XRP Price Prediction: XRP ETF Debut 2593 Million USD Short Term Support at 2 USD

Bitwise XRP ETF: First-Day Trading Highlights

The Bitwise XRP ETF traded 1,127,647 shares on its inaugural day, with a total turnover of approximately $25.93 million. Despite launching amid one of the year’s most volatile market sessions, these results demonstrate a stable debut for the ETF. However, trading volume was considerably lower than Canary’s XRPC ETF, which reached $58.5 million on its first day.

Market Crash Impact on ETF Debut

The Bitwise XRP ETF listing coincided with a major market selloff. On that day, the S&P 500 lost roughly $1.5 trillion in value. Bitcoin briefly plunged to $87,000. This caused widespread forced liquidations in the derivatives market. Total crypto market capitalization also dropped below $2.95 trillion, putting intense pressure on all altcoins—including XRP, which fell below $2 within hours of the ETF’s launch.

XRP Maintains Multi-Month Downtrend

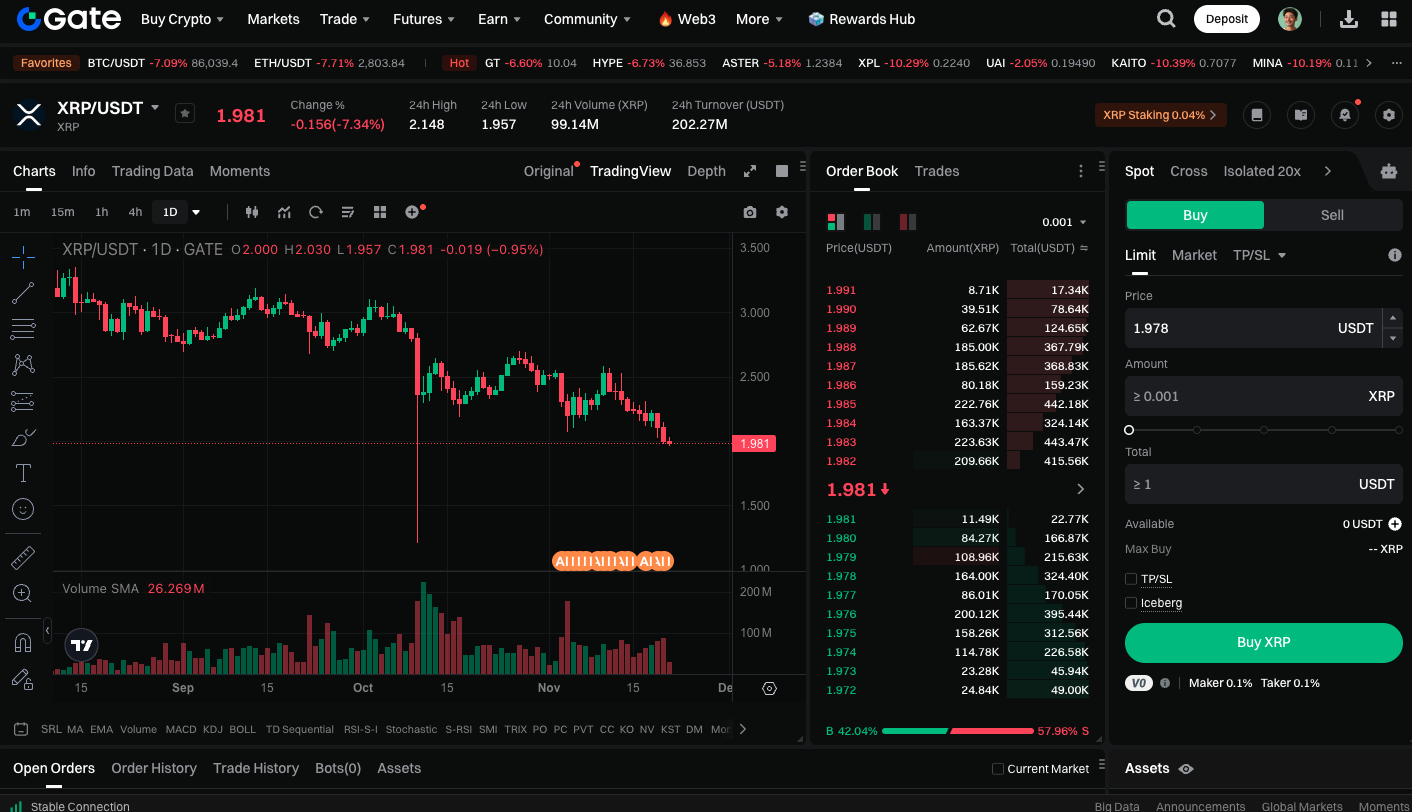

XRP has remained weak in recent weeks, with the latest market crash pushing it into a critical risk zone. Analysts observed that XRP is entering a multi-month decline similar to late 2020, potentially leading to a steep correction.

According to weekly charts, bearish divergence continues to persist. The daily Relative Strength Index (RSI) has dropped below previous lows, invalidating a potential short-term bullish divergence. XRP also closed below the $2.25 support area, increasing the likelihood of further downside.

Short-Term Support and Price Outlook

Analysts regard $2 as XRP’s critical short-term support. A daily close below this threshold could trigger a test of $1.80, and if selling pressure intensifies, the price may drop to $1.60. Investors should monitor liquidity recovery and ETF trading activity to assess XRP’s potential rebound or continued downward trend.

Trade XRP spot instantly at: https://www.gate.com/trade/XRP_USDT

Summary

Investors should view the Bitwise XRP ETF’s debut volume in light of extreme market volatility. Trading performance could improve in the coming sessions. XRP is approaching a pivotal support level and experiencing elevated short-term volatility. Monitor the $2 support level and apply robust risk management.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Pi Coin Transaction Guide: How to Transfer to Gate.com

What is N2: An AI-Driven Layer 2 Solution