2025 TRUF Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: Market Position and Investment Value of TRUF

TRUF Network (TRUF) is a leading DRP (definite reference point protocol) for economic truth backed by Coinbase and Chainlink, dedicated to powering the tokenization of Real World Assets through independent, transparent, and real-time financial data. Since its launch in April 2024, TRUF has established itself as a critical infrastructure provider in the Web3 ecosystem. As of December 2025, TRUF maintains a market capitalization of approximately $2.89 million with a circulating supply of 450.7 million tokens, currently trading at $0.006421. Known as the "economic truth protocol," TRUF is playing an increasingly vital role in enabling DeFi innovations and unlocking diverse financial markets across the blockchain landscape.

This article will comprehensively analyze TRUF's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

TRUF Network (TRUF) Market Analysis Report

I. TRUF Price History Review and Current Market Status

TRUF Historical Price Movement Trajectory

- April 2024: Project listing and market launch, with TRUF reaching its all-time high of $0.91673 on April 15, 2024.

- April 2024 to December 2025: Extended bear market phase, with significant price depreciation from the historical peak through the current period.

- December 2025: TRUF reached its all-time low of $0.006069 on December 19, 2025, representing an 87.51% decline from its all-time high.

TRUF Current Market Situation

As of December 25, 2025, TRUF is trading at $0.006421, with a 24-hour trading volume of $101,782.02. The token has experienced a modest 1.02% gain in the past 24 hours, recovering slightly from the lows reached on December 19. However, on a longer-term basis, TRUF continues to face significant headwinds, declining 0.77% over the past 7 days and 22.45% over the past 30 days.

The token's market capitalization stands at approximately $2.89 million, with a fully diluted valuation of $6.42 million. TRUF's circulating supply comprises 450.7 million tokens out of a total supply of 1 billion tokens, representing 45.07% of the maximum supply. The project currently ranks 1,894 in terms of global market capitalization, reflecting its relatively modest market presence despite being backed by prominent crypto infrastructure players Coinbase and Chainlink.

TRUF is available for trading on Gate.com and one additional exchange platform. The token operates on the ERC20 standard and is deployed across multiple blockchain networks, including Ethereum and Arbitrum, providing users with multiple chain options for transactions and custody. With 2,050 token holders, the distribution remains relatively concentrated.

Market sentiment surrounding TRUF reflects broader crypto market conditions, with elevated volatility indicators suggesting cautious investor positioning.

Check current TRUF market price

TRUF Market Sentiment Index

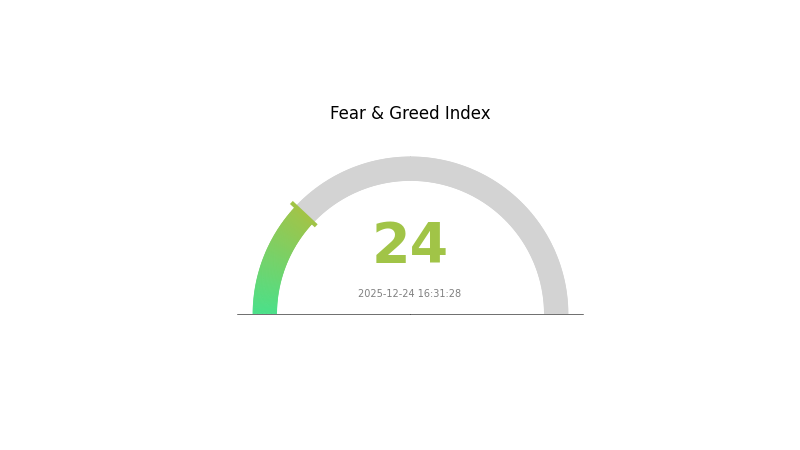

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear as the index drops to 24, signaling intense panic among investors. This sentiment reflects significant market volatility and declining confidence. During periods of extreme fear, experienced traders often view this as a potential buying opportunity, as assets may be oversold. However, caution is advised as market uncertainty remains high. Investors should conduct thorough research and risk assessment before making trading decisions. Monitor market developments closely and consider your risk tolerance when participating in this volatile environment.

TRUF Holdings Distribution

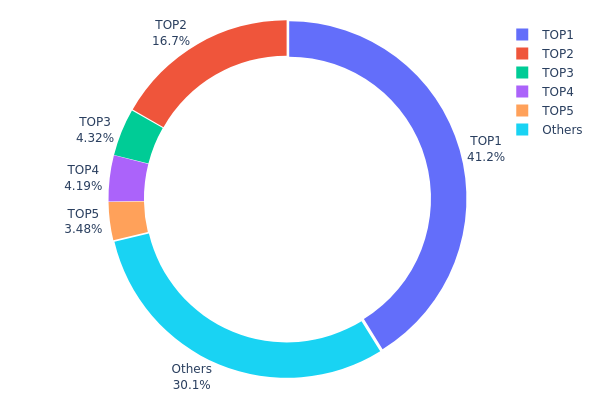

The address holdings distribution chart provides a comprehensive view of how TRUF tokens are distributed across blockchain addresses, serving as a critical indicator of token concentration risk and market structure health. By analyzing the top holders and their proportional ownership, we can assess the degree of decentralization and evaluate potential vulnerabilities to price manipulation or sudden liquidity shifts.

The current TRUF distribution reveals significant concentration concerns. The top address commands 41.16% of total holdings, while the second-largest holder controls an additional 16.74%, meaning just two addresses account for over 57% of all circulating tokens. When combined, the top five addresses hold approximately 69.87% of the token supply, leaving only 30.13% distributed among all other participants. This level of concentration substantially exceeds healthy decentralization benchmarks and indicates that decision-making power and price discovery mechanisms are heavily influenced by a small number of stakeholders.

Such pronounced concentration presents considerable risks to market stability and fair price discovery. The top holders possess sufficient capital to execute significant sell-offs that could trigger severe price volatility, or conversely, to accumulate additional tokens and influence market direction. The asymmetric distribution between the top two addresses and the remaining market participants creates an environment where large holders could potentially engage in coordinated strategies that disproportionately affect smaller investors. The relatively thin distribution among the broader market further amplifies the dependence on these major stakeholders' actions, reducing the resilience of the market structure and increasing systemic risk. To monitor TRUF's on-chain dynamics and track real-time holdings changes, visit the analytics section on Gate.com.

Click to view current TRUF holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7e3a...2780b6 | 411691.17K | 41.16% |

| 2 | 0x8d78...25d740 | 167418.80K | 16.74% |

| 3 | 0x8356...8a2cd3 | 43166.02K | 4.31% |

| 4 | 0x9052...209222 | 41853.59K | 4.18% |

| 5 | 0x653d...ca3ae2 | 34811.51K | 3.48% |

| - | Others | 301058.91K | 30.13% |

II. Core Factors Affecting TRUF's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve monetary policy directly influences liquidity flow in the market, which is closely related to cryptocurrency price trends. The stability of monetary policy can be questioned when the independence of central banks faces challenges, thereby affecting cryptocurrency valuations.

Market Dynamics and Sentiment

TRUF's future price is influenced by multiple factors including market demand, adoption levels, technology development, regulatory changes, and overall market sentiment. Due to the high volatility of cryptocurrencies, price prediction presents significant difficulty, with market trends and investor sentiment playing critical roles in price movements.

III. 2025-2030 TRUF Price Forecast

2025 Outlook

- Conservative Forecast: $0.00345 - $0.00500

- Neutral Forecast: $0.00500 - $0.00639

- Optimistic Forecast: $0.00700 - $0.00786 (requires positive market sentiment and increased adoption)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Recovery and consolidation phase with gradual momentum building, characterized by steady institutional interest and ecosystem expansion

- Price Range Forecasts:

- 2026: $0.00363 - $0.00955 (10% potential gain)

- 2027: $0.00492 - $0.01142 (29% potential gain)

- 2028: $0.00553 - $0.01215 (53% potential gain)

- Key Catalysts: Enhanced tokenomics implementation, strategic partnerships, increased utility on Gate.com and other major platforms, growing developer ecosystem participation

2029-2030 Long-term Outlook

- Base Case: $0.00716 - $0.01630 (71% potential upside by 2029, assuming steady market adoption and execution of development roadmap)

- Optimistic Case: $0.00956 - $0.01694 (112% potential upside by 2030, contingent on breakthrough technological innovations and widespread institutional adoption)

- Transformative Case: $0.02000+ (assumes market-wide bull cycle, significant protocol upgrades, and exponential user growth)

- December 25, 2025: TRUF trading near $0.00639 (consolidation phase ongoing)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00786 | 0.00639 | 0.00345 | 0 |

| 2026 | 0.00955 | 0.00713 | 0.00363 | 10 |

| 2027 | 0.01142 | 0.00834 | 0.00492 | 29 |

| 2028 | 0.01215 | 0.00988 | 0.00553 | 53 |

| 2029 | 0.0163 | 0.01102 | 0.00716 | 71 |

| 2030 | 0.01694 | 0.01366 | 0.00956 | 112 |

TRUF Network Professional Investment Strategy and Risk Management Report

IV. TRUF Professional Investment Strategy and Risk Management

TRUF Investment Methodology

(1) Long-term Holding Strategy

- Suitable for investors who believe in the long-term value of decentralized data infrastructure and real-world asset tokenization

- Operation Suggestions:

- Accumulate TRUF tokens during market downturns when prices are significantly depressed, particularly considering the token has declined 87.51% over the past year

- Hold positions through market cycles, recognizing that data infrastructure projects typically require extended development periods

- Reinvest any staking rewards or yield generated from TRUF holdings to compound returns over time

(2) Active Trading Strategy

- Market Sentiment Analysis:

- Monitor TRUF's 24-hour trading volume ($101,782) relative to market cap to identify liquidity conditions and potential entry/exit points

- Track price movements within the 24-hour range ($0.006094 to $0.007354) to identify intraday support and resistance levels

- Wave Trading Key Points:

- Identify support levels near the recent all-time low of $0.006069 as potential accumulation zones

- Consider resistance levels around historical price points when planning profit-taking strategies

TRUF Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-7% of total portfolio allocation

- Professional Investors: Up to 10% of specialized digital infrastructure portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance TRUF holdings with other established cryptocurrency positions and traditional assets to reduce concentration risk

- Position Sizing: Use dollar-cost averaging over multiple months rather than lump-sum investments to reduce the impact of short-term volatility

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for frequent trading and active management of TRUF tokens

- Cold Storage Approach: Transfer TRUF to self-custodial wallets for long-term holdings exceeding 6 months, prioritizing security over liquidity

- Security Precautions: Never share private keys, enable two-factor authentication on all exchange accounts, and regularly audit wallet activity for unauthorized access

V. TRUF Potential Risks and Challenges

TRUF Market Risk

- Extreme Price Volatility: TRUF has experienced a 99.30% decline from its all-time high of $0.91673 (April 15, 2024) to current levels, indicating severe historical volatility and potential for further significant price movements

- Limited Liquidity: With only 2,050 token holders and low 24-hour trading volume of approximately $101,782, TRUF faces significant liquidity constraints that could result in high slippage during large trades

- Circulating Supply Dilution: Only 45.07% of the total 1 billion token supply is currently in circulation, meaning substantial future dilution is likely as remaining tokens enter the market

TRUF Regulatory Risk

- Evolving Regulatory Framework: As decentralized data protocols and real-world asset tokenization remain relatively new in most jurisdictions, regulatory changes could significantly impact TRUF's operational model and token utility

- Classification Uncertainty: Regulatory clarity regarding whether TRUF should be classified as a security or utility token in major markets remains ambiguous, creating potential compliance challenges

- Compliance Requirements: Future regulatory actions could impose stricter requirements on data access, transparency, or token economics that may negatively affect TRUF's adoption and value proposition

TRUF Technology Risk

- Protocol Adoption Risk: Despite backing from Coinbase and Chainlink, widespread adoption of Truflation's DRP (Definite Reference Point) protocol remains uncertain and depends on dApp developers choosing to integrate its data infrastructure

- Data Accuracy Risk: The protocol's value depends on maintaining the integrity and accuracy of price data across 18 million tracked items; any data manipulation, oracle failures, or inaccuracies could undermine user confidence

- Smart Contract Risk: As an ERC20 token deployed on Ethereum and Arbitrum, TRUF faces potential smart contract vulnerabilities or security exploits that could result in token loss or protocol disruption

VI. Conclusion and Action Recommendations

TRUF Investment Value Assessment

Truflation represents a unique positioning in the decentralized finance ecosystem as a censorship-resistant data infrastructure provider backed by established names like Coinbase and Chainlink. The protocol's focus on enabling tokenization of real-world assets and providing independent price data addresses a genuine infrastructure need in Web3. However, investors must carefully weigh the project's significant technical merit against substantial market headwinds: the token has lost 87.51% of its value over the past year, maintains minimal trading liquidity, and faces uncertain regulatory treatment. The massive gap between the current price ($0.006421) and historical high ($0.91673) reflects either profound undervaluation or fundamental challenges yet to be resolved.

TRUF Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) through Gate.com to gain familiarity with the token and ecosystem. Use dollar-cost averaging over 3-6 months rather than attempting to time the market. Prioritize education on data infrastructure protocols and DeFi fundamentals before scaling position size.

✅ Experienced Investors: Consider building a moderate position (3-5% of crypto allocation) while using technical analysis to identify support levels near recent lows. Actively monitor development progress, partnerships, and adoption metrics. Consider hedging exposure through stablecoin holdings or complementary infrastructure tokens.

✅ Institutional Investors: Evaluate TRUF as a potential component of specialized digital infrastructure or DeFi data protocols allocations (up to 10%). Conduct deep due diligence on Truflation's technology differentiation, competitive positioning relative to Chainlink and other oracles, and long-term protocol economics.

TRUF Trading Participation Methods

- Gate.com Direct Trading: Access TRUF trading pairs on Gate.com through spot trading, where you can exchange fiat currency or other cryptocurrencies for TRUF tokens with full order book transparency

- Accumulation Through Liquidity Provision: Advanced users may participate in liquidity pools on decentralized exchanges that support TRUF trading pairs, earning yield while maintaining token exposure

- Blockchain Direct Interaction: Interact directly with smart contracts on Ethereum (0x243c9be13faba09f945ccc565547293337da0ad7) or Arbitrum (0xB59c8912c83157a955f9D715E556257F432C35D7) networks for users comfortable with technical complexity

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions carefully based on their individual risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before making investment decisions. Never invest more than you can afford to lose.

FAQ

What is the price prediction for TrueFi in 2040?

TrueFi is predicted to reach approximately $1.45 by 2040 based on current market trend analysis. This projection reflects potential long-term growth in the DeFi lending protocol sector.

What factors influence TrueFi (TRUF) price movements?

TRUF price is driven by supply and demand dynamics, blockchain updates, market sentiment, trading volume, and overall crypto market conditions. Fundamental developments and investor adoption also play key roles in price fluctuations.

What is the current market cap and trading volume of TrueFi (TRUF)?

TrueFi's market cap is $11.98 million with a 24-hour trading volume of $8.83 million. The current price stands at $0.008741, showing steady market activity in the crypto space.

How does TrueFi compare to other DeFi protocols in terms of price potential?

TrueFi offers strong price potential through its crypto lending focus. With current momentum in DeFi adoption and institutional interest, TrueFi is positioned for significant upside, potentially reaching $0.05-$0.10 by 2026 as market maturity increases.

Is Avantis (AVNT) a good investment?: Analyzing the potential risks and rewards of this diversified ETF provider

Is Soil (SOIL) a good investment?: Analyzing the potential of this agricultural cryptocurrency in the evolving digital asset landscape

2025 CFG Price Prediction: Analyzing Market Trends and Potential Growth Factors for Centrifuge Token

Is Spark (SPK) a good investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency

CBL vs SNX: Comparing Two Approaches to Decentralized Synthetic Asset Trading

2025 HDRO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is OpenSea? Complete Guide to the Leading NFT Marketplace

Comprehensive Guide to Cryptocurrency Exchange Platforms for Beginners

GM: A Social Greeting in the Crypto Community

ADA Coin (Cardano) Là Gì? Đầu Tư Có Đáng Không? Cách Mua