Practical Strategies for Trading Gate Leveraged ETF Tokens: Improving Capital Efficiency in Trend Markets

Why Are Gate ETF Leveraged Tokens Considered “Efficiency Tools”?

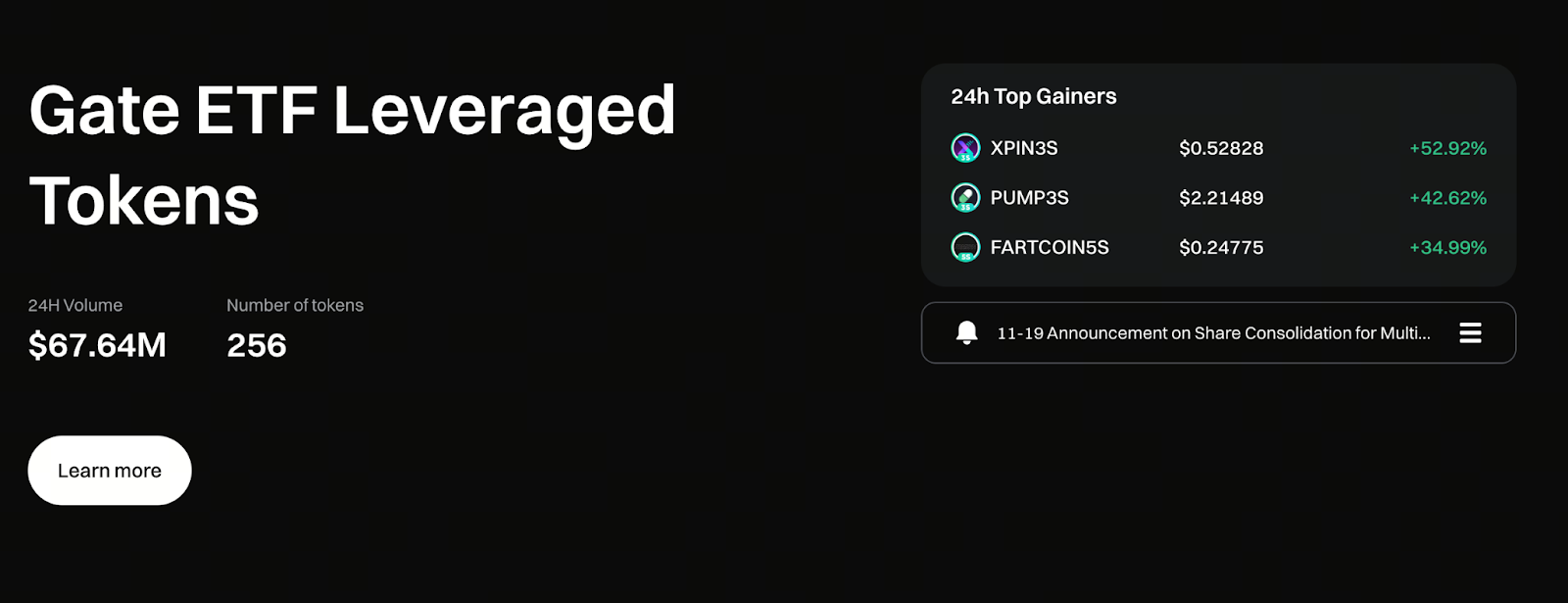

Image: https://www.gate.com/leveraged-etf

In the crypto market, trading outcomes hinge on two key factors: making the right directional call and maximizing capital efficiency.

The core value of Gate ETF Leveraged Tokens lies not in their “thrill,” but in boosting capital efficiency during trending markets. Compared to spot trading, they amplify returns from market moves. Compared to futures contracts, they dramatically reduce operational complexity and psychological stress.

As a result, they have become the preferred tool for many traders when a trend takes shape.

The Logic Behind Gate ETF Leveraged Tokens Is Exceptionally Simple

Unlike complex derivatives, Gate ETF Leveraged Tokens operate with clear and straightforward logic:

- Identify market direction

- Choose the corresponding long or short token

- Buy and sell at the appropriate times

No margin requirements, no liquidation thresholds, no position calculations. All risk and reward are directly reflected in the token’s net asset value.

This “what you see is what you get” structure lets traders focus on market trends rather than the intricacies of the instrument itself.

Which Real-World Scenarios Are Best for Using Gate ETF Leveraged Tokens?

1. When a Trend Has Just Formed or Been Confirmed

When prices break out and market direction becomes clear, the efficiency advantage of ETF Leveraged Tokens comes into play. At this stage, using leverage to capture trend gains offers a clear edge over simply holding spot positions.

2. Medium- to Short-Term Swing Trading

ETF Leveraged Tokens are ideally suited for trading cycles of one day to one week. This timeframe allows you to benefit from market trends while avoiding the net asset value decay associated with long-term holding.

3. When Market Sentiment Is Clearly One-Sided

When market sentiment is obviously bullish or bearish and trading volume supports the move, ETF Leveraged Tokens can directly amplify these shifts in sentiment.

Why Are ETF Leveraged Tokens More “User-Friendly”?

Many traders lose money trading futures—not because their market calls are wrong, but because of:

- Forced liquidations

- Excessive leverage

- High psychological pressure leading to premature exits

Gate ETF Leveraged Tokens address these issues by:

- Eliminating forced liquidations

- Maintaining fixed leverage ratios

- Reflecting risk through net asset value, not forced liquidation events

This results in smoother trading and makes it easier to stick to your original strategy.

Mindset Matters More Than Technique When Using Gate ETF Leveraged Tokens

While ETF Leveraged Tokens lower the operational barrier, they are not meant for indiscriminate use.

The following mindsets are essential for effective trading:

- Embrace the volatility that comes with leverage

- Avoid emotional decisions after short-term drawdowns

- Do not treat ETF Leveraged Tokens as long-term investments

Think of them as “tactical tools,” not as part of your long-term asset allocation. This distinction is key to using them effectively.

Common Pitfalls to Avoid

Frequent mistakes in trading include:

- Repeatedly entering and exiting during sideways markets

- Holding positions too long without monitoring trend changes

- Allocating all capital to a single leveraged token

- Assuming no forced liquidation means no risk

These behaviors can undermine the advantages that ETF Leveraged Tokens offer.

The Role of Gate ETF Leveraged Tokens Within a Trading System

In a mature trading system, Gate ETF Leveraged Tokens are best positioned as:

- Trend amplifiers

- Swing trading instruments

- Short-term capital efficiency solutions

They are not intended as the core of a long-term portfolio. When combined with spot holdings and other strategies, they help achieve more stable overall performance.

Why “Knowing How to Use” Is More Important Than “Daring to Use”

Gate ETF Leveraged Tokens are not a rarity—the real differentiator is how you use them. Understanding their structure, respecting their limits, and acting only in suitable market conditions matter far more than trading frequently.

Only when a tool is used appropriately does it deliver maximum value.

Conclusion

Gate ETF Leveraged Tokens are not designed for speculation. They’re a tool to help traders boost efficiency in trending markets. When the market direction is clear, they help turn sound judgments into profits faster. When conditions aren’t right, exercising restraint is a sign of maturity.

Understand the product and manage your pace—only then can ETF Leveraged Tokens truly become an asset to your trading.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution