- Trending TopicsView More

234.11K Popularity

30.52K Popularity

5.17K Popularity

5.09K Popularity

4.6K Popularity

- Hot Gate FunView More

- MC:$0.1Holders:10.00%

- MC:$3.57KHolders:10.29%

- MC:$3.52KHolders:10.00%

- MC:$3.58KHolders:10.31%

- MC:$3.48KHolders:10.00%

- Pin

November 26 | ETH Trend Analysis

Core Insights

Current Price: $2,951.89 (as of November 26, 09:25)

Short-term outlook: The short-term bias is bullish, with technical indicators showing an upward trend on the 1-hour and 4-hour charts. The RSI is in a neutral to bullish zone, and the MACD maintains a bullish signal. Although the daily chart is still in a downward trend, the oversold state of the RSI provides support for a rebound. The probability of testing the $3,000-$3,050 area upwards in the next 24-48 hours is 60%.

Key Support:

Key Resistance:

Technical Analysis

multi-timeframe structure

The current price is above the short-term moving average but below the daily moving average, showing a pattern of divergence between bulls and bears. The 1-hour and 4-hour charts indicate healthy upward momentum, with RSI values of 57.6 and 58.5 respectively, and the MACD histogram is positive. The daily chart shows an RSI of 37.5, which is in the oversold area, providing a technical basis for a potential rebound.

Key Price Level Analysis

The technical analysis shows that a breakout above $2,987 (the upper Bollinger Band on the 4-hour chart) will open up upward space towards $3,132; if it falls below the support at $2,919, there is a risk of probing down to the $2,867 liquidation zone.

On-chain Data Analysis

Whale Activity

There has been significant whale activity in the past 24-48 hours, with the top 10 transactions involving approximately 240,000 ETH (worth about $709 million). This includes a large transfer of 60,000 ETH and multiple chain transfers of over 30,000 ETH, indicating active reallocation of funds by large holders.

exchange capital flow

ETF capital inflow

The spot ETH ETF recorded a net inflow of $96.67 million on November 24, led by BlackRock's ETHA (+$92.61 million), reversing the previous trend of capital outflow and indicating a recovery in institutional confidence.

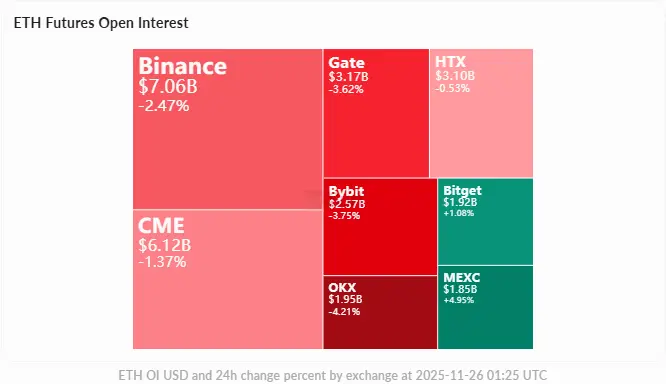

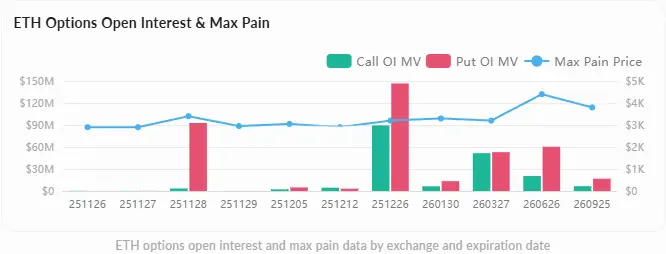

Derivative Data

The total position amount is $35.1 billion (a 24-hour decrease of 1.33%), and the funding rate is neutral to slightly bullish. The maximum pain point for options is around $2900, indicating that short-term prices may be influenced by this level.

The liquidation risk chart shows that there is a cumulative long liquidation risk of $498 million below $2854, while there is a short liquidation pressure of $547 million above $3053, presenting an asymmetric downside waterfall risk.

Market Sentiment

Social media sentiment is cautiously optimistic, with key opinion leaders highlighting bullish factors such as the decline in ETH supply and inflows of stablecoins. Technical analysts are generally focused on whether the current support level can hold effectively; if it does, a rebound above $3000 is anticipated. Some analysts maintain the judgment that ETH will perform better relative to BTC in the next round of upward movement.

Trading Suggestions

Bullish Scenario (Probability 60%):

Key Points:

Risk Warning

Although the short-term technical outlook is bullish, the daily level is still in a downward trend and is approaching a densely packed area for long liquidation. It is necessary to closely monitor changes in the macro environment and the trend of Bitcoin's dominance, as the latter has historically affected ETH's relative performance.