2025 TOWNS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of TOWNS

TOWNS (TOWNS) is a decentralized real-time messaging protocol built on an EVM-compatible L2 with smart contracts on Base, powering ownable, revenue-generating "Spaces" through on-chain memberships, encrypted messaging, and programmable reputation mechanisms. As of 2025, TOWNS has achieved a market capitalization of $55.11 million, with a circulating supply of approximately 2.11 billion tokens trading at around $0.005441. This innovative protocol, which integrates blockchain-based communication infrastructure with sustainable tokenomics through ETH buy-and-burn mechanisms, is playing an increasingly critical role in the decentralized messaging and community space sectors.

This article will comprehensively analyze TOWNS' price trajectory through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and actionable investment strategies.

TOWNS Market Analysis Report

I. TOWNS Price History Review and Current Market Status

TOWNS Historical Price Evolution

- August 5, 2025: Peak performance reached, TOWNS attained its all-time high of $0.06597, marking the strongest market sentiment period for the project.

- October 10, 2025: Market downturn phase, TOWNS declined to its all-time low of $0.00198, representing a significant correction from historical peaks.

- December 21, 2025: Continued bearish pressure, price descended to $0.005441, reflecting prolonged downward momentum over the year.

TOWNS Current Market Performance

As of December 21, 2025, TOWNS is trading at $0.005441, representing a -3.55% decline over the past 24 hours and a -24.75% downturn over the past 7 days. The token has experienced substantial depreciation on longer timeframes, with -32.47% over 30 days and a significant -82.72% decline over the past year, indicating sustained downward pressure since its August 2025 peak.

The token maintains a market capitalization of approximately $11.48 million based on its circulating supply of 2.11 billion TOWNS tokens. The fully diluted valuation stands at $55.11 million with a maximum supply of 15.33 billion tokens, positioning TOWNS at a #1108 ranking among cryptocurrencies. Current trading volume reached $165,136.64 in the last 24 hours across approximately 30 trading venues.

With a circulating supply ratio of 20.83% of total supply, the token exhibits significant inflationary potential as more tokens enter circulation. The project currently holds 50,531 token holders, demonstrating a distributed holder base across the protocol's ecosystem.

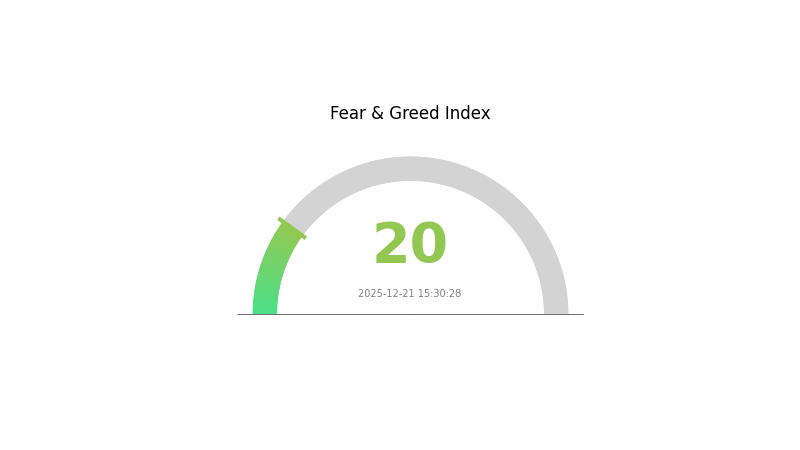

Market sentiment indicators reflect extreme fear conditions (VIX: 20), suggesting challenging broader market conditions influencing TOWNS' trading dynamics.

Visit TOWNS Market Price on Gate.com for real-time pricing information

TOWNS Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The market is currently experiencing extreme fear with the index at 20, indicating heightened panic sentiment among investors. This reading suggests significant risk aversion and potential capitulation in the market. During such periods, long-term investors often view sharp declines as buying opportunities, while risk-averse traders may prefer to stay cautious. Extreme fear typically creates a contrarian signal in markets. Monitor key support levels closely and consider your risk tolerance before making investment decisions on Gate.com or other platforms.

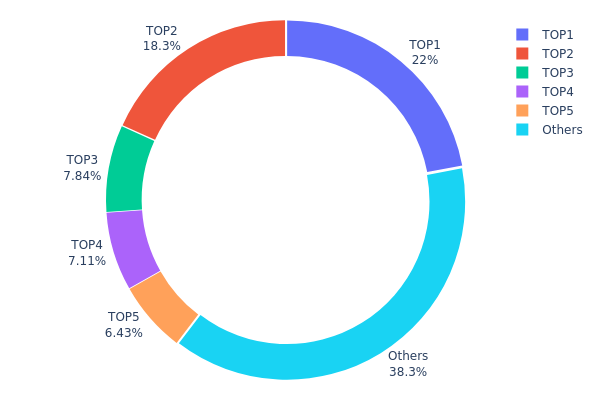

TOWNS Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, measuring the percentage of total token supply held by individual addresses or address groups. This metric serves as a critical indicator for evaluating market decentralization, identifying potential whale concentrations, and assessing the structural stability of a project's on-chain ecosystem. By analyzing the distribution pattern, investors and analysts can gauge the vulnerability of a token to price manipulation and the degree of democratic participation in the network.

The current TOWNS holdings data reveals a moderately concentrated ownership structure. The top five addresses collectively control approximately 61.63% of the total token supply, with the leading address alone commanding 22.02% of all circulating TOWNS tokens. The second and third largest holders maintain significant positions at 18.25% and 7.84% respectively, indicating a clear hierarchy in token allocation. While the remaining addresses account for 38.37% of the supply, this diffusion suggests that the majority of TOWNS holders maintain relatively smaller individual positions, which could indicate a broader distribution among retail or smaller institutional participants.

The concentration pattern observed in TOWNS presents a mixed risk profile for market dynamics. Although the top five addresses represent a substantial portion of the token supply, the majority stake is not confined to a single entity—the largest holder possesses less than one-quarter of total tokens. This distribution, while showing signs of centralization, has not reached critical concentration levels that would indicate severe vulnerability to coordinated market manipulation. The significant long tail of smaller holders provides some resilience against extreme price volatility triggered by single whale transactions, though the combined voting power of the top addresses could still influence market sentiment and price action. The current structure reflects a moderately decentralized network with room for continued distribution improvement.

Click to view current TOWNS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7c04...5b7698 | 399987.98K | 22.02% |

| 2 | 0x8ee4...6c85c0 | 331538.47K | 18.25% |

| 3 | 0xaba5...e3d47d | 142461.53K | 7.84% |

| 4 | 0xbaed...e9439f | 129144.86K | 7.10% |

| 5 | 0x1e9e...ce2ff5 | 116795.73K | 6.42% |

| - | Others | 696515.47K | 38.37% |

II. Core Factors Affecting TOWNS' Future Price

Supply Mechanism and Tokenomics

- Token Utility: TOWNS token is designed to serve as the core driving force of the Towns ecosystem. The token can be used for staking to generate rewards, unlock exclusive features, and participate in governance, making it a long-term growth driver.

Macroeconomic Environment

-

Demand Insufficiency: The primary reason for prolonged price weakness in this cycle is insufficient demand. This factor is expected to continue influencing market trends during the upcoming planning period.

-

Historical Price Performance: In August 2025, TOWNS reached its historical high of $0.06597. However, by October 2025, the price declined significantly from $0.0233 to $0.0007133, indicating substantial market volatility and correction pressure. As of October 2025, the current price stands at approximately $0.0009981, with a market capitalization of $454,135.5 and circulating supply of approximately 455 million tokens.

Note: Investment involves risks. Please conduct thorough research before making investment decisions. For real-time market data, visit Gate.com.

Three、2025-2030 TOWNS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00322-$0.00545

- Neutral Forecast: $0.00545

- Bullish Forecast: $0.00693 (requires sustained market demand and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with incremental growth momentum

- Price Range Forecast:

- 2026: $0.00600-$0.00730 (13% appreciation potential)

- 2027: $0.00519-$0.00857 (23% appreciation potential)

- 2028: $0.00651-$0.01133 (40% appreciation potential)

- Key Catalysts: Ecosystem expansion, increased adoption within the TOWNS network, market sentiment improvement, and institutional interest accumulation

2029-2030 Long-term Outlook

- Base Case: $0.00494-$0.01149 by 2029 (74% total gains from 2025 levels, assuming steady adoption and market maturation)

- Bullish Case: $0.01007-$0.01102 by 2030 (92% total gains from 2025 levels, with accelerated network growth and mainstream recognition)

- Transformational Case: $0.01149+ (contingent on breakthrough technological developments, significant partnership announcements, or major industry tailwinds)

- December 21, 2030: TOWNS trading near $0.01049 (consolidated mid-range valuation reflecting mature market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00693 | 0.00545 | 0.00322 | 0 |

| 2026 | 0.0073 | 0.00619 | 0.006 | 13 |

| 2027 | 0.00857 | 0.00675 | 0.00519 | 23 |

| 2028 | 0.01133 | 0.00766 | 0.00651 | 40 |

| 2029 | 0.01149 | 0.00949 | 0.00494 | 74 |

| 2030 | 0.01102 | 0.01049 | 0.01007 | 92 |

TOWNS Investment Strategy and Risk Management Report

IV. TOWNS Professional Investment Strategy and Risk Management

TOWNS Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Crypto enthusiasts interested in decentralized messaging and Web3 infrastructure, with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate TOWNS during market downturns, particularly when prices fall below the 30-day moving average

- Hold through market cycles to benefit from protocol adoption and ecosystem expansion

- Reinvest protocol rewards if available through node operation or governance participation

(2) Active Trading Strategy

-

Price Volatility Insights:

- TOWNS has experienced significant volatility with a 24-hour price change of -3.55% and 7-day decline of -24.75%

- Historical performance shows price peaked at $0.06597 on August 5, 2025, and currently trades at $0.005441 (December 21, 2025)

- 24-hour trading range: $0.005436 to $0.005886

-

Wave Trading Key Points:

- Monitor support levels around recent lows and resistance near the 24-hour high

- Watch for volume spikes accompanying price movements to confirm trend changes

- Consider the 30-day decline of -32.47% as context for mean reversion opportunities

TOWNS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation for experimental positions in emerging protocols

- Active Investors: 3-8% allocation to balance protocol exposure with downside protection

- Institutional Investors: Case-by-case evaluation based on protocol maturity, developer activity, and ecosystem metrics

(2) Risk Mitigation Approaches

- Diversification: Balance TOWNS holdings with established blockchain infrastructure tokens and stablecoins

- Dollar-Cost Averaging: Spread purchases over multiple time periods to reduce timing risk and average entry costs

- Position Sizing: Never exceed 10% of total crypto portfolio in any single emerging protocol

(3) Secure Storage Solutions

- Self-Custody Recommendation: Transfer TOWNS to a hardware-backed wallet for holdings beyond 6 months or amounts exceeding your active trading capital

- Exchange Storage: Gate.com provides secure custody for active traders, with insurance coverage on platform-held assets

- Security Considerations:

- Never share private keys or recovery phrases

- Enable two-factor authentication on all exchange accounts

- Use whitelist addresses for withdrawal confirmations

- Verify token contract address before transfers: 0x00000000a22c618fd6b4d7e9a335c4b96b189a38 on Base network

V. TOWNS Potential Risks and Challenges

TOWNS Market Risks

- Extreme Price Volatility: TOWNS has declined 82.72% over the past year, indicating high sensitivity to market sentiment and adoption cycles

- Limited Liquidity Depth: Trading volume of approximately $165,136 in 24 hours may result in slippage on larger orders

- Market Capitalization Concentration: At $55.1 million fully diluted valuation, TOWNS remains susceptible to concentration risk if major holders execute large exits

TOWNS Regulatory Risks

- Decentralized Protocol Uncertainty: Regulatory frameworks for messaging protocols and decentralized applications remain ambiguous across jurisdictions

- Base Network Dependencies: Regulatory changes affecting Base (Coinbase's L2 solution) could impact TOWNS protocol operations

- Compliance Evolution: Increased SEC scrutiny of decentralized finance may impose new requirements on token holders or node operators

TOWNS Technology Risks

- Protocol Maturity: As a relatively new decentralized messaging protocol, TOWNS faces execution risks in achieving scale and network effects

- Smart Contract Vulnerabilities: The protocol relies on smart contracts on Base; undiscovered vulnerabilities could affect token value and user security

- Adoption Barriers: Competition from established messaging platforms may slow user acquisition and network growth

VI. Conclusion and Action Recommendations

TOWNS Investment Value Assessment

TOWNS presents a speculative opportunity within the decentralized messaging space, built on the Base network with a focus on encrypted communications and programmable reputation systems. The protocol's innovative approach to sustainable tokenomics through ETH buy-and-burns offers differentiation, but the project remains in early stages with substantial execution risks. Current market conditions reflect investor caution, with significant year-over-year decline indicating substantial risk exposure. The project warrants monitoring for protocol development milestones, user growth metrics, and ecosystem partnerships rather than immediate large-scale investment.

TOWNS Investment Recommendations

✅ Beginners: Start with small exploratory positions (0.5-1% of crypto portfolio) on Gate.com to understand protocol mechanics without excessive capital risk. Focus on learning about decentralized messaging use cases and Base ecosystem before scaling exposure.

✅ Experienced Investors: Consider 2-5% allocation balanced with defensive positions. Implement technical analysis-based entry points during downtrends, and establish clear exit rules tied to specific risk/reward ratios or protocol development milestones.

✅ Institutional Investors: Conduct comprehensive due diligence on developer team, protocol security audits, and roadmap deliverables before any allocation. Consider small pilot programs to evaluate network adoption metrics and actual user engagement with "Spaces" functionality.

TOWNS Trading Participation Methods

- Gate.com Direct Trading: Purchase TOWNS pairs directly on Gate.com spot market using USDT, USDC, or other stablecoins for immediate exposure

- Limit Order Strategy: Set limit buy orders at support levels identified through technical analysis to accumulate at more favorable prices

- Gradual Accumulation: Use automated recurring purchases on Gate.com to implement dollar-cost averaging strategies and reduce timing risk

Cryptocurrency investing carries extreme risk. This report is educational in nature and does not constitute investment advice. All investors must conduct independent research and consult qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely. Past performance does not guarantee future results.

FAQ

Is Towns Coin a good investment?

Towns Coin shows strong potential as an investment based on current market trends and technical analysis. Projections for 2030 are optimistic, indicating promising growth opportunities. Always conduct your own research before investing.

What is the price prediction for the towns token?

The maximum price for Towns token is expected to reach $0.057531 in November 2030, with a minimum of $0.053717, accounting for market volatility and historical trends.

What factors influence TOWNS token price movements?

TOWNS token price is influenced by market demand, overall cryptocurrency market trends, trading volume, supply dynamics, regulatory announcements, and community sentiment. Network adoption and development milestones also significantly impact price movements.

ALEPH vs DOT: A Comprehensive Comparison of Two Leading Blockchain Networks

AA vs STX: A Comprehensive Comparison of Two Leading Blockchain Platforms and Their Impact on the Cryptocurrency Market

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

Analysis of GT coin price and investment prospects in 2025

Futures Là Gì? Hướng Dẫn Giao Dịch Futures Cho Người Mới

Is Web3 Dead?

Is cryptocurrency mining legal in Algeria?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is the CROSS Token? An In-Depth Guide to Crypto Gaming