Liquidity, the lifeblood of crypto

Liquidity defines every crypto cycle. Adoption might drive the long-term story, but it is the flow of money that moves prices. Over the past few months, that momentum of inflow has slowed down. Across all three channels through which capital enters the ecosystem, stablecoins, ETFs and digital asset treasuries (DATs), momentum has faded, leaving crypto in a self-funded phase rather than one of expansion.

While technological adoption is one thing, liquidity is what truly drives and defines every crypto cycle. It is not just about market depth but about the availability of money itself. When global money supply expands or real rates fall, that excess liquidity inevitably seeks risk, and crypto has historically, especially during the 2021 cycle, been one of the biggest beneficiaries.

In previous cycles, liquidity entered digital assets primarily through the issuance of stablecoins, the core fiat on-ramp. As the space matured, three large funnels of liquidity have come to dictate the flow of fresh capital into crypto:

- Digital Asset Treasuries (DATs), tokenized fund and yield structures bridging traditional assets and on-chain liquidity.

- Stablecoins, the on-chain representation of fiat liquidity acting as the base collateral for leverage and trading activity.

- ETFs, the traditional finance access point for passive and institutional capital seeking BTC and ETH exposure.

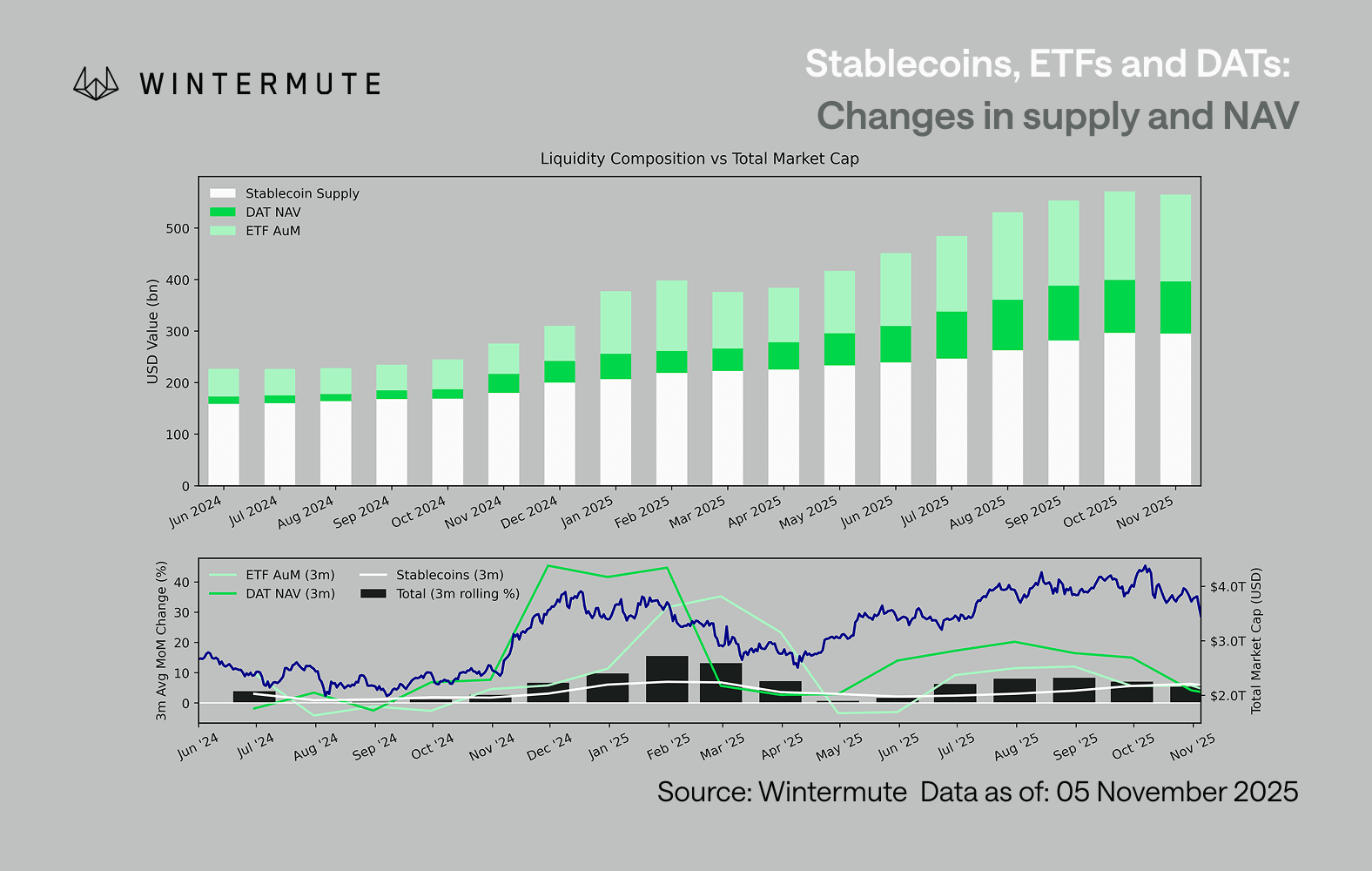

Combining ETF AUM, DAT NAV and stablecoins issued provides a reasonable proxy for total capital flowing into digital assets. The exhibit below shows how these components have evolved over the past eighteen months. The bottom panel highlights how changes in this aggregate correlate closely with total digital asset market cap, showing that when inflows accelerate, prices follow.

The key observation is that the momentum of DAT and ETF inflows has slowed materially. Both were strong through 4Q24 and 1Q25, with a brief resurgence at the start of summer, but that impulse has since faded. Liquidity (M2) is no longer finding its way into the ecosystem as naturally as it did earlier in the year. Since early 2024, combined DATs and ETFs have grown from roughly $40 billion to $270 billion, while stablecoins have doubled from ~$140 billion to ~$290 billion, showing strong structural growth but also a clear plateau.

This slowdown matters because each conduit reflects a different source of liquidity. Stablecoins track crypto-native risk appetite, DATs capture institutional yield demand, and ETFs mirror broader TradFi allocation trends. That all three are flattening signals a broad deceleration in fresh capital deployment, not simply rotation between products. Liquidity has not disappeared, it is just recycling within the system instead of expanding it.

Looking outside of crypto to the wider economy, it’s not like liquidity (M2) is flatlining either. While high SOFR rates create some short-term constraint by keeping cash yields attractive and liquidity parked in T-bills, we’re still in a global easing cycle, with QT now officially over in the U.S. The structural backdrop remains supportive, it’s just that, for now, liquidity is choosing other expressions of risk like the equity markets With fewer external inflows, market dynamics have become increasingly insular. Capital rotates between majors and alt sectors rather than entering net new, creating this PVP scenario. That explains why rallies have been short-lived and why breadth has narrowed, even as total AUM holds steady. Volatility spikes are now largely driven by liquidation cascades rather than sustained trend formation.

Looking ahead, a meaningful revival in any of these liquidity channels, renewed stablecoin minting, fresh ETF creations, or a pickup in DAT issuance, would signal that macro liquidity is once again finding its way back into digital assets. Until then, crypto remains in a self-funded phase, where capital is circulating, not compounding.

Disclaimer:

- This article is reprinted from [wintermute]. All copyrights belong to the original author [Jasper De Maere]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?