How Gate GTETH Turns ETH Staking into a Flexible Asset Allocation Tool

Why Has PoS Gained Traction While Staking Adoption Lags?

After Ethereum’s transition to Proof of Stake, many expected staking to become a default strategy for ETH holders. In reality, the barriers to participation have not dropped as much as anticipated. Running a node requires technical expertise and ongoing operational costs. Once assets are staked, they become illiquid for extended periods. The yield structure is also not intuitive, so most users understand the concept but stop short of participating.

This has resulted in PoS serving as the network’s backbone, while staking remains concentrated among a handful of professionals and large capital holders—a clear disconnect from typical asset management practices.

GTETH’s Approach

GTETH is designed to eliminate the need for users to grasp the technical details of PoS. Instead, it streamlines participation. Users simply convert ETH to GTETH, and the system automatically manages node operations, yield accumulation, and distribution.

This process makes staking feel like a straightforward asset conversion, not a traditional lockup. It lowers both psychological and operational barriers, making participation more accessible and predictable.

Yield Accrual Driven by Value Growth

Unlike most staking models that require users to claim rewards periodically, GTETH employs a value-accrual structure. Daily ETH staking rewards, plus additional platform incentives, are directly reflected in GTETH’s value.

There’s no need to track distribution times or decide on reinvestment. As long as you hold GTETH, your yield accumulates automatically. All fund flows and yield sources are verifiable on-chain, simplifying the process while maintaining full transparency.

Staking Shouldn’t Mean Locking Up Your Funds

GTETH’s defining feature is its break from the traditional asset lockup model. While holding GTETH, your assets remain fully accessible. You can redeem for ETH or trade on the market at any time—no fixed unlock periods apply.

This design eliminates the trade-off between yield and liquidity. Staking becomes part of a dynamic asset allocation strategy, not a long-term, illiquid position.

Zero Lockup Means Greater Strategic Flexibility

Removing lockup restrictions does more than add convenience—it fundamentally changes asset management. As market conditions shift, you can adjust positions instantly. When new investment opportunities arise, funds are readily deployable.

This flexibility transforms GTETH from a passive yield instrument into a strategic asset that adapts to market cycles and supports diverse strategies.

Where GTETH Returns Come From

GTETH’s yield structure is transparent, with two primary sources:

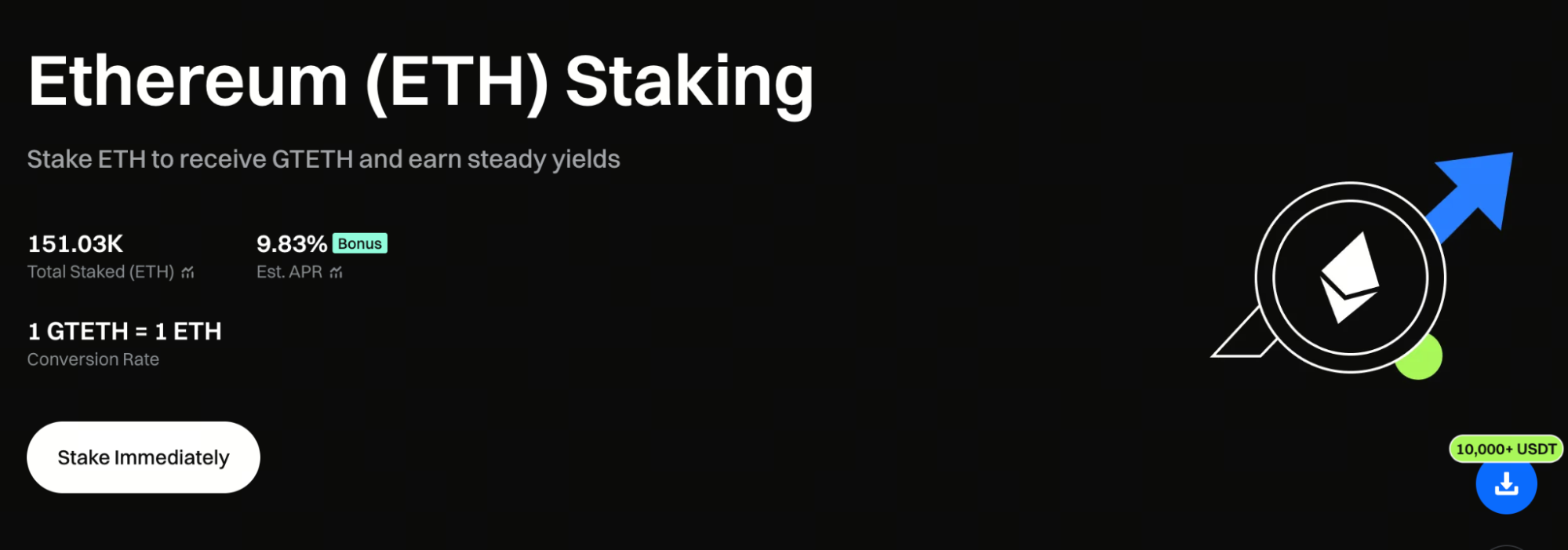

1. Staking rewards from Ethereum’s PoS mechanism, currently offering an annualized rate of about 2.83%.

2. Additional GT incentives from Gate, with an annualized rate of about 7%, further enhancing the total APR.

When you redeem ETH, both yield components are settled together and reflected in the payout—no extra steps or waiting required.

Start your on-chain mining journey today with Gate ETH staking: https://www.gate.com/staking/ETH?ch=ann46659

How Does VIP Status Impact Actual Returns?

GTETH’s fee structure features tiered reductions based on VIP status. The base rate is 6%, but higher VIP levels unlock substantial discounts that directly increase your net annualized return.

- VIP 5 – 7: 20% fee discount

- VIP 8 – 11: 40% fee discount

- VIP 12 – 14: 60% fee discount

For long-term holders, these fee differences compound over time, significantly enhancing overall returns.

How GTETH Differs from Mainstream LSTs

Most liquid staking tokens serve primarily as locked staking certificates. In contrast, GTETH functions as a practical asset management tool. It offers instant entry and exit, daily value updates, and balances both yield and liquidity for ETH allocation. Staking is no longer a single-purpose yield product—it becomes an integrated part of your broader asset management strategy.

Summary

GTETH is more than a streamlined process—it redefines the role of ETH staking in asset allocation. By removing the capital and psychological pressures of long-term lockups, it preserves the yield potential of PoS while building trust through on-chain transparency. With PoS now central to Ethereum’s operation, staking no longer needs to be a rigid, long-term commitment. It can serve as a flexible allocation tool, adapting to market trends and strategic needs. For users seeking both liquidity and stable returns, GTETH offers a solution tailored to the demands of modern Web3 asset management.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution