Dogecoin Price Prediction: Whales Dump Over 1 Billion DOGE

Whale Sell-Off Pressure Intensifies

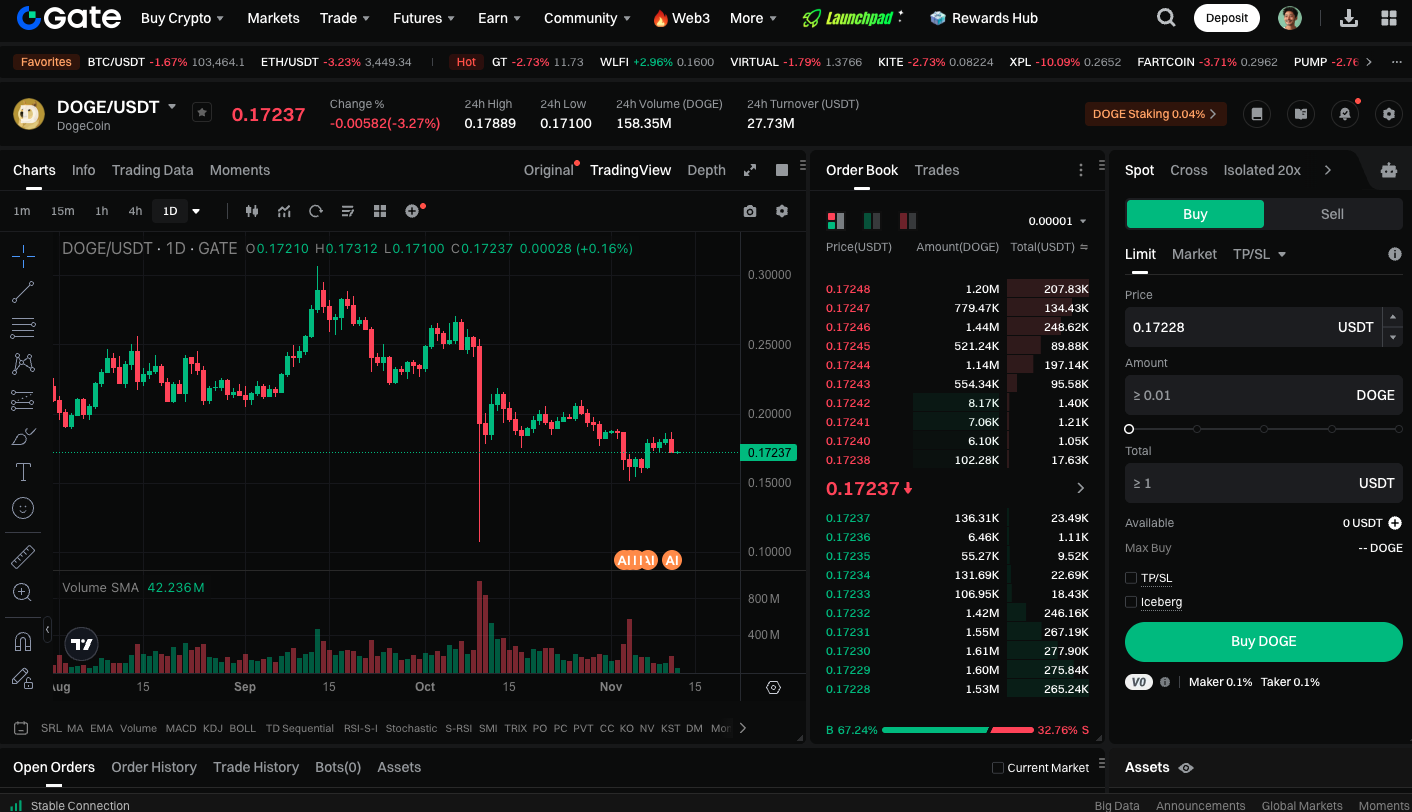

Market data shows that this round of selling has created significant resistance for DOGE, pushing its price down to $0.15 on November 4 UTC. This mirrors the pattern seen in March: repeated failed attempts to reclaim the $0.20 range, followed by a sharp decline.

Unlike previous moves driven by social media buzz or celebrity influence—such as Elon Musk’s tweets or new exchange listings—this DOGE correction is purely a result of on-chain capital flows. Major holders are exiting in unison, while retail investors continue searching for a bottom.

Multiple Indicators Signal Broad-Based Selling

According to on-chain analytics provider Santiment, the number of DOGE whale wallets has dropped notably. Simultaneously, Binance order books show significant imbalances and a spike in trading volume—clear signs of widespread selling, not just minor portfolio adjustments. The last time this occurred was before DOGE plunged from $0.26 to $0.12. If history repeats, the market could enter a short-term consolidation phase, awaiting renewed buyer interest.

Risk and Support Zone Analysis

DOGE’s current price structure shows $0.15 as the only clear support level. Should it break, the next psychological barrier will be the $0.10 mark. Technically, DOGE faces near-term downside risk; absent new capital inflows or positive catalysts, prices may continue to consolidate in this range. However, some analysts believe that after the recent whale sell-off, short-term selling pressure is easing, potentially setting the stage for a rebound—especially if retail selling tapers off and capital returns to the market.

Start DOGE spot trading now: https://www.gate.com/trade/DOGE_USDT

Summary

At press time, DOGE is quoted around $0.17—about 15% below the $0.20 high and significantly down from last month’s peak. While the short-term outlook remains uncertain, historical patterns show that Dogecoin typically enters a recovery phase after large-scale sell-offs. Investors should monitor capital inflows, as renewed momentum will determine whether DOGE can stage a rebound in the coming weeks.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution