- Trending TopicsView More

251.72K Popularity

43.43K Popularity

4.07K Popularity

6.7K Popularity

6.85K Popularity

- Hot Gate FunView More

- MC:$3.7KHolders:20.18%

- MC:$3.65KHolders:10.00%

- MC:$3.68KHolders:20.00%

- MC:$3.69KHolders:20.00%

- MC:$4.07KHolders:22.86%

- Pin

November 29 | ETH Trend Analysis

Current Price: $3047 (As of November 29, 9 AM)

Short-term outlook: Cautiously bullish

Key Support:

Key Resistance:

Technical Analysis

price trend

ETH is currently consolidating around $3047, located near the middle band of the Bollinger Bands at $3044. Multi-timeframe signals are mixed, with the 1-hour and 4-hour showing a neutral stance, while the daily chart indicates a weak bearish trend as it is situated below the key moving averages.

Technical Indicator Status

Position Analysis

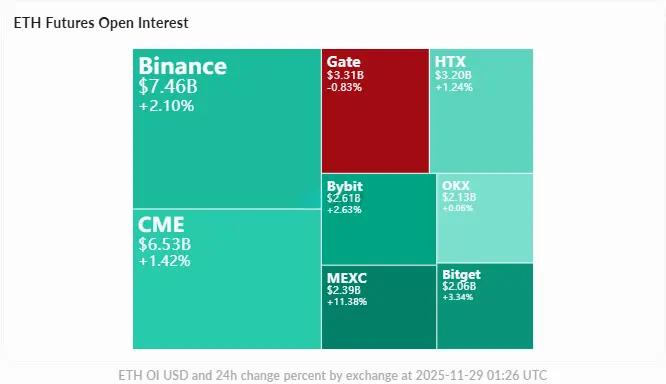

The futures open interest presents a net long position, with a long-to-short ratio of 2.51 (71.5% long accounts). In the last 24 hours, $58.7M has been liquidated, of which $34.4M was short liquidations, providing upward momentum for the price.

Options Market

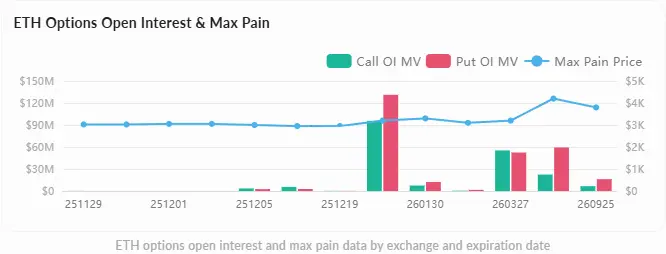

The maximum pain point for options lies in the $3000-3050 range, reinforcing the importance of the current price range.

Market Sentiment

social media sentiment

Overall sentiment leans bullish, main driving factors:

Key narrative theme

24-Hour Outlook

Bullish scenario (60% probability)

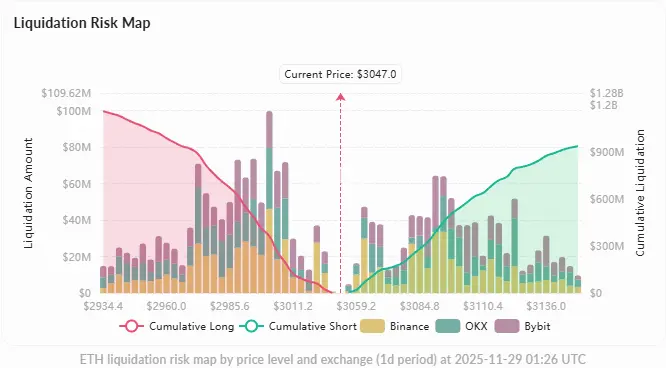

After breaking the $3082 resistance, the target is $3100, benefiting from the positive MACD divergence and short liquidation support. The liquidation risk chart shows that there is only $4.8M short exposure near $3056, indicating low resistance to the breakout.

bearish scenario (probability 40%)

Breaking below the $3006 support will test $2988, especially if the 1-hour MACD weakens further.

Trading Strategy Suggestions

Risk Warning: Digital currency investments involve high risks, please invest cautiously according to your own risk tolerance.