Post content & earn content mining yield

placeholder

SAWA

ETH's slowness is actually speed: it’s slow now, but will be fast in the future. Has the ETH ecosystem made any breakthrough progress from 1400-4900? No. Bullish trend, market frenzy, no decline despite bad news; bearish trend, market is quiet, no rise despite good news. The Bandwagon Effect: also known as the bandwagon phenomenon, herd behavior, or flock mentality, is a social psychology phenomenon where people are influenced by the majority's thoughts or actions, leading them to doubt and change their own opinions, judgments, or behaviors, aligning with the majority of the group, commonly kn

ETH-1,07%

- Reward

- like

- Comment

- Repost

- Share

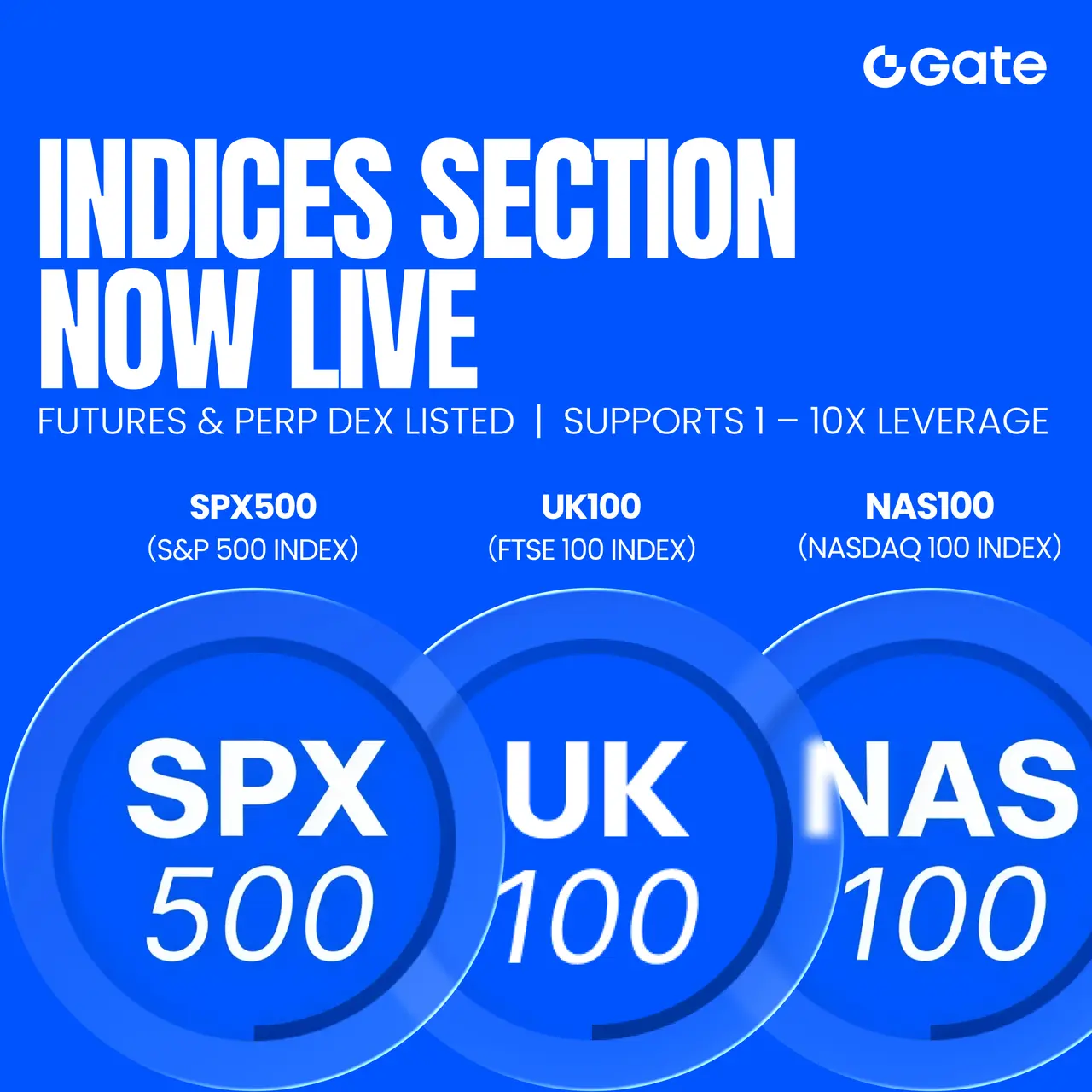

Gate Indices Section is now live!

Indices Section Futures & Perp DEX Initial Listings:SPX500 & UK100 & NAS100

🔹 Trading: OPEN

🔹 Supports 1 – 10x Leverage

🔹 Trading Pair: #SPX500 / $USDT

Futures Trading: gate.com/futures/USDT/SPX500_USDT

Perp DEX Trading: web3.gate.com/perps?settle=USDT&symbol=SPX500_USDT

🔹 Trading Pair: #UK100/ $USDT

Futures Trading: gate.com/futures/USDT/UK100_USDT

Perp DEX Trading: web3.gate.com/perps?settle=USDT&symbol=UK100_USDT

🔹 Trading Pair: #NAS100 / $USDT

Futures Trading: gate.com/futures/USDT/NAS100_USDT

Perp DEX Trading: web3.gate.com/perps?settle=USDT&symbol=

Indices Section Futures & Perp DEX Initial Listings:SPX500 & UK100 & NAS100

🔹 Trading: OPEN

🔹 Supports 1 – 10x Leverage

🔹 Trading Pair: #SPX500 / $USDT

Futures Trading: gate.com/futures/USDT/SPX500_USDT

Perp DEX Trading: web3.gate.com/perps?settle=USDT&symbol=SPX500_USDT

🔹 Trading Pair: #UK100/ $USDT

Futures Trading: gate.com/futures/USDT/UK100_USDT

Perp DEX Trading: web3.gate.com/perps?settle=USDT&symbol=UK100_USDT

🔹 Trading Pair: #NAS100 / $USDT

Futures Trading: gate.com/futures/USDT/NAS100_USDT

Perp DEX Trading: web3.gate.com/perps?settle=USDT&symbol=

- Reward

- 1

- 2

- Repost

- Share

dragon_fly2 :

:

2026 GOGOGO 👊View More

- Reward

- 1

- 3

- Repost

- Share

CowDungMarket :

:

He said it doesn't matter, the long position at 2.1 is still holding.View More

芝麻传奇

芝麻传奇之路

Created By@gatefunuser_e111

Listing Progress

100.00%

MC:

$3.39K

Create My Token

🚨 #IranTradeSanctions — Key Market Implications

1️⃣ Global Trade Disruption

Sanctions limit cross-border payments & trade flows → global liquidity & supply chains affected.

2️⃣ Energy Market Volatility

Restrictions on Iran’s oil exports make crude prices volatile, impacting inflation & energy costs.

3️⃣ Geopolitical Risk Premium

Rising regional tensions push investors into risk-off mode, increasing market uncertainty.

4️⃣ Crypto as an Alternative

When traditional finance is restricted, digital assets & blockchain settlements gain attention for cross-border efficiency.

5️⃣ Traders Should Watch

1️⃣ Global Trade Disruption

Sanctions limit cross-border payments & trade flows → global liquidity & supply chains affected.

2️⃣ Energy Market Volatility

Restrictions on Iran’s oil exports make crude prices volatile, impacting inflation & energy costs.

3️⃣ Geopolitical Risk Premium

Rising regional tensions push investors into risk-off mode, increasing market uncertainty.

4️⃣ Crypto as an Alternative

When traditional finance is restricted, digital assets & blockchain settlements gain attention for cross-border efficiency.

5️⃣ Traders Should Watch

BTC-0,81%

- Reward

- 1

- Comment

- Repost

- Share

$WCT

Price is hovering near $0.088 after a strong spike and a steady pullback. It feels like sellers are cooling off while buyers try to protect the $0.085–$0.083 area. If this zone holds, a recovery push toward $0.095 and $0.10 is very possible, but if it slips, we may see one more sweep before momentum flips again. I’m watching how price reacts here because this level matters.

Let’s go and Trade now

Price is hovering near $0.088 after a strong spike and a steady pullback. It feels like sellers are cooling off while buyers try to protect the $0.085–$0.083 area. If this zone holds, a recovery push toward $0.095 and $0.10 is very possible, but if it slips, we may see one more sweep before momentum flips again. I’m watching how price reacts here because this level matters.

Let’s go and Trade now

WCT4,11%

- Reward

- like

- Comment

- Repost

- Share

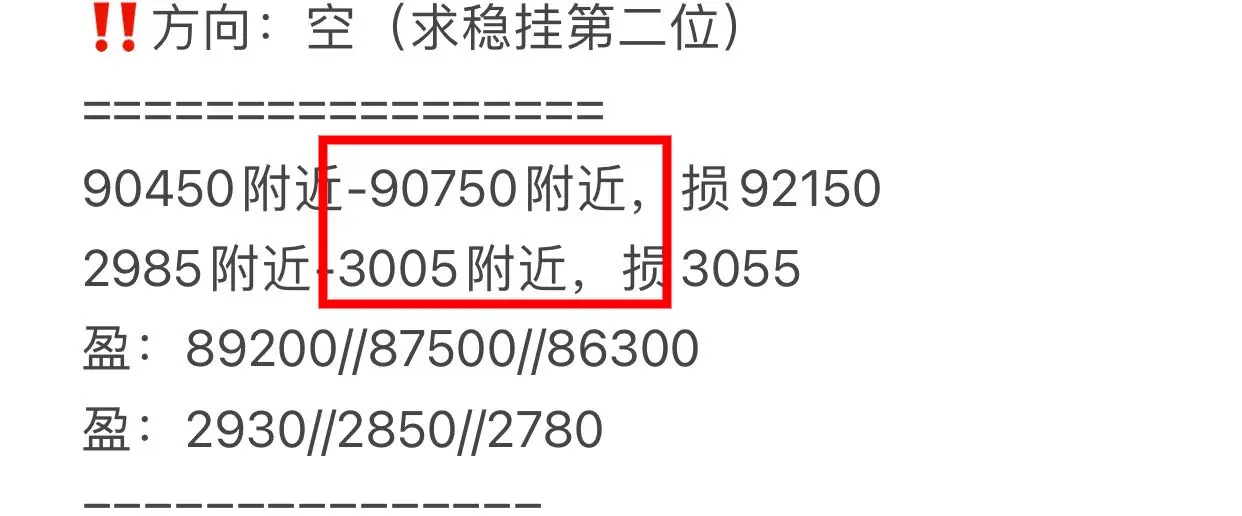

‼️ Guan He Ping Wheel Brothers, give U‼️ The contract/spot order for the night of the 25th has been updated👇 In the crypto world, only follow the right people. Thank you all for your support. The 3.5gt half-price for the New Year has already exceeded 200 people. The discount will end in 1 day, and 7gt will be restored‼️ Tap 👇 on Apple

https://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently ate over 2 million U‼️ Last week 3400/97800 short, yesterday 2865/87250 big buy📉 Thursday 2900/87900 reverse long 3065/91100, eating more📈 Friday reverse long 90800/3005 short, now 88100

View Originalhttps://www.gate.com/zh/profile/ Little Ghost Daily Contract

🔥 Recently ate over 2 million U‼️ Last week 3400/97800 short, yesterday 2865/87250 big buy📉 Thursday 2900/87900 reverse long 3065/91100, eating more📈 Friday reverse long 90800/3005 short, now 88100

- Reward

- 10

- 10

- Repost

- Share

InvincibilityIsMyNickname. :

:

2026 Go Go Go 👊View More

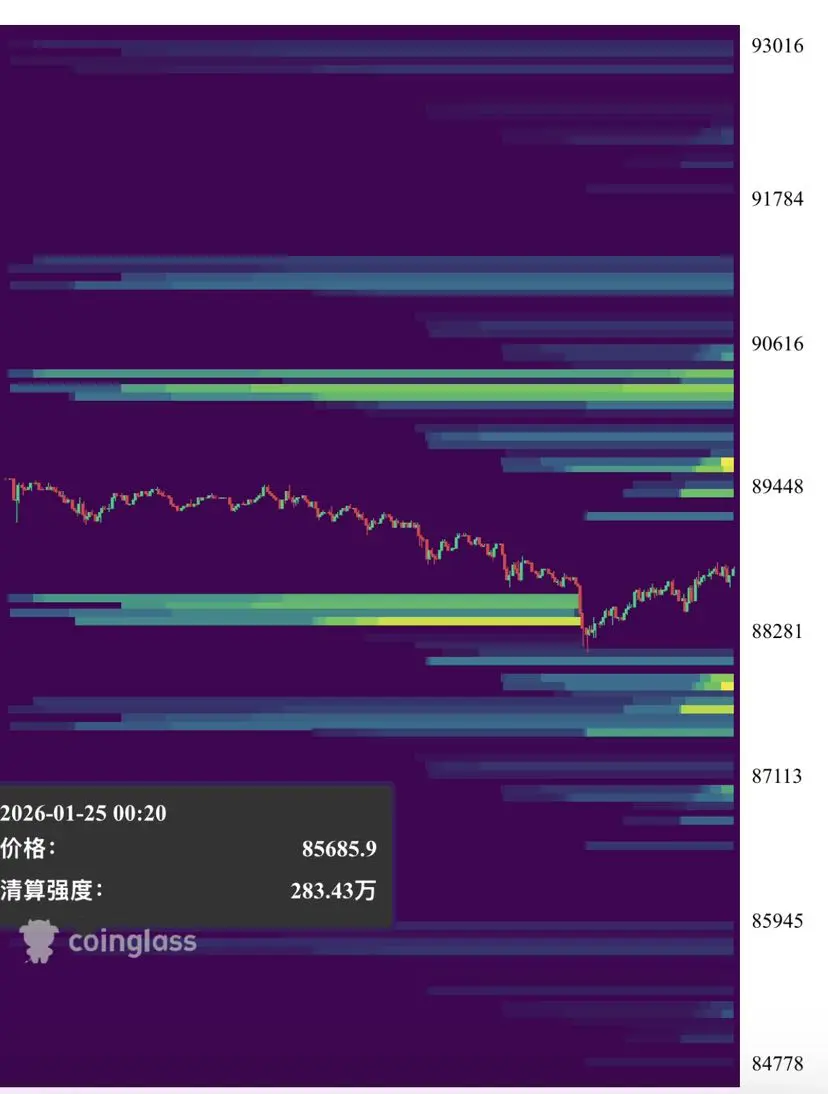

Buy or sell#btc 📈

1. Reached the $88,000 mark again over the weekend. Since the sell-off, short positions have increased significantly, so an short squeeze can be expected, and the price may rebound upward. After all, the market is now particularly clear; all that needed to be liquidated has been liquidated, leaving only panic🙀.

2. There are currently too many adverse factors, so this correction requires a strong narrative to guide the next direction. More points of concern include 1. Canadian tariffs 2. Possible shutdown 3. U.S. deployment near Iran. For retail investors, panic sentiment co

View Original1. Reached the $88,000 mark again over the weekend. Since the sell-off, short positions have increased significantly, so an short squeeze can be expected, and the price may rebound upward. After all, the market is now particularly clear; all that needed to be liquidated has been liquidated, leaving only panic🙀.

2. There are currently too many adverse factors, so this correction requires a strong narrative to guide the next direction. More points of concern include 1. Canadian tariffs 2. Possible shutdown 3. U.S. deployment near Iran. For retail investors, panic sentiment co

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

GateUser-d160046d :

:

Stay tuned for it to start!Valentine's Day will be the dark horse of the next half month

View Original

[The user has shared his/her trading data. Go to the App to view more.]

MC:$53.56KHolders:26

100.00%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

After the Ethereum top pattern, it rapidly declined. Now it has formed a triangle structure, and the oscillation range will get smaller and smaller! A big move is expected in the early hours of January 26!#黄金白银再创新高 #特朗普取消对欧关税威胁 #GateWeb3正式升级为GateDEX

ETH-1,07%

- Reward

- 1

- 3

- Repost

- Share

KrisRo :

:

Must surge explosivelyView More

Bhutan Elevates #SEI Token to a New Level

In January 2026, the Kingdom of Bhutan announced its plans to deploy and operate a validation node on the Sei network, with operations expected to begin in the first quarter of 2026.

This marks a shift from merely adopting blockchain technology passively to actively owning the infrastructure. Bhutan will store #SEIUSDT tokens to validate transactions, earn rewards, and gain strategic presence.

Long-term goals include tokenizing assets, digital payments, and national digital identity systems, based on Bhutan's current sovereign Bitcoin mining program

In January 2026, the Kingdom of Bhutan announced its plans to deploy and operate a validation node on the Sei network, with operations expected to begin in the first quarter of 2026.

This marks a shift from merely adopting blockchain technology passively to actively owning the infrastructure. Bhutan will store #SEIUSDT tokens to validate transactions, earn rewards, and gain strategic presence.

Long-term goals include tokenizing assets, digital payments, and national digital identity systems, based on Bhutan's current sovereign Bitcoin mining program

SEI-0,18%

- Reward

- 1

- 5

- Repost

- Share

BasheerAlgundubi :

:

Countries do not wait for permission; they establish their existence on the blockchain.View More

孔子

孔子

Created By@PiggyFromTheOcean

Listing Progress

100.00%

MC:

$29.65K

Create My Token

Whales Are Accumulating While Fear Is Extreme Is This the Perfect Crypto Entry Zone

- Reward

- 1

- 3

- Repost

- Share

HighAmbition :

:

great 👍View More

- Reward

- like

- Comment

- Repost

- Share

#黄金白银再创新高 Ethereum surges surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge fans surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge fans surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge surge fans

ETH-1,07%

- Reward

- like

- Comment

- Repost

- Share

Gate Annual Report is out! Let's take a look at my yearly performance

Click the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVVEBW0MVG&ref_type=126&shareUid=VFZDXF5cAgQO0O0O

View OriginalClick the link to view your exclusive #2025Gate年度账单 and receive a 20 USDT position experience voucher https://www.gate.com/zh/competition/your-year-in-review-2025?ref=VVVEBW0MVG&ref_type=126&shareUid=VFZDXF5cAgQO0O0O

- Reward

- like

- Comment

- Repost

- Share

It's been over 5 years overdue. Will I be sued or visited?

View Original

- Reward

- 2

- 1

- Repost

- Share

CangshanSnowfallY :

:

What is the use of credit reporting🐴🔥 THROWBACK:

16 years ago today, someone offered to sell digital art for 500 $BTC worth $1 at the time.

Was this the first NFT?

#GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

16 years ago today, someone offered to sell digital art for 500 $BTC worth $1 at the time.

Was this the first NFT?

#GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

BTC-0,81%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More69.72K Popularity

44.01K Popularity

36.92K Popularity

13.92K Popularity

29.4K Popularity

News

View MoreUpcoming Major Macro Events and Data Next Week: Federal Reserve Decision Announcement, Tech Giants' Earnings Reports Released Sequentially

21 m

Gate has launched MEMES perpetual contract trading

57 m

Next week, the US stock market faces a life-and-death situation with earnings reports, shifting from the "Seven Giants' Faith" to "Letting Performance Speak."

1 h

Data: 1,565,600 TON transferred from an anonymous address to TON, worth approximately $2.41 million

1 h

CZ: The new book may be published in late February or early March.

1 h

Pin