Gate Leveraged ETFs: When Market Speed Outgrows Allocation Thinking

ETFs: From Investment Instruments to Trading Modules

Traditionally, most investors have viewed ETFs as allocation tools designed to reduce volatility and limit the frequency of investment decisions. Their primary value lies in smoothing investment returns over time through diversification, not in capturing short-term market swings. However, this approach is increasingly at odds with the realities of today’s markets.

In an environment where high volatility is the norm and market trends can shift in moments, capital now prioritizes speed and amplified efficiency over simple long-term average returns. ETFs are no longer just portfolio stabilizers—they’re evolving into trading instruments tailored for strategy execution.

The Rise of Leveraged ETFs

The constraints of traditional ETFs stem not from the products themselves, but from their design, which doesn’t suit short-term trading. When market trends reverse in hours or even minutes, single exposure often lags behind. Leveraged ETFs address this by magnifying price movements’ impact on capital—without changing trading habits. This is why more traders now see leveraged ETFs as a strategic choice that bridges spot and derivatives trading.

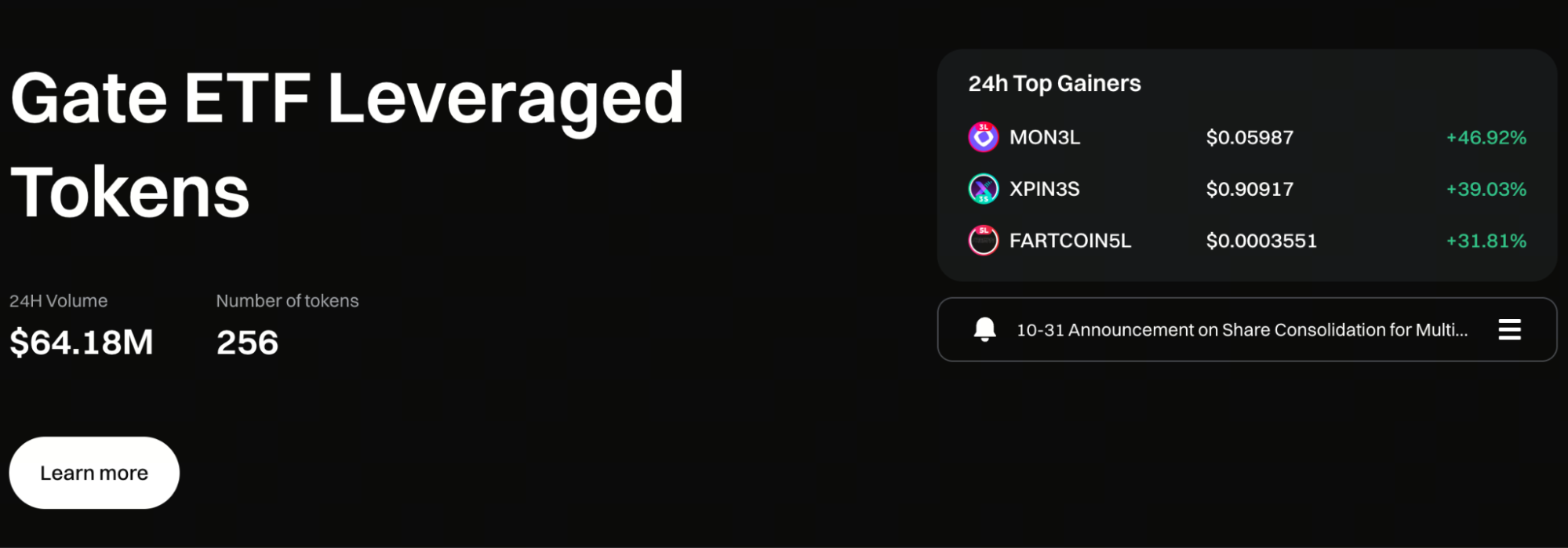

What Are Gate Leveraged ETF Tokens?

Gate Leveraged ETF Tokens are fundamentally backed by positions in perpetual contracts. However, the system fully integrates this structure, so users experience trading just like spot markets—without any operational difference.

Users never have to deal with:

- Margin requirements

- Liquidation prices

- Borrowing or funding rate calculations

All the user needs to consider is whether their market direction is correct and when to enter or exit a trade.

This design makes leveraged strategies—once reserved for advanced traders—accessible with lower psychological and operational barriers.

Start trading Gate Leveraged ETF Tokens now: https://www.gate.com/leveraged-etf

Dynamic Leverage Management

Many mistakenly believe that a leveraged ETF’s leverage ratio is fixed. In reality, these products use a dynamic adjustment mechanism that operates continuously in the background.

Gate Leveraged ETFs maintain target leverage by:

- Using perpetual contract positions for underlying exposure

- Rebalancing at set intervals

This keeps performance as close as possible to the target leverage. These adjustments are seamless for users but are essential for the product’s long-term sustainability.

Access Leveraged Markets Without Contracts

For many traders, the real barrier isn’t leverage itself but the complexity of risk management. Leveraged ETFs don’t eliminate risk—they transform how it’s presented. Price volatility is reflected directly in the token’s net asset value, not through forced liquidations or margin calls.

This lets traders focus on:

- Whether a trend is forming

- When to exit

- Whether their original strategy assumptions still hold

rather than reacting to sudden position risks.

Amplifying Efficiency in Trending Markets

In clear market trends, leveraged ETFs magnify price moves, enabling capital to work more efficiently over the same period. Thanks to the rebalancing mechanism, these products can also accumulate gains during sustained one-way moves. Combined with a trading process nearly identical to spot, leveraged ETFs have become a preferred transitional tool for traders exploring leverage.

Key Structural Limitations

Leveraged ETFs aren’t suitable for all market conditions. In choppy, trendless markets, rebalancing can cause volatility decay, leading to returns that fall short of expectations. Final performance is not simply the underlying asset’s return multiplied by the leverage factor—position adjustments, trading costs, and market swings all impact results. For this reason, leveraged ETFs are rarely used as long-term holdings.

Why Is There a Daily Management Fee?

Gate Leveraged ETFs currently charge a 0.1% daily management fee. This covers:

- Contract opening/closing and funding rates

- Hedging and position adjustments

- Slippage and trading costs during rebalancing

This fee isn’t an extra burden—it’s necessary for stable operation and is standard across the industry.

Best for Strategic Use, Not Passive Holding

Leveraged ETFs aren’t meant to replace spot investments—they’re an essential piece of the strategic trading toolbox.

They’re suitable for traders who:

- Have a clear market outlook

- Plan entries and exits

- Can accept short-term volatility in their strategies

They’re not for passive, buy-and-hold investors.

Only when users understand both the structure and the appropriate scenarios can leveraged ETFs deliver their full efficiency potential.

Conclusion

Leveraged ETFs don’t make trading easier—they make strategy execution more direct. They amplify both price movements and the importance of every decision. For traders who understand market dynamics and manage risk, leveraged ETFs are powerful tools for boosting capital efficiency. However, ignoring their costs and volatility structure can lead to risks that exceed expectations.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution