Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-Stop Lending Hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

249.58K Popularity

42.53K Popularity

4.14K Popularity

6.9K Popularity

6.27K Popularity

- Pin

November 27 | BTC Trend Analysis

Core Insights

Current Price: $90,673 (as of November 27, 10:36)

Short-term Outlook: The short-term rebound momentum continues, but technical indicators show an overheating state. It is expected to oscillate in the range of $89,000-$93,000 within the next 24-48 hours, with holiday liquidity constraints limiting significant fluctuations. Market sentiment has shifted from extreme fear to cautious optimism.

Key Support:

Key Resistance:

Technical Analysis

Multi-Time Frame Analysis

The current price is above the short-term moving average, but still below the long-term trend line, reflecting a long-term adjustment pattern during the short-term recovery.

Derivatives Data Analysis

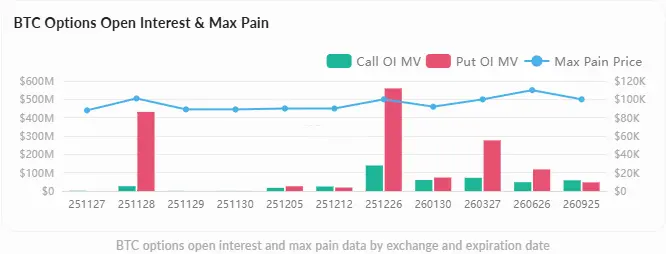

The maximum pain point for Bitcoin options is around $88,000, suggesting that the price may pull back to that level. Open interest has increased by 3.47% in the past 24 hours, indicating that traders are adding positions.

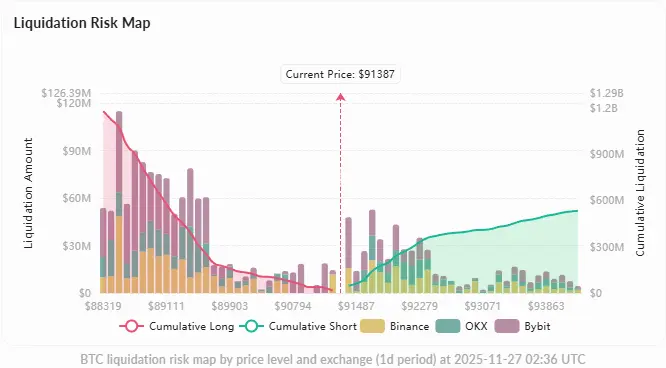

The liquidation risk chart shows significant long liquidation pressure below $89,000 (approximately $1.07B cumulative), providing strong support at this level.

Market Sentiment and Capital Flows

social media sentiment

Market sentiment is shifting from extreme panic to cautious optimism. Major KOLs believe that the current panic sentiment is a typical “Wall Street manipulation” tactic, where institutions create panic to accumulate positions at lower levels. The surrender signal from short-term holders (SOPR 0.94<1) has historically marked the formation of a bottom multiple times.

capital flow

Trading Strategy Suggestions

Bullish scenario (60% probability)

Short Position Scenario (Probability 40%)

Risk Warning

Summary

After experiencing an 18% adjustment this month, Bitcoin has shown signs of short-term stabilization above $90K. The technical analysis indicates short-term rebound momentum, but the daily level is still in an adjustment phase. It is recommended to pay attention to the fluctuation trend in the $89,000-$93,000 range. A breakout above $91,500 will open up further upward space, while a drop below $89,000 requires caution regarding deep correction risks. The current market is in a stage of emotional bottom rebound, suitable for cautious participation in short-term trading.