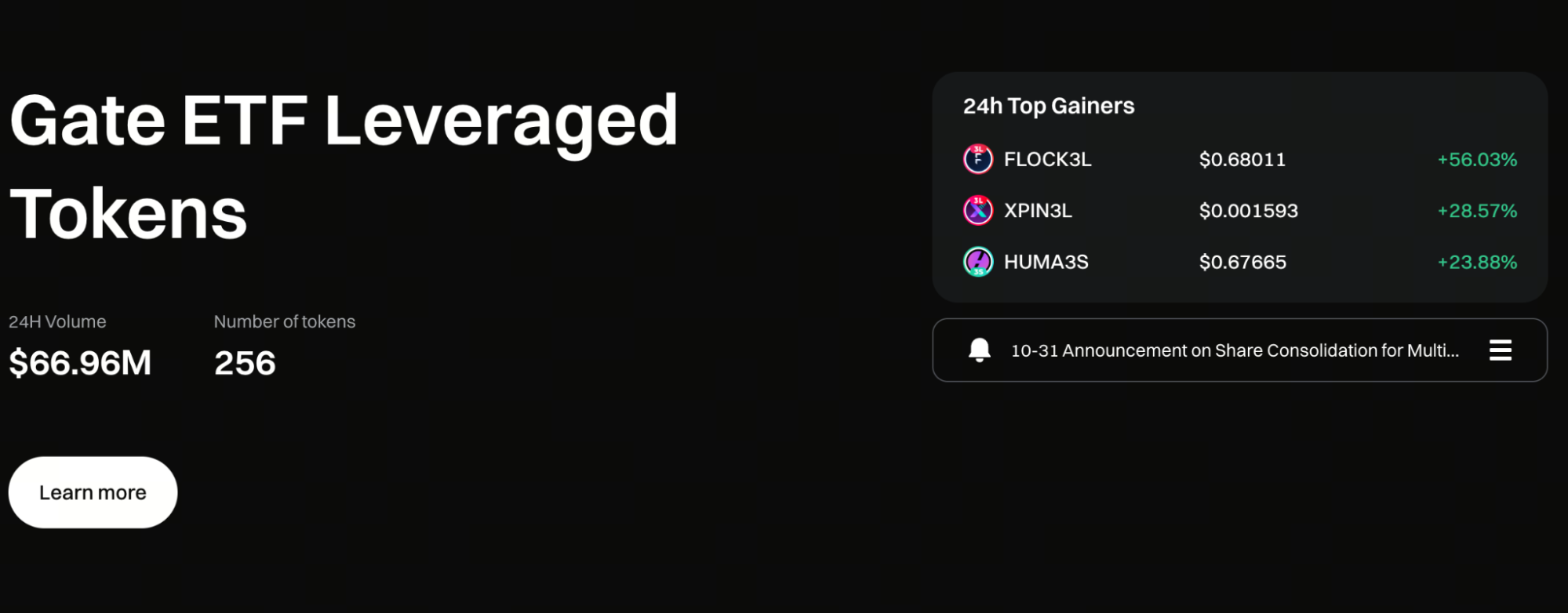

Gate ETF Leveraged Tokens Explained: An Advanced Tool for Capturing Trend Profits in Volatile Markets

Image: https://www.gate.com/leveraged-etf

What Are Gate ETF Leveraged Tokens?

Gate ETF Leveraged Tokens are financial instruments that transform leveraged trading into tokenized assets. Rather than directly participating in perpetual contracts or margin trading, users can buy and sell tokens with built-in leverage mechanisms, allowing them to capture amplified price movements indirectly.

For example, BTC3L represents a 3x long position on Bitcoin, while BTC3S represents a 3x short position on Bitcoin.

When Bitcoin experiences a strong directional move, the net asset value of the leveraged token will change by a multiple of the underlying price movement.

This design aims to preserve the benefits of leverage while reducing the operational complexity and risk barriers of traditional derivatives trading.

Core Differences Between Gate ETF Leveraged Tokens and Traditional Contracts

Traditional contract trading requires investors to monitor margin ratios, liquidation thresholds, funding rates, and manually set stop-loss orders. Gate ETF Leveraged Tokens offer a streamlined structure.

- Gate ETF Leveraged Tokens do not have forced liquidation mechanisms. Users are only at risk of losing their invested principal and will not be forcibly liquidated due to short-term volatility.

- No margin calls are required. Once purchased, both risk and return are limited to the net asset value fluctuations of the token.

- An automatic rebalancing system maintains the target leverage ratio. If market volatility causes leverage to deviate from its target range, the system will automatically adjust underlying positions to restore the intended leverage.

This structure makes ETF Leveraged Tokens function as “passively managed leverage tools” instead of contracts that require constant monitoring.

Why Do ETF Leveraged Tokens Excel in Trending Markets?

ETF Leveraged Tokens are best suited for markets with clear directional trends.

During sustained uptrends or downtrends, the net asset value of leveraged tokens amplifies daily returns. This compounding effect is their greatest advantage.

- In an uptrend: Price rises → Net asset value increases → The amplified base continues to participate in subsequent rallies

- In a downtrend (short tokens): Price drops → Net asset value rises → Downside profits keep accumulating

That’s why many short-term traders choose Gate ETF Leveraged Tokens as trend-following instruments during breakouts or when market direction is confirmed.

Key Risks and Common Pitfalls

While Gate ETF Leveraged Tokens reduce the risk of forced liquidation, they are not low-risk products.

The most common pitfall is holding the tokens for extended periods in a sideways market. Due to automatic rebalancing and management fees, repeated price fluctuations can gradually erode the net asset value—a phenomenon known as “volatility decay.”

Additionally, leverage amplifies emotional swings. Even in the absence of liquidation, sharp short-term drawdowns can impact trading psychology.

Therefore, ETF Leveraged Tokens are best suited for:

- Traders with clear market outlooks \

- Those who can tolerate higher volatility \

- Individuals with well-defined entry and exit strategies \

They are not appropriate for strategy-less, long-term holding, or emotional trading.

How to Use Gate ETF Leveraged Tokens More Effectively?

Prudent trading approaches include:

- Trade with the trend rather than frequently chasing rallies or selloffs. Entering only after a trend is established or a key breakout occurs helps maximize the advantages of leveraged tokens.

- Control position size. Even with products that lack a forced liquidation mechanism, you should avoid allocating all funds to a single leveraged token.

- Avoid long-term holding in range-bound markets. If the market lacks a clear direction, consider staying on the sidelines or switching to spot trading strategies.

Used this way, ETF Leveraged Tokens become “precision tools” rather than ordinary tokens for casual trading.

Gate ETF Leveraged Tokens in Today’s Market

As the cryptocurrency market matures, more traders are moving away from high-risk contracts to more structured and transparent leveraged products.

Gate ETF Leveraged Tokens are positioned precisely for this transition:

- Greater return flexibility than spot trading \

- Easier risk management than contracts \

- More flexibility than traditional leveraged ETFs \

They do not replace spot or contract trading, but serve as a complementary module within trend trading strategies.

Conclusion

Gate ETF Leveraged Tokens are not suitable for everyone. However, for traders who understand market trends and can harness volatility, they are highly efficient instruments.

- In clear trending markets, they help amplify the advantages of sound judgment.

- In uncertain market conditions, cautious use or temporary avoidance is recommended.

To unlock the full value of Gate ETF Leveraged Tokens, understand the product structure and respect leverage-related risks.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution