XRP Price Prediction: Five Catalysts Could Drive Price to 5 Dollars by 2026

XRP Faces Market Correction Pressure

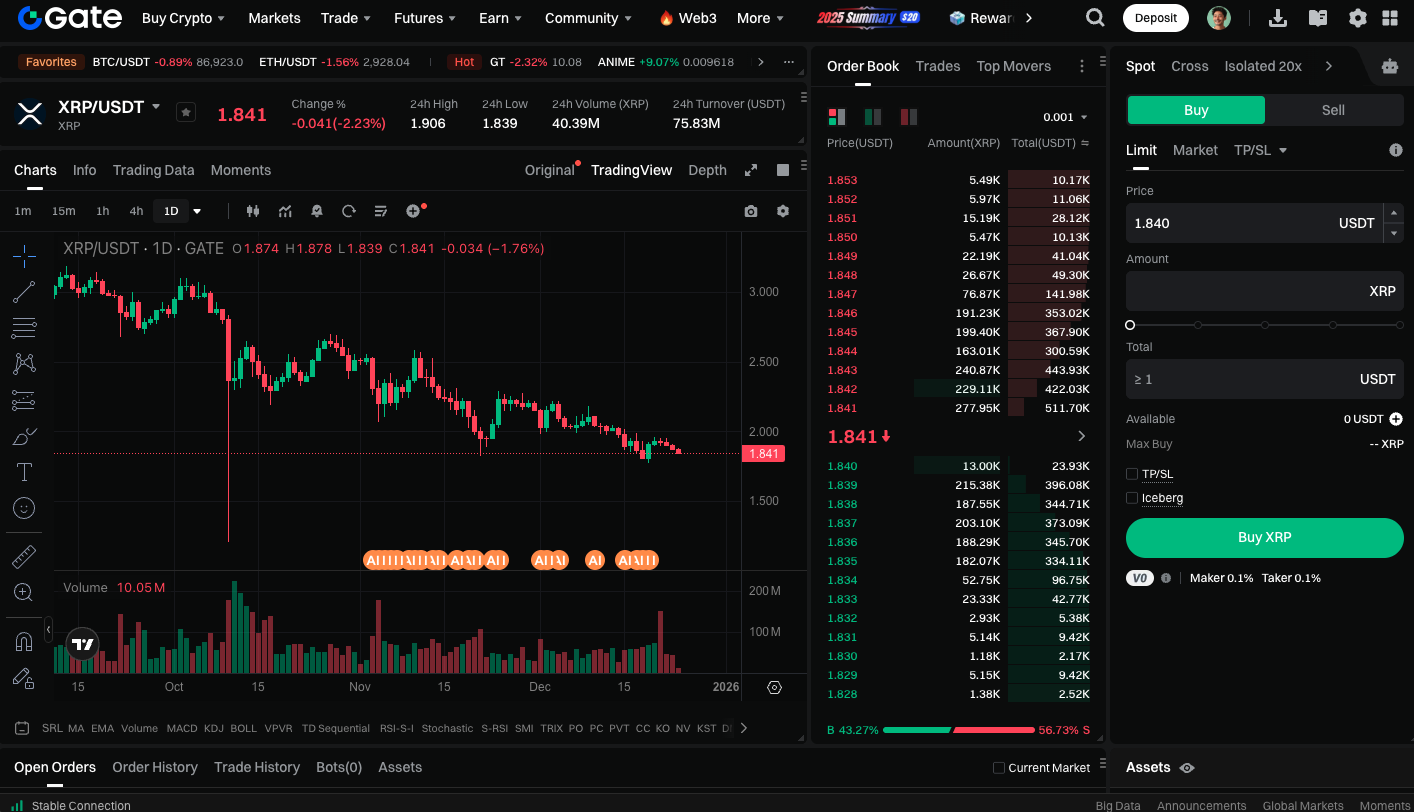

XRP, currently the fifth-largest cryptocurrency by market capitalization, has seen its price drop below the critical $2 threshold since the overall market pullback in October last year, dampening investor sentiment. Despite these challenges, market analyst Sam Daodu identifies five key catalysts that could propel XRP to test its all-time high of $5 in 2026.

Five Major Catalysts for Growth

1. BlackRock-Backed XRP ETF

Daodu highlights the BlackRock-backed XRP exchange-traded fund (ETF) as one of the most significant drivers. Since mid-November 2025, the spot XRP ETF has attracted over $1 billion in capital inflows. Should BlackRock advance its ETF initiative, inflows could exceed $2 billion. This surge would substantially boost market demand and reinforce XRP’s status as the only fully compliant token in the United States.

2. Expansion in the Japanese Market

Ripple, in partnership with SBI Holdings, plans to launch the USD stablecoin RLUSD (pending regulatory approval) in Japan during the first quarter of 2026. The integration of RLUSD on the XRP Ledger (XRPL) is expected to steadily increase demand for XRP as a bridge currency, supporting its price trajectory toward $5.

3. Asset Tokenization

Ripple’s collaboration with Archax aims to bring hundreds of millions of dollars’ worth of tokenized stocks, bonds, and funds onto the XRP Ledger, with completion targeted before mid-2026. If XRPL captures even 5–10% of the tokenized asset settlement market, demand for XRP could rise sharply.

4. Supportive Macroeconomic Policies

Anticipated Federal Reserve rate cuts are expected to reduce returns on cash and short-term bonds, encouraging capital to flow into higher-yielding, more liquid risk assets. XRP stands to benefit from this capital shift, providing additional price support.

5. Declining On-Chain Supply

Recent on-chain data indicates a sharp reduction in XRP held on exchanges, with balances dropping by approximately 1.35 billion tokens in less than two months. This trend shows investors are moving XRP into long-term storage. The resulting supply contraction is expected to further support upward price movement.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Summary

Daodu stresses that XRP’s path to $5 will require a combination of ETF inflows, institutional adoption, and favorable macroeconomic conditions—not just a single event. Currently, XRP trades around $1.84, nearly 50% below its record high from July this year, but its long-term potential remains strong.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution