Post content & earn content mining yield

placeholder

TheCryptera

4 years ago, someone bought this JPEG for $70M

Today, it’s worth $19K

#NFTs #Crypto #MarketReality #Cryptera

Today, it’s worth $19K

#NFTs #Crypto #MarketReality #Cryptera

- Reward

- like

- Comment

- Repost

- Share

The new Chairman of the U.S. Commodity Futures Trading Commission (CFTC), Mike Selig, publicly stated that he will promote a rules-based approach to cryptocurrency regulation, reducing the past reliance on enforcement actions and instead managing the crypto market through clear regulations.

This statement indicates that the U.S. regulatory direction is shifting from uncertain enforcement to a more predictable institutional framework.

The White House has reaffirmed that the U.S. government is advancing its policy goal of making the United States a global crypto capital hub. Although specific de

View OriginalThis statement indicates that the U.S. regulatory direction is shifting from uncertain enforcement to a more predictable institutional framework.

The White House has reaffirmed that the U.S. government is advancing its policy goal of making the United States a global crypto capital hub. Although specific de

- Reward

- like

- Comment

- Repost

- Share

#欧美关税风波冲击市场 Macroeconomic Shocks Intensify Bull-Bear Battles: What Stage Is the Current Crypto Market At?

Macroeconomic Shocks and Structural Evolution

The core driver of this market volatility stems from changes in the international trade environment. The United States announced a 10% tariff increase on eight European countries starting February 1, and hinted that if no agreement is reached on the Greenland issue, the relevant tariffs will be raised to 25% in June. This policy move quickly triggered a chain reaction in global financial markets, with traditional safe-haven assets experiencing

Macroeconomic Shocks and Structural Evolution

The core driver of this market volatility stems from changes in the international trade environment. The United States announced a 10% tariff increase on eight European countries starting February 1, and hinted that if no agreement is reached on the Greenland issue, the relevant tariffs will be raised to 25% in June. This policy move quickly triggered a chain reaction in global financial markets, with traditional safe-haven assets experiencing

- Reward

- 1

- Comment

- Repost

- Share

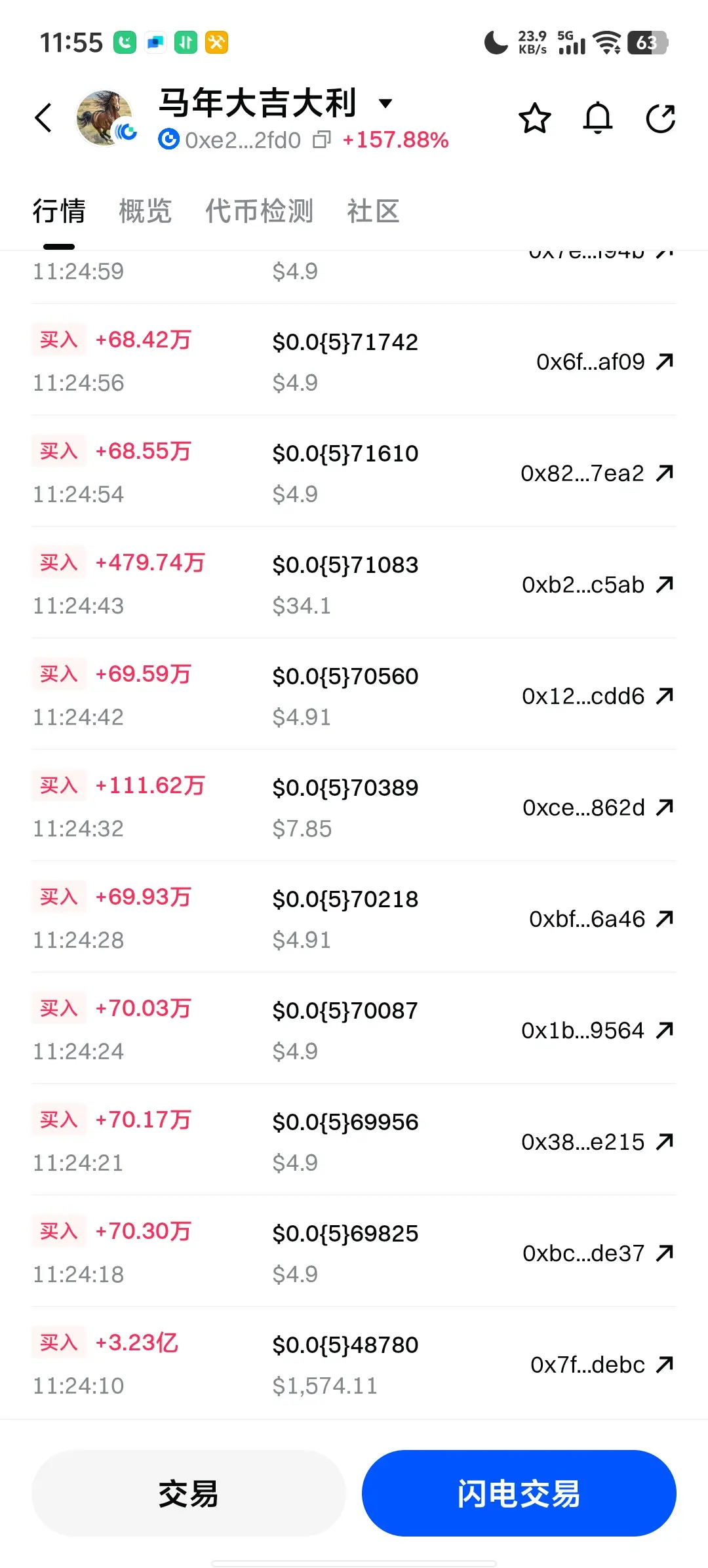

马年大富大贵

马年大富大贵

Created By@YearOfTheHorseMemeGlobal

Listing Progress

0.00%

MC:

$3.36K

Create My Token

#Greenland tariff chaos = ES/NQ dumping hard (ES ~6,835, NQ ~25,150) while liquidity floods #GOLD to $4,840+ ATH—pure risk-off rotation, don't fight it.

All of this is Trump's doing. We should shift to retirement assets when the geopolitical situation is so unstable. Buying $XAU and $XAG is limited.

#TrumpTariffsOnEurope

All of this is Trump's doing. We should shift to retirement assets when the geopolitical situation is so unstable. Buying $XAU and $XAG is limited.

#TrumpTariffsOnEurope

- Reward

- like

- Comment

- Repost

- Share

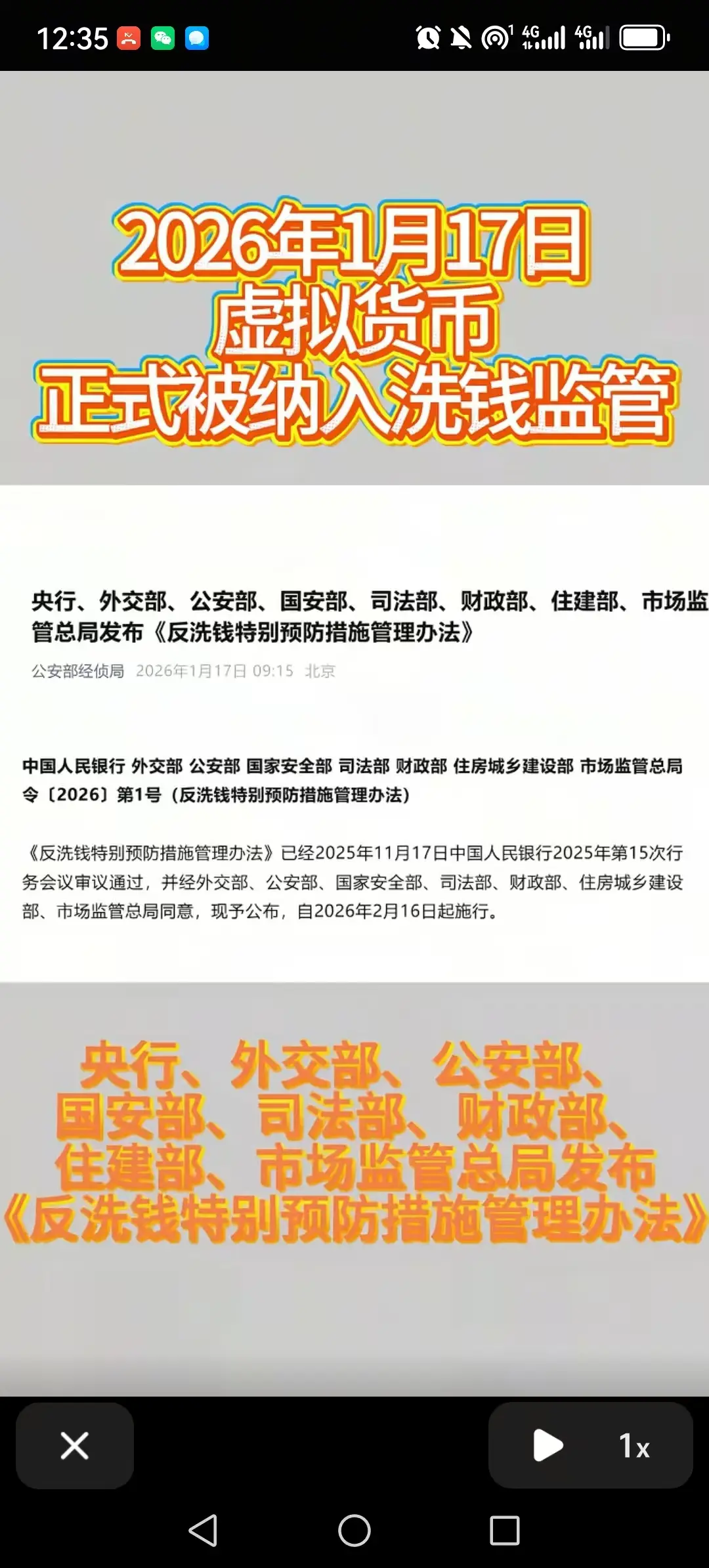

2026: Virtual Currency Legislation Enters Countdown, Signaling Major Transformation

The recently concluded Central Political and Legal Work Conference sent a key signal: virtual currency legislation is truly on its way.

Unlike previous years, the significant conference at the start of 2026 for the first time listed "virtual currency" alongside autonomous driving and low-altitude economy, explicitly proposing to conduct "forward-looking legislative research." This means that virtual currency is no longer a marginal issue but a key compliance area at the national level.

Why now?

Because the situ

The recently concluded Central Political and Legal Work Conference sent a key signal: virtual currency legislation is truly on its way.

Unlike previous years, the significant conference at the start of 2026 for the first time listed "virtual currency" alongside autonomous driving and low-altitude economy, explicitly proposing to conduct "forward-looking legislative research." This means that virtual currency is no longer a marginal issue but a key compliance area at the national level.

Why now?

Because the situ

BTC-2,17%

- Reward

- like

- Comment

- Repost

- Share

#PI Complaining is useless; accept your fate. No one can guarantee success, and ordinary people can only take a gamble.

View Original

- Reward

- like

- 1

- Repost

- Share

EmbraceTheGood :

:

Buying at any price results in a loss#CLARITYBillDelayed

With the latest developments in the U.S. Senate, the long-anticipated CLARITY Act has entered an uncertain phase, creating new concerns across the cryptocurrency market.

Why Was the CLARITY Act Delayed?

The vote on the bill—expected to establish a federal regulatory framework for digital assets—has been postponed. Three key factors contributed to this decision:

1. Industry Pushback:

Major crypto firms withdrew their support, claiming the current draft could restrict DeFi innovation and weaken incentives for stablecoins.

2. Procedural & Consensus Challenges:

A large number o

With the latest developments in the U.S. Senate, the long-anticipated CLARITY Act has entered an uncertain phase, creating new concerns across the cryptocurrency market.

Why Was the CLARITY Act Delayed?

The vote on the bill—expected to establish a federal regulatory framework for digital assets—has been postponed. Three key factors contributed to this decision:

1. Industry Pushback:

Major crypto firms withdrew their support, claiming the current draft could restrict DeFi innovation and weaken incentives for stablecoins.

2. Procedural & Consensus Challenges:

A large number o

DEFI-5,41%

- Reward

- 3

- 2

- Repost

- Share

楚老魔 :

:

2026 Go Go Go 👊View More

Based on historical trading data, the fundamental development of the ONRE project, and on-chain data, estimate the likelihood of ONyc dropping to $0.84. This price is the liquidation price in my Kamino cyclic lending (deposit USDC, borrow ONyc, 1.9x leverage). @grok

USDC0,05%

- Reward

- like

- Comment

- Repost

- Share

Why could previous copycats make big money?

Because there were big fools willing to spend millions or tens of millions of dollars to buy, institutions also believed and bought, and there were also a huge number of retail investors who believed.

Now there are none. Only smart 00s are gambling, retail investors without money are stubbornly taking a gamble, and rats are listening to bed trades to create new addresses to buy some.

View OriginalBecause there were big fools willing to spend millions or tens of millions of dollars to buy, institutions also believed and bought, and there were also a huge number of retail investors who believed.

Now there are none. Only smart 00s are gambling, retail investors without money are stubbornly taking a gamble, and rats are listening to bed trades to create new addresses to buy some.

- Reward

- like

- Comment

- Repost

- Share

【$ALCH Signal】Short + Volume Breakout

$ALCH Forms a breakdown structure after volume decline, high open interest suggests a large number of long positions are under pressure.

🎯 Direction: Short (Short)

🎯 Entry: 0.0910 - 0.0930

🛑 Stop Loss: 0.0985 ( Rigid stop loss, invalidates the structure if broken )

🚀 Target 1: 0.0820

🚀 Target 2: 0.0740

$ALCH A daily drop of over 25% accompanied by massive volume is a typical weak signal. High open interest did not significantly decrease during the price decline, indicating that it is not just long liquidation but active selling. The price has broke

$ALCH Forms a breakdown structure after volume decline, high open interest suggests a large number of long positions are under pressure.

🎯 Direction: Short (Short)

🎯 Entry: 0.0910 - 0.0930

🛑 Stop Loss: 0.0985 ( Rigid stop loss, invalidates the structure if broken )

🚀 Target 1: 0.0820

🚀 Target 2: 0.0740

$ALCH A daily drop of over 25% accompanied by massive volume is a typical weak signal. High open interest did not significantly decrease during the price decline, indicating that it is not just long liquidation but active selling. The price has broke

ALCH-26,09%

- Reward

- like

- Comment

- Repost

- Share

The Year of the Horse Usachi is not here to explain the market, but to mock it. While others are still waiting for confirmation and drawing trend lines, this rabbit has already been rushing around wildly, riding the inertia of the Year of the Horse. It represents retail investor sentiment, community playfulness, and irrational consensus—no roadmap, no promises, only constantly shared memes and increasingly noisy chat rooms. Here, we don't sell rationality, only amplify emotions; we don't guarantee success, only guarantee participation. This is not an investment plan, but a meme conspiracy expe

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$267.99KHolders:157

100.00%

- Reward

- like

- Comment

- Repost

- Share

💥BREAKING: $BTC

Bitcoin falls -$2,000 in minutes as $360 million worth of levered longs are liquidated over the last 60 minutes. $AXS

Bitcoin is back below $87,000, now down -9% in 48 hours.

Bitcoin falls -$2,000 in minutes as $360 million worth of levered longs are liquidated over the last 60 minutes. $AXS

Bitcoin is back below $87,000, now down -9% in 48 hours.

- Reward

- like

- Comment

- Repost

- Share

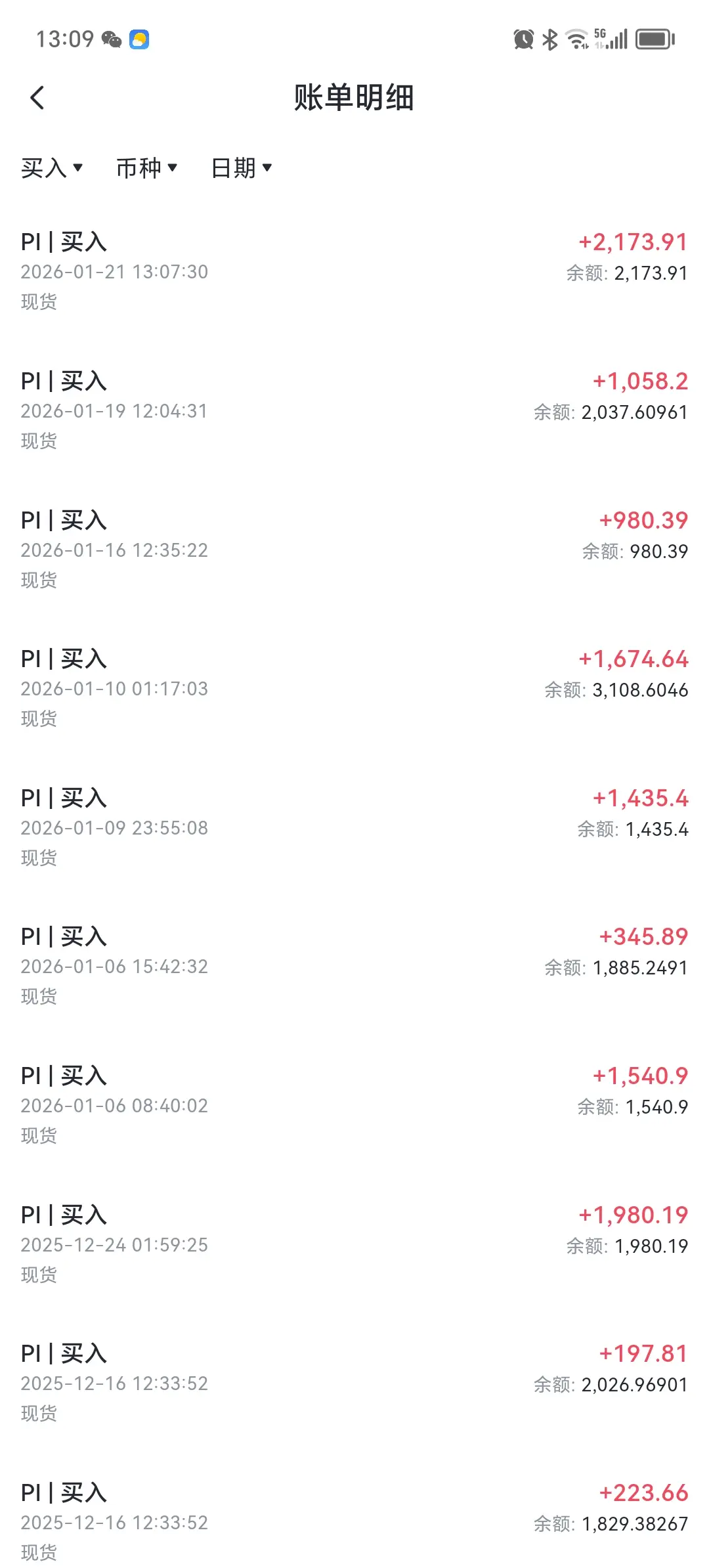

Accepting gambling and losing. Farewell to those who are destined to meet. I will be back. This time, a profit of over 3,000 USDT. Friends who didn't follow the early orders have suffered significant losses. Sorry about that.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

prawns :

:

。。。。。迷你娃娃

迷你娃娃

Created By@0xd1b5...a733

Listing Progress

0.00%

MC:

$3.36K

Create My Token

BTC is dropping sharply again, down around 2%–3% in the last 24 hours, currently trading near $88,900 – $89,400, after recently touching the $95,000 area.

The main driver is a global risk-off

environment:

Renewed tariff concerns from the U.S., especially related to Europe and Greenland

Stress signals from the Japanese bond market

Investors rotating into safe havens → gold reaching a new all-time high

Crypto remains under pressure as a risk asset

As a result, BTC has erased nearly all early 2026 gains, while altcoins are seeing heavier losses (ETH down over 6%).

Why $PNDS? 🐼

While the market

The main driver is a global risk-off

environment:

Renewed tariff concerns from the U.S., especially related to Europe and Greenland

Stress signals from the Japanese bond market

Investors rotating into safe havens → gold reaching a new all-time high

Crypto remains under pressure as a risk asset

As a result, BTC has erased nearly all early 2026 gains, while altcoins are seeing heavier losses (ETH down over 6%).

Why $PNDS? 🐼

While the market

MC:$3.79KHolders:3

0.60%

- Reward

- like

- Comment

- Repost

- Share

Recently, I've been too lazy to move, just showing off occasionally. Whether I'm awesome or not is up to you to decide😎😀

View Original

- Reward

- like

- Comment

- Repost

- Share

🔹 Tariff threats resurface! Crypto market flashed down overnight – can BTC hold?

- Reward

- like

- Comment

- Repost

- Share

0.0000048 bought 300 million chips, waiting for us to pick them up?

View Original

MC:$10.44KHolders:2

4.89%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More20.44K Popularity

3.45K Popularity

56.16K Popularity

48.12K Popularity

339.95K Popularity

News

View More"Victory War God" 40x short 40.81 BTC, average opening price $89,435.4

1 m

Dogecoin Price Prediction: DOGE Breaks Below Key Resistance Level, Drops to $0.12 Triggering Market Concerns

3 m

Dogecoin payment app "Such" is about to launch. Will the improved practicality boost the DOGE price?

7 m

Trump's trade threats and bond market turmoil trigger cryptocurrency safe-haven, ETH, SOL, and ADA collectively decline

13 m

Data: 1962.45 ETH transferred from an anonymous address, worth approximately 5.84 million USD

16 m

Pin