Interpreting Gate’s Stock Token Zone: Tracking Stock Price Movements Through Tokenized Assets

I. Gate Tokenized Stocks Section: Purpose and Design

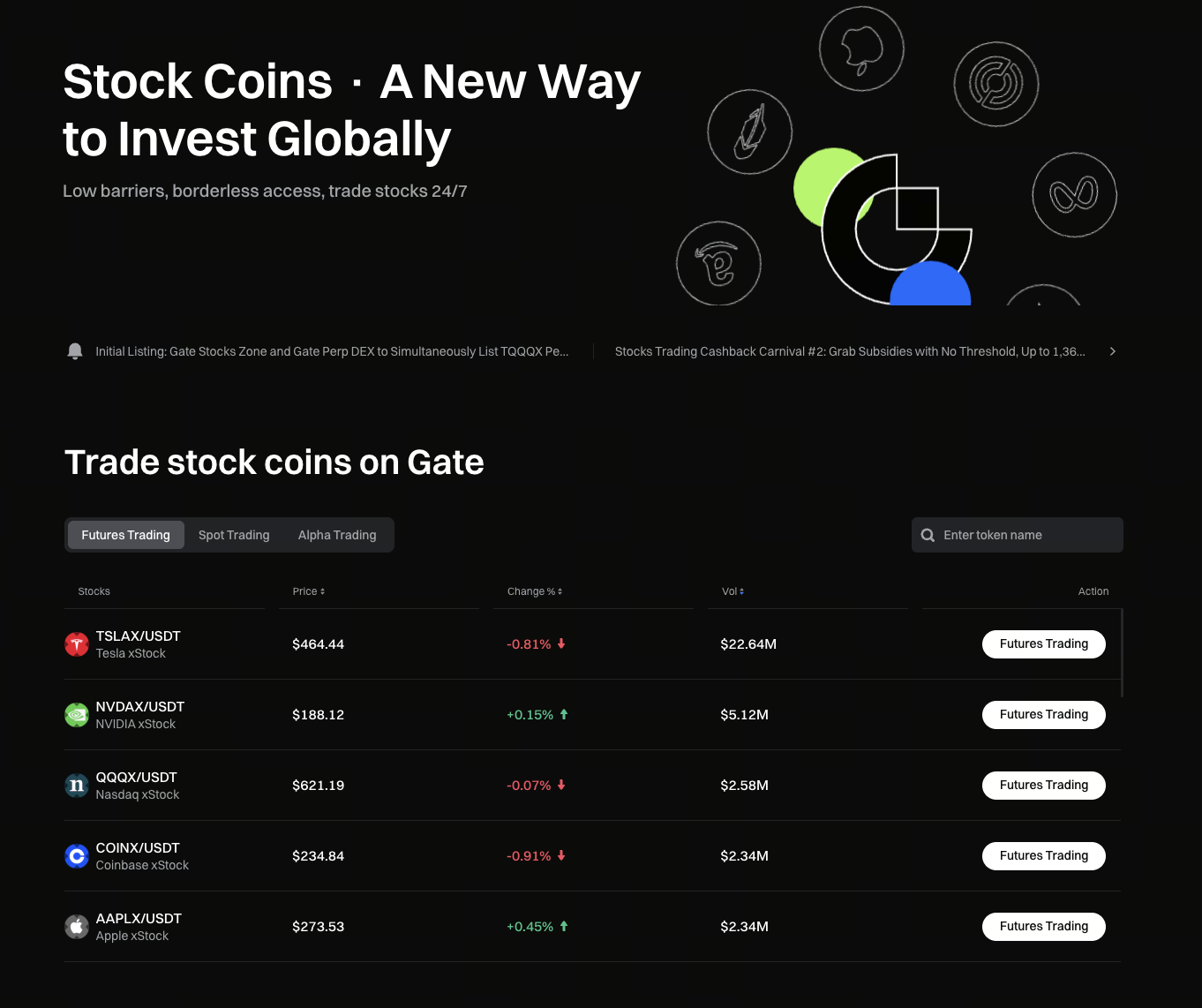

Image: https://www.gate.com/tokenized-stocks

The Gate Tokenized Stocks section was developed to give crypto asset users a streamlined way to track and engage with price movements in the traditional stock market. By tokenizing stock prices, Gate consolidates pricing data from multiple markets into a single trading environment. This integration enables users to monitor a wide range of market trends without the hassle of switching platforms.

This approach does not alter the fundamental nature of the underlying stocks. Instead, it centers on price representation. Within the Gate Tokenized Stocks section, users interact with price-mapped assets whose value changes mirror the performance of their corresponding stocks in traditional markets. As a result, this section is designed for trading and market observation, rather than conventional investment or asset holding.

II. Trading Logic and Product Features of Tokenized Stocks

The defining feature of tokenized stocks is their price linkage to specific underlying equities. As the underlying stock price fluctuates, the market price of the tokenized stock moves accordingly. However, since trading takes place within the digital asset market, tokenized stocks may sometimes display short-term price differences compared to traditional stocks, typically due to variations in market liquidity and trading activity.

Within the Gate Tokenized Stocks section, trading follows the standard logic of digital asset transactions. Users can buy or sell at their discretion, without navigating complex securities settlement procedures. This simplified trading process makes tokenized stocks easy to incorporate into daily trading routines, especially for users already accustomed to crypto market operations.

III. Practical Value of Gate Tokenized Stocks Section

In practical terms, the value of the Gate Tokenized Stocks section lies primarily in enhancing market awareness. By tracking tokenized stock price movements, users can gain direct insights into how macroeconomic events, industry developments, or shifts in market sentiment impact stock prices. This observational approach deepens understanding of volatility patterns across different asset classes.

Tokenized stocks also serve as a tool for monitoring multiple markets simultaneously. For users who want to follow both crypto assets and traditional stocks on a single platform, this section offers a centralized access point for real-time pricing. The focus is on flexible participation and quick response, rather than long-term holding or value investing.

IV. Key Considerations Before Trading Tokenized Stocks

While tokenized stocks lower the entry barrier for participation, they still carry significant price volatility risk. Tokenized stock prices are influenced not only by the performance of their underlying stocks but also by overall fluctuations in the digital asset market. During periods of heightened market sentiment, price swings can be even more pronounced.

Before engaging with the Gate Tokenized Stocks section, users should fully understand the product characteristics of tokenized stocks and avoid confusing them with actual equities. Carefully assess your personal risk tolerance and manage your trade size prudently—these are essential prerequisites for trading price-based products. Gate also advises users to exercise rational judgment and proceed with caution when trading in volatile market conditions.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution