2025 VLR Price Prediction: Expert Analysis and Market Forecast for Valour Inc.'s Digital Asset Performance

Introduction: VLR's Market Position and Investment Value

Velora (VLR) is a cross-chain intent-centric protocol that has processed over $125 billion in trading volume, providing DeFi blue chips like Aave, Morpho, and Pendle with a secure, efficient, and scalable execution layer. As of December 2025, VLR has achieved a market capitalization of $7.9 million with a circulating supply of 1.9 billion tokens, trading at approximately $0.003951. This innovative asset is playing an increasingly critical role in the decentralized finance ecosystem through its advanced execution infrastructure.

This article will provide a comprehensive analysis of VLR's price trends and market dynamics, combining historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors through 2030.

I. VLR Price History Review and Current Market Status

VLR Historical Price Evolution Trajectory

- September 2025: VLR reached its all-time high of $0.03111, marking the peak of its initial market performance.

- December 2025: VLR declined significantly, reaching its all-time low of $0.003765 on December 18, 2025, representing an 87.89% decline from the all-time high.

VLR Current Market Status

As of December 23, 2025, VLR is trading at $0.003951, with a 24-hour trading volume of $23,658.86. The token exhibits the following market characteristics:

Price Performance:

- 1-Hour Change: -0.41%

- 24-Hour Change: +0.48%

- 7-Day Change: -8.16%

- 30-Day Change: -32.2%

- 1-Year Change: -86.33%

Market Capitalization Metrics:

- Current Market Cap: $7,506,900

- Fully Diluted Valuation: $7,902,000

- Market Dominance: 0.00024%

- Circulating Supply: 1,900,000,000 VLR (95% of total supply)

- Total Supply: 2,000,000,000 VLR

- Total Holders: 1,486

24-Hour Price Range:

- High: $0.004329

- Low: $0.003901

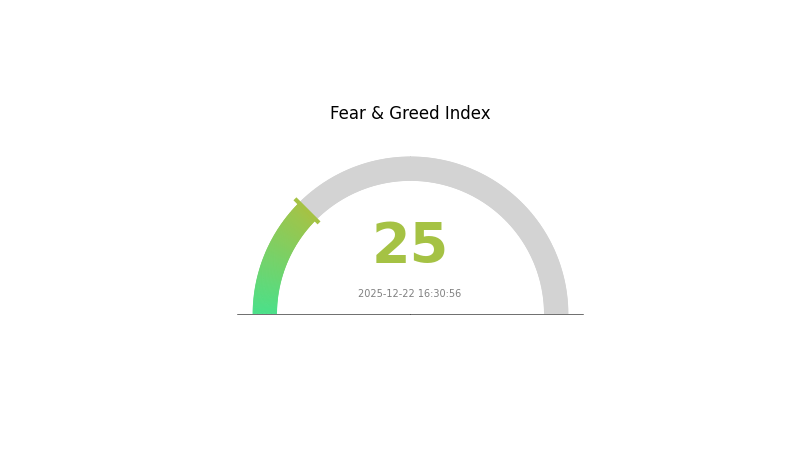

VLR demonstrates significant bearish pressure with steep declines over the medium to long-term periods. The token has experienced a -32.2% decline over the past 30 days and continues to trade well below its historical peak. Market sentiment reflects extreme fear as indicated by the current VIX reading of 25.

Click to view current VLR market price

VLR Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index dropping to 25. This significant decline reflects heightened market anxiety and risk aversion among investors. During periods of extreme fear, opportunities often emerge for contrarian investors. Market volatility typically increases, creating both challenges and potential entry points. Investors should exercise caution while considering their long-term investment strategies. Gate.com provides real-time market sentiment data to help you make informed trading decisions. Monitor the index closely as market conditions continue to evolve.

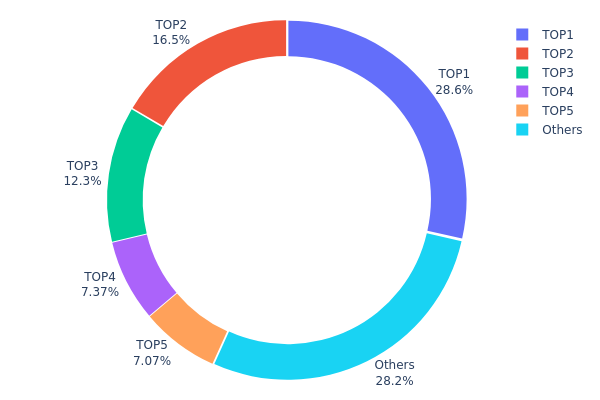

VLR Holdings Distribution

The address holdings distribution map illustrates the concentration of VLR tokens across the top wallet addresses on the blockchain. This metric provides critical insights into token ownership patterns, revealing whether the asset exhibits characteristics of decentralization or concentration risk. By analyzing the distribution of holdings among addresses, market participants can assess the potential for price manipulation, market stability, and the overall health of the token's network structure.

VLR demonstrates notable concentration characteristics in its current holder distribution. The top five addresses collectively control approximately 71.8% of all circulating tokens, with the largest address alone accounting for 28.57% of total holdings. This level of concentration is substantial, indicating that a significant portion of VLR's liquidity and market influence is concentrated among a limited number of wallet addresses. The second and third-largest holders maintain positions of 16.53% and 12.26% respectively, further amplifying concentration risk. The remaining 28.2% of tokens are distributed across a broader range of addresses, which provides some diversification but remains insufficient to offset the dominance of the top holders.

This concentrated distribution structure presents meaningful implications for VLR's market dynamics and stability. The high concentration among top addresses introduces elevated counterparty risk, as large token movements by these addresses could trigger significant price volatility or market disruption. Such centralization also raises concerns regarding potential manipulation, as coordinated actions by major holders could disproportionately influence price discovery mechanisms. Furthermore, the current distribution pattern reflects limited decentralization, suggesting that VLR's blockchain network and governance structure remain subject to influence from a narrow stakeholder base. For long-term sustainability and market confidence, the project would benefit from implementing mechanisms to promote broader token distribution and reduce reliance on large individual addresses.

Click to view current VLR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x311b...55bde7 | 571459.36K | 28.57% |

| 2 | 0xcf8c...3ffa73 | 330613.07K | 16.53% |

| 3 | 0xba12...6bf2c8 | 245236.75K | 12.26% |

| 4 | 0x3154...0f2c35 | 147401.41K | 7.37% |

| 5 | 0x7510...f2bae1 | 141496.68K | 7.07% |

| - | Others | 563792.73K | 28.2% |

II. Core Factors Influencing VLR's Future Price

Market Conditions and Investor Sentiment

VLR's future price is subject to significant fluctuations driven by various market dynamics. Key factors include:

-

Market Demand: The price of VLR may experience substantial volatility based on overall market conditions and shifts in investor demand for the token.

-

Investor Sentiment: Market participants closely monitor VLR's value to make informed decisions regarding purchasing, selling, or holding positions. Sentiment shifts can trigger rapid price movements.

-

Price Volatility: Due to market conditions, investor emotions, regulatory developments, and technological progress, VLR's value is subject to considerable price swings.

Regulatory Environment and Competitive Dynamics

-

Regulatory Developments: Changes in regulatory policies and frameworks significantly impact VLR's price trajectory. Regulatory clarity or uncertainty can substantially influence market valuations.

-

Market Competition: Competitive pressures from other cryptocurrency projects and market participants play an important role in determining VLR's future price performance.

Technological Progress

- Technology Advancement: Ongoing technological improvements and innovations contribute to the long-term value proposition of VLR, potentially supporting price appreciation over time.

III. 2025-2030 VLR Price Forecast

2025 Outlook

- Conservative Forecast: $0.0028 - $0.00394

- Base Case Forecast: $0.00394

- Optimistic Forecast: $0.00465 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with incremental price appreciation as market conditions stabilize and adoption metrics improve.

- Price Range Forecast:

- 2026: $0.00374 - $0.00541

- 2027: $0.00359 - $0.00553

- 2028: $0.00499 - $0.00613

- Key Catalysts: Increased institutional adoption, ecosystem expansion, strategic partnerships, regulatory clarity, and improved market liquidity on platforms such as Gate.com.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.0035 - $0.00601 (assumes moderate adoption growth and stable macroeconomic conditions)

- Optimistic Scenario: $0.00510 - $0.00613 (assumes accelerated platform integration and strengthened market fundamentals)

- Transformational Scenario: $0.006+ (assumes breakthrough technological advancements, mainstream institutional adoption, and favorable regulatory environment)

- December 23, 2030: VLR projected at $0.00583 average (consolidation phase with 47% cumulative gain from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00465 | 0.00394 | 0.0028 | 0 |

| 2026 | 0.00541 | 0.0043 | 0.00374 | 8 |

| 2027 | 0.00553 | 0.00485 | 0.00359 | 22 |

| 2028 | 0.00613 | 0.00519 | 0.00499 | 31 |

| 2029 | 0.006 | 0.00566 | 0.0051 | 43 |

| 2030 | 0.00601 | 0.00583 | 0.0035 | 47 |

Velora (VLR) Professional Investment Strategy and Risk Management Report

IV. VLR Professional Investment Strategy and Risk Management

VLR Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: DeFi protocol users, infrastructure investors, and those bullish on cross-chain intent-centric solutions

- Operational Recommendations:

- Accumulate VLR tokens during market downturns, leveraging current 86.33% year-over-year decline as a potential entry point

- Hold tokens through multiple market cycles to benefit from Velora's growing adoption among DeFi blue chips like Aave, Morpho, and Pendle

- Reinvest any staking rewards or protocol incentives to compound returns over time

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Volatility Metrics: Monitor the 24-hour range ($0.003901 - $0.004329) and 30-day decline of 32.2% to identify support and resistance levels

- Volume Analysis: With 24-hour volume of $23,658.86, assess liquidity conditions before executing large orders

- Trading Operation Key Points:

- Capitalize on mean reversion opportunities given the significant drawdown from all-time high of $0.03111 (reached September 17, 2025)

- Track protocol adoption metrics and DeFi blue chip integrations as fundamental drivers of VLR value appreciation

VLR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum

- Active Investors: 2-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Stablecoin Pairing Strategy: Maintain a portion of holdings in stablecoins to capture rebound opportunities without continuous exposure

- Dollar-Cost Averaging (DCA): Deploy capital in fixed intervals to reduce timing risk and average entry prices

(3) Secure Storage Solutions

- Hot Wallet Options: Gate.com Web3 wallet for active trading and frequent transactions

- Cold Storage Approach: For long-term holdings, utilize hardware wallets or secure self-custody solutions with multi-signature protection

- Security Best Practices: Enable two-factor authentication on all exchange accounts, use hardware wallet backup phrases stored securely offline, never share private keys, and verify all contract addresses before transactions

V. VLR Potential Risks and Challenges

VLR Market Risks

- Severe Price Volatility: The token has experienced an 86.33% decline over the past year and a 32.2% decline over the past month, indicating extreme price fluctuations that may not suit risk-averse investors

- Limited Trading Liquidity: With only 24-hour volume of $23,658.86 and 1 exchange listing, VLR faces significant liquidity constraints that could result in slippage on larger trades

- Reliance on DeFi Protocol Adoption: VLR's value proposition depends heavily on continued adoption by major protocols; slower-than-expected integration could negatively impact tokenomics

VLR Regulatory Risks

- Evolving Regulatory Landscape: Cross-chain protocols face increasing scrutiny from regulators regarding compliance, financial licensing, and consumer protection

- Jurisdiction-Specific Restrictions: Different countries may impose restrictions on intent-centric protocols or token trading, potentially limiting market access

- Smart Contract Regulation: Future regulatory frameworks may require additional compliance measures for decentralized execution layers

VLR Technical Risks

- Smart Contract Vulnerabilities: Despite processing over $125 billion in trading volume, undiscovered vulnerabilities could pose risks to user funds and protocol integrity

- Cross-Chain Bridge Risk: Operating across multiple blockchain networks introduces complexity and potential failure points in cross-chain messaging and settlement

- Scalability Challenges: As transaction volumes increase, the protocol must maintain security and efficiency without compromising performance

VI. Conclusion and Action Recommendations

VLR Investment Value Assessment

Velora presents a compelling but high-risk investment opportunity within the cross-chain DeFi infrastructure sector. The protocol's $125+ billion in processed volume and partnerships with blue-chip projects (Aave, Morpho, Pendle) demonstrate real adoption and utility. However, the 86.33% year-over-year decline and current market cap of $7.9 million suggest the token is significantly undervalued or faces fundamental headwinds. Investors should recognize that current pricing reflects substantial skepticism about near-term prospects, making VLR suitable only for risk-tolerant participants with conviction in the protocol's long-term vision.

VLR Investment Recommendations

✅ Beginners: Start with minimal position sizes (0.5-1% of portfolio) through Gate.com's user-friendly platform, focus on understanding the protocol's cross-chain value proposition before increasing exposure

✅ Experienced Investors: Consider tactical accumulation using dollar-cost averaging strategies during volatility, establish clear profit-taking targets at 50%, 100%, and 200% gains

✅ Institutional Investors: Conduct thorough due diligence on protocol security, team capabilities, and competitive positioning; consider larger allocations only after confirming smart contract audits and regulatory clarity

VLR Trading Participation Methods

- Spot Trading on Gate.com: Purchase VLR directly using fiat or other cryptocurrencies with transparent pricing and secure custody options

- Active Trading: Utilize Gate.com's advanced trading tools to execute swing trades based on technical levels and volume analysis

- Strategic Accumulation: Implement systematic buying programs during market weakness to build positions at favorable entry points

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors must make decisions based on their personal risk tolerance and circumstances. Consult with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

Is Velo worth investing in?

Velo shows promising potential with strong development roadmap and growing ecosystem adoption. As a utility token in the DeFi space, it offers real-world use cases. However, like all cryptocurrencies, it carries market volatility risks. Consider your investment strategy carefully before committing capital.

What is the price prediction for VLR in 2025?

Based on current market trends and a 5% annual growth rate, VLR is predicted to reach approximately $0.010001 by end of 2025. This forecast reflects moderate market expansion and increasing adoption momentum throughout the year.

What factors affect Velo (VLR) price movements?

VLR price movements are driven by technology adoption, market demand, investor sentiment, trading volume, and overall crypto market conditions. Strong fundamentals and ecosystem growth typically support bullish momentum.

What is Velo (VLR) and what is its use case?

Velo (VLR) is a blockchain protocol enabling collateral-backed digital credit issuance for efficient value transfer. VLR tokens facilitate seamless transactions on the Velo network, supporting diverse financial applications with secure and transparent settlements.

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

2025 UNCX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHESSPrice Prediction: Market Analysis and Future Trends for the CHESS Token Ecosystem

2025 EDGE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Futures Là Gì? Hướng Dẫn Giao Dịch Futures Cho Người Mới

Is Web3 Dead?

Is cryptocurrency mining legal in Algeria?

Cách Đào Bitcoin Trên Điện Thoại Hiệu Quả Và Mẹo Tối Ưu Tốc Độ Đào

What is the CROSS Token? An In-Depth Guide to Crypto Gaming