Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More27.87K Popularity

34.84K Popularity

20.73K Popularity

3.99K Popularity

2.53K Popularity

Pin

January 07 | BTC Trend Analysis

Core Viewpoints

Current Price: $92,554 (as of January 7, 10:13)

Short-term Outlook: Neutral leaning cautious. The daily chart maintains a strong upward trend, but the 1-hour and 4-hour charts show short-term correction pressures. Coupled with significant long liquidation and decreasing open interest, it is expected to fluctuate between $91,700 and $93,300 today. If it loses $92,500, a retest of $91,700 support is possible; a break above $93,300 could challenge the $94,000 level.

Key Support Levels: $91,724 (1-hour Bollinger lower band), $90,326 (4-hour Bollinger lower band), $89,415 (large liquidation cluster zone)

Key Resistance Levels: $93,072 (1-hour Bollinger upper middle band), $93,364 (daily Bollinger upper band), $94,400 (recent local high)

Technical Analysis

Multi-timeframe Structure

1-Hour Level: RSI(14) at 44.46, neutral to slightly bearish; MACD shows a death cross (histogram -49.40), price below 12/26/50 moving averages, currently trading above the Bollinger lower band at $91,724. Short-term structure is weak, with further correction risks.

4-Hour Level: RSI(14) rebounded to 53.28, in neutral zone; MACD still above signal line but histogram turned negative at -159.36, indicating weakening bullish momentum; price remains above 26/50 MAs but below 12 MA, near the Bollinger middle band at $92,614. Overall, a consolidation pattern with bullish dominance but caution for short-term pullback.

Daily Level: RSI(14) at 59.42, leaning bullish; MACD shows a clear golden cross (histogram +795.99), price above all major MAs and approaching the Bollinger upper band at $93,364. The main trend remains strong and bullish, providing support for short-term fluctuations.

Derivatives Market Signals

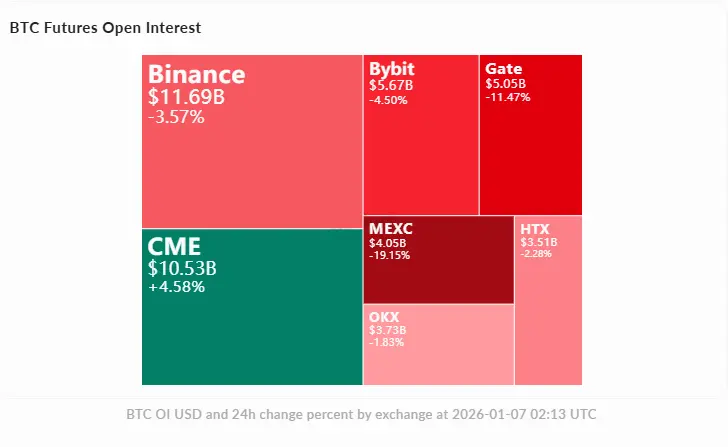

Futures Open Interest: Total open interest at $59.8B, down 2.84% in 24 hours, indicating market caution. Funding rates on major exchanges remain positive (Binance +0.0097%, Bybit +0.01%), longs paying shorts, showing mild bullish bias but caution against over-crowding.

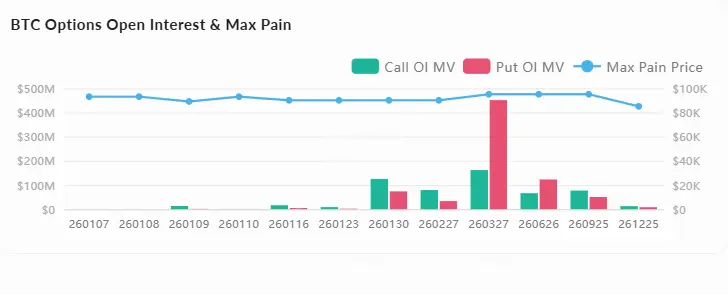

Options Market: Total open interest at $32.3B, up 2.8% in 24 hours; maximum pain points for short-term expiry contracts are concentrated between $89,000 and $95,000, with $93,000 being a key battleground near current price.

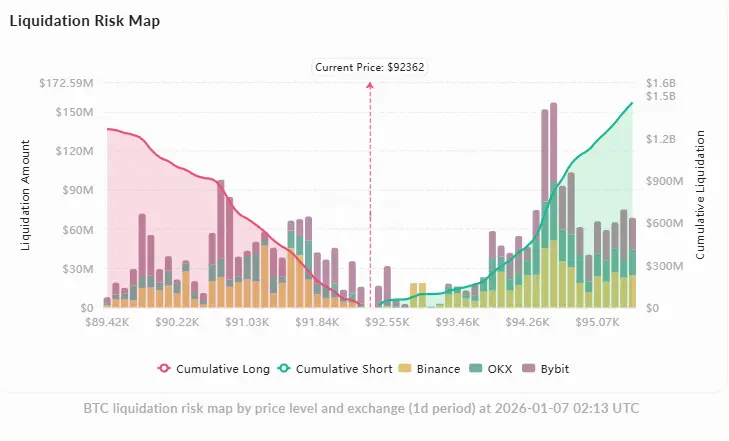

Liquidation Distribution: Total liquidation in 24 hours is $144M, with longs at $112M far exceeding shorts at $32M, reflecting leveraged long pressure. Heatmap shows $15.9M long liquidation around $92,344, and $16.6M short liquidation near $92,445. High-risk zones are between $92,000 and $92,500. Below, at $89,415, there is a cluster of $1.26B long liquidation walls; above, at $95,475, a $1.45B short liquidation wall.

On-chain Dynamics

Exchange Flows: Net outflows over the past 7 days, with a single-day outflow of 5,638 BTC on Jan 5, and slight inflow of 114 BTC on Jan 6. Net withdrawal often indicates long-term holding, providing bottom support.

Exchange Reserves: Reserves decreased from 2.76 million BTC to 2.745 million BTC over the past 30 days (worth $257B), with reduced selling pressure supporting price structure.

Market Sentiment and Narrative

Community Focus:

Key Opinion Leaders:

Mainstream Narrative: Policy dividends (Trump-era BTC reserve policies, index inclusion) offset previous FUD; technical focus on liquidity battles, cautious high points, but overall bullish after consolidation; altcoin rotation and strong BTC momentum resonate, with declining dominance and ETF approvals driving capital inflows.

News and Market Dynamics

Price Action: BTC peaked at $94,600 in early January, then consolidated above $90,000. Market cap increased by $300B in the first week, supported by ETF inflows and reduced tax selling. Current price at $92,516 is about 2% below the high, with a 24-hour decline of 1.27%, and volume remains active at $54-60B.

Regulatory Developments: The CLARITY Act (crypto market structure legislation) may be delayed until 2027 due to US midterm elections, but market remains optimistic about long-term compliance frameworks.

Technical Events: Bitcoin Core v30.0/30.1 issued warnings over wallet migration bugs affecting pruning mode users; versions have been withdrawn pending v30.2 patch. Limited impact on price.

Analyst Expectations: Mainstream forecasts target a breakout to $100,000 this month, with some predicting a new high possibly exceeding $124,000. Liquidity concerns flagged as risk factors, caution advised for rapid volatility.

Trading Strategy References

Long (Aggressive traders):

Short (Defensive traders):

Risk Warning: Currently in a high-volatility zone, with dense liquidations between $92,000 and $92,500. Control position size, avoid high leverage. If price breaks and holds above $93,300, can chase $94,400-$96,000; if it falls below $91,700, prepare for deeper correction to $90,300 or even $89,400.