- Trending TopicsView More

229.37K Popularity

23.59K Popularity

3.86K Popularity

3.58K Popularity

3.67K Popularity

- Hot Gate FunView More

- MC:$4.01KHolders:23.11%

- MC:$3.46KHolders:20.34%

- MC:$3.59KHolders:20.61%

- MC:$3.38KHolders:10.00%

- MC:$3.43KHolders:20.04%

- Pin

November 27 | ETH Trend Analysis

Core Insights

Current Price: $3,037 ( as of November 27, 10:36 )

Short-term Outlook: Bullish

Key Support: $2,778 - $2,860

Key Resistance: $3,094 - $3,115

Technical Analysis

Multi-Period Indicator

Key Price Level Analysis

Derivatives Data

The open interest has increased by 6.85% in the last 24 hours, indicating a strengthened market confidence. Large-scale liquidation of shorts ( $37.2M vs longs $14.0M ) supports a short-term bullish sentiment. The negative funding rate suggests that the cost of shorting is high, which is favorable for price upward movement.

On-chain Metrics

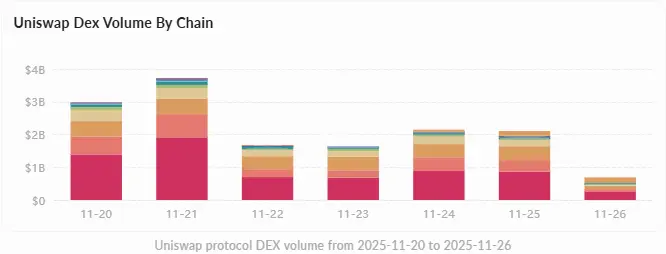

In the past 7 days, there has been a net outflow of 257,000 ETH, with exchange reserves dropping to 16.85 million (-1.4%), indicating that large holders continue to accumulate. The DeFi ecosystem's TVL has rebounded from a low of $65B to $69.4B, and DEX trading volume remains at an average of $2.75B per day, suggesting that on-chain activity is steadily recovering.

Social Sentiment

The Twitter/X platform shows a cautiously optimistic sentiment, with KOLs generally optimistic about ETH breaking the downward trend line, believing that the current position is a stage for institutions and whales to accumulate. Technical breakout signals and on-chain accumulation data have become the main bullish arguments, but attention still needs to be paid to whether it can effectively break through the $3,000-$3,115 resistance range.

Conclusion

The short-term technical outlook for ETH is bullish, with relatively strong support levels. Institutional capital inflow and whale accumulation provide fundamental support. The key is whether it can break through the $3,115 resistance to confirm a trend reversal. It is recommended to pay attention to the volume-price relationship near this level.