IKA: Sui’s Parallel MPC Network Star Launches on Gate.com Launchpad

IKA: Sui’s Parallel MPC Network Star Launches on Gate.com Launchpad

Ika’s branding highlights its vision as “the fastest parallel MPC network,” symbolized by a multi-armed mascot. Built on the Sui blockchain, this project aims to enable high-speed, privacy-preserving computations across Web3 applications. The crypto world is abuzz as Gate.com’s Launchpad unveils its latest token sale: Ika (IKA). Ika is a new project built on the Sui blockchain that promises to be a “parallel MPC network” – essentially a platform for ultra-fast, secure multi-party computations.

With Gate Launchpad offering early access to IKA tokens at an attractive entry price, traders and enthusiasts are eyeing this as a potential breakout opportunity. In this article, we’ll explore what Ika is all about, why it’s generating excitement, how Gate.com’s Launchpad works, and why this token sale could be one of the most interesting crypto opportunities of the season (with the proper caution, of course).

What Is Gate.com Launchpad?

For those unfamiliar, Gate Launchpad is Gate.com’s flagship platform for debuting new crypto projects via token sales. It allows everyday users to participate in early-stage token offerings – often at a fixed low price – before the tokens get listed on the open market.

This means investors can get in on the “ground floor” of promising projects. Gate.com carefully selects a limited number of projects for Launchpad, focusing on those with strong fundamentals, innovative technology, and significant growth potential.

Past Launchpad sales have seen high demand because they offer a transparent, fair way to access new tokens with all participants subject to the same price and terms. Each Launchpad event outlines exactly how many tokens are available, the purchase currency and price, the timeline, and any limits per user – ensuring clarity and fairness.

In the case of IKA, Gate.com’s Launchpad is hosting its third major project here, underlining how selective the platform is. Gate wants to ignite a token sale frenzy with IKA by showcasing a project that could be a game-changer in the crypto industry.

Launchpad participants will have the chance to obtain IKA tokens at the early-offering price of just $0.025 each, before the coin makes its market debut. This early access via a reputable exchange platform has many traders paying attention, as Launchpad tokens can sometimes see significant interest once open trading begins.

Meet Ika – The Fastest Parallel MPC Network on Sui

So what exactly is Ika, and what is MPC?

Ika is a tech-forward project aiming to build the fastest parallel Multi-Party Computation (MPC) network in the blockchain space. In simple terms, MPC technology allows multiple parties to compute data together without ever revealing their private inputs to each other. It’s like collaborating on a calculation where each participant keeps their own data secret, yet the group can still arrive at a correct result.

This is a big deal for privacy: imagine scenarios where banks want to jointly calculate an index without sharing customer data, or multiple organizations want to train an AI model on combined data sets without exposing sensitive information.

MPC makes such feats possible, and Ika is taking it a step further by optimizing it for speed and scale.

Built on the Sui blockchain, Ika leverages Sui’s high-performance architecture to achieve sub-second transaction finality and massive throughput. Sui is known as a next-generation Layer-1 blockchain designed for scalability (capable of handling thousands of transactions per second), and Ika taps into that power.

The Ika network coordinates a large number of signer nodes (the participants in the computation) in parallel, so that complex computations can be processed quickly and efficiently. The project’s goal is to hit up to 10,000 transactions per second in its MPC operations, making it perhaps the fastest solution of its kind.

By combining parallel processing with the trustless security of blockchain, Ika provides a foundation for privacy-preserving computing in Web3 that could underpin a whole new wave of applications.

Crucially, Ika’s approach means that things like data privacy and blockchain don’t have to be at odds. We could see Ika’s tech applied in decentralized finance (DeFi) for private yet verifiable transactions, in digital identity systems to prove credentials without exposing personal data, in data marketplaces where multiple sources jointly compute insights without sharing raw data, and even in gaming or social platforms for secure, multi-party interactions.

In short, Ika is positioning itself as a Web3 infrastructure project that brings advanced cryptographic computation capabilities to everyday decentralized applications.

Why Ika Is Generating Excitement

It’s not by chance that Gate.com chose Ika as the next Launchpad project. Gate’s team evaluates projects based on technological edge, real-world utility, and growth potential – and Ika checks all those boxes.

First:

The technical innovation is clear: combining MPC with a parallel, scalable network on a modern blockchain (Sui) explores an untapped frontier in crypto technology.

Second:

The breadth of potential applications for Ika’s technology is impressively broad. We’re talking about use cases across finance, data, AI, gaming, identity, and beyond.

Third:

Ika is built on Sui, a relatively new high-performance blockchain. By aligning with Sui, Ika can integrate into an ecosystem that is known for speed and low latency, and it may also ride the momentum of the growing Sui community.

Lastly:

The timing is ideal. The crypto industry in 2025 has been heavily emphasizing privacy and scalability solutions. Ika’s parallel MPC network is arriving at a moment when demand for such solutions is ramping up.

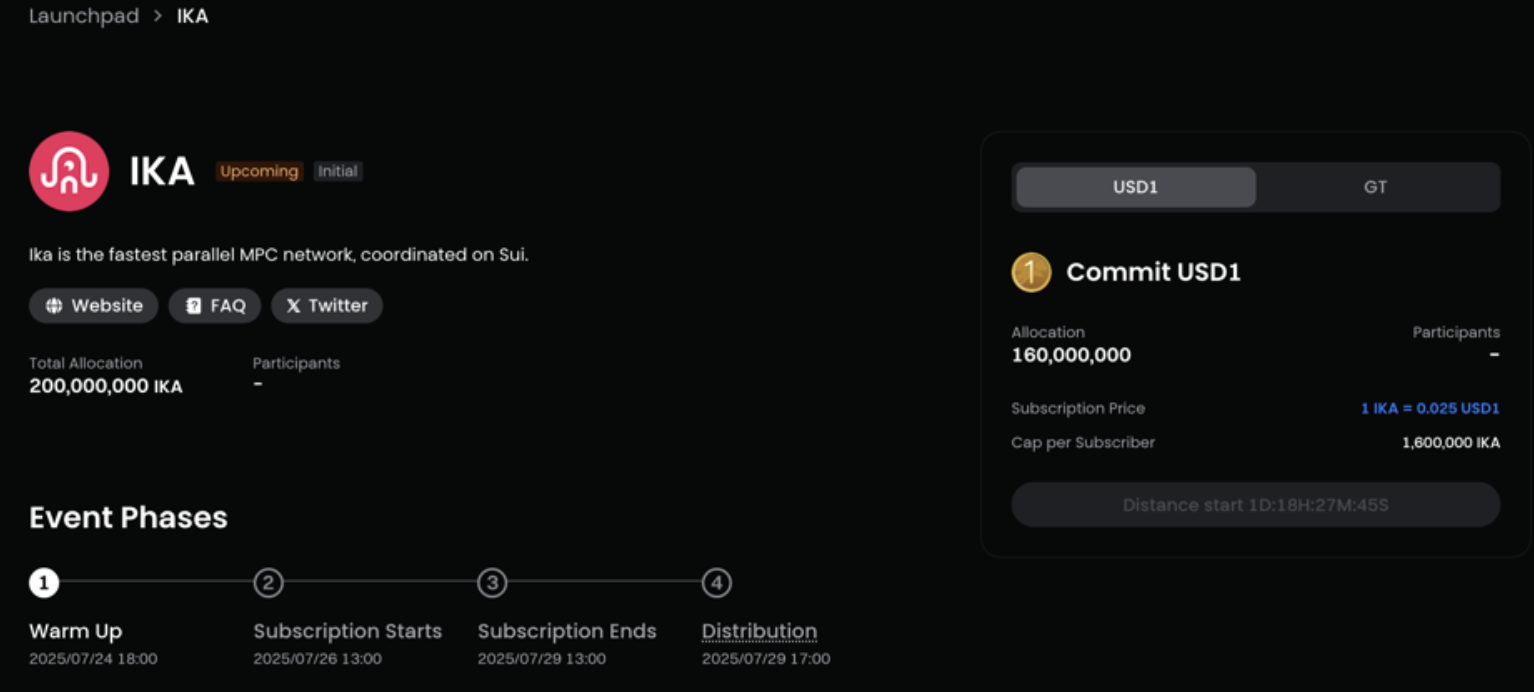

IKA Token Sale Details on Gate Launchpad

| Category | Details |

|---|---|

| Total Token Allocation | 200,000,000 IKA |

| Token Price | $0.025 USD1 |

| Subscription Currencies | USD1 (80%) and GT (20%) |

| Sale Dates | July 26–29, 2025 (13:00 UTC) |

| Warm-Up Phase | Starts July 24, 2025 |

| Individual Cap | 2,000,000 IKA per user |

| Distribution Date | July 29, 2025 (17:00 UTC) |

| Listing Time | July 29, 2025 (18:00 UTC) – IKA/USD1 pair |

| Unlock Policy | 100% unlocked at listing |

How to Participate

- Complete KYC: Verify your Gate.com account.

- Fund Wallet: Deposit USD1 or GT in your Spot Wallet.

- Subscribe: Head to Launchpad, find IKA, click “Subscribe Now.”

- Wait: Tokens will be allocated pro-rata. Refunds issued for oversubscriptions.

- Trade: 100% of your tokens will be tradable immediately post-distribution.

Short-Term Hype vs. Long-Term Vision

- Short-Term: Traders might target a price spike post-listing. IKA could open at a multiple of its $0.025 sale price.

- Long-Term: Ika offers compelling tech. Those bullish on privacy infrastructure may choose to hold and watch its adoption curve.

Some users may choose to sell part of their allocation for short-term gains and hold the rest for potential long-term value.

Conclusion and Final Thoughts

Gate.com’s Launchpad for IKA combines the appeal of cutting-edge MPC tech with a transparent, accessible token sale. Whether you’re in it for quick returns or long-term exposure to secure Web3 computation, IKA is one to watch.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Avalanche (AVAX) 2025 Price Analysis and Market Trends

Latest analysis and investment prospects for Toncoin price in June 2025

Sui Price Market Analysis and Long-term Investment Potential in 2025

Where to Find Alpha in the 2025 Crypto Spot Market

What do derivatives market signals reveal about crypto price movements: futures open interest, funding rates, and liquidation data explained

How Will Regulatory Compliance and SEC Policies Impact LUNC's Future in 2025-2026?

What is ARTY's current market cap and 24-hour trading volume in 2026?

What is a TechyPaper?

How to Analyze HBAR On-Chain Data: Active Addresses, Transaction Volume, and Whale Distribution Trends