Has Bitcoin’s Value Relative to Gold Fallen by 50%? Bloomberg Analyst Warning and Market Update Explained

1. Market Background: Why Monitor the Bitcoin/Gold Value Ratio?

Bitcoin and gold have been recognized for years as reliable stores of value. Traditionally, gold is viewed as a safe haven asset, while Bitcoin is often called “digital gold,” especially when macroeconomic uncertainty or inflation expectations rise. Analyzing the Bitcoin/Gold price ratio helps investors assess shifting market preferences between risk assets and safe havens. A higher ratio signals Bitcoin outperforming gold, while a lower ratio indicates stronger market demand for gold.

2. Bloomberg Analyst’s Warning: Bitcoin May Lose 50% of Its Value Against Gold

Chart: https://www.gate.com/trade/BTC_USDT

Recent reports highlight that Bloomberg’s senior commodity strategist, Mike McGlone, sees mounting pressure on the Bitcoin/gold ratio as risk appetite wanes. He predicts Bitcoin’s value relative to gold could drop from about 20 ounces of gold per BTC to 10 ounces per BTC—suggesting a depreciation of roughly 50% is more likely than a rally. This shift doesn’t mean Bitcoin’s nominal price will collapse, but its purchasing power versus gold would fall significantly.

3. Bitcoin vs. Gold Ratio: Current Status and Historical Trends

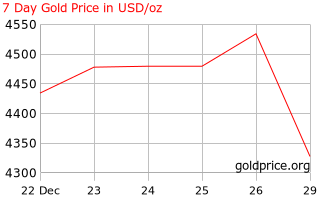

Chart: https://goldprice.org/

Recent market data shows the Bitcoin/Gold ratio has dropped sharply since late 2024. The amount of gold one BTC can buy is decreasing. This trend reflects either rising gold prices, weakening BTC, or both. Analysts suggest this ratio decline is more than a short-term fluctuation—it’s driven by increased safe haven demand and capital flowing into gold amid the macroeconomic landscape of 2025.

4. Price Reality: Comparing Recent Performance of Bitcoin and Gold

Gold has attracted steady capital inflows throughout 2025, delivering strong performance and pushing the ratio even lower. Meanwhile, Bitcoin’s nominal price remains volatile, but its value relative to gold is under pressure. Market data confirms gold’s clear outperformance versus Bitcoin in 2025, fueling risk aversion and driving more capital toward gold assets.

5. Key Risks and Opportunities for Investors

While Bloomberg’s analyst view is worth noting, it does not spell doom for Bitcoin’s prospects:

- Risk factors: A falling ratio points to growing preference for safe havens; macroeconomic weakness may amplify volatility.

- Opportunities: If the ratio strays far from its average, a rebound is possible. Corrections in gold prices or renewed BTC liquidity could trigger a reversal.

- No absolute price collapse: Even if Bitcoin drops 50% versus gold, its nominal price may remain relatively high, though competitive pressure from safe haven assets will weigh on its value.

Investors should recognize that relative value and absolute price are distinct concepts. Effective asset allocation and risk management require attention to multiple market signals.

6. Conclusion: Outlook for Bitcoin as “Digital Gold”

The competition between Bitcoin and gold is more than a numbers game—it reflects how the market perceives risk appetite and safe haven demand. While current data and analysis suggest Bitcoin faces headwinds relative to gold, this is a market trend, not an absolute verdict. For long-term holders and active traders, monitoring relative valuations and the broader macro environment remains a critical strategy.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution