- Trending TopicsView More

237.34K Popularity

33.92K Popularity

5.64K Popularity

5.51K Popularity

5.12K Popularity

- Hot Gate FunView More

- MC:$3.74KHolders:30.99%

- MC:$3.54KHolders:10.00%

- MC:$3.53KHolders:10.00%

- MC:$3.57KHolders:10.29%

- MC:$3.52KHolders:10.00%

- Pin

November 24 | ETH Trend Analysis

Core Points

Current Price

$2,797 ( as of November 24th, 2023, 24-hour increase +0.99%, fluctuation range between $2,788-$2,855

) Short-term Outlook

Cautiously bullish. The technical indicators show that the daily RSI has reached the oversold zone ###30(, and on-chain data indicates that large amounts of funds are flowing out of exchanges, forming a positive signal. The expectations for the Fusaka upgrade on )12 December 3rd ( provide an upward catalyst. It is expected that the price will fluctuate in the $2,750-$2,850 range within the next 24-48 hours, with a key focus on whether the $2,785 support can hold.

) Key Support

) key resistance

Technical Analysis

The current price is near a convergence point of multiple support levels, the OBV indicator shows continuous selling pressure, but the exchange's capital outflow of )-1.73M ETH( suggests that institutions are accumulating at lower levels.

![])https://img-cdn.gateio.im/webp-social/moments-b997ede9b7-f308ea88d7-153d09-cd5cc0.webp(

Market Drivers

) positive factors

( Risk Factors

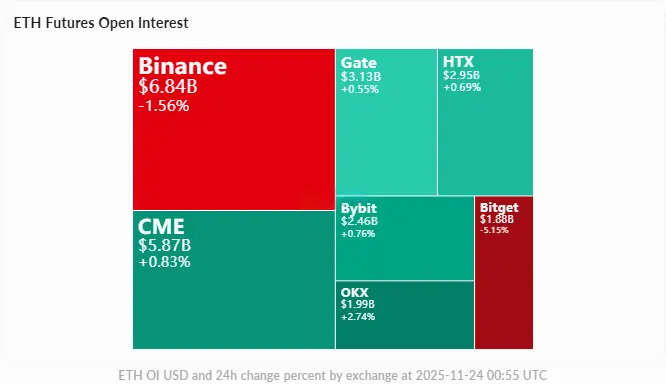

Derivatives Data

The open interest increased by 1.73% in the past 24 hours, and the funding rates showed differentiation ) Binance +0.021%, Bybit -0.057% ###, overall indicating a neutral to bullish sentiment. The liquidation risk chart shows that $563M of long positions are concentrated around $2,688 below, while $789M of short positions are concentrated around $2,883 above, creating bidirectional liquidation pressure.

Trading Strategies

Long Position Settings:

Short Selling Settings:

Summary

ETH is currently at a critical point of a technical oversold rebound, with the gain or loss of the $2,785 support level determining the short-term direction. Expectations for the Fusaka upgrade and institutional accumulation provide fundamental support for the bulls, but volume must confirm the validity of the rebound. It is recommended to closely monitor the volume and price performance during today's European and American trading sessions; a breakthrough of $2,816 will confirm the short-term rebound, while a drop below $2,785 will necessitate caution regarding a further decline to the $2,632 area.