Zcash: A Hedge Against BTC?

The following is an excerpt from @ MessariCrypto‘s “The Crypto Theses 2026.” You can find the full report here:

https://messari.io/report/the-crypto-theses-2026

Among all the cryptoassets outside BTC and ETH, ZEC’s monetary perception shifted the most significantly in 2025. For years, ZEC sat outside the cryptomoney hierarchy, viewed as a niche privacy coin rather than a monetary asset. However, as concerns surrounding surveillance and the institutionalization of Bitcoin accelerated, privacy resurfaced as a core monetary property, rather than a niche ideological preference.

Bitcoin has proven that non-sovereign digital money can function at a global scale, but it failed to preserve the privacy that we have become accustomed to using physical cash. Every transaction is broadcast on a transparent public ledger that anyone with a block explorer can monitor. It is a bitter irony that a tool designed to subvert the state inadvertently created a financial panopticon.

Zcash combines Bitcoin’s monetary policy with the privacy properties of physical cash via zero-knowledge cryptography. No digital asset can offer the same battle-tested and deterministic privacy guarantees as the latest Zcash shielded pool, making it a valuable form of private money that cannot be easily replicated. In our view, the market re-rated ZEC relative to BTC to reflect its status as an aspirational private cryptomoney, positioning ZEC as a hedge against the rise of the surveillance state and the institutionalization of Bitcoin.

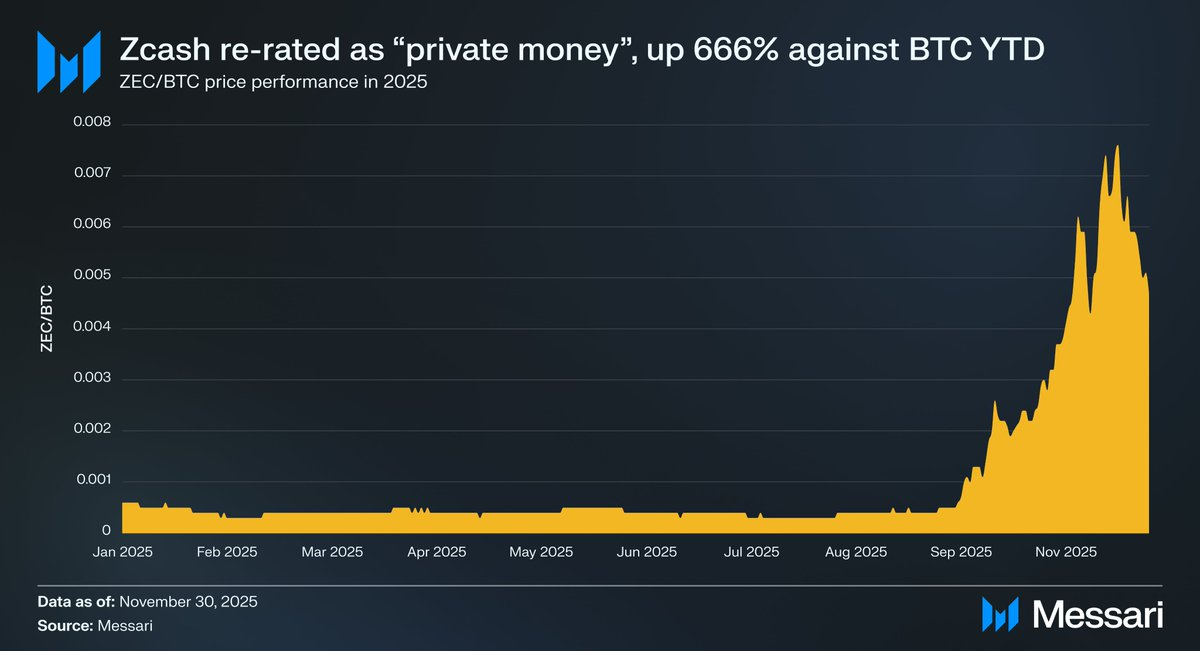

Year-to-date ZEC surged 666% against BTC, pushing its market cap to $7.0 billion and briefly surpassing XMR as the most valuable privacy coin by market cap. This relative strength signals that ZEC is being priced as a viable form of private cryptomoney alongside XMR.

Privacy on Bitcoin

Bitcoin is very unlikely to adopt a shielded pool architecture, rendering the notion that it will eventually absorb Zcash’s value proposition unfounded. Bitcoin is known for its conservative culture, which prioritizes ossification to reduce attack surfaces and maintain monetary integrity. Embedding privacy at the protocol level would necessitate changes to Bitcoin’s core architecture, introducing the risk of an inflation bug that could harm its monetary integrity. Zcash is willing to take this risk as privacy is its main value proposition.

Implementing zero-knowledge cryptography at the base layer would also reduce the scalability of the blockchain as it would necessitate the use of nullifiers and hashed notes to prevent double-spending, which raises long-term concerns about “state bloat.” Nullifiers create an append-only “list” that grows indefinitely, potentially resulting in a scenario where running a node would be resource-intensive. Forcing nodes to store a massive, ever-growing nullifier set would harm Bitcoin’s decentralization, as it would increase the requirements to run a node on the network over time.

As mentioned earlier, absent a soft fork that enables ZK verification, such as OP_CAT, no Bitcoin L2 can inherit Bitcoin’s security while delivering Zcash-level privacy. You either introduce trusted intermediaries (federations), accept long and interactive withdrawal delays (BitVM model), or push execution and security to a separate system entirely (sovereign rollups). Unless that changes, there is simply no existing path to achieve Bitcoin’s security with Zcash’s privacy, positioning ZEC as a valuable form of private cryptomoney.

A Hedge Against CBDCs

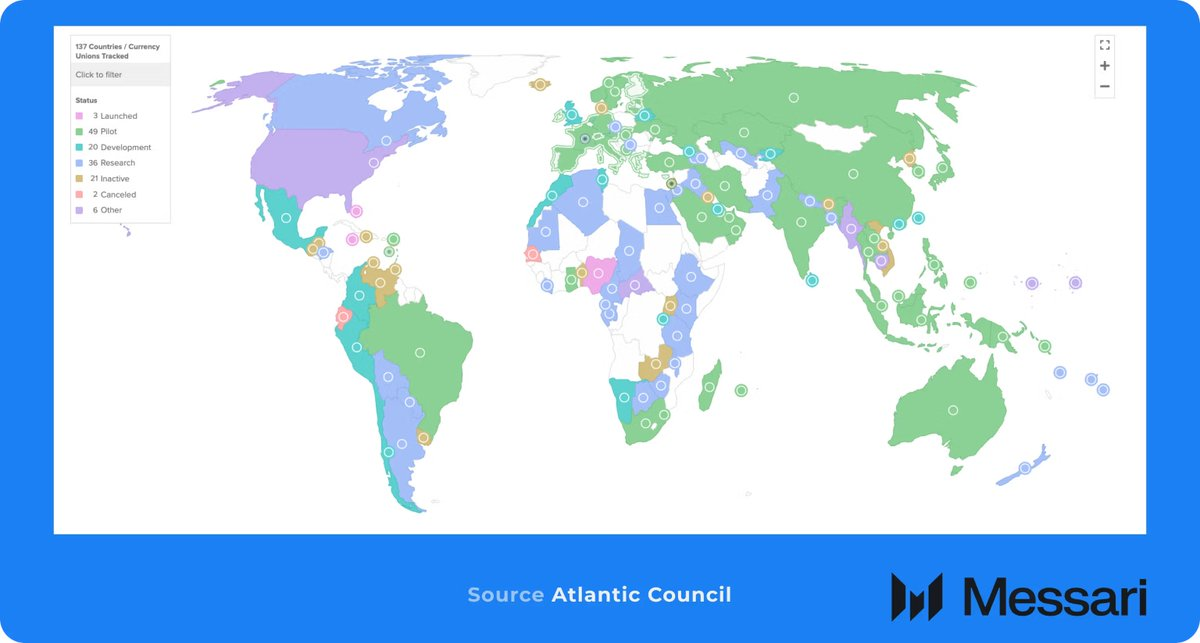

The urgency for privacy is compounded by the arrival of Central Bank Digital Currencies (CBDCs). Half the countries in the world are either investigating or have implemented a CBDC. CBDCs are programmable, meaning issuers can not only track every transaction but also control how, when, and where funds are spent. Funds could be programmed to work only at approved merchants or within specific geographies.

While this may sound like a dystopian fantasy, the weaponization of the banking system is grounded in reality:

- Nigeria (2020): During the #EndSARS protests against police brutality, the Central Bank of Nigeria froze the bank accounts of prominent protest organizers and feminist groups, forcing the movement to rely on crypto to sustain itself.

- United States of America (2020-2025): Regulators and the largest banks have debanked lawful but politically disfavored sectors on the basis of “reputation risk” and ideology rather than safety and soundness, a pattern serious enough that the White House ordered a review and the OCC’s 2025 debanking study documented systematic restrictions on legal industries ranging from oil and gas to firearms, adult content, and crypto.

- Canada (2022): During the Freedom Convoy protests, the Canadian government invoked the Emergencies Act to freeze the bank and crypto accounts of protesters and even small-dollar donors without a court order. The Royal Canadian Mounted Police even blacklisted 34 self-custody crypto wallet addresses, ordering all regulated exchanges to cease facilitating transactions with them. This proved that Western democracies are willing to weaponize the financial system against political dissent.

In an era where money can be programmed to control you, ZEC offers a definitive opt-out. However, Zcash isn’t just for escaping CBDCs; it is becoming increasingly necessary to protect Bitcoin itself.

A Hedge Against Bitcoin’s Capture

As influential advocates like Naval Ravikant and Balaji Srinivasan have argued, Zcash is an insurance policy for maintaining Bitcoin’s vision of financial freedom.

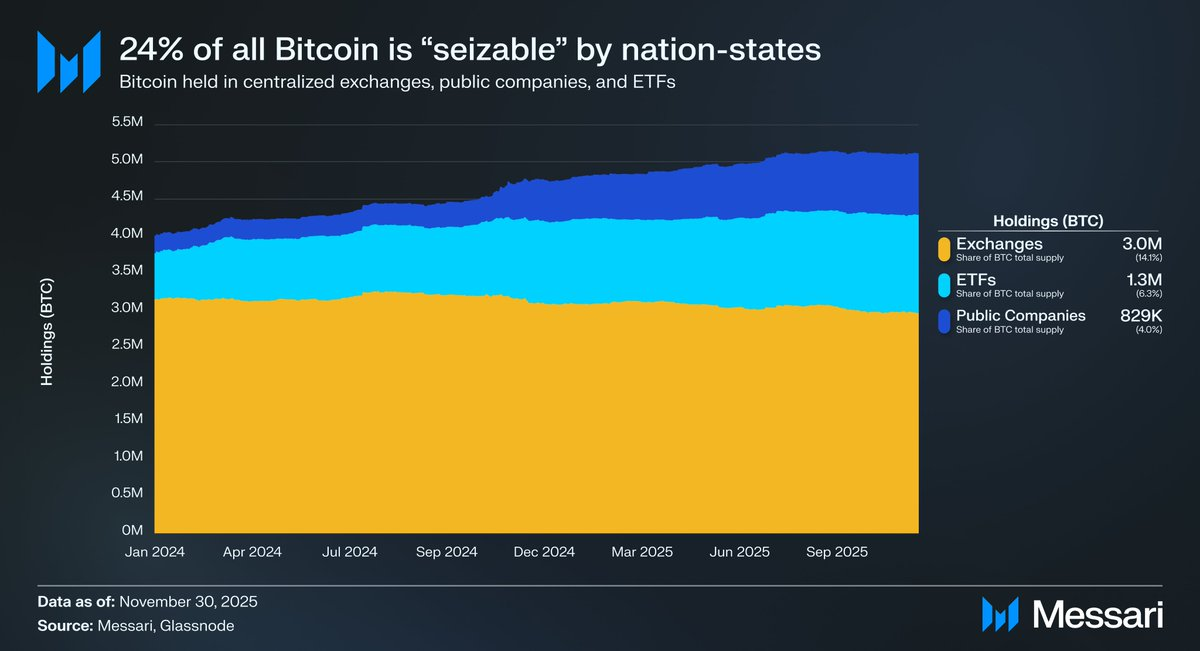

Bitcoin is rapidly consolidating under centralized entities. Between centralized exchanges (3.0 million BTC), ETFs (1.3 million BTC), and publicly traded companies (829,192 BTC), approximately 5.1 million BTC (24% of total supply) is currently held by third parties.

This concentration implies that 24% of the total BTC supply is vulnerable to regulatory seizure, mirroring the centralized conditions that enabled the U.S. Government’s confiscation of gold in 1933. Executive Order 6102 legally forced U.S. citizens to surrender all gold holdings above $100 to the Federal Reserve. In exchange, they received paper currency at the official rate of $20.67 per troy ounce. It was enforced through banking choke points rather than physical force.

For Bitcoin, the mechanism would be identical. Regulators do not need your private keys to seize 24% of the supply; they only need legal authority over the custodians. In this scenario, the government issues an enforcement order to entities like BlackRock and Coinbase. Legally bound to comply, these companies would be forced to freeze and transfer the BTC they hold. Overnight, nearly a quarter of the BTC supply could be effectively nationalized without a single line of code being broken. While this is certainly an edge case, it cannot be entirely ruled out.

Given the blockchain’s transparency, it also means that self-custody is no longer a viable standalone defense. Any BTC withdrawn from a KYC’d exchange or brokerage account is susceptible to seizure, as a “paper trail” eventually leads the government to the coin’s final destination.

BTC holders can swap into Zcash to sever the chain of custody, “air-gapping” their wealth from surveillance. Once funds enter the shielded pool, the destination address becomes a cryptographic “black hole” to observers. Regulators can track funds leaving the Bitcoin network, but they cannot see where they ultimately end up, rendering the assets invisible to state actors. While off-ramping to domestic banks remains a bottleneck, the assets themselves are censorship-resistant and difficult to trace proactively. The strength of this anonymity depends entirely on operational security; reusing addresses or acquiring funds via KYC’d exchanges creates a permanent link before shielding ever occurs.

Paving the Road to PMF

The demand for private money has always existed; Zcash simply struggled to meet users where they were. For years, the protocol was burdened by intensive memory requirements, lengthy proving times, and cumbersome desktop setups, which made shielded transactions slow and intimidating for most users. A recent convergence of infrastructure breakthroughs has systematically dismantled these barriers, priming it for user adoption.

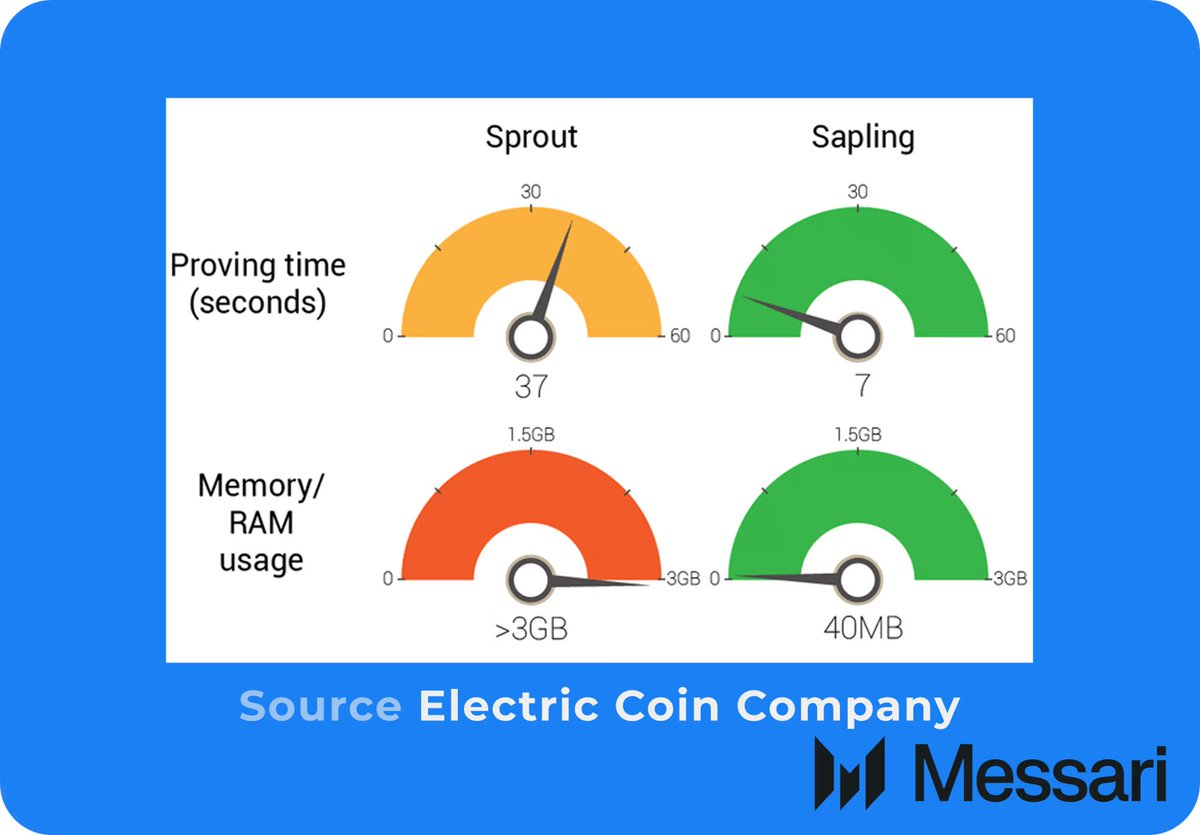

The Sapling upgrade reduced memory requirements by 97% (to ~40 MB) and cut proving times by 81% (to ~7 seconds), paving the way for shielded transactions on mobile devices.

While Sapling solved for speed, trusted setups remained a concern within the privacy community. By implementing Halo 2, Orchard eliminated Zcash’s reliance on a trusted setup, making it fully trustless. It also introduced Unified Addresses, which bundle transparent and shielded pools into a single destination, removing the need for users to manually select between address types.

These architectural improvements culminated in the release of Zashi, a mobile wallet developed by the Electric Coin Company in March 2024. Leveraging the abstraction of Unified Addresses, Zashi reduced the friction of shielded transactions to a few taps on a screen, making privacy the default user experience (UX).

With the UX hurdle cleared, distribution remained an issue. Users still relied on CEXs to deposit and withdraw ZEC into their wallets. The integration of NEAR Intents removed this dependency. NEAR Intents enable Zashi users to swap supported assets (e.g., BTC, ETH) directly into shielded ZEC without ever interacting with a CEX. NEAR Intents also allow users to pay any address across 20 blockchains in any supported asset while funding the transaction with shielded ZEC.

Together, these initiatives allowed Zcash to bypass historical frictions and access global liquidity, meeting the market exactly where it is.

Looking Ahead

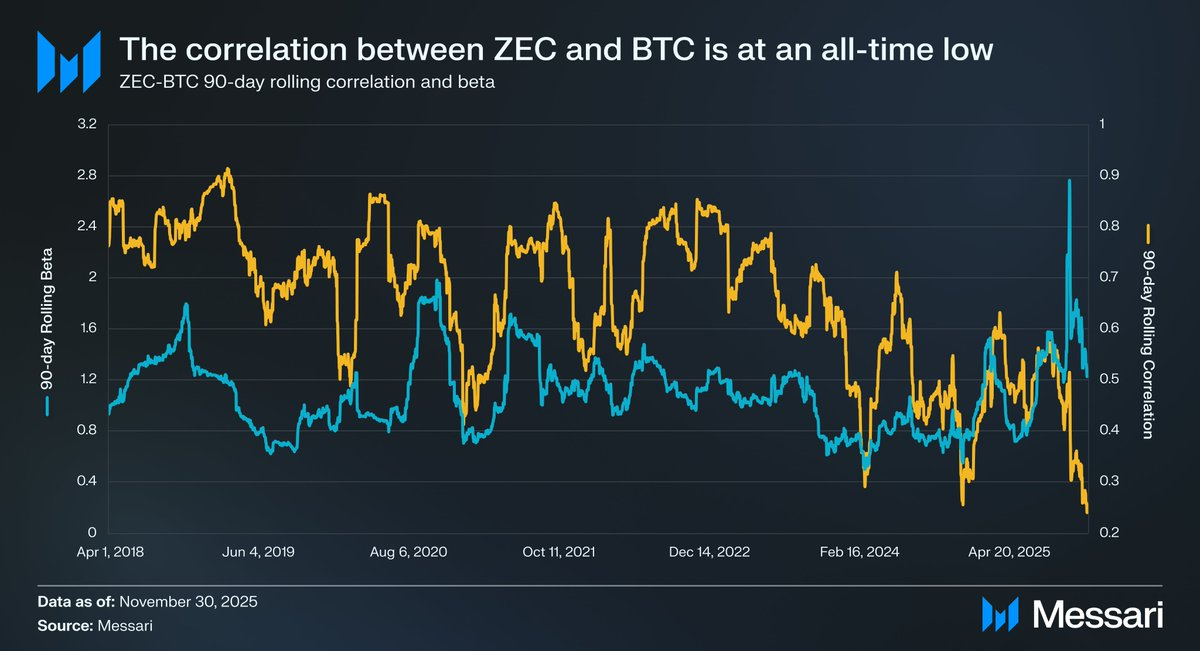

Since 2019, the rolling correlation between ZEC and BTC has been in a definitive downtrend, declining from highs of 0.90 to recent lows of 0.24. ZEC’s rolling beta to BTC has risen to all-time highs, meaning ZEC now amplifies BTC’s price action even as their rolling correlation has fallen. This divergence signals that the market is beginning to assign an idiosyncratic premium to Zcash’s privacy guarantees. Looking forward, we expect ZEC’s performance to be defined by this “privacy premium,” the value the market ascribes to financial anonymity in an era of increasing surveillance and the weaponization of the global financial system.

We believe it is extremely unlikely that ZEC overtakes BTC. Bitcoin’s transparent supply and unassailable auditability have cemented it as the soundest form of cryptomoney. Zcash, by contrast, will continue to carry the inherent trade-offs of a privacy coin. By encrypting the ledger to preserve privacy, it sacrifices auditability and introduces the theoretical risk of inflation bugs, undetected supply inflation within the shielded pool, that Bitcoin’s transparent ledger explicitly eliminates.

Regardless, ZEC can carve out its own niche independent of BTC. The two assets are not competing to solve the same problem, but rather address different use cases within cryptomoney. BTC is positioned as sound cryptomoney optimized for transparency and security, while ZEC serves as private cryptomoney, optimized for confidentiality and financial privacy. In that sense, ZEC’s success does not require displacing BTC, but rather complementing it by offering properties Bitcoin deliberately does not.

For a comprehensive overview of Zcash, refer to this Messari report: https://messari.io/report/understanding-zcash-a-comprehensive-overview.

Disclaimer:

- This article is reprinted from [0xYoussef_]. All copyrights belong to the original author [0xYoussef_]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?