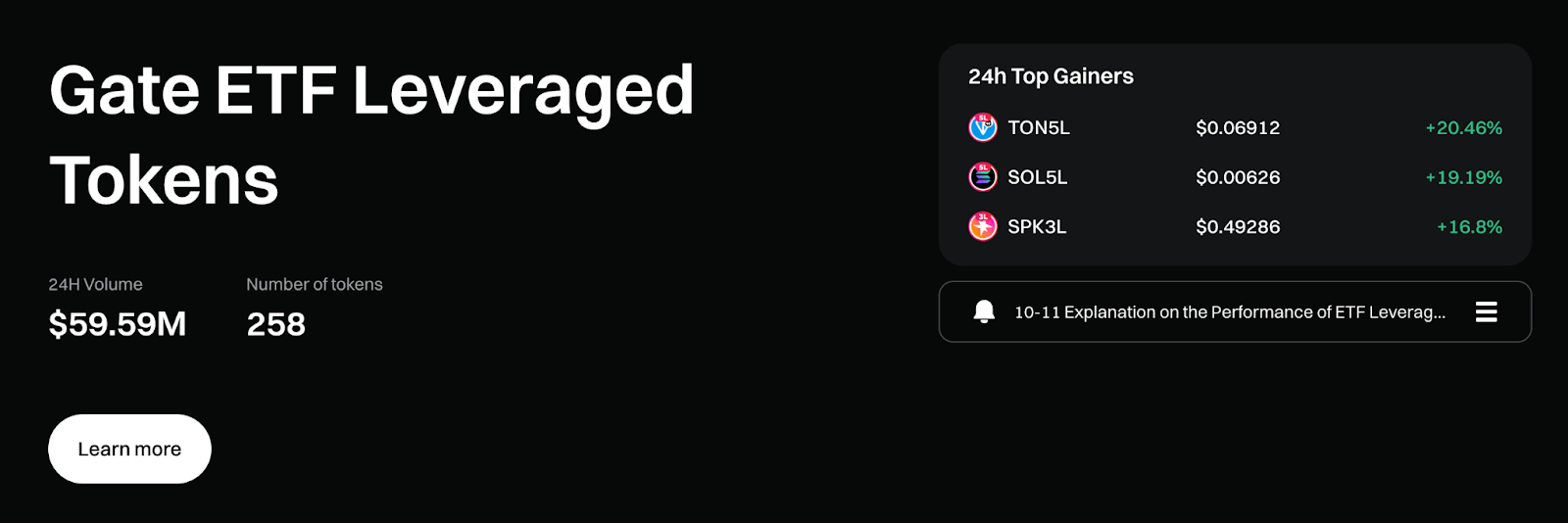

Gate Leveraged ETFs: From Passive Allocation to Active Trading Efficiency

The Role of ETFs Is Evolving

Traditionally, most investors have viewed ETFs as instruments for stability, diversification, and long-term portfolio allocation. Designed to reduce the frequency of investment decisions and smooth market volatility, ETFs were not intended to capture short-term market swings. However, as high volatility becomes the norm and market trends reverse more frequently, the conventional approach of averaging returns over time is becoming less adaptable.

Capital flows are shifting, and market participants now prioritize speed and capital efficiency. In this new landscape, ETFs are no longer just passive allocation tools. They are being reimagined as trading modules that enable direct participation in market movements.

Leveraged ETFs: Purpose-Built for Short-Term Market Cycles

Conventional ETFs were not designed for short-term trend trading. When market direction can change within hours, single exposure is often insufficient to amplify the value of accurate market calls. Leveraged ETFs were developed specifically to address this gap.

The core principle behind leveraged ETFs is to boost the impact of price movements on capital without changing the trading experience users are accustomed to. As a result, more traders now see leveraged ETFs as strategic tools that bridge the gap between spot and futures trading, balancing efficiency with accessibility.

How Do Gate Leveraged ETF Tokens Work?

Gate Leveraged ETF tokens are backed by underlying perpetual futures positions, with all structural complexity handled entirely by the system. For users, the trading experience closely mirrors that of spot trading.

Users do not need to manage margin ratios, liquidation prices, borrowing, or funding rate calculations. Instead, they can focus solely on the core questions: Is their market view correct, and when should they enter or exit?

This design lowers both the operational and psychological barriers, making leveraged strategies—once reserved for advanced traders—accessible to a broader audience.

Start trading Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

Leverage Ratios Are Continuously Managed

It’s a common misconception that the leverage ratio in leveraged ETFs is fixed. In reality, these products employ dynamic management mechanisms. Gate Leveraged ETFs use corresponding perpetual futures positions as their exposure base and automatically rebalance at set intervals.

These adjustments are seamless for users but are essential for maintaining the target leverage range over time. As a result, leveraged ETFs are not simple leverage multipliers, but continuously managed systems.

Access Leveraged Markets Without Futures Trading

For many traders, the main source of stress isn’t leverage itself, but the complex risk controls in futures trading. Leveraged ETFs don’t remove risk—they simplify risk exposure to price changes.

Volatility directly impacts the token’s net asset value, rather than triggering forced liquidations or margin calls. This allows traders to focus on trend analysis and strategy validity, rather than sudden position management issues.

Maximize Capital Efficiency in Clear Market Trends

When market direction is clear, leveraged ETFs can magnify price movements, enhancing capital efficiency over the same period. The rebalancing mechanism may also allow gains to accumulate during sustained trends. Combined with spot-like trading, leveraged ETFs often serve as a transitional tool for traders exploring leverage strategies—offering efficiency gains without requiring full immersion in the futures market.

Structural Limitations to Consider

Leveraged ETFs are not universal solutions. In sideways or choppy markets, the rebalancing mechanism can cause volatility decay, leading to actual results that may differ from intuitive expectations.

Final returns are not simply the underlying’s price movement multiplied by the leverage factor. Position adjustments, trading costs, and market volatility all affect outcomes. For this reason, leveraged ETFs are generally not recommended for long-term holding.

Why Daily Management Fees Exist

Gate Leveraged ETFs currently charge a daily management fee of 0.1%. This fee covers:

- Opening and closing futures positions, and funding rates

- Hedging and position adjustments

- Slippage and trading costs during rebalancing

This is not an added burden but an essential structure for the stable operation of leveraged ETFs—a common practice across the industry.

Leveraged ETFs: Strategic Tools, Not Passive Investments

Leveraged ETFs are not meant to replace spot allocations—they are a strategic addition to the trader’s toolkit. They are best suited for strategies with clear market outlooks, defined entry and exit plans, and a tolerance for short-term volatility, rather than buy-and-hold investing. Only by understanding their structure and appropriate use cases can users unlock the true efficiency value of leveraged ETFs.

Conclusion

Leveraged ETFs do not make trading easier—they make strategy execution more direct. They amplify both price movements and the importance of each decision. For traders who understand market dynamics and actively manage risk, Gate Leveraged ETFs are powerful tools for boosting capital efficiency. However, overlooking their cost structure and volatility characteristics can result in taking on greater risk than anticipated.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution