-5% of total cryptocurrency portfolio

- Professional Investors: 5-8% of total cryptocurrency portfolio allocation

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance MLT holdings with other established cryptocurrencies to reduce concentration risk

- Position Sizing: Never allocate more than you can afford to lose; consider the -27.15% one-year price decline

(3) Secure Storage Solutions

- Cold Storage Solution: Store large holdings offline using hardware wallets with proper backup procedures

- Hot Wallet Security: For active trading, use reputable wallet solutions with security features including two-factor authentication

- Security Best Practices: Never share private keys, use strong passwords, enable withdrawal whitelisting, and regularly audit account activity

V. MLT Potential Risks and Challenges

MLT Market Risk

- Price Volatility: MLT has experienced significant price fluctuations, with -27.15% decline over one year and -27.11% over 30 days, indicating high volatility

- Low Trading Volume: Daily volume of $12,939.59 suggests limited liquidity, which may result in wider bid-ask spreads and difficulty executing large orders

- Market Concentration: With only 5,074 token holders and circulation ratio of 73.20%, token distribution concentration may amplify price movements

MLT Regulatory Risk

- Evolving Media Licensing Laws: As MILC platform operates across multiple jurisdictions (Germany, Switzerland, and globally), changing broadcast and content licensing regulations could impact platform operations

- Securities Classification Uncertainty: Regulatory bodies may reassess whether media licensing tokens constitute securities, affecting trading and holding restrictions

- Compliance Requirements: Different regions may impose additional KYC/AML requirements that could affect token transfers and exchange operations

MLT Technical Risk

- Platform Adoption Risk: MILC platform success depends on media industry adoption; slow uptake could diminish MLT token utility

- Smart Contract Risk: Smart contract vulnerabilities on ETH and BSC networks could pose security threats to token holders

- Integration Challenges: Success requires seamless integration with existing broadcast and VOD infrastructure, presenting technical and operational challenges

VI. Conclusion and Action Recommendations

MLT Investment Value Assessment

Media Licensing Token represents a niche play in the media and entertainment blockchain sector, backed by Welt der Wunder GmbH's 25-year broadcasting heritage. The MILC platform's vision to streamline media licensing through one-click solutions has compelling fundamentals. However, the token currently faces challenges including low trading liquidity, significant price decline (-27.15% annually), and limited mainstream media industry adoption. The project's success depends on achieving critical mass adoption among broadcasters and content platforms. Long-term value creation remains possible if MILC platform gains traction in revolutionizing media licensing, but significant execution risks and market uncertainties persist.

MLT Investment Recommendations

✅ Beginners: Start with minimal position sizing (1-2% of crypto allocation) via Gate.com; focus on understanding MILC platform fundamentals before increasing exposure; use dollar-cost averaging to reduce timing risk.

✅ Experienced Investors: Establish core positions at attractive valuations; use technical analysis to identify accumulation zones; maintain strict position management and consider rebalancing quarterly.

✅ Institutional Investors: Conduct comprehensive due diligence on MILC platform's regulatory compliance across target markets; evaluate partnership pipelines with major broadcasters; assess smart contract audit history before substantial allocation.

MLT Trading Participation Methods

- Gate.com Direct Trading: Purchase MLT using ETH or BSC networks with competitive spreads and reliable liquidity on Gate.com

- Technical Analysis Entry: Monitor resistance levels and volume patterns to identify optimal entry and exit points for active traders

- Long-term Accumulation: Implement systematic DCA programs to build positions gradually while minimizing price exposure risk

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MLT crypto?

MLT is the native cryptocurrency of the MILC Platform, designed to streamline media licensing processes. It enables secure and efficient transactions for media rights management and licensing operations.

What is the value of MLT?

The value of MLT is $0.02378 as of December 24, 2025. It has increased by 3.19% in the last 24 hours with a 24-hour trading amount of $21,216. The price is down 14.71% from its 7-day average.

What is the price prediction for MTL?

Metal (MTL) is predicted to trade between $0.3030 and $0.3654 in 2025. If it reaches the upper target, MTL could increase by 5.48% from current levels. This forecast is based on current market trend analysis.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community

ADA Coin (Cardano) Là Gì? Đầu Tư Có Đáng Không? Cách Mua